As per Intent Market Research, the Veterinary Medicine Market was valued at USD 30.1 Billion in 2024-e and will surpass USD 46.5 Billion by 2030; growing at a CAGR of 7.5% during 2025-2030.

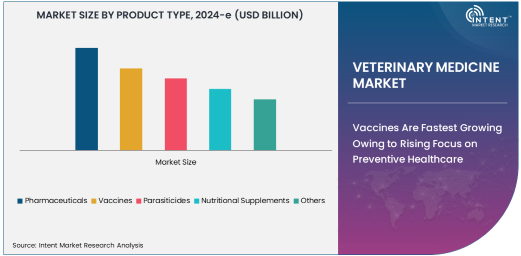

The veterinary medicine market is integral to ensuring the health and well-being of animals through the use of pharmaceuticals, vaccines, and other medical products. Pharmaceuticals are the largest product type in this market, as they are essential in treating a variety of conditions in companion animals, livestock, and other animal species. These medicines include antibiotics, anti-inflammatory drugs, analgesics, and vaccines, which are critical in preventing and treating infections, managing pain, and supporting overall animal health.

Pharmaceuticals are also widely used in both routine care and emergency treatments, making them a key part of veterinary practices globally. The increasing adoption of veterinary pharmaceuticals is driven by the growing awareness of animal welfare and advances in veterinary medicine, which have led to a greater demand for effective and safe pharmaceutical products. As veterinary practices become more specialized, the demand for pharmaceuticals is expected to continue to dominate the veterinary medicine market.

Vaccines Are Fastest Growing Owing to Rising Focus on Preventive Healthcare

Vaccines represent the fastest-growing product type in the veterinary medicine market, driven by the increasing focus on preventive healthcare for animals. Vaccination plays a crucial role in preventing the spread of infectious diseases among both companion animals and livestock. The growing adoption of vaccines is particularly notable in companion animal care, where diseases such as rabies, distemper, and parvovirus can be effectively prevented through vaccination.

Advancements in vaccine technology, including the development of more effective, safe, and long-lasting vaccines, have contributed to this segment's rapid growth. Additionally, the global expansion of the livestock sector, particularly in emerging economies, is fueling the demand for vaccines to prevent outbreaks of diseases such as foot-and-mouth disease and avian influenza. As awareness of the benefits of vaccination increases, the vaccine segment is poised for continued growth within the veterinary medicine market.

Companion Animals Are Largest Animal Type Due to Increased Pet Ownership and Healthcare Investment

Companion animals, particularly dogs and cats, represent the largest animal type segment in the veterinary medicine market. This dominance is attributed to the growing trend of pet humanization, increased disposable income, and the rising willingness of pet owners to invest in their pets' health. Companion animals are frequently treated for various health issues using pharmaceuticals, vaccines, and nutritional supplements, leading to the highest demand for veterinary medicines.

The increased focus on pet healthcare, along with the availability of pet insurance, has also contributed to the growth of this segment. As pet ownership continues to rise globally, especially in developed markets, the companion animal segment is expected to maintain its leading position in the veterinary medicine market. Furthermore, the increasing prevalence of chronic conditions such as arthritis and obesity in pets further fuels the demand for veterinary treatments and medications.

Veterinary Clinics Are Largest End-User Due to Accessibility and Routine Care

Veterinary clinics are the largest end-user segment in the veterinary medicine market, owing to their accessibility and the wide range of routine and emergency services they provide. These clinics serve as the primary point of contact for pet owners seeking medical care for their animals. Veterinary clinics provide various treatments, including the administration of vaccines, pharmaceuticals for infections, pain management, and other conditions requiring ongoing care.

The growth of veterinary clinics is supported by the increasing number of pet owners who seek preventive care and health management solutions for their animals. Clinics are also essential for providing immediate care in emergencies, which often involves the use of pharmaceutical treatments. With the expanding number of veterinary clinics globally and their essential role in animal health, this segment is expected to remain a significant driver of growth in the veterinary medicine market.

Oral Administration Is Largest Route of Administration Due to Convenience and Ease of Use

Oral administration is the largest route of administration in the veterinary medicine market, driven by its ease of use and convenience for both animals and veterinarians. Oral medications, including tablets, powders, and liquids, are widely used for treating a variety of conditions in animals, ranging from infections to chronic diseases. Oral treatments are particularly popular in companion animals, where administering pills or liquid medications is often the preferred method for pet owners.

The growing adoption of oral medications is also driven by the development of flavored tablets and chewable formulations, which improve compliance, particularly in pets. Additionally, the ease of administering oral medications in livestock and large animals makes it an attractive option for farmers and veterinary professionals. As convenience remains a top priority in animal healthcare, the oral route of administration is expected to continue dominating the market.

North America Is Largest Region Due to Advanced Veterinary Infrastructure and Pet Care Trends

North America is the largest regional market for veterinary medicine, largely due to the region's well-established veterinary infrastructure, high standards of animal healthcare, and advanced research capabilities. The United States, in particular, leads the market, driven by a strong veterinary pharmaceutical industry and high pet ownership rates. The growing focus on preventive care and the humanization of pets further contribute to the demand for veterinary medicines in the region.

Moreover, the presence of leading pharmaceutical companies, along with a strong regulatory framework for veterinary drugs and vaccines, ensures the availability of safe and effective veterinary medicines. As pet healthcare continues to be a priority in North America, the region is expected to maintain its dominance in the veterinary medicine market.

Leading Companies and Competitive Landscape

The veterinary medicine market is highly competitive, with major players such as Zoetis, Merck Animal Health, Elanco, Boehringer Ingelheim, and Bayer Animal Health dominating the landscape. These companies focus on developing innovative pharmaceutical products, vaccines, and parasiticides to meet the growing demand for animal healthcare solutions.

The competitive environment is marked by ongoing research and development activities aimed at creating more effective and specialized veterinary medicines. Additionally, companies are increasingly focusing on partnerships with veterinary clinics and hospitals to expand their market reach and improve the availability of advanced treatments. As the veterinary industry continues to evolve, the market for veterinary medicines is expected to experience sustained growth, driven by advancements in product offerings and increased consumer demand for high-quality animal healthcare.

Recent Developments:

- Zoetis Inc. launched a new vaccine for livestock to combat emerging infectious diseases.

- Merck Animal Health expanded its product portfolio with a new oral treatment for companion animals.

- Boehringer Ingelheim Animal Health introduced a cutting-edge injectable parasiticide for livestock.

- Virbac S.A. unveiled a new range of nutritional supplements for horses aimed at improving joint health.

- Ceva Santé Animale received regulatory approval for a new vaccine aimed at preventing respiratory infections in poultry

List of Leading Companies:

- Zoetis Inc.

- Merck Animal Health

- Elanco Animal Health

- Boehringer Ingelheim Animal Health

- Bayer Animal Health

- IDEXX Laboratories, Inc.

- Ceva Santé Animale

- Virbac S.A.

- Vetoquinol S.A.

- Aratana Therapeutics

- PetIQ, Inc.

- Elanco

- Phibro Animal Health Corporation

- Dechra Pharmaceuticals PLC

- Norbrook Laboratories Ltd

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 30.1 Billion |

|

Forecasted Value (2030) |

USD 46.5 Billion |

|

CAGR (2025 – 2030) |

7.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Veterinary Medicine Market By Product Type (Pharmaceuticals, Vaccines, Parasiticides, Nutritional Supplements), By Animal Type (Companion Animals, Livestock, Equine, Aquatic Animals), By End-User (Veterinary Clinics, Veterinary Hospitals, Research Institutions, Pharmaceutical Companies), and By Route of Administration (Oral, Injectable, Topical) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Zoetis Inc., Merck Animal Health, Elanco Animal Health, Boehringer Ingelheim Animal Health, Bayer Animal Health, IDEXX Laboratories, Inc., Ceva Santé Animale, Virbac S.A., Vetoquinol S.A., Aratana Therapeutics, PetIQ, Inc., Elanco, Phibro Animal Health Corporation, Dechra Pharmaceuticals PLC, Norbrook Laboratories Ltd |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Veterinary Medicine Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Pharmaceuticals |

|

4.2. Vaccines |

|

4.3. Parasiticides |

|

4.4. Nutritional Supplements |

|

4.5. Others |

|

5. Veterinary Medicine Market, by Animal Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Companion Animals |

|

5.2. Livestock |

|

5.3. Equine |

|

5.4. Aquatic Animals |

|

5.5. Others |

|

6. Veterinary Medicine Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Veterinary Clinics |

|

6.2. Veterinary Hospitals |

|

6.3. Research Institutions |

|

6.4. Pharmaceutical Companies |

|

6.5. Others |

|

7. Veterinary Medicine Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Oral |

|

7.2. Injectable |

|

7.3. Topical |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Veterinary Medicine Market, by Product Type |

|

8.2.7. North America Veterinary Medicine Market, by Animal Type |

|

8.2.8. North America Veterinary Medicine Market, by End-User |

|

8.2.9. North America Veterinary Medicine Market, by Route of Administration |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Veterinary Medicine Market, by Product Type |

|

8.2.10.1.2. US Veterinary Medicine Market, by Animal Type |

|

8.2.10.1.3. US Veterinary Medicine Market, by End-User |

|

8.2.10.1.4. US Veterinary Medicine Market, by Route of Administration |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Zoetis Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Merck Animal Health |

|

10.3. Elanco Animal Health |

|

10.4. Boehringer Ingelheim Animal Health |

|

10.5. Bayer Animal Health |

|

10.6. IDEXX Laboratories, Inc. |

|

10.7. Ceva Santé Animale |

|

10.8. Virbac S.A. |

|

10.9. Vetoquinol S.A. |

|

10.10. Aratana Therapeutics |

|

10.11. PetIQ, Inc. |

|

10.12. Elanco |

|

10.13. Phibro Animal Health Corporation |

|

10.14. Dechra Pharmaceuticals PLC |

|

10.15. Norbrook Laboratories Ltd |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Veterinary Medicine Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Veterinary Medicine Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Veterinary Medicine Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA