As per Intent Market Research, the Virtual Sports Betting Market was valued at USD 2.3 billion in 2024-e and will surpass USD 4.3 billion by 2030; growing at a CAGR of 11.2% during 2025 - 2030.

The global virtual sports betting market is witnessing robust growth, driven by advancements in technology and the increasing popularity of virtual sports among bettors. Virtual sports betting offers a unique blend of sports simulation and gambling, attracting a diverse audience from casual bettors to seasoned professionals. These platforms provide continuous betting opportunities, unaffected by real-world sports schedules or events, making them highly appealing in today's fast-paced digital environment.

The rising adoption of mobile and web-based platforms for betting, coupled with the integration of immersive technologies such as augmented reality (AR) and artificial intelligence (AI), is reshaping the industry landscape. Operators are leveraging these technologies to enhance user engagement and offer personalized experiences, further boosting market growth.

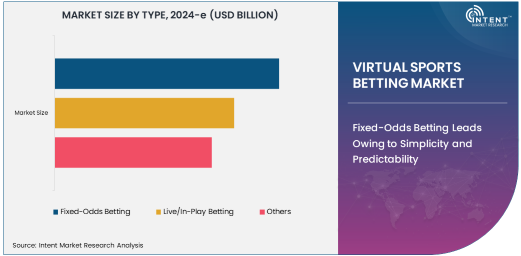

Fixed-Odds Betting Leads Owing to Simplicity and Predictability

The fixed-odds betting segment holds the largest share in the virtual sports betting market, attributed to its straightforward structure and predictability. Bettors are drawn to fixed-odds betting because it provides clarity on potential returns before placing a wager, fostering trust and transparency. This betting type is widely favored by both casual and professional gamblers due to its low barrier to entry and well-established market presence. The integration of advanced algorithms and real-time analytics has further enhanced the appeal of fixed-odds betting, allowing operators to offer competitive odds and improve customer satisfaction.

Mobile Applications Are Fastest Growing Owing to Convenience and Accessibility

Mobile applications are the fastest-growing platform segment in the virtual sports betting market, driven by the widespread adoption of smartphones and high-speed internet connectivity. These apps offer unparalleled convenience, enabling users to place bets, monitor outcomes, and access exclusive promotions from the palm of their hand. Operators are investing heavily in mobile app development, incorporating features such as live streaming, personalized recommendations, and secure payment gateways to attract and retain users. The growing popularity of mobile wallets and advancements in app design are further propelling this segment's growth.

Football Dominates the Sports Type Segment Owing to Global Popularity

Football is the largest segment in the sports type category, driven by its massive global fan base and widespread appeal across diverse demographics. Virtual football leagues and tournaments are meticulously designed to mimic real-world gameplay, offering bettors an engaging and immersive experience. The sport's extensive coverage in virtual betting platforms, coupled with frequent matches and quick results, has contributed to its dominance. Operators often introduce innovative features such as dynamic odds and interactive interfaces to enhance the betting experience for football enthusiasts.

Casual Gamblers Drive the Market Owing to Rising Engagement in Entertainment Betting

Casual gamblers represent the largest segment in the end-use category, driven by the increasing trend of entertainment-focused betting. This demographic is attracted to virtual sports betting for its convenience, quick outcomes, and minimal commitment compared to traditional sports betting. Operators are focusing on gamification and social features to engage casual bettors, offering user-friendly interfaces and smaller betting amounts to cater to this segment. The rising adoption of virtual sports during off-seasons and lockdowns has further solidified the appeal of casual betting.

Europe Leads the Market Owing to a Strong Regulatory Framework and Mature Gambling Ecosystem

Europe dominates the virtual sports betting market, supported by a robust regulatory framework, widespread digital adoption, and a mature gambling ecosystem. Countries such as the UK, Italy, and Spain have well-established markets with a high prevalence of online and virtual sports betting. The region's leadership is further bolstered by strong consumer demand and continuous innovation by operators. European companies are at the forefront of developing sophisticated platforms, incorporating AI and machine learning to offer dynamic odds and enhanced user experiences.

Leading Companies and Competitive Landscape

The virtual sports betting market is highly competitive, with prominent players such as Bet365, William Hill, Paddy Power, and Betfair driving innovation through cutting-edge technologies and strategic partnerships. New entrants and niche providers are also gaining ground by offering unique virtual sports and tailored betting solutions. Operators are focusing on expanding their global presence, enhancing user engagement through gamification, and diversifying their offerings to meet the growing demand. Mergers, acquisitions, and collaborations remain key strategies to strengthen market position and address evolving consumer preferences.

Recent Developments:

- In November 2024, DraftKings launched an AI-powered tool to enhance in-play betting experiences.

- In October 2024, Flutter Entertainment introduced new virtual sports options on its platforms.

- In September 2024, Bet365 expanded its mobile betting app with real-time updates for live betting.

- In August 2024, Inspired Entertainment partnered with a major European operator to roll out virtual horse racing.

- In July 2024, Playtech unveiled a next-generation virtual sports betting platform with enhanced graphics.

List of Leading Companies:

- Bet365 Group Ltd

- William Hill PLC

- Flutter Entertainment (Paddy Power Betfair)

- 888 Holdings PLC

- Entain PLC (formerly GVC Holdings)

- DraftKings Inc.

- Kindred Group PLC (Unibet)

- Caesars Entertainment Corporation

- PointsBet Holdings Limited

- Betsson AB

- Betway Group

- Playtech PLC

- Sportradar AG

- Inspired Entertainment, Inc.

- Scientific Games Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.3 billion |

|

Forecasted Value (2030) |

USD 4.3 billion |

|

CAGR (2025 – 2030) |

11.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Virtual Sports Betting Market By Type (Fixed-Odds Betting, Live/In-Play Betting), By Platform (Web-Based, Mobile Applications, In-Person Betting Terminals), By Sports Type (Football, Basketball, Tennis, Horse Racing), By End-Use (Casual Gamblers, Professional Gamblers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Bet365 Group Ltd, William Hill PLC, Flutter Entertainment (Paddy Power Betfair), 888 Holdings PLC, Entain PLC (formerly GVC Holdings), DraftKings Inc., Kindred Group PLC (Unibet), Caesars Entertainment Corporation, PointsBet Holdings Limited, Betsson AB, Betway Group, Playtech PLC, Sportradar AG, Inspired Entertainment, Inc., Scientific Games Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Virtual Sports Betting Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Fixed-Odds Betting |

|

4.2. Live/In-Play Betting |

|

4.3. Others |

|

5. Virtual Sports Betting Market, by Platform (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Web-Based |

|

5.2. Mobile Applications |

|

5.3. In-Person Betting Terminals |

|

5.4. Others |

|

6. Virtual Sports Betting Market, by Sports Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Football |

|

6.2. Basketball |

|

6.3. Tennis |

|

6.4. Horse Racing |

|

6.5. Others |

|

7. Virtual Sports Betting Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Casual Gamblers |

|

7.2. Professional Gamblers |

|

7.3. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Virtual Sports Betting Market, by Type |

|

8.2.7. North America Virtual Sports Betting Market, by Platform |

|

8.2.8. North America Virtual Sports Betting Market, by Sports Type |

|

8.2.9. North America Virtual Sports Betting Market, by End-Use |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Virtual Sports Betting Market, by Type |

|

8.2.10.1.2. US Virtual Sports Betting Market, by Platform |

|

8.2.10.1.3. US Virtual Sports Betting Market, by Sports Type |

|

8.2.10.1.4. US Virtual Sports Betting Market, by End-Use |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Bet365 Group Ltd |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. William Hill PLC |

|

10.3. Flutter Entertainment (Paddy Power Betfair) |

|

10.4. 888 Holdings PLC |

|

10.5. Entain PLC (formerly GVC Holdings) |

|

10.6. DraftKings Inc. |

|

10.7. Kindred Group PLC (Unibet) |

|

10.8. Caesars Entertainment Corporation |

|

10.9. PointsBet Holdings Limited |

|

10.10. Betsson AB |

|

10.11. Betway Group |

|

10.12. Playtech PLC |

|

10.13. Sportradar AG |

|

10.14. Inspired Entertainment, Inc. |

|

10.15. Scientific Games Corporation |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Virtual Sports Betting Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Virtual Sports Betting Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Virtual Sports Betting Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA