As per Intent Market Research, the Veterinary Services Market was valued at USD 43.0 Billion in 2024-e and will surpass USD 64.1 Billion by 2030; growing at a CAGR of 6.9% during 2025-2030.

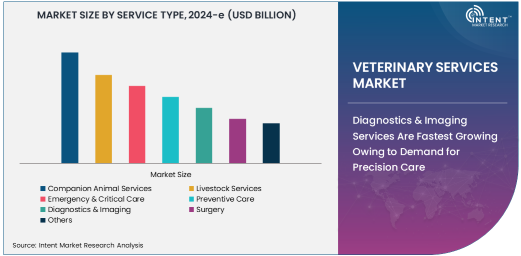

The veterinary services market is a cornerstone of animal healthcare, providing essential medical, preventive, and surgical care for animals. Companion animal services dominate the market due to the rising global trend of pet ownership and growing awareness about advanced veterinary care. These services include routine check-ups, vaccinations, diagnostics, imaging, and surgical procedures for pets like dogs and cats. With increasing disposable incomes and a growing human-animal bond, pet owners are more willing to invest in high-quality healthcare for their animals.

Companion animal services are further bolstered by innovations in veterinary medicine, including advanced imaging technologies, minimally invasive surgeries, and specialized care for aging pets. Additionally, the rise of pet insurance has made premium services more accessible, further driving the growth of this segment. The growing demand for specialized treatments and preventive care ensures the continued dominance of companion animal services in the veterinary market.

Diagnostics & Imaging Services Are Fastest Growing Owing to Demand for Precision Care

Diagnostics and imaging services are the fastest-growing segment in the veterinary services market, fueled by advancements in veterinary diagnostic tools and the increasing demand for precision care. Services such as X-rays, ultrasounds, MRI scans, and laboratory diagnostics enable veterinarians to accurately diagnose and treat a wide range of conditions in animals. These technologies have become integral to providing comprehensive care for both companion and livestock animals.

The growth of diagnostics and imaging services is further supported by the rising prevalence of chronic diseases and injuries among pets, as well as the increasing focus on preventive healthcare. Modern diagnostic tools not only improve treatment outcomes but also allow early detection of diseases, enhancing overall animal welfare. As veterinary practices continue to adopt advanced imaging and diagnostic solutions, this segment is expected to witness robust growth.

Veterinary Clinics Are Largest End-User Due to Accessibility and Comprehensive Care

Veterinary clinics are the largest end-user segment in the veterinary services market, serving as the primary point of care for both routine and emergency services. Clinics provide a wide range of services, including vaccinations, diagnostics, surgeries, and preventive care, making them accessible and convenient for pet owners and livestock handlers alike. Their ability to offer specialized and cost-effective care has made them a preferred choice for animal healthcare.

The growth of veterinary clinics is supported by their widespread presence, especially in urban and semi-urban areas, and the increasing number of veterinarians establishing private practices. Clinics are also integrating advanced diagnostic and imaging technologies to enhance their service offerings, further solidifying their role as the leading end-user in the veterinary services market.

Mobile/At-Home Services Are Fastest Growing Owing to Convenience and Personalized Care

Mobile and at-home veterinary services are rapidly gaining popularity, emerging as the fastest-growing delivery mode in the veterinary services market. These services cater to the rising demand for convenient, stress-free, and personalized care for pets. Mobile veterinarians offer on-site vaccinations, diagnostics, minor surgeries, and wellness checks, reducing the need for animals to travel and experience the stress associated with clinic visits.

The COVID-19 pandemic accelerated the adoption of mobile services, as pet owners sought safer alternatives to traditional clinic visits. Additionally, mobile services are increasingly being used for livestock healthcare in remote and rural areas, where access to veterinary clinics is limited. As pet owners continue to prioritize convenience and personalized care, mobile and at-home veterinary services are expected to experience significant growth.

Companion Animals Are Largest Animal Type Due to Rising Pet Population

Companion animals, including dogs, cats, and small mammals, represent the largest segment in the veterinary services market by animal type. The growing global pet population, coupled with the increasing humanization of pets, has significantly boosted the demand for veterinary services tailored to companion animals. Pet owners are increasingly investing in advanced healthcare services, such as diagnostics, surgeries, and preventive care, to ensure the well-being of their pets.

The surge in pet adoption, particularly during the pandemic, further amplified the need for companion animal healthcare. With rising awareness about pet health and the availability of pet insurance, the companion animal segment is expected to maintain its leadership position in the veterinary services market.

North America Is Largest Region Owing to Advanced Infrastructure and High Pet Ownership

North America is the largest regional market for veterinary services, driven by the region's advanced veterinary healthcare infrastructure and high levels of pet ownership. The United States, in particular, leads the market, supported by a well-established network of veterinary clinics and hospitals, widespread adoption of advanced diagnostic tools, and significant spending on pet healthcare.

The presence of key market players, coupled with a strong focus on preventive care and technological innovation, further strengthens North America’s position in the veterinary services market. Additionally, the growing awareness of animal welfare and the increasing prevalence of chronic diseases in pets and livestock contribute to the region's dominance.

Leading Companies and Competitive Landscape

The veterinary services market is competitive, with leading players such as Banfield Pet Hospital, VCA Animal Hospitals, Greencross Vets, CVS Group plc, and IDEXX Laboratories. These companies leverage advanced technologies, including telemedicine platforms and sophisticated diagnostic tools, to enhance their service offerings and cater to the evolving needs of pet owners and livestock handlers.

The competitive landscape is also characterized by the expansion of veterinary service networks, strategic partnerships, and the integration of digital solutions. The rise of telemedicine and mobile veterinary services has further intensified competition, as companies seek to provide innovative, convenient, and high-quality care. With the growing emphasis on precision medicine and preventive healthcare, the veterinary services market is poised for continued growth and innovation.

Recent Developments:

- Banfield Pet Hospital expanded its preventive care offerings with new wellness plans for pets.

- VCA Animal Hospitals announced a partnership with a leading diagnostics firm to enhance its imaging capabilities.

- Mars Veterinary Health acquired a regional veterinary chain to strengthen its presence in the U.S. market.

- IDEXX Laboratories, Inc. launched an advanced diagnostic tool for detecting early-stage diseases in companion animals.

- Greencross Limited opened a new state-of-the-art veterinary hospital specializing in critical care services.

List of Leading Companies:

- Banfield Pet Hospital

- VCA Animal Hospitals

- Greencross Limited

- CVS Group plc

- IDEXX Laboratories, Inc.

- Mars Veterinary Health

- National Veterinary Associates

- Patterson Veterinary Supply

- The Animal Medical Center

- Ethos Veterinary Health

- MedVet Medical & Cancer Centers for Pets

- Petco Health and Wellness Company, Inc.

- VetPartners

- IVC Evidensia

- AniCura Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 43.0 Billion |

|

Forecasted Value (2030) |

USD 64.1 Billion |

|

CAGR (2025 – 2030) |

6.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Veterinary Services Market By Service Type (Companion Animal Services, Livestock Services, Emergency & Critical Care, Preventive Care, Diagnostics & Imaging, Surgery), By Animal Type (Companion Animals, Livestock, Equine), By End-User (Veterinary Clinics, Hospitals, Research & Academia), and By Delivery Mode (On-Site, Mobile/At-Home Services, Telemedicine) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Banfield Pet Hospital, VCA Animal Hospitals, Greencross Limited, CVS Group plc, IDEXX Laboratories, Inc., Mars Veterinary Health, National Veterinary Associates, Patterson Veterinary Supply, The Animal Medical Center, Ethos Veterinary Health, MedVet Medical & Cancer Centers for Pets, Petco Health and Wellness Company, Inc., VetPartners, IVC Evidensia, AniCura Group |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Veterinary Services Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Companion Animal Services |

|

4.2. Livestock Services |

|

4.3. Emergency & Critical Care |

|

4.4. Preventive Care |

|

4.5. Diagnostics & Imaging |

|

4.6. Surgery |

|

4.7. Others |

|

5. Veterinary Services Market, by Animal Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Companion Animals |

|

5.2. Livestock |

|

5.3. Equine |

|

5.4. Others |

|

6. Veterinary Services Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Veterinary Clinics |

|

6.2. Hospitals |

|

6.3. Research & Academia |

|

6.4. Others |

|

7. Veterinary Services Market, by Delivery Mode (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. On-Site |

|

7.2. Mobile/At-Home Services |

|

7.3. Telemedicine |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Veterinary Services Market, by Service Type |

|

8.2.7. North America Veterinary Services Market, by Animal Type |

|

8.2.8. North America Veterinary Services Market, by End-User |

|

8.2.9. North America Veterinary Services Market, by Delivery Mode |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Veterinary Services Market, by Service Type |

|

8.2.10.1.2. US Veterinary Services Market, by Animal Type |

|

8.2.10.1.3. US Veterinary Services Market, by End-User |

|

8.2.10.1.4. US Veterinary Services Market, by Delivery Mode |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Banfield Pet Hospital |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. VCA Animal Hospitals |

|

10.3. Greencross Limited |

|

10.4. CVS Group plc |

|

10.5. IDEXX Laboratories, Inc. |

|

10.6. Mars Veterinary Health |

|

10.7. National Veterinary Associates |

|

10.8. Patterson Veterinary Supply |

|

10.9. The Animal Medical Center |

|

10.10. Ethos Veterinary Health |

|

10.11. MedVet Medical & Cancer Centers for Pets |

|

10.12. Petco Health and Wellness Company, Inc. |

|

10.13. VetPartners |

|

10.14. IVC Evidensia |

|

10.15. AniCura Group |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Veterinary Services Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Veterinary Services Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Veterinary Services Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA