As per Intent Market Research, the Virtual Events Market was valued at USD 2.4 billion in 2024-e and will surpass USD 4.6 billion by 2030; growing at a CAGR of 11.3% during 2025 - 2030.

The virtual events market has experienced rapid growth in recent years, driven by the increasing demand for digital interaction and remote engagement across industries. Virtual events, including conferences, trade shows, webinars, and corporate gatherings, offer businesses and organizations the ability to connect with their audiences on a global scale without the need for physical presence. The convenience and cost-effectiveness of hosting virtual events, combined with technological advancements, have made them a preferred choice for many businesses, particularly in light of the global pandemic which accelerated the adoption of digital solutions. As a result, virtual events have become an integral part of business strategies for promoting products, sharing knowledge, and engaging with stakeholders.

Virtual event platforms have continued to evolve, offering advanced features like live streaming, interactive webinars, and networking tools to enhance the attendee experience. From large-scale conferences to small corporate meetings, virtual events provide flexibility, accessibility, and scalability. With the increasing reliance on digital and remote work environments, the virtual events market is expected to grow substantially in the coming years, driven by businesses across various sectors embracing this technology to engage with their audiences in new and innovative ways.

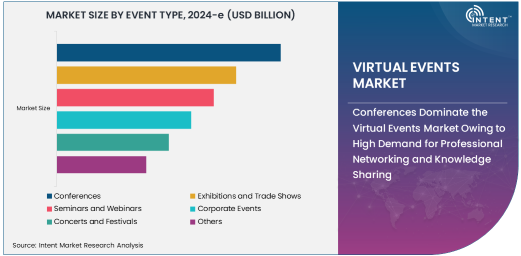

Conferences Dominate the Virtual Events Market Owing to High Demand for Professional Networking and Knowledge Sharing

Conferences remain the largest segment within the virtual events market, owing to the high demand for professional networking and knowledge sharing in various industries. Virtual conferences allow professionals, experts, and thought leaders to connect with attendees across the globe, offering seminars, keynote speeches, and panel discussions that facilitate learning and information exchange. The ability to reach a broader audience, coupled with cost savings related to travel and venue expenses, has made virtual conferences a highly attractive option for businesses and organizations.

The COVID-19 pandemic accelerated the adoption of virtual conferences, as organizations sought ways to continue hosting industry events while adhering to health and safety protocols. Even after the return of in-person gatherings, the convenience and expanded reach offered by virtual formats have ensured the continued popularity of virtual conferences. As businesses embrace hybrid events, where virtual components complement in-person activities, the demand for virtual conference platforms is expected to remain strong in the coming years.

Web-Based Platforms Lead the Way in Virtual Event Hosting Due to Accessibility and User-Friendly Features

Web-based platforms dominate the virtual events market in terms of platform type, owing to their accessibility and user-friendly features. These platforms allow event organizers to host a variety of events, from small meetings to large conferences, with ease. Web-based platforms are accessible across different devices, such as desktops, laptops, and smartphones, making them highly convenient for both event organizers and participants. Furthermore, these platforms offer a wide range of features, including live streaming, attendee networking, interactive sessions, and real-time feedback tools, ensuring a seamless and engaging experience for all involved.

The popularity of web-based platforms is also fueled by their affordability and scalability. These platforms allow organizers to host events of varying sizes without the need for significant investments in infrastructure or specialized equipment. With continuous advancements in cloud-based technologies and streaming capabilities, web-based platforms are likely to remain a dominant choice for virtual events, especially for organizations seeking reliable, cost-effective, and flexible solutions.

Corporate and Business Sector Drives Demand for Virtual Events Solutions

The corporate and business sector is the largest end-user of virtual event solutions, with organizations utilizing virtual events for meetings, product launches, corporate conferences, and employee training. The flexibility and scalability of virtual events make them ideal for companies looking to engage with employees, clients, and stakeholders in an efficient and cost-effective manner. Virtual events also allow businesses to extend their reach beyond geographical limitations, enabling them to connect with a global audience while reducing logistical costs associated with in-person events.

As remote work becomes more prevalent and organizations increasingly prioritize digital solutions, the demand for virtual event platforms is expected to rise in the corporate sector. Virtual events also play a crucial role in employee development, team-building activities, and client engagement initiatives, further driving the growth of this segment. The ease of organizing and attending virtual events has made them an integral part of business communication strategies, positioning the corporate sector as a key contributor to the expansion of the virtual events market.

North America Leads the Virtual Events Market Owing to High Adoption and Technological Advancements

North America is the largest region in the virtual events market, driven by high adoption rates, technological advancements, and the presence of key players in the industry. The region is home to numerous global businesses, technology companies, and event management firms that have embraced virtual events to connect with their audiences and stakeholders. Additionally, North American companies are increasingly investing in innovative solutions to enhance the virtual event experience, such as interactive platforms, networking tools, and immersive technologies like VR and AR.

The widespread use of digital technologies and internet connectivity in North America has contributed to the strong demand for virtual event solutions in the region. Furthermore, the impact of the COVID-19 pandemic accelerated the adoption of virtual events, as businesses sought alternatives to traditional in-person gatherings. As the market for virtual events continues to grow, North America is expected to maintain its leading position, with increasing investments in technology and the ongoing development of hybrid event formats that combine in-person and virtual experiences.

Leading Companies and Competitive Landscape

The virtual events market is highly competitive, with several key players offering diverse solutions to meet the needs of different industries. Leading companies such as Zoom Video Communications, Microsoft, Cisco WebEx, and Hopin dominate the market by providing comprehensive virtual event platforms with a wide range of features. These companies are continually innovating to enhance the user experience, offering tools for event management, attendee engagement, networking, and analytics.

In addition to these established players, a growing number of startups and niche providers are entering the market, offering specialized platforms for specific types of virtual events, such as conferences, trade shows, and corporate meetings. The competitive landscape is characterized by intense competition, with companies focusing on product differentiation, customer experience, and integration with other digital tools to stay ahead in the market. As the demand for virtual events continues to rise, the competitive dynamics will likely evolve, with players emphasizing flexibility, scalability, and immersive technologies to meet the diverse needs of their clients.

Recent Developments:

- In November 2024, Zoom introduced new features for hybrid events, including enhanced virtual networking options.

- In October 2024, Hopin acquired a virtual event management company to expand its capabilities in corporate event solutions.

- In September 2024, ON24 launched an AI-driven engagement tool for improving attendee interactions during webinars and conferences.

- In August 2024, vFairs rolled out a new platform for hosting virtual trade shows with immersive 3D environments.

- In July 2024, Airmeet announced a partnership with global event organizers to enhance virtual networking and community-building experiences.

List of Leading Companies:

- Zoom Video Communications, Inc.

- Hopin

- ON24, Inc.

- vFairs

- Remo

- Intrado Corporation

- InXpo (Acquired by Intrado)

- BigMarker

- Cvent, Inc.

- Socialive

- EventMobi

- 6Connex

- PheedLoop

- VFairs

- Airmeet

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.4 billion |

|

Forecasted Value (2030) |

USD 4.6 billion |

|

CAGR (2025 – 2030) |

11.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Virtual Events Market By Event Type (Conferences, Exhibitions and Trade Shows, Seminars and Webinars, Corporate Events, Concerts and Festivals), By Platform Type (Web-Based Platforms, Mobile-Based Platforms, Virtual Reality (VR) Platforms, Augmented Reality (AR) Platforms), By End-User Industry (Corporate and Business, Entertainment and Media, Education and Training, Healthcare, Retail and E-commerce) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Zoom Video Communications, Inc., Hopin, ON24, Inc., vFairs, Remo, Intrado Corporation, InXpo (Acquired by Intrado), BigMarker, Cvent, Inc., Socialive, EventMobi, 6Connex, PheedLoop, VFairs, Airmeet |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Virtual Events Market, by Event Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Conferences |

|

4.2. Exhibitions and Trade Shows |

|

4.3. Seminars and Webinars |

|

4.4. Corporate Events |

|

4.5. Concerts and Festivals |

|

4.6. Others |

|

5. Virtual Events Market, by Platform Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Web-Based Platforms |

|

5.2. Mobile-Based Platforms |

|

5.3. Virtual Reality (VR) Platforms |

|

5.4. Augmented Reality (AR) Platforms |

|

5.5. Others |

|

6. Virtual Events Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Corporate and Business |

|

6.2. Entertainment and Media |

|

6.3. Education and Training |

|

6.4. Healthcare |

|

6.5. Retail and E-commerce |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Virtual Events Market, by Event Type |

|

7.2.7. North America Virtual Events Market, by Platform Type |

|

7.2.8. North America Virtual Events Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Virtual Events Market, by Event Type |

|

7.2.9.1.2. US Virtual Events Market, by Platform Type |

|

7.2.9.1.3. US Virtual Events Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Zoom Video Communications, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Hopin |

|

9.3. ON24, Inc. |

|

9.4. vFairs |

|

9.5. Remo |

|

9.6. Intrado Corporation |

|

9.7. InXpo (Acquired by Intrado) |

|

9.8. BigMarker |

|

9.9. Cvent, Inc. |

|

9.10. Socialive |

|

9.11. EventMobi |

|

9.12. 6Connex |

|

9.13. PheedLoop |

|

9.14. VFairs |

|

9.15. Airmeet |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Virtual Events Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Virtual Events Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Virtual Events Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA