As per Intent Market Research, the Video Transcoding Market was valued at USD 3.0 billion in 2024-e and will surpass USD 17.0 billion by 2030; growing at a CAGR of 33.8% during 2025 - 2030.

The video transcoding market has seen substantial growth as the demand for high-quality video content continues to surge across various platforms. Video transcoding is the process of converting digital video files from one format to another, enabling seamless playback across different devices and platforms. As more consumers engage with video content through Over-the-Top (OTT) platforms, social media, and video streaming services, the need for efficient and effective transcoding solutions has become critical. The increasing popularity of video-based content, driven by trends in entertainment, education, and social media, further underscores the importance of this technology.

The market is anticipated to continue expanding as businesses seek to enhance their video streaming services and improve the user experience across diverse devices. The growing adoption of cloud technology, combined with the rise in content consumption, particularly in video-on-demand services, is fueling the need for sophisticated transcoding solutions. With advancements in encoding technology and AI-powered optimizations, the market for video transcoding is poised for significant developments in the coming years.

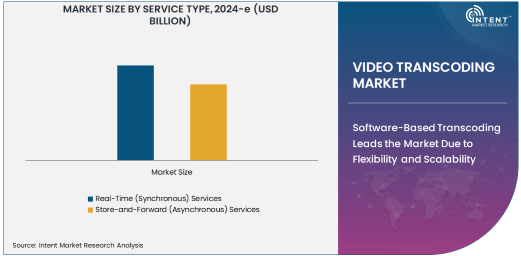

Software-Based Transcoding Leads the Market Due to Flexibility and Scalability

Software-Based Transcoding is the largest segment in the video transcoding market, driven by its flexibility, scalability, and ease of integration with existing systems. Software-based transcoding solutions offer significant advantages, particularly for OTT platforms, video streaming services, and social media applications, where content needs to be converted and optimized for different devices and resolutions. These solutions are highly adaptable and can scale according to the growing needs of businesses, making them suitable for companies of all sizes.

With the increasing demand for video content across a wide variety of devices, including smartphones, tablets, smart TVs, and laptops, software-based transcoding allows service providers to manage large volumes of video traffic with efficiency. Additionally, software solutions are often more cost-effective and offer greater customization, enabling content creators to ensure that their videos are optimized for different formats and playback environments. As the demand for video content continues to grow, software-based transcoding will remain a dominant force in the market, providing an essential solution for content delivery across diverse platforms.

Cloud-Based Video Transcoding Grows Rapidly Due to Scalability and Cost-Efficiency

Cloud-Based Video Transcoding is the fastest-growing segment within the technology category, largely due to its scalability and cost-efficiency. Cloud-based solutions allow businesses to offload the heavy computational tasks associated with video transcoding to remote servers, which can be accessed on-demand. This model eliminates the need for expensive hardware and infrastructure, providing companies with greater flexibility in scaling their transcoding capabilities as their content library grows. The cloud also offers the ability to process large volumes of video data in parallel, reducing the time required for transcoding and enabling faster delivery of content to end-users.

The growing adoption of cloud-based services across various industries, especially in media & entertainment and IT & telecom, has been a major factor in driving this segment’s rapid growth. Moreover, the integration of cloud transcoding with other cloud-based services, such as storage, content delivery networks (CDNs), and video analytics, makes it an attractive solution for video streaming providers, OTT platforms, and social media networks. As more organizations embrace cloud technologies, the demand for cloud-based video transcoding is expected to continue its upward trajectory, offering enhanced flexibility and reducing infrastructure management costs.

OTT Platforms Drive the Market’s Expansion Due to Increased Content Consumption

OTT (Over-the-Top) Platforms represent the largest application segment in the video transcoding market, as these platforms continue to lead the shift in how consumers access video content. With the proliferation of streaming services like Netflix, Amazon Prime Video, Hulu, and Disney+, OTT platforms have become the dominant force in the entertainment industry. Video transcoding is essential for OTT platforms to deliver content in various formats, resolutions, and bitrates to ensure compatibility with a wide range of devices, including smartphones, tablets, and smart TVs.

The rapid rise of OTT platforms has significantly increased the demand for video transcoding solutions, as these platforms must handle vast libraries of video content and deliver them seamlessly to millions of users worldwide. Furthermore, the growing trend of multi-device viewing, where users access content across different devices and network conditions, amplifies the need for transcoding services that can optimize video quality and reduce buffering. As OTT platforms continue to gain market share, the demand for efficient video transcoding technologies will remain strong, making this application segment the largest in the market.

Media & Entertainment Industry Is the Largest End-Use Industry Owing to Video Content Demand

The Media & Entertainment industry is the largest end-use industry in the video transcoding market, driven by the increasing consumption of digital video content. As the media and entertainment sector embraces digital transformation, the need to process and deliver video content in multiple formats for various devices has never been more critical. Video transcoding allows content providers, broadcasters, and streaming platforms to cater to diverse audience preferences and device compatibility requirements, ensuring high-quality video experiences.

With the rise of streaming services, video on demand (VoD), and user-generated content, the media and entertainment industry is witnessing an explosion in video content. This surge in content creation and consumption is fueling the need for efficient and scalable transcoding solutions to deliver videos in real-time to users around the globe. As content libraries continue to expand, media companies are increasingly relying on transcoding solutions to streamline their operations and provide optimized content delivery, making this sector a key driver of the video transcoding market.

North America is the Largest Region in the Viral Conjunctivitis Drugs Market

North America holds the largest share of the Viral Conjunctivitis Drugs market, primarily due to the high prevalence of viral eye infections, strong healthcare infrastructure, and significant demand for advanced medical treatments. The region benefits from well-established healthcare systems, particularly in the United States, where there is high awareness of viral conjunctivitis and its treatments. In addition, the widespread availability of both prescription and over-the-counter drugs in North America facilitates easy access to viral conjunctivitis medications. The demand for antiviral drugs, including both prescription and OTC options, is particularly strong in this region due to the effectiveness of these treatments and their availability through hospitals, pharmacies, and online platforms.

Competitive Landscape

The video transcoding market is highly competitive, with several major players offering a range of transcoding solutions across different technologies and applications. Key players include Amazon Web Services (AWS), Telestream, Harmonic, Media Excel, and Panasonic, which provide cloud-based, on-premises, and hybrid transcoding solutions tailored to the needs of media & entertainment companies, OTT platforms, and broadcasters. These companies focus on offering scalable, high-performance transcoding systems that can handle increasing volumes of video content while maintaining optimal video quality.

As competition intensifies, companies are differentiating themselves by integrating advanced technologies like artificial intelligence (AI) and machine learning (ML) to improve transcoding efficiency, enhance video quality, and optimize workflows. Moreover, partnerships between video transcoding providers and content delivery network (CDN) companies are becoming more common, enabling seamless content delivery and improving the overall user experience. As the market continues to evolve, leading players are expected to innovate and expand their offerings to stay ahead in this dynamic and fast-growing industry.

Recent Developments:

- AWS Elemental MediaConvert launched new features for adaptive bitrate streaming, enhancing video quality across multiple devices.

- Bitmovin expanded its cloud-based transcoding service to support new video formats, aiming to reduce latency and increase content delivery efficiency.

- Telestream introduced a new hardware-based transcoding solution designed for high-volume broadcast environments.

- Vimeo updated its video transcoding engine to improve efficiency and video resolution for higher-quality streaming experiences.

- Encoding.com partnered with a major OTT platform to provide scalable video transcoding services for large-scale content distribution.

List of Leading Companies:

- Amazon Web Services (AWS)

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Harmonic Inc.

- Vimeo Inc.

- Zencoder (Brightcove Inc.)

- SnapStream Media

- Apple Inc.

- Telestream, LLC

- Hulu LLC

- Akamai Technologies

- Media Melon, Inc.

- Encoding.com

- Bitmovin, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.0 Billion |

|

Forecasted Value (2030) |

USD 17.0 Billion |

|

CAGR (2025 – 2030) |

33.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Video Transcoding Market by Type (Software-Based Transcoding, Hardware-Based Transcoding), by Application (OTT (Over-the-Top) Platforms, Broadcast & Cable TV, Video Streaming, Social Media Platforms), by Technology (Cloud-Based Video Transcoding, On-Premises Video Transcoding, Hybrid Video Transcoding), by End-Use Industry (Media & Entertainment, IT & Telecom, Education & Training, Healthcare) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Amazon Web Services (AWS), IBM Corporation, Microsoft Corporation, Google LLC, Harmonic Inc., Vimeo Inc., SnapStream Media, Apple Inc., Telestream, LLC, Hulu LLC, Akamai Technologies, Media Melon, Inc., Bitmovin, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Video Transcoding Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Software-Based Transcoding |

|

4.2. Hardware-Based Transcoding |

|

5. Video Transcoding Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. OTT (Over-the-Top) Platforms |

|

5.2. Broadcast & Cable TV |

|

5.3. Video Streaming |

|

5.4. Social Media Platforms |

|

6. Video Transcoding Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Cloud-Based Video Transcoding |

|

6.2. On-Premises Video Transcoding |

|

6.3. Hybrid Video Transcoding |

|

7. Video Transcoding Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Media & Entertainment |

|

7.2. IT & Telecom |

|

7.3. Education & Training |

|

7.4. Healthcare |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Video Transcoding Market, by Type |

|

8.2.7. North America Video Transcoding Market, by Application |

|

8.2.8. North America Video Transcoding Market, by Technology |

|

8.2.9. North America Video Transcoding Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Video Transcoding Market, by Type |

|

8.2.10.1.2. US Video Transcoding Market, by Application |

|

8.2.10.1.3. US Video Transcoding Market, by Technology |

|

8.2.10.1.4. US Video Transcoding Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Amazon Web Services (AWS) |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. IBM Corporation |

|

10.3. Microsoft Corporation |

|

10.4. Google LLC |

|

10.5. Harmonic Inc. |

|

10.6. Vimeo Inc. |

|

10.7. Zencoder (Brightcove Inc.) |

|

10.8. SnapStream Media |

|

10.9. Apple Inc. |

|

10.10. Telestream, LLC |

|

10.11. Hulu LLC |

|

10.12. Akamai Technologies |

|

10.13. Media Melon, Inc. |

|

10.14. Encoding.com |

|

10.15. Bitmovin, Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Video Transcoding Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Video Transcoding Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Video Transcoding Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA