As per Intent Market Research, the Virtual Reality Content Creation Market was valued at USD 1.1 billion in 2024-e and will surpass USD 2.1 billion by 2030; growing at a CAGR of 12.2% during 2025 - 2030.

The Virtual Reality (VR) Content Creation market is experiencing rapid growth as industries leverage immersive technology to deliver innovative and engaging experiences. VR content creation is the process of developing interactive 3D environments, simulations, and visualizations, which can be used in a wide range of applications, including entertainment, education, healthcare, real estate, and more. As VR technology continues to evolve, content creation has become a critical component in making virtual environments more immersive and realistic. The market for VR content creation is driven by advancements in VR hardware, increased adoption across sectors, and the growing demand for interactive experiences.

As businesses and industries increasingly embrace VR for training, marketing, and entertainment, the need for high-quality, engaging content has grown. The development of VR content requires specialized tools and platforms, with creators relying on powerful software and platforms to craft interactive 3D models, animations, and videos that can be viewed through VR headsets or on digital platforms. The market’s expansion is also fueled by the decreasing costs of VR equipment, improved processing power, and the growing availability of VR platforms for various end-user industries.

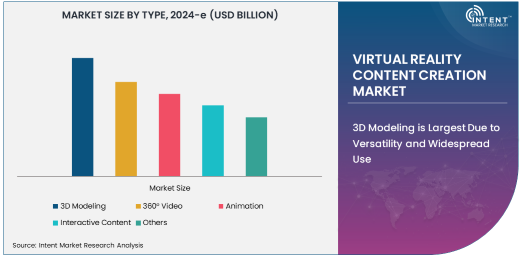

3D Modeling is Largest Due to Versatility and Widespread Use

The 3D Modeling segment dominates the VR content creation market, owing to its versatility and wide range of applications across various industries. 3D modeling involves creating three-dimensional objects or environments that can be used in virtual reality applications, making it a critical element in industries such as gaming, architecture, healthcare, and education. With 3D models forming the foundation of most VR experiences, this type of content creation is in high demand. It enables creators to produce highly detailed and interactive environments that are essential for immersion in VR applications.

In gaming, for example, 3D modeling is used to create game worlds, characters, and assets that players interact with, while in healthcare, 3D models are crucial for simulations and training exercises. The ability to manipulate and interact with 3D objects in virtual spaces has made 3D modeling a cornerstone of VR content creation, further driving its dominance in the market. As industries continue to embrace VR as a tool for visualization and training, the demand for 3D modeling content is expected to remain strong.

Mobile-Based Platform is Fastest Growing Owing to Accessibility and Convenience

The Mobile-Based platform is the fastest-growing segment in the VR content creation market, fueled by the increasing accessibility of mobile devices and the rise of mobile VR applications. Mobile VR platforms, such as Google Cardboard and Samsung Gear VR, have made it easier for users to experience VR content on their smartphones, and content creators are increasingly focusing on mobile platforms to reach a broader audience. Mobile devices offer greater convenience and portability, making them ideal for on-the-go VR experiences.

The mobile-based VR platform is particularly attractive in industries such as retail, where businesses use mobile VR to create virtual stores or interactive advertisements that engage customers in new ways. In addition, mobile VR is gaining traction in education and entertainment, where users can access immersive learning experiences or media content from their smartphones. As smartphone penetration continues to rise globally, the mobile-based platform for VR content creation is expected to see continued growth, offering a more accessible and cost-effective option for both creators and consumers.

Healthcare End-Use Industry Leads Due to Growing Adoption of VR for Medical Training

The healthcare industry is the largest end-user sector in the VR content creation market, driven by the increasing use of VR for medical training, treatment planning, and patient rehabilitation. VR has proven to be an effective tool in training medical professionals by simulating complex procedures and scenarios in a controlled, virtual environment. This allows medical practitioners to gain hands-on experience without the risks associated with real-life practice. In addition, VR is being used for pain management, physical therapy, and mental health treatments, further contributing to its growing use in healthcare.

With the ongoing advancements in VR technology and a greater focus on enhancing medical education and patient care, the healthcare industry continues to be the dominant driver of the VR content creation market. As VR applications become more widespread in medical training programs and therapeutic treatments, demand for high-quality, immersive VR content in healthcare is expected to increase, cementing its position as the leading end-user industry.

Desktop-Based Platform is Largest for Advanced Content Creation

The Desktop-Based platform is the largest segment in the VR content creation market, owing to the advanced capabilities and high processing power required for creating complex VR content. Desktop computers are typically used by professional VR content creators due to their ability to handle the intensive computational demands of 3D modeling, animation, and rendering. These platforms offer specialized software tools that allow for the creation of high-quality VR content, which is essential in industries such as gaming, film production, and simulation-based training.

While mobile-based platforms offer convenience and portability, desktop-based platforms are preferred for creating professional-grade content, where high performance and precision are necessary. This has made desktop-based content creation the go-to solution for many industries that require detailed and interactive virtual environments. As demand for high-quality VR content grows, the desktop-based platform continues to be the largest segment in the market, particularly among professionals and enterprises.

North America Leads the VR Content Creation Market Due to Advanced Technological Infrastructure

North America is the largest region in the VR content creation market, supported by its advanced technological infrastructure and high adoption rate of immersive technologies. The region is home to many of the leading companies in the VR industry, including Oculus, Unity Technologies, and Epic Games, which are driving the development of VR content creation tools and platforms. Additionally, North American industries, including gaming, healthcare, and education, are among the most prominent adopters of VR technology, further bolstering the demand for VR content creation services.

North America's dominance in the VR content creation market is also attributed to its large base of tech-savvy consumers and its status as a global hub for innovation. The region's significant investment in research and development, coupled with a high level of collaboration between technology companies, content creators, and industries such as healthcare and education, ensures continued growth in VR content creation. As VR technology becomes more mainstream, North America is expected to maintain its leadership in the market.

Leading Companies and Competitive Landscape

The VR content creation market is highly competitive, with key players continuously innovating to offer advanced tools and platforms for content creators. Leading companies include Unity Technologies, Epic Games, Adobe, and Autodesk, which provide comprehensive software solutions for 3D modeling, animation, and interactive content creation. These companies are at the forefront of developing VR content creation technologies that cater to a wide range of industries, including gaming, healthcare, and real estate.

The competitive landscape is marked by the rapid development of new VR tools and platforms, as well as the increasing availability of user-friendly applications for creating immersive content. As the demand for VR content creation grows across industries, companies are focusing on improving their offerings with features such as real-time rendering, cloud-based collaboration, and enhanced accessibility. This has led to a highly dynamic and competitive market, where continuous innovation is essential for maintaining a competitive edge.

Recent Developments:

- In November 2024, Unity Technologies launched a new VR content creation toolkit for game developers to streamline workflow.

- In October 2024, Epic Games announced an update to Unreal Engine, offering enhanced support for VR content creation.

- In September 2024, Autodesk introduced a new VR modeling tool aimed at designers and architects for better visualization.

- In August 2024, Oculus unveiled new VR content creation features for creators targeting the education sector.

- In July 2024, Magic Leap partnered with healthcare providers to develop VR content for medical training simulations.

List of Leading Companies:

- Unity Technologies

- Unreal Engine (Epic Games)

- Google LLC

- Oculus (Meta Platforms, Inc.)

- Autodesk, Inc.

- A-Frame (Supermedium)

- NVIDIA Corporation

- HTC Corporation

- Magic Leap, Inc.

- Adobe Inc.

- Vuze XR

- Renderosity

- Lumen Research

- Sketchfab Inc.

- PTC Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 billion |

|

Forecasted Value (2030) |

USD 2.1 billion |

|

CAGR (2025 – 2030) |

12.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Virtual Reality Content Creation Market By Type (3D Modeling, 360° Video, Animation, Interactive Content), By Platform (Desktop-Based, Mobile-Based, Web-Based), By End-User Industry (Gaming, Healthcare, Education, Real Estate, Retail) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Unity Technologies, Unreal Engine (Epic Games), Google LLC, Oculus (Meta Platforms, Inc.), Autodesk, Inc., A-Frame (Supermedium), NVIDIA Corporation, HTC Corporation, Magic Leap, Inc., Adobe Inc., Vuze XR, Renderosity, Lumen Research, Sketchfab Inc., PTC Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Virtual Reality Content Creation Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. 3D Modeling |

|

4.2. 360° Video |

|

4.3. Animation |

|

4.4. Interactive Content |

|

4.5. Others |

|

5. Virtual Reality Content Creation Market, by Platform (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Desktop-Based |

|

5.2. Mobile-Based |

|

5.3. Web-Based |

|

6. Virtual Reality Content Creation Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Gaming |

|

6.2. Healthcare |

|

6.3. Education |

|

6.4. Real Estate |

|

6.5. Retail |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Virtual Reality Content Creation Market, by Type |

|

7.2.7. North America Virtual Reality Content Creation Market, by Platform |

|

7.2.8. North America Virtual Reality Content Creation Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Virtual Reality Content Creation Market, by Type |

|

7.2.9.1.2. US Virtual Reality Content Creation Market, by Platform |

|

7.2.9.1.3. US Virtual Reality Content Creation Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Unity Technologies |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Unreal Engine (Epic Games) |

|

9.3. Google LLC |

|

9.4. Oculus (Meta Platforms, Inc.) |

|

9.5. Autodesk, Inc. |

|

9.6. A-Frame (Supermedium) |

|

9.7. NVIDIA Corporation |

|

9.8. HTC Corporation |

|

9.9. Magic Leap, Inc. |

|

9.10. Adobe Inc. |

|

9.11. Vuze XR |

|

9.12. Renderosity |

|

9.13. Lumen Research |

|

9.14. Sketchfab Inc. |

|

9.15. PTC Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Virtual Reality Content Creation Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Virtual Reality Content Creation Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Virtual Reality Content Creation Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA