Global Vinyl Acetate Monomer Market by Application (Construction, Automotive, Packaging, Textiles, Adhesives & Sealants, Paints & Coatings), by Form (Liquid, Solid), by End-Use Industry (Automotive Industry, Building & Construction, Consumer Goods, Packaging Industry, Textile & Apparel); Insights & Forecast (2024 - 2030)

As per Intent Market Research, the Vinyl Acetate Monomer Market was valued at USD 3.0 Billion in 2024-e and will surpass USD 17.0 Billion by 2030; growing at a CAGR of 33.8% during 2025 - 2030.

The Vinyl Acetate Monomer (VAM) market has seen significant growth due to its versatile applications across various industries, including construction, automotive, packaging, textiles, and adhesives. As a key building block in the production of a wide range of polymers and copolymers, VAM is crucial for the manufacturing of products such as paints, coatings, adhesives, sealants, and films. The increasing demand for consumer goods, along with growing industrial applications, is fueling the market's expansion. Additionally, VAM's role in creating high-performance materials for construction and automotive applications continues to drive demand in the market.

The market is expected to witness continued growth as industries increasingly focus on innovations to improve product durability, quality, and performance. Additionally, with the continued development of sustainable solutions in industries such as packaging and construction, VAM-based products are likely to play an important role due to their reliability, versatility, and contribution to high-quality materials. The increased use of VAM in emerging applications, such as textiles and automotive, is also supporting the growth of this market.

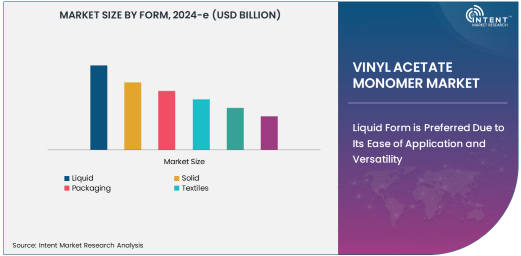

Liquid Form is Preferred Due to Its Ease of Application and Versatility

Liquid VAM is the most preferred form in the market due to its versatility and ease of application. The liquid form is widely used in the production of adhesives, paints, coatings, and a variety of polymers. Liquid VAM is easier to handle and transport, which makes it suitable for industrial-scale applications. Additionally, liquid VAM enables better control over viscosity and can be easily blended with other chemicals to produce a wide range of products.

Liquid VAM’s use in coatings and paints allows for uniform dispersion and effective film formation, which is crucial for producing high-quality, durable products. Its compatibility with other compounds also makes it ideal for use in adhesives that require strong bonding capabilities. The flexibility and performance of liquid VAM make it indispensable for industries such as construction, automotive, and packaging, where materials need to meet stringent quality and durability standards.

Adhesives & Sealants Segment is Largest Owing to Its Versatile Applications in Multiple Industries

The Adhesives & Sealants segment is the largest in the Vinyl Acetate Monomer market due to the widespread use of VAM in the formulation of adhesives and sealants, which are essential in multiple industries, including construction, automotive, and packaging. VAM is a key component in the production of pressure-sensitive adhesives, construction adhesives, and sealants due to its excellent bonding properties and versatility. The growing demand for durable and high-performance adhesives in various applications, from home construction to automotive assembly, drives the market for VAM in this segment.

In the construction industry, adhesives and sealants made from VAM provide strong and long-lasting bonding solutions, crucial for applications such as flooring, roofing, and insulation. In the automotive industry, VAM-based adhesives ensure secure bonding of components, which is important for the lightweight construction of vehicles and overall vehicle performance. The global expansion of industries requiring adhesives and sealants, along with increased construction and automotive activities, makes this segment the largest contributor to the VAM market.

Packaging Industry Drives Demand for Vinyl Acetate Monomer Due to Growth in Flexible Packaging

The Packaging Industry is one of the fastest-growing end-use industries for Vinyl Acetate Monomer. VAM is used in the production of adhesives and films that are integral to flexible packaging solutions, which are in high demand due to the increasing popularity of convenience and sustainability trends. The growing consumer preference for ready-to-use, easy-to-carry packaged goods drives demand for VAM-based packaging solutions. Moreover, as consumers shift toward eco-friendly products, packaging companies are focusing on developing more sustainable and biodegradable packaging materials, where VAM plays a critical role in enhancing the performance and reliability of these solutions.

The VAM market in the packaging industry benefits from the increased demand for high-performance packaging materials, such as those used for food, beverages, pharmaceuticals, and consumer goods. With the rise of e-commerce and the need for effective, lightweight, and protective packaging, the role of VAM in packaging applications continues to expand, making the packaging industry one of the key drivers of growth in the Vinyl Acetate Monomer market.

Building & Construction Industry Leads Market Demand for VAM-Based Products

The Building & Construction industry is another significant end-use sector driving demand for Vinyl Acetate Monomer. VAM-based products, such as adhesives, paints, coatings, and sealants, are essential in construction applications for ensuring durability, weather resistance, and strength. As urbanization increases globally and construction activities continue to expand, the demand for materials that provide superior bonding, insulation, and protection in buildings and infrastructure projects continues to grow.

In addition, VAM is used in the production of exterior coatings and sealants, which offer enhanced protection against the elements, improving the longevity and performance of buildings. With the increasing focus on sustainable and energy-efficient buildings, the use of VAM-based products in the construction sector is expected to increase further, contributing to the growth of the market. The building & construction industry’s ongoing expansion, coupled with the rising demand for high-quality, long-lasting materials, solidifies its position as a leading end-use industry for Vinyl Acetate Monomer.

Asia-Pacific Dominates the Vinyl Acetate Monomer Market

Asia-Pacific is the dominant region in the vinyl acetate monomer (VAM) market, accounting for the largest market share. This growth is primarily driven by the high demand for VAM in key industries such as construction, automotive, packaging, and textiles. Countries like China and India are major contributors to the regional market due to rapid industrialization, growing manufacturing sectors, and increasing infrastructure development. Additionally, the expanding middle class and rising disposable incomes in these nations have spurred demand for consumer goods, which further supports VAM consumption in packaging materials and adhesives.

Competitive Landscape and Key Players

The Vinyl Acetate Monomer market is highly competitive, with a few global players dominating the landscape. Companies such as LyondellBasell Industries, DuPont, Wacker Chemie AG, and ExxonMobil Chemical are the leading players in the market. These companies invest heavily in research and development to enhance the performance and efficiency of VAM-based products, focusing on sustainable production methods and creating innovative solutions for various industries.

Additionally, there is significant competition from regional players that cater to local demands, offering competitive pricing and customized solutions. The market is also witnessing collaborations and partnerships among key players to expand their product portfolios and enter emerging markets. To maintain a competitive edge, companies are focusing on strategic acquisitions, technological advancements, and expanding their manufacturing capacities. The competitive landscape is expected to evolve as the demand for VAM-based products continues to rise across various industries.

Recent Developments:

- ExxonMobil Chemical expanded its production capacity for Vinyl Acetate Monomer in Asia to meet growing demand in the packaging and construction sectors.

- LyondellBasell Industries launched a new environmentally friendly VAM-based adhesive for use in the automotive industry, improving bonding strength while reducing environmental impact.

- Wacker Chemie AG announced a major investment in a VAM production facility in Europe, aimed at increasing supply to the growing demand for coatings and sealants.

- The Dow Chemical Company introduced a new VAM-based polymer that enhances the durability of paint coatings, making them more resistant to wear and weather conditions.

- INEOS Group successfully acquired a Vinyl Acetate Monomer plant in the Asia-Pacific region to expand its footprint and strengthen its position in the global market.

List of Leading Companies:

- ExxonMobil Chemical

- LyondellBasell Industries

- Wacker Chemie AG

- The Dow Chemical Company

- INEOS Group

- LG Chem Ltd.

- SABIC

- China National Petroleum Corporation (CNPC)

- DuPont

- Formosa Plastics Corporation

- Hanwa Chemical Corporation

- Huntsman Corporation

- Reliance Industries Limited

- Eastman Chemical Company

- Sumitomo Chemical Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.0 Billion |

|

Forecasted Value (2030) |

USD 17.0 Billion |

|

CAGR (2025 – 2030) |

33.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Vinyl Acetate Monomer Market by Application (Construction, Automotive, Packaging, Textiles, Adhesives & Sealants, Paints & Coatings), by Form (Liquid, Solid), by End-Use Industry (Automotive Industry, Building & Construction, Consumer Goods, Packaging Industry, Textile & Apparel) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

ExxonMobil Chemical, LyondellBasell Industries, Wacker Chemie AG, The Dow Chemical Company, INEOS Group, LG Chem Ltd., China National Petroleum Corporation (CNPC), DuPont, Formosa Plastics Corporation, Hanwa Chemical Corporation, Huntsman Corporation, Reliance Industries Limited, Sumitomo Chemical Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Vinyl Acetate Monomer Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Construction |

|

4.2. Automotive |

|

4.3. Packaging |

|

4.4. Textiles |

|

4.5. Adhesives & Sealants |

|

4.6. Paints & Coatings |

|

5. Vinyl Acetate Monomer Market, by Form (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Liquid |

|

5.2. Solid |

|

6. Vinyl Acetate Monomer Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Automotive Industry |

|

6.2. Building & Construction |

|

6.3. Consumer Goods |

|

6.4. Packaging Industry |

|

6.5. Textile & Apparel |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Vinyl Acetate Monomer Market, by Application |

|

7.2.7. North America Vinyl Acetate Monomer Market, by Form |

|

7.2.8. North America Vinyl Acetate Monomer Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Vinyl Acetate Monomer Market, by Application |

|

7.2.9.1.2. US Vinyl Acetate Monomer Market, by Form |

|

7.2.9.1.3. US Vinyl Acetate Monomer Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. ExxonMobil Chemical |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. LyondellBasell Industries |

|

9.3. Wacker Chemie AG |

|

9.4. The Dow Chemical Company |

|

9.5. INEOS Group |

|

9.6. LG Chem Ltd. |

|

9.7. SABIC |

|

9.8. China National Petroleum Corporation (CNPC) |

|

9.9. DuPont |

|

9.10. Formosa Plastics Corporation |

|

9.11. Hanwa Chemical Corporation |

|

9.12. Huntsman Corporation |

|

9.13. Reliance Industries Limited |

|

9.14. Eastman Chemical Company |

|

9.15. Sumitomo Chemical Co., Ltd. |

|

10. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Vinyl Acetate Monomer Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Vinyl Acetate Monomer Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Vinyl Acetate Monomer Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats