As per Intent Market Research, the Virtual Reality Market was valued at USD 10.8 billion in 2024-e and will surpass USD 21.9 billion by 2030; growing at a CAGR of 12.5% during 2025 - 2030.

The global virtual reality (VR) market is witnessing significant growth, driven by technological advancements and the increasing demand for immersive experiences across various applications. VR has transformed industries by offering innovative solutions for gaming, education, healthcare, and more. The technology's ability to create simulated environments has opened new avenues for businesses and consumers, fueling its adoption worldwide.

Investments in VR hardware, software, and content are at an all-time high, supported by robust R&D and strategic partnerships among key players. As VR continues to integrate with AI and machine learning, its applications are expanding beyond entertainment, making it a versatile tool across multiple sectors. The market's growth trajectory is further boosted by declining hardware costs and the proliferation of high-speed internet, which has enhanced accessibility and user engagement.

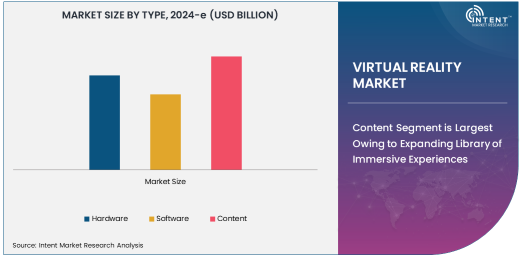

Content Segment is Largest Owing to Expanding Library of Immersive Experiences

The content segment dominates the VR market, fueled by the rising demand for high-quality, interactive, and immersive experiences across various applications. VR content spans a wide range of genres and industries, including gaming, education, healthcare, and virtual tours. Developers are continually innovating to create captivating VR content, with a focus on lifelike visuals, storytelling, and interactivity.

Gaming remains a key driver within this segment, with popular VR games and platforms drawing large audiences. Beyond gaming, industries like real estate and tourism are leveraging VR content to offer virtual walkthroughs and experiences, broadening the segment's appeal. The continuous influx of new VR content and its potential for cross-industry applications make this segment a cornerstone of the VR market.

Head-Mounted Displays Lead Component Segment Owing to Critical Role in Immersion

Head-mounted displays (HMDs) hold the largest share in the component segment due to their central role in delivering immersive VR experiences. These devices provide users with a gateway to virtual environments, featuring advanced visual and auditory capabilities that enhance realism. HMDs are integral to the VR ecosystem, catering to applications in gaming, healthcare, education, and beyond.

Major advancements in HMD technology, such as improved resolution, wider fields of view, and wireless connectivity, have made these devices more user-friendly and accessible. Companies like Meta, Sony, and HTC are at the forefront of HMD innovation, ensuring that these devices continue to drive adoption across diverse industries.

Healthcare is Fastest Growing in Applications Owing to Rising Adoption of VR in Medical Training and Therapy

Within the application segment, the healthcare sector is the fastest-growing due to its expanding use of VR for medical training, therapy, and patient engagement. VR technology provides healthcare professionals with realistic simulations for surgical training and diagnostic procedures, enhancing skills and reducing errors. Patients also benefit from VR-based therapies for mental health conditions, pain management, and rehabilitation.

The integration of VR into telemedicine and remote consultations is further fueling its adoption in healthcare. With ongoing advancements in medical-grade VR solutions and increasing awareness of its benefits, the healthcare application segment is expected to maintain rapid growth in the coming years.

Enterprise End-User Segment is Largest Owing to Widespread Industrial Applications

The enterprise segment leads the VR market's end-user category, driven by widespread adoption across industries such as manufacturing, retail, real estate, and education. Enterprises utilize VR for training, design visualization, customer engagement, and operational efficiency. For instance, VR enables architects to create virtual walkthroughs of buildings, while retailers use it for immersive shopping experiences.

The ability to offer cost-effective and scalable solutions has made VR an attractive investment for enterprises. The continued development of industry-specific VR applications and tools ensures the enterprise segment’s prominence in the market.

North America Leads VR Market Owing to Technological Advancements and Robust Ecosystem

North America holds the largest share in the global VR market, supported by its advanced technological infrastructure, significant R&D investments, and strong presence of leading VR companies. The region's tech-savvy population and high disposable income have also contributed to the widespread adoption of VR devices and solutions.

The U.S., in particular, is a hub for VR innovation, hosting major players like Meta, Microsoft, and Google. These companies are driving market growth through continuous product development and strategic collaborations. With a thriving gaming industry and increasing adoption across healthcare and enterprise sectors, North America remains at the forefront of the VR market.

Leading Companies and Competitive Landscape

The VR market is characterized by intense competition, with key players including Meta Platforms (Oculus), Sony Corporation, HTC Corporation, Valve Corporation, and Samsung Electronics. These companies focus on delivering innovative hardware, software, and content solutions to cater to a growing and diverse audience.

Startups and smaller firms are also making significant contributions by developing niche VR applications and cutting-edge technologies. The competitive landscape is further defined by strategic partnerships, mergers, and acquisitions aimed at expanding market reach and capabilities. As VR technology continues to evolve, companies are prioritizing affordability, usability, and content diversity to capture a larger share of this dynamic market.

Recent Developments:

- In November 2024, Meta Platforms, Inc. launched its latest VR headset with enhanced immersive capabilities.

- In October 2024, HTC announced new enterprise-focused VR solutions targeting industrial and healthcare sectors.

- In September 2024, Unity Technologies released updates to its VR development platform, offering better real-time rendering.

- In August 2024, NVIDIA unveiled a new VR-ready graphics card optimized for professional and gaming use.

- In July 2024, Microsoft expanded its VR applications in mixed reality, targeting education and training sectors.

List of Leading Companies:

- Meta Platforms, Inc. (Oculus)

- Sony Corporation

- HTC Corporation

- Microsoft Corporation

- Samsung Electronics Co., Ltd.

- Google LLC

- NVIDIA Corporation

- Unity Technologies

- Autodesk, Inc.

- Epic Games, Inc.

- Lenovo Group Limited

- Qualcomm Incorporated

- Magic Leap, Inc.

- PTC Inc.

- Dassault Systèmes

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 10.8 billion |

|

Forecasted Value (2030) |

USD 21.9 billion |

|

CAGR (2025 – 2030) |

12.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Virtual Reality Market By Type (Hardware, Software, Content), By Component (Head-Mounted Displays (HMDs), Gesture-Tracking Devices, Projectors and Display Walls), By Application (Gaming and Entertainment, Healthcare, Education and Training, Retail and E-Commerce, Real Estate and Architecture, Industrial and Manufacturing), By End-User (Consumer, Enterprise) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Meta Platforms, Inc. (Oculus), Sony Corporation, HTC Corporation, Microsoft Corporation, Samsung Electronics Co., Ltd., Google LLC, NVIDIA Corporation, Unity Technologies, Autodesk, Inc., Epic Games, Inc., Lenovo Group Limited, Qualcomm Incorporated, Magic Leap, Inc., PTC Inc., Dassault Systèmes |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Virtual Reality Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Hardware |

|

4.2. Software |

|

4.3. Content |

|

5. Virtual Reality Market, by Component (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Head-Mounted Displays (HMDs) |

|

5.2. Gesture-Tracking Devices |

|

5.3. Projectors and Display Walls |

|

5.4. Others |

|

6. Virtual Reality Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Gaming and Entertainment |

|

6.2. Healthcare |

|

6.3. Education and Training |

|

6.4. Retail and E-Commerce |

|

6.5. Real Estate and Architecture |

|

6.6. Industrial and Manufacturing |

|

6.7. Others |

|

7. Virtual Reality Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Consumer |

|

7.2. Enterprise |

|

7.3. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Virtual Reality Market, by Type |

|

8.2.7. North America Virtual Reality Market, by Component |

|

8.2.8. North America Virtual Reality Market, by Application |

|

8.2.9. North America Virtual Reality Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Virtual Reality Market, by Type |

|

8.2.10.1.2. US Virtual Reality Market, by Component |

|

8.2.10.1.3. US Virtual Reality Market, by Application |

|

8.2.10.1.4. US Virtual Reality Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Meta Platforms, Inc. (Oculus) |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Sony Corporation |

|

10.3. HTC Corporation |

|

10.4. Microsoft Corporation |

|

10.5. Samsung Electronics Co., Ltd. |

|

10.6. Google LLC |

|

10.7. NVIDIA Corporation |

|

10.8. Unity Technologies |

|

10.9. Autodesk, Inc. |

|

10.10. Epic Games, Inc. |

|

10.11. Lenovo Group Limited |

|

10.12. Qualcomm Incorporated |

|

10.13. Magic Leap, Inc. |

|

10.14. PTC Inc. |

|

10.15. Dassault Systèmes |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Virtual Reality Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Virtual Reality Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Virtual Reality Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA