As per Intent Market Research, the Video Telemedicine Market was valued at USD 15.0 billion in 2024-e and will surpass USD 42.7 billion by 2030; growing at a CAGR of 19.1% during 2025 - 2030.

The video telemedicine market has witnessed significant growth in recent years, largely fueled by the increasing demand for accessible, convenient healthcare services, especially in remote areas. With advancements in digital health technologies, telemedicine has become a critical component of modern healthcare delivery, offering patients and healthcare providers the ability to interact in real-time, regardless of geographical location. Video telemedicine, in particular, has proven to be an effective solution in delivering virtual consultations, monitoring chronic conditions, and providing specialty care, making healthcare more accessible and efficient.

The market is expected to continue growing as the adoption of telemedicine platforms becomes more widespread across healthcare systems globally. Video telemedicine services are particularly popular in rural and underserved areas where access to in-person healthcare is limited. Moreover, as the healthcare industry embraces digital transformation, advancements in technologies such as AI, 5G, and mobile applications are expected to drive further innovation, expanding the reach and capabilities of video telemedicine services.

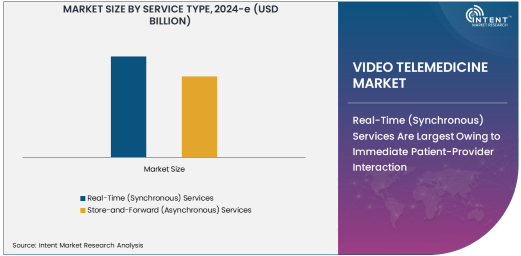

Real-Time (Synchronous) Services Are Largest Owing to Immediate Patient-Provider Interaction

The Real-Time (Synchronous) Services segment is the largest within the video telemedicine market, driven by the increasing demand for immediate interaction between patients and healthcare providers. Real-time video consultations enable healthcare professionals to diagnose, treat, and manage patients remotely, offering the same level of care as in-person visits. This service type is especially valuable for urgent consultations, follow-up appointments, and managing chronic conditions that require regular monitoring and adjustments.

Real-time services are highly popular in areas such as general medicine, mental health, and cardiology, where timely communication is critical to managing patient health. With the rise of high-speed internet connectivity, including the deployment of 5G, real-time telemedicine consultations have become more efficient and widely accessible. This segment is likely to continue dominating the market as patients increasingly prefer the convenience of real-time consultations over waiting for physical appointments. Additionally, healthcare providers benefit from improved patient engagement and reduced no-show rates, making this segment integral to the growth of the video telemedicine market.

Store-and-Forward (Asynchronous) Services Are Fastest Growing Due to Flexibility

The Store-and-Forward (Asynchronous) Services segment is the fastest-growing within the video telemedicine market, thanks to the flexibility it offers both patients and healthcare providers. Unlike real-time services, store-and-forward services allow for the transmission of medical information—such as medical images, test results, or patient data—at a later time for review by healthcare professionals. This model allows patients to submit their health information at their convenience, with the healthcare provider reviewing it at a scheduled time, facilitating more efficient use of resources.

Asynchronous services are particularly popular in dermatology, pediatrics, and mental health specialties, where patients can send images or videos of their conditions for review by specialists without needing to be available for a live consultation. This increases the accessibility of healthcare, especially for those in rural or underserved locations, and allows healthcare professionals to manage their time more effectively. Asynchronous services are also more affordable for both providers and patients, making them an attractive option for many users. As a result, this segment is expected to grow rapidly in the coming years.

Video Conferencing Platforms Lead the Market Due to Widespread Adoption in Healthcare

The Video Conferencing Platforms segment is the largest in the technology category of the video telemedicine market. Video conferencing platforms, such as Zoom, Microsoft Teams, and proprietary healthcare-specific solutions, have been widely adopted by healthcare providers for remote consultations. These platforms are easy to use, integrate well with existing healthcare IT systems, and provide secure communication channels, which are essential for compliance with healthcare regulations like HIPAA.

The widespread adoption of video conferencing for telemedicine has been further accelerated by the COVID-19 pandemic, as healthcare providers quickly shifted to virtual consultations to ensure continuity of care while adhering to social distancing measures. These platforms offer the necessary features such as high-definition video, screen sharing, file transfer, and real-time communication, making them ideal for both real-time and store-and-forward services. With the ongoing shift towards digital health solutions, video conferencing platforms are expected to continue dominating the video telemedicine market in both developed and emerging markets.

General Medicine Specialty Leads the Market Due to Broad Applications

The General Medicine specialty is the largest within the video telemedicine market, accounting for a significant portion of the overall market share. General medicine encompasses a wide range of healthcare services, including primary care, routine check-ups, and management of chronic conditions, all of which are well-suited for telemedicine. Patients increasingly turn to virtual consultations for non-emergency health concerns, such as flu-like symptoms, minor injuries, and health monitoring, given the convenience and accessibility offered by video telemedicine platforms.

General medicine is the most commonly practiced specialty in telemedicine, with services ranging from consultations for common ailments to remote management of chronic conditions like hypertension, diabetes, and asthma. The adoption of video telemedicine for general medical consultations is particularly high among elderly patients and those with mobility challenges, as it eliminates the need for travel. The broad applicability and versatility of general medicine in telemedicine make it a dominant force in this growing market.

North America Region Is Largest Due to High Adoption and Technological Advancements

The North America region is the largest market for video telemedicine, driven by the rapid adoption of telemedicine solutions, technological advancements, and a supportive regulatory environment. The U.S., in particular, has seen widespread use of video telemedicine services, driven by the large number of healthcare providers integrating digital platforms into their practice, as well as government incentives to expand telehealth access. The region's highly developed healthcare infrastructure, combined with high internet penetration and increasing demand for remote healthcare services, has created an ideal environment for the growth of video telemedicine.

Moreover, North America is home to many leading telemedicine technology providers, which have played a significant role in expanding the availability and sophistication of video telemedicine services. The market in this region is also supported by strong reimbursement policies, further promoting the adoption of telemedicine services. As telemedicine becomes an integral part of healthcare delivery, North America will continue to dominate the global video telemedicine market.

Competitive Landscape

The video telemedicine market is highly competitive, with key players such as Teladoc Health, Amwell, Doctor on Demand, MDTech, and Doxy.me leading the charge in providing innovative telemedicine solutions. These companies are continuously improving their platforms, integrating new technologies like AI-driven diagnostics and digital health monitoring tools to enhance user experience and patient care. Additionally, partnerships between healthcare providers, technology companies, and government agencies are fostering the growth of telemedicine services globally. As the demand for telemedicine services continues to rise, these companies are expanding their market presence, focusing on product development, and offering more specialized services across different medical fields to stay ahead in this evolving market.

Recent Developments:

- Teladoc Health expanded its video telemedicine platform with new AI-driven features aimed at improving diagnostic accuracy and patient engagement.

- Amwell launched a new service offering mental health consultations, integrating its telemedicine platform with licensed therapists and counselors.

- Babylon Health secured a partnership with a major healthcare system to provide telemedicine consultations and AI-powered health assessments.

- VSee announced the release of a new mobile telemedicine app that allows healthcare providers to offer video consultations from any device.

- Push Doctor introduced a new feature for video consultations that includes real-time document sharing and collaborative diagnosis tools for clinicians.

List of Leading Companies:

- Teladoc Health, Inc.

- American Well Corporation

- MDTech Inc.

- InTouch Health

- Doctors on Demand

- Telenor Health

- Doxy.me

- Push Doctor

- HealthTap

- VSee

- Amwell

- LiveHealth Online

- CloudVisit Telemedicine

- Babylon Health

- Babylon Care

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 15.0 Billion |

|

Forecasted Value (2030) |

USD 42.7 Billion |

|

CAGR (2025 – 2030) |

19.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Video Telemedicine Market by Service Type (Real-Time (Synchronous) Services, Store-and-Forward (Asynchronous) Services), by Technology (Video Conferencing Platforms, Mobile Telemedicine Apps, Web-Based Telemedicine Platforms), by Specialty (General Medicine, Mental Health, Dermatology, Cardiology, Pediatrics), by End-Use Industry (Healthcare Providers (Hospitals, Clinics), Patients (Individual Consumers), Telemedicine Providers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Teladoc Health, Inc., American Well Corporation, MDTech Inc., InTouch Health, Doctors on Demand, Telenor Health, Push Doctor, HealthTap, VSee, Amwell, LiveHealth Online, CloudVisit Telemedicine, Babylon Care |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Video Telemedicine Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Real-Time (Synchronous) Services |

|

4.2. Store-and-Forward (Asynchronous) Services |

|

5. Video Telemedicine Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Video Conferencing Platforms |

|

5.2. Mobile Telemedicine Apps |

|

5.3. Web-Based Telemedicine Platforms |

|

6. Video Telemedicine Market, by Specialty (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. General Medicine |

|

6.2. Mental Health |

|

6.3. Dermatology |

|

6.4. Cardiology |

|

6.5. Pediatrics |

|

7. Video Telemedicine Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Healthcare Providers (Hospitals, Clinics) |

|

7.2. Patients (Individual Consumers) |

|

7.3. Telemedicine Providers |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Video Telemedicine Market, by Service Type |

|

8.2.7. North America Video Telemedicine Market, by Technology |

|

8.2.8. North America Video Telemedicine Market, by Specialty |

|

8.2.9. North America Video Telemedicine Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Video Telemedicine Market, by Service Type |

|

8.2.10.1.2. US Video Telemedicine Market, by Technology |

|

8.2.10.1.3. US Video Telemedicine Market, by Specialty |

|

8.2.10.1.4. US Video Telemedicine Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Teladoc Health, Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. American Well Corporation |

|

10.3. MDTech Inc. |

|

10.4. InTouch Health |

|

10.5. Doctors on Demand |

|

10.6. Telenor Health |

|

10.7. Doxy.me |

|

10.8. Push Doctor |

|

10.9. HealthTap |

|

10.10. VSee |

|

10.11. Amwell |

|

10.12. LiveHealth Online |

|

10.13. CloudVisit Telemedicine |

|

10.14. Babylon Health |

|

10.15. Babylon Care |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Video Telemedicine Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Video Telemedicine Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Video Telemedicine Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA