As per Intent Market Research, the Veterinary Pharmacovigilance Market was valued at USD 1.1 Billion in 2024-e and will surpass USD 1.7 Billion by 2030; growing at a CAGR of 7.4% during 2025-2030.

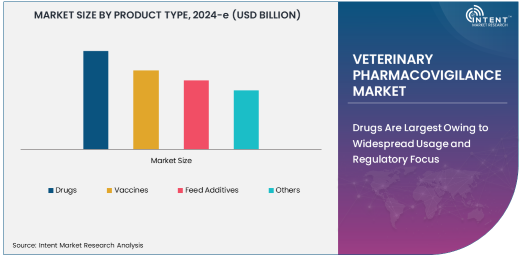

Drugs Are Largest Owing to Widespread Usage and Regulatory Focus

The veterinary pharmacovigilance market is essential for ensuring the safety and efficacy of veterinary pharmaceutical products. Among the product types, drugs dominate the market due to their extensive use in treating a wide range of animal diseases and conditions. Veterinary drugs, including antibiotics, anti-inflammatory agents, and antiparasitics, are critical in managing both acute and chronic health issues in companion and livestock animals.

The prominence of drugs in this market is further amplified by stringent regulatory requirements for monitoring adverse drug reactions and ensuring animal welfare. Increased awareness among veterinarians and pharmaceutical companies regarding pharmacovigilance practices has also contributed to the growth of this segment. As governments and industry stakeholders emphasize drug safety and effectiveness, the dominance of drugs in the veterinary pharmacovigilance market is expected to continue.

Regulatory Compliance Services Are Fastest Growing Owing to Stringent Global Standards

Regulatory compliance services represent the fastest-growing segment in the veterinary pharmacovigilance market, driven by the increasingly stringent regulations governing animal health products. These services ensure that manufacturers and distributors adhere to national and international guidelines for the safety and monitoring of veterinary pharmaceuticals, vaccines, and feed additives.

The rapid growth of this segment is fueled by the expanding scope of pharmacovigilance requirements, including the mandatory reporting of adverse events and the implementation of comprehensive risk management plans. As global regulatory bodies, such as the European Medicines Agency (EMA) and the U.S. FDA, enhance their oversight of veterinary products, demand for specialized compliance services is rising. This trend is expected to continue as regulatory frameworks evolve to address emerging risks in animal health.

Companion Animals Are Largest Animal Type Owing to Growing Pet Ownership

The companion animal segment holds the largest share in the veterinary pharmacovigilance market, reflecting the growing global population of pets and the increasing focus on their health and well-being. Pet owners are increasingly investing in high-quality veterinary pharmaceuticals and vaccines, necessitating robust pharmacovigilance systems to monitor the safety of these products.

Additionally, the humanization of pets and rising adoption of pet insurance have spurred the demand for veterinary drugs and vaccines, further driving the need for pharmacovigilance services for companion animals. With a strong emphasis on the safety and efficacy of products for dogs, cats, and other small mammals, this segment is expected to maintain its leading position in the market.

Veterinary Hospitals Are Largest End-User Due to Comprehensive Care and Advanced Infrastructure

Veterinary hospitals are the largest end-user segment in the veterinary pharmacovigilance market, owing to their ability to provide comprehensive care and house advanced infrastructure for monitoring drug safety. Hospitals play a pivotal role in administering veterinary pharmaceuticals and vaccines, making them a central hub for pharmacovigilance activities such as adverse event reporting and signal detection.

The presence of specialized veterinary professionals and diagnostic equipment in hospitals ensures effective monitoring and management of potential risks associated with animal health products. Additionally, veterinary hospitals often collaborate with pharmaceutical companies and regulatory bodies to maintain high standards of drug safety and efficacy. As the demand for advanced veterinary care grows, hospitals are expected to remain the dominant end-user in this market.

Signal Detection Services Are Fastest Growing Owing to Need for Proactive Safety Monitoring

Signal detection services are experiencing the fastest growth in the veterinary pharmacovigilance market, driven by the need for proactive safety monitoring of veterinary drugs and vaccines. These services involve the identification and analysis of trends or patterns in adverse event data to detect potential safety concerns early.

As the volume of pharmacovigilance data increases due to widespread drug usage and improved reporting systems, the demand for advanced signal detection services has risen significantly. Emerging technologies, such as AI and big data analytics, are being integrated into pharmacovigilance practices to enhance the efficiency and accuracy of signal detection. This growth is expected to accelerate as the industry prioritizes early risk identification to safeguard animal health.

North America Is Largest Region Due to Strong Regulatory Framework and Market Presence

North America leads the veterinary pharmacovigilance market, attributed to the region's stringent regulatory framework, advanced veterinary infrastructure, and strong market presence of leading pharmaceutical companies. The United States, in particular, drives the market with its robust systems for adverse event reporting and risk management.

The region’s focus on animal welfare, coupled with the rising adoption of companion animals and high expenditure on veterinary healthcare, further boosts the demand for pharmacovigilance services. The growing awareness of drug safety among veterinarians and pet owners reinforces North America's position as the dominant regional market.

Leading Companies and Competitive Landscape

The veterinary pharmacovigilance market is highly competitive, with key players such as Zoetis Inc., Elanco Animal Health, Boehringer Ingelheim, Merck Animal Health, and Bayer Animal Health. These companies emphasize regulatory compliance and invest heavily in pharmacovigilance systems to ensure the safety of their products.

The competitive landscape is shaped by partnerships between pharmaceutical companies and regulatory agencies, as well as advancements in pharmacovigilance technologies like AI-driven analytics and automated reporting systems. As the veterinary pharmaceutical industry continues to evolve, companies are expected to expand their pharmacovigilance capabilities to meet global regulatory standards and maintain market leadership.

Recent Developments:

- Zoetis Inc. launched an advanced pharmacovigilance platform for real-time monitoring of adverse events in veterinary drugs.

- Elanco Animal Health introduced a global initiative to improve adverse event reporting for companion animal medicines.

- Boehringer Ingelheim Animal Health announced a partnership with a leading tech company to develop AI-driven signal detection tools.

- Ceva Santé Animale expanded its pharmacovigilance operations with a new regional hub in Asia.

- Virbac S.A. implemented enhanced risk management protocols for its range of livestock vaccines.

List of Leading Companies:

- Zoetis Inc.

- Elanco Animal Health

- Boehringer Ingelheim Animal Health

- Merck Animal Health

- Ceva Santé Animale

- Vetoquinol S.A.

- Virbac S.A.

- Bayer Animal Health

- IDEXX Laboratories, Inc.

- Dechra Pharmaceuticals PLC

- Evonik Industries AG

- Phibro Animal Health Corporation

- Norbrook Laboratories Ltd

- HIPRA

- Biogenesis Bago

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 Billion |

|

Forecasted Value (2030) |

USD 1.7 Billion |

|

CAGR (2025 – 2030) |

7.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Veterinary Pharmacovigilance Market By Product Type (Drugs, Vaccines, Feed Additives), By Animal Type (Companion Animals, Livestock, Equine, Aquatic Animals), By End-User (Veterinary Clinics, Veterinary Hospitals, Research Institutions, Pharmaceutical Companies), and By Service Type (Adverse Event Reporting, Risk Management, Signal Detection, Regulatory Compliance) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Zoetis Inc., Elanco Animal Health, Boehringer Ingelheim Animal Health, Merck Animal Health, Ceva Santé Animale, Vetoquinol S.A., Virbac S.A., Bayer Animal Health, IDEXX Laboratories, Inc., Dechra Pharmaceuticals PLC, Evonik Industries AG, Phibro Animal Health Corporation, Norbrook Laboratories Ltd, HIPRA, Biogenesis Bago |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Veterinary Pharmacovigilance Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Drugs |

|

4.2. Vaccines |

|

4.3. Feed Additives |

|

4.4. Others |

|

5. Veterinary Pharmacovigilance Market, by Animal Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Companion Animals |

|

5.2. Livestock |

|

5.3. Equine |

|

5.4. Aquatic Animals |

|

5.5. Others |

|

6. Veterinary Pharmacovigilance Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Veterinary Clinics |

|

6.2. Veterinary Hospitals |

|

6.3. Research Institutions |

|

6.4. Pharmaceutical Companies |

|

6.5. Others |

|

7. Veterinary Pharmacovigilance Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Adverse Event Reporting |

|

7.2. Risk Management |

|

7.3. Signal Detection |

|

7.4. Regulatory Compliance |

|

7.5. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Veterinary Pharmacovigilance Market, by Product Type |

|

8.2.7. North America Veterinary Pharmacovigilance Market, by Animal Type |

|

8.2.8. North America Veterinary Pharmacovigilance Market, by End-User |

|

8.2.9. North America Veterinary Pharmacovigilance Market, by Service Type |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Veterinary Pharmacovigilance Market, by Product Type |

|

8.2.10.1.2. US Veterinary Pharmacovigilance Market, by Animal Type |

|

8.2.10.1.3. US Veterinary Pharmacovigilance Market, by End-User |

|

8.2.10.1.4. US Veterinary Pharmacovigilance Market, by Service Type |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Zoetis Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Elanco Animal Health |

|

10.3. Boehringer Ingelheim Animal Health |

|

10.4. Merck Animal Health |

|

10.5. Ceva Santé Animale |

|

10.6. Vetoquinol S.A. |

|

10.7. Virbac S.A. |

|

10.8. Bayer Animal Health |

|

10.9. IDEXX Laboratories, Inc. |

|

10.10. Dechra Pharmaceuticals PLC |

|

10.11. Evonik Industries AG |

|

10.12. Phibro Animal Health Corporation |

|

10.13. Norbrook Laboratories Ltd |

|

10.14. HIPRA |

|

10.15. Biogenesis Bago |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Veterinary Pharmacovigilance Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Veterinary Pharmacovigilance Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Veterinary Pharmacovigilance Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA