As per Intent Market Research, the Veterinary Orthopedic Implants Market was valued at USD 121.6 Million in 2024-e and will surpass USD 187.7 Million by 2030; growing at a CAGR of 7.5% during 2025-2030.

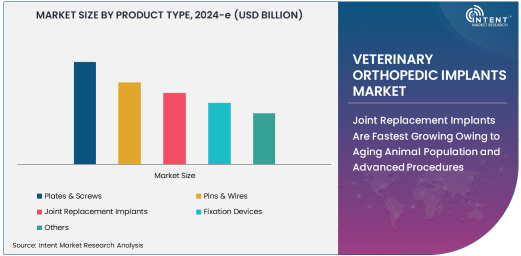

The veterinary orthopedic implants market plays a crucial role in improving the mobility and quality of life for animals suffering from bone fractures, joint issues, and other orthopedic conditions. Among the various product types, plates and screws dominate the market due to their versatility and widespread use in fracture repair and joint reconstruction procedures. These implants are commonly used in both companion animals and livestock, providing a reliable method for stabilizing broken bones and promoting proper healing.

Plates and screws are preferred due to their effectiveness in achieving stable fixation, which accelerates recovery and reduces the likelihood of complications. Additionally, the development of advanced materials and innovations in implant design, such as bioresorbable materials and minimally invasive techniques, continues to drive their demand. As veterinary practices adopt more sophisticated surgical approaches, the market for plates and screws is expected to maintain its leading position in the veterinary orthopedic implants sector.

Joint Replacement Implants Are Fastest Growing Owing to Aging Animal Population and Advanced Procedures

Joint replacement implants represent the fastest-growing segment in the veterinary orthopedic implants market, driven by the increasing prevalence of degenerative joint diseases in aging animals, particularly companion animals. Just as in humans, older pets suffer from conditions such as hip and elbow dysplasia, osteoarthritis, and other joint disorders, which often require surgical intervention and joint replacement.

The growing awareness of joint replacement procedures, combined with technological advancements in implant materials and surgical techniques, has contributed to the growth of this segment. The development of customized implants and minimally invasive surgical methods has improved the success rates of joint replacement surgeries, making these procedures more accessible and effective for pets. As the number of aging animals continues to rise globally, joint replacement implants are expected to see sustained demand in the veterinary orthopedic implants market.

Companion Animals Are Largest Animal Type Due to Increased Pet Ownership and Healthcare Investment

Companion animals, including dogs, cats, and small mammals, represent the largest animal type segment in the veterinary orthopedic implants market. The growing trend of pet humanization, increased disposable income, and rising pet healthcare spending are major factors driving demand for advanced orthopedic treatments. Pet owners are increasingly seeking specialized care, including surgeries involving plates, screws, and joint replacement implants, to ensure the well-being of their pets.

As the pet population continues to rise globally, particularly in developed regions, companion animals will continue to dominate the orthopedic implants market. This segment benefits from a combination of rising pet ownership, advancements in veterinary orthopedic surgery, and a growing willingness to invest in high-quality care for pets.

Veterinary Hospitals Are Largest End-User Due to Advanced Surgical Capabilities

Veterinary hospitals are the largest end-user of veterinary orthopedic implants, largely due to their advanced surgical infrastructure and specialized staff. These facilities are equipped to handle complex orthopedic surgeries, including joint replacements, fracture repairs, and spinal implants. Veterinary hospitals often offer the latest in diagnostic imaging and surgical technologies, allowing for precise planning and successful outcomes in orthopedic procedures.

The preference for veterinary hospitals is further supported by the growing trend of pet owners seeking comprehensive, specialized care for their animals, particularly in cases involving serious fractures or joint problems. With advanced facilities and a focus on providing cutting-edge treatments, veterinary hospitals continue to be the primary end-users of orthopedic implants in the veterinary market.

Fracture Repair Application Is Largest Due to Common Injuries in Animals

Fracture repair is the largest application segment in the veterinary orthopedic implants market, driven by the frequent occurrence of bone fractures in both companion animals and livestock. Animals, particularly active companion animals like dogs and cats, are prone to fractures due to accidents, falls, or trauma. As veterinary medicine advances, fracture repair techniques, including the use of plates, screws, and pins, have evolved, offering faster recovery times and improved surgical outcomes.

The high incidence of bone fractures in animals ensures the continued dominance of the fracture repair segment in the orthopedic implants market. Moreover, the increasing acceptance of advanced surgical techniques and the rising number of veterinary professionals specializing in orthopedic surgery will further support the growth of this application segment.

North America Is Largest Region Due to High Veterinary Care Standards and Pet Ownership

North America is the largest region in the veterinary orthopedic implants market, primarily due to its high standards of veterinary care, significant pet ownership rates, and advanced healthcare infrastructure. The United States, in particular, is a leader in the adoption of orthopedic surgeries and treatments for companion animals. With a strong focus on pet welfare and increasing demand for specialized surgical interventions, North America remains at the forefront of the veterinary orthopedic implants market.

Additionally, the region benefits from a well-established network of veterinary hospitals, a high level of public awareness regarding pet health, and the availability of cutting-edge orthopedic implant technologies. As pet ownership continues to rise and veterinary practices adopt advanced surgical methods, North America is expected to maintain its dominant position in the veterinary orthopedic implants market.

Leading Companies and Competitive Landscape

The veterinary orthopedic implants market is competitive, with key players such as Veterinary Orthopedic Implants, Biomet, DePuy Synthes, and DJO Global leading the industry. These companies focus on product innovation, including the development of advanced materials and minimally invasive techniques that improve the effectiveness and reduce recovery times of orthopedic surgeries.

The competitive landscape is also characterized by strategic partnerships between veterinary implant manufacturers, research institutions, and veterinary hospitals. Companies are increasingly focusing on creating implants tailored to the unique needs of different animal species, including custom joint replacement implants and fracture repair devices. With ongoing advancements in technology and growing demand for orthopedic treatments, the veterinary orthopedic implants market is expected to witness continued growth and innovation.

Recent Developments:

- DePuy Synthes Vet launched a new range of titanium plates for small animal fracture repairs.

- Kyon Veterinary Surgical Products introduced a minimally invasive joint replacement system for companion animals.

- Stryker Corporation expanded its veterinary implant portfolio with new spinal implants designed for large animals.

- Orthomed announced a partnership to develop advanced orthopedic tools for livestock surgery.

- BioMedtrix, LLC unveiled a 3D-printed hip replacement system for dogs.

List of Leading Companies:

- DePuy Synthes Vet

- B. Braun Vet Care

- Kyon Veterinary Surgical Products

- Integra LifeSciences

- Vet Implants

- IMEX Veterinary, Inc.

- Scil Animal Care Company

- Orthomed (a Covetrus Company)

- Stryker Corporation

- Everost Inc.

- Securos Surgical

- Intrauma S.p.A.

- BioMedtrix, LLC

- Veterinary Orthopedic Implants (VOI)

- Auxein Medical

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 121.6 Million |

|

Forecasted Value (2030) |

USD 187.7 Million |

|

CAGR (2025 – 2030) |

7.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Veterinary Orthopedic Implants Market By Product Type (Plates & Screws, Pins & Wires, Joint Replacement Implants, Fixation Devices), By Animal Type (Companion Animals, Livestock, Equine), By Application (Fracture Repair, Joint Reconstruction, Spinal Implants), and By End-User (Veterinary Hospitals, Veterinary Clinics, Research Institutions) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

DePuy Synthes Vet, B. Braun Vet Care, Kyon Veterinary Surgical Products, Integra LifeSciences, Vet Implants, IMEX Veterinary, Inc., Scil Animal Care Company, Orthomed (a Covetrus Company), Stryker Corporation, Everost Inc., Securos Surgical, Intrauma S.p.A., BioMedtrix, LLC, Veterinary Orthopedic Implants (VOI), Auxein Medical |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Veterinary Orthopedic Implants Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Plates & Screws |

|

4.2. Pins & Wires |

|

4.3. Joint Replacement Implants |

|

4.4. Fixation Devices |

|

4.5. Others |

|

5. Veterinary Orthopedic Implants Market, by Animal Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Companion Animals |

|

5.2. Livestock |

|

5.3. Equine |

|

5.4. Others |

|

6. Veterinary Orthopedic Implants Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Fracture Repair |

|

6.2. Joint Reconstruction |

|

6.3. Spinal Implants |

|

6.4. Others |

|

7. Veterinary Orthopedic Implants Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Veterinary Hospitals |

|

7.2. Veterinary Clinics |

|

7.3. Research Institutions |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Veterinary Orthopedic Implants Market, by Product Type |

|

8.2.7. North America Veterinary Orthopedic Implants Market, by Animal Type |

|

8.2.8. North America Veterinary Orthopedic Implants Market, by Application |

|

8.2.9. North America Veterinary Orthopedic Implants Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Veterinary Orthopedic Implants Market, by Product Type |

|

8.2.10.1.2. US Veterinary Orthopedic Implants Market, by Animal Type |

|

8.2.10.1.3. US Veterinary Orthopedic Implants Market, by Application |

|

8.2.10.1.4. US Veterinary Orthopedic Implants Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. DePuy Synthes Vet |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. B. Braun Vet Care |

|

10.3. Kyon Veterinary Surgical Products |

|

10.4. Integra LifeSciences |

|

10.5. Vet Implants |

|

10.6. IMEX Veterinary, Inc. |

|

10.7. Scil Animal Care Company |

|

10.8. Orthomed (a Covetrus Company) |

|

10.9. Stryker Corporation |

|

10.10. Everost Inc. |

|

10.11. Securos Surgical |

|

10.12. Intrauma S.p.A. |

|

10.13. BioMedtrix, LLC |

|

10.14. Veterinary Orthopedic Implants (VOI) |

|

10.15. Auxein Medical |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Veterinary Orthopedic Implants Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Veterinary Orthopedic Implants Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Veterinary Orthopedic Implants Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA