As per Intent Market Research, the Vertical Farming Market was valued at USD 5.5 billion in 2023 and will surpass USD 18.9 billion by 2030; growing at a CAGR of 19.5% during 2024 - 2030.

As urbanization accelerates and the global population continues to rise, vertical farming offers a viable solution to meet food demand sustainably. The market encompasses various segments, including technology, structure, growth mechanism, and crop type, each contributing to the overall growth trajectory of vertical farming. With the increasing focus on food security and environmental sustainability, vertical farming is becoming a key component of the modern agricultural landscape

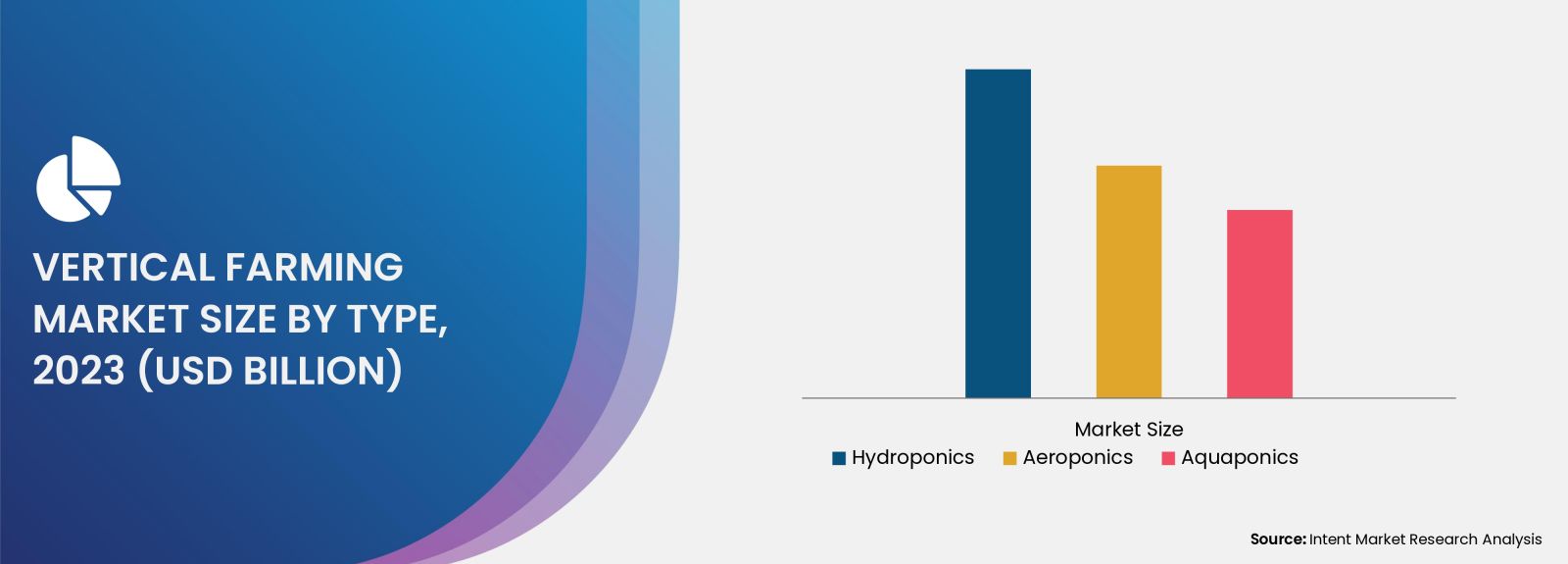

Hydroponics Segment is Largest Owing to Efficient Resource Utilization

The hydroponics segment stands out as the largest within the vertical farming market, primarily due to its efficient use of resources and ability to produce high yields in limited spaces. Hydroponics involves growing plants in a nutrient-rich water solution, eliminating the need for soil while providing essential nutrients directly to the roots. This method significantly reduces water consumption compared to traditional farming, making it particularly attractive in regions facing water scarcity.

Hydroponics also allows for precise control over growing conditions, including nutrient levels, pH, and environmental factors, leading to enhanced crop quality and faster growth rates. As urban areas expand and the demand for fresh produce rises, hydroponics is increasingly adopted by vertical farms seeking to maximize productivity and minimize resource use. The segment's dominance is expected to continue as technological advancements improve hydroponic systems, making them more accessible and efficient for a wider range of producers.

Indoor Farming Segment is Fastest Growing Owing to Urbanization Trends

The indoor farming segment is emerging as the fastest-growing category within the vertical farming market, driven by urbanization and the need for localized food production. Indoor farming refers to the cultivation of crops within controlled environments, utilizing artificial lighting and climate control systems to create optimal growing conditions. This method allows for year-round production, independent of external weather conditions, making it an attractive option for urban centers with limited agricultural space.

As cities grow and populations increase, the demand for fresh, locally sourced produce is on the rise. Indoor farming provides a sustainable solution by reducing the distance food travels from farm to table, minimizing carbon emissions associated with transportation. Additionally, advancements in smart farming technologies, such as IoT sensors and data analytics, are enhancing the efficiency and profitability of indoor farms. The rapid adoption of indoor farming practices is expected to drive significant growth in this segment as urban areas continue to prioritize food security and sustainability.

Aeroponics Segment is Fastest Growing Owing to Resource Efficiency

The aeroponics segment is also gaining momentum in the vertical farming market, recognized for its resource-efficient approach to crop cultivation. Aeroponics involves growing plants in a mist or aerosolized nutrient solution, allowing for maximum oxygen exposure to the roots while minimizing water use. This innovative technique reduces the amount of water and nutrients needed for plant growth, making it an appealing choice for producers focused on sustainability.

With the increasing emphasis on environmentally friendly agricultural practices, aeroponics is becoming a preferred method among vertical farmers looking to optimize resource utilization. The segment's growth is fueled by advancements in aeroponic technology, enabling higher yields and faster crop cycles. As consumers demand more sustainable food sources, aeroponics is well-positioned to contribute to the evolving landscape of vertical farming, catering to both commercial producers and home gardeners alike.

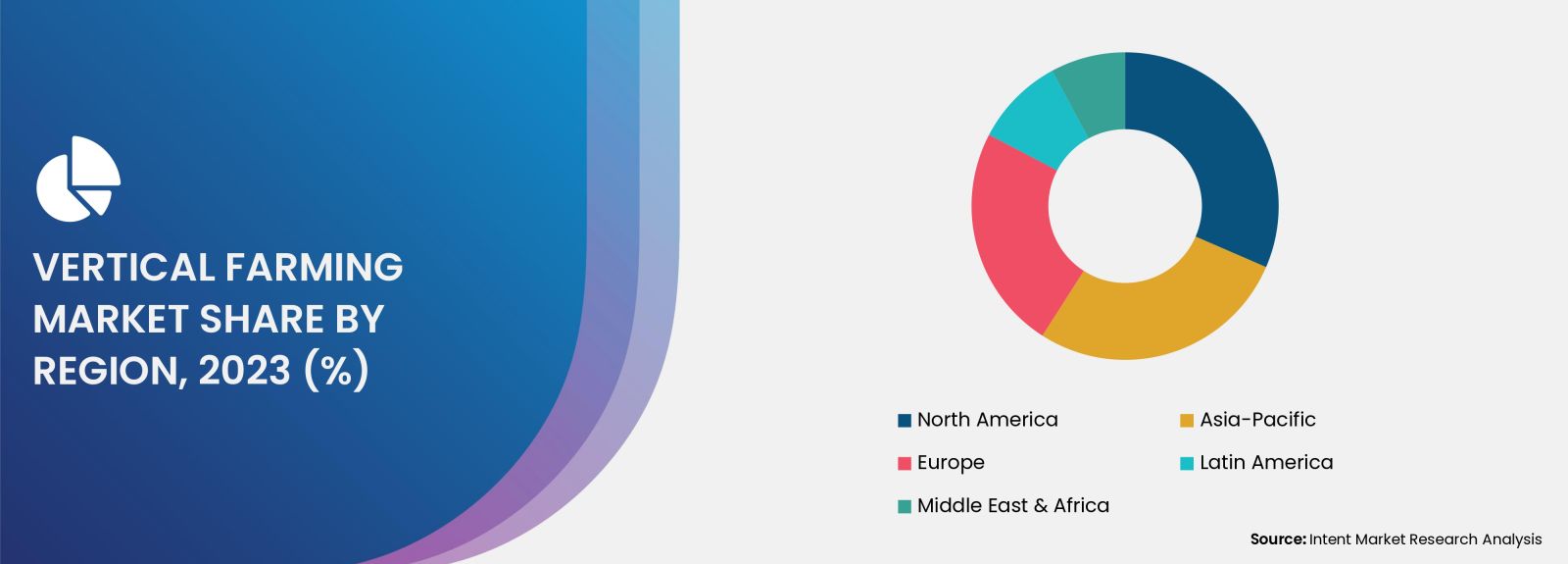

Asia Pacific Region is Fastest Growing Owing to Urbanization and Technology Adoption

The Asia Pacific region is poised to be the fastest-growing market for vertical farming, driven by rapid urbanization and the adoption of advanced agricultural technologies. Countries like Japan, Singapore, and China are leading the way in implementing vertical farming practices to address food security challenges posed by their growing urban populations. The region's dense population centers create a high demand for fresh produce, and vertical farming offers a viable solution to meet this demand sustainably.

In addition to urbanization, the region is witnessing significant investments in research and development of vertical farming technologies. Government initiatives aimed at promoting sustainable agriculture and food security are further propelling the growth of the vertical farming market in Asia Pacific. As technology continues to evolve and the market matures, this region is expected to experience substantial growth in vertical farming, positioning itself as a key player in the global agricultural landscape.

Competitive Landscape of Leading Companies

The competitive landscape of the vertical farming market is characterized by a diverse array of companies focused on innovative agricultural solutions. Key players in the market include:

- AeroFarms: A leader in indoor vertical farming, AeroFarms utilizes proprietary aeroponic technology to grow crops sustainably and efficiently.

- Plenty: Known for its cutting-edge indoor farms, Plenty employs advanced robotics and data analytics to optimize crop growth and resource use.

- Bowery Farming: Bowery Farming is a prominent player in the vertical farming sector, focusing on providing fresh produce to urban markets using technology-driven methods.

- Vertical Harvest: This company combines social impact with vertical farming, creating job opportunities while providing fresh, locally grown produce.

- Gotham Greens: Gotham Greens operates greenhouse facilities in urban areas, producing high-quality greens and herbs while minimizing transportation emissions.

- Green Spirit Farms: Green Spirit Farms focuses on sustainable practices and offers a variety of vertically farmed crops using hydroponic systems.

- Mirai Co., Ltd.: Based in Japan, Mirai specializes in indoor farming technologies and has made significant advancements in hydroponics and automation.

- FarmOne: FarmOne utilizes innovative farming techniques to grow specialty crops in urban settings, catering to chefs and restaurants.

- Oishii Farm: Oishii Farm is known for its strawberry production in vertical farms, utilizing advanced technology to enhance flavor and quality.

- Sky Greens: This Singapore-based company operates vertical farms using a unique rotating system, allowing for maximum exposure to sunlight and efficient space utilization.

The competitive landscape in the vertical farming market is dynamic, with companies continually innovating to improve productivity, reduce costs, and enhance sustainability. Collaborations, partnerships, and mergers are common as firms seek to leverage technological advancements and expand their market reach. As the vertical farming market evolves, competition is expected to intensify, with a strong emphasis on delivering high-quality produce and sustainable farming practices..

Report Objectives:

The report will help you answer some of the most critical questions in the Vertical Farming Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Vertical Farming Market?

- What is the size of the Vertical Farming Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 5.5 billion |

|

Forecasted Value (2030) |

USD 18.9 billion |

|

CAGR (2024 – 2030) |

19.5% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Vertical Farming Market By Type (Hydroponics, Aeroponics, Aquaponics), By Structure (Building-Based Vertical Farms, Shipping-Container Vertical Farms), By Component (Hardware, Software, Services) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Vertical Farming Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Hydroponics |

|

4.2. Aeroponics |

|

4.3. Aquaponics |

|

5. Vertical Farming Market, by Structure (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Building-Based Vertical Farms |

|

5.2. Shipping-Container Vertical Farms |

|

6. Vertical Farming Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Hardware |

|

6.1.1. Lighting System |

|

6.1.2. Irrigation and Fertigation System |

|

6.1.3. Climate Control |

|

6.1.4. Sensors |

|

6.1.5. Others (HVAC systems, Shelves and Racks, etc.) |

|

6.2. Software |

|

6.3. Services |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Vertical Farming Market, by Type |

|

7.2.7. North America Vertical Farming Market, by Structure |

|

7.2.8. North America Vertical Farming Market, by Component |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Vertical Farming Market, by Type |

|

7.2.9.1.2. US Vertical Farming Market, by Structure |

|

7.2.9.1.3. US Vertical Farming Market, by Component |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Signify Holding |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. AeroFarms |

|

9.3. EVERLIGHT ELECTRONICS CO., LTD. |

|

9.4. Freight Farms, Inc. |

|

9.5. Heliospectra AB |

|

9.6. Osram |

|

9.7. Plenty Unlimited Inc. |

|

9.8. Sky Greens |

|

9.9. Spread Co., Ltd. |

|

9.10. Valoya |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Vertical Farming Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Vertical Farming Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Vertical Farming ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Vertical Farming Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA