As per Intent Market Research, the Virtual Reality Headset Market was valued at USD 5.2 billion in 2024-e and will surpass USD 14.4 billion by 2030; growing at a CAGR of 18.6% during 2025 - 2030.

The Virtual Reality (VR) headset market has seen significant growth, driven by advancements in immersive technologies that are reshaping entertainment, healthcare, education, military, and other industries. With an increasing demand for more engaging and realistic experiences, VR headsets are becoming a staple in gaming, medical applications, and even corporate training environments. The market is segmented based on headset type, display technology, and end-use industry, with each segment contributing to the expansion of VR’s capabilities and applications. As industries continue to explore the potential of VR technology, the demand for these devices is expected to grow exponentially, offering both new opportunities and challenges for manufacturers.

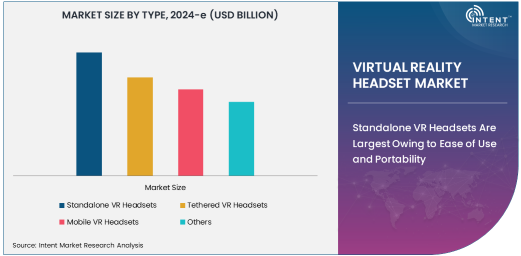

Standalone VR Headsets Are Largest Owing to Ease of Use and Portability

Standalone VR headsets are the largest segment in the VR headset market, primarily due to their ease of use, portability, and reduced dependency on external hardware such as computers or gaming consoles. These headsets are self-contained, featuring built-in processors, storage, and display systems that eliminate the need for cables and additional devices. This independence from external hardware makes standalone VR headsets particularly appealing for consumers who desire a simple, plug-and-play solution for their virtual reality experiences.

The rise in mobile VR gaming, virtual tourism, and education has contributed significantly to the popularity of standalone VR headsets, with models like the Oculus Quest 2 leading the charge. These devices offer high-quality immersive experiences without requiring a computer or console, making them ideal for home use, entertainment, and educational purposes. As VR content becomes more widely available and the technology continues to evolve, standalone VR headsets are expected to maintain their dominant position in the market, with advancements in processing power and display technology further enhancing their appeal.

Tethered VR Headsets Are Fastest Growing Owing to Superior Performance for Professional Use

Tethered VR headsets are the fastest-growing segment in the market, driven by their superior performance and higher-quality experiences, which make them ideal for professional and enterprise applications. These headsets are connected to a computer or gaming console via cables, allowing for more powerful processors, better graphics rendering, and improved latency reduction compared to standalone units. This makes tethered VR headsets particularly suited for gaming enthusiasts, professional simulations, design applications, and VR training programs in fields such as medicine, engineering, and architecture.

The enhanced performance of tethered headsets enables users to experience more complex virtual environments and high-resolution graphics, which is essential for industries that rely on VR for simulation and visualization purposes. As the demand for VR technology grows in sectors like healthcare, defense, and manufacturing, tethered VR headsets are becoming increasingly popular for tasks that require high levels of immersion, accuracy, and detail. As VR technology continues to evolve, tethered headsets are expected to see continued growth, especially in professional environments where performance is paramount.

OLED Display Technology Is Largest Owing to Superior Visual Quality and Immersive Experience

OLED (Organic Light Emitting Diode) display technology is the largest segment in the VR headset market, due to its superior visual quality, deep blacks, vibrant colors, and higher contrast ratios. OLED displays are known for delivering exceptional color accuracy and immersive visuals, making them highly sought after in VR applications where visual experience is critical. The ability of OLED screens to provide true-to-life colors and sharper images enhances the realism of virtual environments, creating a more engaging and comfortable experience for users.

In addition, OLED technology's faster refresh rates and lower power consumption make it ideal for VR headsets, where performance and battery life are essential. Leading VR headset manufacturers like Oculus and HTC have integrated OLED displays into their devices to meet consumer demand for high-quality visual experiences. As VR content continues to demand higher resolution and more vibrant visuals, OLED displays are expected to maintain their leadership position in the market, offering a superior visual experience for both gaming and professional applications.

Gaming Industry Is Largest End-Use Industry Owing to Immersive Entertainment Experiences

The gaming industry is the largest end-use segment in the VR headset market, owing to the increasing demand for immersive, interactive, and realistic gaming experiences. Virtual reality gaming has revolutionized how players interact with digital environments, offering them the ability to experience games in a completely new and immersive way. VR headsets allow gamers to fully engage with the virtual world, offering a sense of presence and interactivity that traditional gaming methods cannot provide.

Major gaming companies, including Sony, Oculus, and HTC, have integrated VR capabilities into their consoles and standalone systems, making VR gaming more accessible and appealing to a broader audience. As game developers create more VR-compatible titles and the technology behind VR gaming headsets continues to improve, the gaming industry will continue to drive the growth of the VR headset market. With gaming enthusiasts seeking out more engaging and realistic experiences, the gaming sector is expected to remain the dominant consumer of VR headset technology.

North America Is Largest Region Owing to High Adoption of Advanced Technologies in Multiple Sectors

North America is the largest region in the VR headset market, driven by the high adoption of advanced technologies across gaming, healthcare, education, and military sectors. The United States, in particular, is a key market for VR headsets, as it houses a large number of tech companies, research institutions, and consumer-facing industries that are early adopters of virtual reality. The region's strong focus on technological innovation, coupled with high disposable income and a tech-savvy population, has led to the widespread adoption of VR technology.

In addition to gaming and entertainment, industries such as healthcare, education, and military are increasingly turning to VR to enhance their offerings. The integration of VR in medical training, therapeutic practices, and military simulations further contributes to North America’s dominance in the market. As the demand for immersive and interactive experiences continues to rise, North America is expected to remain a key market for VR headset manufacturers, driving the overall market growth in the coming years.

Leading Companies and Competitive Landscape

The VR headset market is competitive, with several key players leading innovation and market development. Leading companies include Oculus (Meta), HTC, Sony, and Valve, all of which are driving the development of both consumer-grade and professional VR systems. These companies are investing in research and development to improve the performance of their headsets, enhance the VR experience, and expand their market reach.

Competition in the market is driven by factors such as headset performance, comfort, content availability, and price. Manufacturers are focusing on creating lighter, more comfortable devices with better visual fidelity and processing power. As industries explore the potential applications of VR technology, partnerships with content creators, software developers, and educational institutions are expected to play a significant role in the continued growth and evolution of the VR headset market.

Recent Developments:

- In November 2024, Sony Corporation unveiled a new version of its PlayStation VR headset, offering enhanced resolution and a wider field of view for immersive gaming experiences.

- In October 2024, Oculus VR (Facebook Technologies) launched a new standalone VR headset with improved processing power and new interactive capabilities for gaming and social VR experiences.

- In September 2024, HTC Corporation introduced a high-end VR headset for enterprise use, focusing on training and simulation applications in sectors like healthcare and defense.

- In August 2024, Microsoft Corporation partnered with educational institutions to deploy VR headsets for immersive learning experiences across various academic disciplines.

- In July 2024, Lenovo Group Ltd. launched an affordable mobile VR headset designed for casual consumers, featuring an improved display and lightweight design.

List of Leading Companies:

- Sony Corporation

- Oculus VR (Facebook Technologies)

- HTC Corporation

- Valve Corporation

- Samsung Electronics

- Microsoft Corporation

- Google LLC

- Pico Interactive

- Lenovo Group Ltd.

- Razer Inc.

- HP Inc.

- Xiaomi Corporation

- Huawei Technologies Co., Ltd.

- Acer Inc.

- Magic Leap, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 5.2 billion |

|

Forecasted Value (2030) |

USD 14.4 billion |

|

CAGR (2025 – 2030) |

18.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Virtual Reality Headset Market By Type (Standalone VR Headsets, Tethered VR Headsets, Mobile VR Headsets), By Display Technology (OLED, LCD, LCoS), By End-Use Industry (Gaming, Healthcare, Education, Military and Defense, Retail) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Sony Corporation, Oculus VR (Facebook Technologies), HTC Corporation, Valve Corporation, Samsung Electronics, Microsoft Corporation, Google LLC, Pico Interactive, Lenovo Group Ltd., Razer Inc., HP Inc., Xiaomi Corporation, Huawei Technologies Co., Ltd., Acer Inc., Magic Leap, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Virtual Reality Headset Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Standalone VR Headsets |

|

4.2. Tethered VR Headsets |

|

4.3. Mobile VR Headsets |

|

4.4. Others |

|

5. Virtual Reality Headset Market, by Display Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. OLED |

|

5.2. LCD |

|

5.3. LCoS |

|

5.4. Others |

|

6. Virtual Reality Headset Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Gaming |

|

6.2. Healthcare |

|

6.3. Education |

|

6.4. Military and Defense |

|

6.5. Retail |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Virtual Reality Headset Market, by Type |

|

7.2.7. North America Virtual Reality Headset Market, by Display Technology |

|

7.2.8. North America Virtual Reality Headset Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Virtual Reality Headset Market, by Type |

|

7.2.9.1.2. US Virtual Reality Headset Market, by Display Technology |

|

7.2.9.1.3. US Virtual Reality Headset Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Sony Corporation |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Oculus VR (Facebook Technologies) |

|

9.3. HTC Corporation |

|

9.4. Valve Corporation |

|

9.5. Samsung Electronics |

|

9.6. Microsoft Corporation |

|

9.7. Google LLC |

|

9.8. Pico Interactive |

|

9.9. Lenovo Group Ltd. |

|

9.10. Razer Inc. |

|

9.11. HP Inc. |

|

9.12. Xiaomi Corporation |

|

9.13. Huawei Technologies Co., Ltd. |

|

9.14. Acer Inc. |

|

9.15. Magic Leap, Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Virtual Reality Headset Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Virtual Reality Headset Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Virtual Reality Headset Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA