As per Intent Market Research, the Ventilator Breathing Circuit Market was valued at USD 0.7 billion in 2024-e and will surpass USD 1.2 billion by 2030; growing at a CAGR of 8.3% during 2025 - 2030.

The ventilator breathing circuit market plays a pivotal role in the healthcare sector, particularly in respiratory care settings. These circuits are essential components of mechanical ventilation, facilitating the controlled delivery of oxygen and air to patients who require assistance with their breathing. The market for ventilator breathing circuits has seen significant growth, driven by the increasing prevalence of respiratory diseases, rising demand for critical care services, and the ongoing COVID-19 pandemic. Additionally, the market is bolstered by advancements in healthcare infrastructure and the increasing availability of sophisticated ventilators that require compatible breathing circuits for optimal functionality.

The global demand for ventilator breathing circuits is also influenced by factors such as aging populations, rising incidences of chronic respiratory conditions, and improved awareness about respiratory care. Hospitals, particularly intensive care units (ICUs), along with other healthcare settings, are increasing their usage of ventilators, which in turn propels the demand for breathing circuits. The market is also benefiting from innovation in product development, such as circuits with integrated features that enhance ease of use and improve patient outcomes.

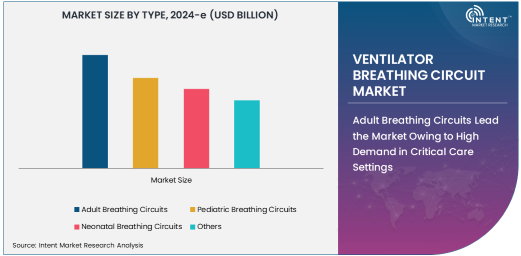

Adult Breathing Circuits Lead the Market Owing to High Demand in Critical Care Settings

Adult breathing circuits dominate the ventilator breathing circuit market, owing to the high demand for mechanical ventilation in adult patients in critical care settings, especially in intensive care units (ICUs) and emergency departments. These circuits are designed to meet the specific needs of adult patients who require ventilation support due to conditions such as respiratory failure, chronic obstructive pulmonary disease (COPD), pneumonia, and post-surgical recovery. The increasing prevalence of these conditions among the adult population, coupled with the growing aging demographic, is driving the demand for adult breathing circuits.

Furthermore, technological advancements in adult breathing circuits, such as improved tubing materials, enhanced filtration systems, and increased safety features, have contributed to their widespread adoption in healthcare facilities. As the number of adults requiring critical respiratory care continues to rise, adult breathing circuits will remain the dominant segment within the market.

Pediatric Breathing Circuits Gaining Traction Due to Rising Respiratory Conditions in Children

Pediatric breathing circuits are gaining traction in the ventilator breathing circuit market, driven by the rising number of respiratory diseases in children. Conditions such as asthma, bronchiolitis, pneumonia, and congenital respiratory disorders are leading to a growing need for pediatric ventilator support in healthcare facilities. Hospitals and specialized pediatric care centers are increasingly adopting ventilators tailored for children, which require specific pediatric breathing circuits.

The demand for pediatric breathing circuits is further fueled by advancements in medical technology that enable more precise and effective ventilation for younger patients. As healthcare providers continue to enhance their pediatric respiratory care capabilities, the adoption of specialized pediatric breathing circuits is expected to continue growing, contributing to the expansion of this segment within the overall market.

Neonatal Breathing Circuits Lead the Market in Premature and Critical Infant Care

Neonatal breathing circuits hold a critical position in the ventilator breathing circuit market, especially in neonatal intensive care units (NICUs). These circuits are specifically designed for the delicate and critical needs of neonates, particularly premature infants and those with respiratory distress. The increasing rate of premature births globally, along with higher incidences of neonatal respiratory disorders, is driving the demand for neonatal ventilator support systems and compatible breathing circuits.

Technological innovations in neonatal breathing circuits, such as low-volume tubing, precise pressure control, and enhanced safety mechanisms, are enabling better outcomes for infants who require ventilation support. As the prevalence of preterm births and respiratory issues among neonates continues to rise, the neonatal breathing circuit segment is expected to grow rapidly.

Tubing is the Largest Component Segment Owing to Its Essential Role in Ventilation Systems

The tubing component segment dominates the ventilator breathing circuit market, owing to its fundamental role in the overall functionality of the breathing circuit. Tubing serves as the conduit for the delivery of air and oxygen to the patient and must be designed to handle various airflow rates and pressures without compromising safety or performance. The increasing demand for ventilators in both acute and chronic care settings drives the need for high-quality, durable tubing systems that ensure seamless ventilation.

Advancements in tubing materials, such as flexible, kink-resistant, and biocompatible plastics, have improved the performance and patient safety of ventilator breathing circuits. As the demand for mechanical ventilation systems continues to grow globally, the tubing component remains essential to the functioning of these systems, solidifying its position as the largest segment in the market.

Hospitals Lead the End-User Segment Due to High Utilization of Ventilator Support in Critical Care

Hospitals are the leading end-users in the ventilator breathing circuit market, owing to the high utilization of ventilators in critical care settings such as intensive care units (ICUs), emergency departments, and neonatal care units. Hospitals account for a large share of ventilator support needs, as they treat a significant number of patients requiring mechanical ventilation due to conditions such as respiratory failure, trauma, and post-surgical recovery.

The growth of hospital infrastructure, coupled with the increasing incidence of respiratory diseases and critical care cases, is driving the demand for ventilators and associated breathing circuits. Hospitals continue to invest in state-of-the-art respiratory care equipment, including ventilators, which drives the need for high-quality, reliable breathing circuits. As healthcare systems worldwide continue to expand their critical care capabilities, the hospital sector remains a dominant force in the ventilator breathing circuit market.

North America Leads Owing to Advanced Healthcare Systems and High Demand for Respiratory Devices

North America remains the dominant region for the ventilator breathing circuit market, largely due to its well-developed healthcare infrastructure and high prevalence of respiratory diseases, such as asthma and chronic obstructive pulmonary disease (COPD). The region's demand for ventilators surged during the COVID-19 pandemic, which significantly impacted the growth of the ventilator breathing circuit market. The presence of key manufacturers and a strong regulatory environment further solidifies North America's position.

The growing elderly population, which is more prone to respiratory conditions, along with increasing awareness about respiratory care, continues to drive the demand for ventilators and their associated components, such as breathing circuits. The ongoing investments in healthcare technologies and medical devices also contribute to the market's robust growth in the region.

Leading Companies and Competitive Landscape

The ventilator breathing circuit market is highly competitive, with key players such as Medtronic, Smiths Medical, and Draegerwerk AG leading the charge in the development and manufacturing of high-quality breathing circuits. These companies are focusing on product innovation, enhancing the safety and performance of their circuits, and expanding their global presence through strategic partnerships and acquisitions. Additionally, the growing focus on enhancing the functionality of breathing circuits, such as integrating sensors for real-time monitoring, is further strengthening the position of these market leaders.

New entrants and smaller players are also capitalizing on emerging opportunities by offering specialized solutions for neonatal, pediatric, and adult ventilation. As the global demand for ventilators continues to rise, particularly in the wake of the COVID-19 pandemic, competition within the ventilator breathing circuit market is expected to intensify, with companies focusing on improving product quality, expanding distribution channels, and increasing collaborations with healthcare providers.

Recent Developments:

- In March 2025, Philips Healthcare launched a new series of high-performance ventilator breathing circuits for neonatal care, designed to improve oxygen delivery and reduce patient discomfort.

- In February 2025, Medtronic announced an expansion of its ventilator-related product portfolio, introducing a range of disposable breathing circuits aimed at reducing the risk of infection.

- In January 2025, Fisher & Paykel Healthcare received regulatory approval for their new breathing circuit technology that integrates sensors to monitor airflow in real time, enhancing ventilator management.

- In December 2024, ResMed Inc. unveiled a new product line focused on improving breathing circuit connectivity with ventilators, aimed at improving patient outcomes in critical care.

- In November 2024, Teleflex launched an innovative, user-friendly ventilator breathing circuit for homecare applications, designed to simplify patient use and reduce caregiver involvement.

List of Leading Companies:

- Philips Healthcare

- Medtronic plc

- GE Healthcare

- Drägerwerk AG & Co. KGaA

- Smiths Group plc

- Fisher & Paykel Healthcare Corporation

- ResMed Inc.

- Teleflex Incorporated

- Hamilton Medical

- Edwards Lifesciences Corporation

- Vyaire Medical, Inc.

- Covidien (now part of Medtronic)

- Getinge AB

- Armstrong Medical Ltd.

- ConvaTec Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.7 billion |

|

Forecasted Value (2030) |

USD 1.2 billion |

|

CAGR (2025 – 2030) |

8.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Ventilator Breathing Circuit Market By Type (Adult Breathing Circuits, Pediatric Breathing Circuits, Neonatal Breathing Circuits), By Component (Tubing, Filters, Connectors, Valves), By End-User (Hospitals, Ambulatory Surgical Centers, Homecare) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Philips Healthcare, Medtronic plc, GE Healthcare, Drägerwerk AG & Co. KGaA, Smiths Group plc, Fisher & Paykel Healthcare Corporation, ResMed Inc., Teleflex Incorporated, Hamilton Medical, Edwards Lifesciences Corporation, Vyaire Medical, Inc., Covidien (now part of Medtronic), Getinge AB, Armstrong Medical Ltd., ConvaTec Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Ventilator Breathing Circuit Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Adult Breathing Circuits |

|

4.2. Pediatric Breathing Circuits |

|

4.3. Neonatal Breathing Circuits |

|

4.4. Others |

|

5. Ventilator Breathing Circuit Market, by Component (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Tubing |

|

5.2. Filters |

|

5.3. Connectors |

|

5.4. Valves |

|

5.5. Others |

|

6. Ventilator Breathing Circuit Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Ambulatory Surgical Centers |

|

6.3. Homecare |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Ventilator Breathing Circuit Market, by Type |

|

7.2.7. North America Ventilator Breathing Circuit Market, by Component |

|

7.2.8. North America Ventilator Breathing Circuit Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Ventilator Breathing Circuit Market, by Type |

|

7.2.9.1.2. US Ventilator Breathing Circuit Market, by Component |

|

7.2.9.1.3. US Ventilator Breathing Circuit Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Philips Healthcare |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Medtronic plc |

|

9.3. GE Healthcare |

|

9.4. Drägerwerk AG & Co. KGaA |

|

9.5. Smiths Group plc |

|

9.6. Fisher & Paykel Healthcare Corporation |

|

9.7. ResMed Inc. |

|

9.8. Teleflex Incorporated |

|

9.9. Hamilton Medical |

|

9.10. Edwards Lifesciences Corporation |

|

9.11. Vyaire Medical, Inc. |

|

9.12. Covidien (now part of Medtronic) |

|

9.13. Getinge AB |

|

9.14. Armstrong Medical Ltd. |

|

9.15. ConvaTec Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Ventilator Breathing Circuit Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Ventilator Breathing Circuit Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Ventilator Breathing Circuit Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA