As per Intent Market Research, the Virtual Sports Market was valued at USD 3.2 billion in 2024-e and will surpass USD 6.6 billion by 2030; growing at a CAGR of 12.5% during 2025 - 2030.

The global virtual sports market is experiencing significant growth, driven by the increasing interest in online betting and the broader digital transformation in sports entertainment. Virtual sports are computer-generated simulations of real-world sports events, providing users with the opportunity to place bets on sports leagues and races that take place 24/7. These virtual events are designed to closely replicate the dynamics and excitement of real sports, offering a seamless experience for bettors around the globe. The demand for virtual sports is further fueled by advancements in gaming technology, making the betting experience more interactive and engaging.

The market has benefitted from the flexibility virtual sports offer, as they allow players to bet on simulated events regardless of the real-world sports season or global events. Additionally, the rise of mobile betting platforms has allowed more people to engage with virtual sports on the go, while advancements in 3D rendering and animation have made virtual events more realistic and appealing. The growing acceptance of virtual sports, especially in regions with stringent regulations on traditional sports betting, has propelled the market to new heights.

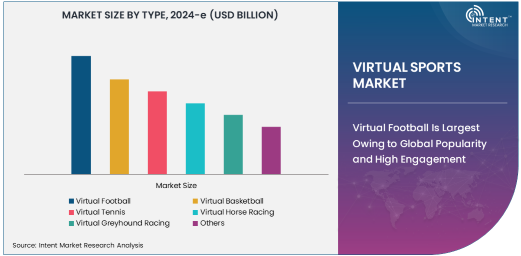

Virtual Football Is Largest Owing to Global Popularity and High Engagement

Virtual football holds the largest share in the virtual sports market due to its massive global following and the growing appetite for digital sports betting. Football's extensive fanbase across continents makes it a natural fit for virtual sports platforms, which simulate live football matches. These simulations often mirror the gameplay, rules, and outcomes of real-world football, creating a familiar environment for bettors. The engagement levels with virtual football have surged as fans can bet on matches at any time, even when live football events are not taking place.

The high frequency of virtual football games and quick bet settlement times contribute to its dominance, as users can place multiple bets within a short span. This segment has also benefited from partnerships between virtual sports providers and major football leagues, enhancing its credibility and appeal. Football's dominance in traditional sports betting naturally translates into virtual sports as well, where its popularity continues to drive market growth.

Mobile Applications Are Fastest Growing Owing to Ease of Access and Convenience

Mobile applications are the fastest-growing platform segment within the virtual sports market, largely driven by the increasing use of smartphones and the growing trend of mobile-based betting. These apps allow users to engage with virtual sports events and place bets anytime and anywhere, providing significant flexibility and convenience. Mobile applications have become a popular choice for bettors, offering a user-friendly interface and quick access to a variety of virtual sports options.

With mobile apps, bettors can receive real-time updates, place wagers on-the-go, and enjoy enhanced features like live streaming of events and integrated payment options. The ease of access, combined with advanced mobile technologies like 5G, has further accelerated the growth of mobile-based virtual sports betting. Operators are continuously improving these apps with features such as push notifications and personalized betting options to enhance user engagement and retention.

Casual Gamers Dominate the End-Use Segment Due to Fun and Accessible Betting Options

Casual gamers make up the largest segment in the end-use category, as virtual sports betting offers an easy and enjoyable form of entertainment. This segment includes individuals who may not be professional gamblers but are drawn to the accessibility and simplicity of virtual sports betting. Casual gamers often place smaller bets on virtual events, driven by the entertainment value and convenience these platforms provide.

Virtual sports appeal to this demographic because they do not require deep knowledge of sports statistics or extensive experience in betting. Instead, they offer an engaging and risk-managed way to experience the excitement of sports betting. The growing availability of virtual sports options and their easy integration into mobile apps have further strengthened the casual gamers segment, making virtual betting a mainstream form of digital entertainment.

Europe Leads the Market Owing to High Digital Engagement and Regulatory Support

Europe dominates the virtual sports market, driven by high digital engagement and a favorable regulatory environment for online betting. Countries such as the United Kingdom, Spain, and Italy have well-established online sports betting markets, and virtual sports have seamlessly integrated into these frameworks. In Europe, there is strong demand for simulated sports events that offer continuous betting opportunities, especially in regions with regulated gambling industries.

The region’s advanced infrastructure and wide internet penetration have also contributed to the growth of the virtual sports market, making Europe the leading hub for both bettors and operators. Furthermore, virtual sports betting aligns well with European consumer preferences, offering high-quality digital experiences with rapid bet turnover and engaging content.

Leading Companies and Competitive Landscape

The virtual sports market is highly competitive, with major players such as Inspired Entertainment, Sportradar, and Bet365 dominating the space. These companies are continually innovating to offer more immersive and realistic virtual sports experiences, integrating advanced graphics, artificial intelligence, and real-time analytics into their offerings. Partnerships with well-known sports leagues and teams are also a common strategy to increase market credibility and appeal.

New entrants and smaller providers are focusing on niche sports and innovative features to carve out a position in the market. Competition in the virtual sports market is expected to intensify, with companies investing in mobile technologies, virtual reality (VR), and augmented reality (AR) to enhance user experiences and expand their market reach.

Recent Developments:

- In November 2024, Inspired Entertainment launched an advanced virtual football product with enhanced visuals.

- In October 2024, Playtech introduced new virtual basketball simulations targeting European markets.

- In September 2024, Golden Race partnered with a leading operator in Africa to expand virtual sports offerings.

- In August 2024, Leap Gaming unveiled a new range of immersive virtual racing games for mobile users.

- In July 2024, Sportradar launched an AI-driven analytics tool to improve virtual sports event predictions.

List of Leading Companies:

- Inspired Entertainment, Inc.

- BetConstruct

- Playtech PLC

- Sportradar AG

- Leap Gaming

- 1xBet

- Scientific Games Corporation

- Kiron Interactive

- Golden Race

- Betgenius (Genius Sports Group)

- GlobalBet Virtual Sports

- Vermantia

- EveryMatrix Ltd.

- Digitain

- Highlight Games Limited

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.2 billion |

|

Forecasted Value (2030) |

USD 6.6 billion |

|

CAGR (2025 – 2030) |

12.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Virtual Sports Market By Type (Virtual Football, Virtual Basketball, Virtual Tennis, Virtual Horse Racing, Virtual Greyhound Racing), By Platform (Web-Based, Mobile Applications, In-Person Terminals), By End-Use (Casual Gamers, Professional Gamblers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Inspired Entertainment, Inc., BetConstruct, Playtech PLC, Sportradar AG, Leap Gaming, 1xBet, Scientific Games Corporation, Kiron Interactive, Golden Race, Betgenius (Genius Sports Group), GlobalBet Virtual Sports, Vermantia, EveryMatrix Ltd., Digitain, Highlight Games Limited |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Virtual Sports Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Virtual Football |

|

4.2. Virtual Basketball |

|

4.3. Virtual Tennis |

|

4.4. Virtual Horse Racing |

|

4.5. Virtual Greyhound Racing |

|

4.6. Others |

|

5. Virtual Sports Market, by Platform (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Web-Based |

|

5.2. Mobile Applications |

|

5.3. In-Person Terminals |

|

5.4. Others |

|

6. Virtual Sports Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Casual Gamers |

|

6.2. Professional Gamblers |

|

6.3. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Virtual Sports Market, by Type |

|

7.2.7. North America Virtual Sports Market, by Platform |

|

7.2.8. North America Virtual Sports Market, by End-Use |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Virtual Sports Market, by Type |

|

7.2.9.1.2. US Virtual Sports Market, by Platform |

|

7.2.9.1.3. US Virtual Sports Market, by End-Use |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Inspired Entertainment, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. BetConstruct |

|

9.3. Playtech PLC |

|

9.4. Sportradar AG |

|

9.5. Leap Gaming |

|

9.6. 1xBet |

|

9.7. Scientific Games Corporation |

|

9.8. Kiron Interactive |

|

9.9. Golden Race |

|

9.10. Betgenius (Genius Sports Group) |

|

9.11. GlobalBet Virtual Sports |

|

9.12. Vermantia |

|

9.13. EveryMatrix Ltd. |

|

9.14. Digitain |

|

9.15. Highlight Games Limited |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Virtual Sports Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Virtual Sports Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Virtual Sports Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA