As per Intent Market Research, the Venous Thromboembolism Market was valued at USD 1.8 billion in 2024-e and will surpass USD 3.4 billion by 2030; growing at a CAGR of 10.9% during 2025 - 2030.

Venous Thromboembolism (VTE) encompasses a range of serious medical conditions, including Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE), that pose significant risks to patient health. As a leading cause of morbidity and mortality worldwide, the management of VTE is crucial for both patient safety and healthcare systems. VTE occurs when blood clots form in veins, which can then travel to the lungs, resulting in a pulmonary embolism. Increasing awareness of these conditions, along with the development of innovative treatments and diagnostic methods, is driving the growth of the VTE market.

The rising prevalence of risk factors such as obesity, sedentary lifestyles, aging populations, and post-surgical complications are contributing to the global burden of venous thromboembolism. Additionally, advancements in diagnostic technologies and treatment options are enhancing early detection and more effective management of these conditions. With increasing investments in research and healthcare infrastructure, the market is expected to expand significantly in the coming years.

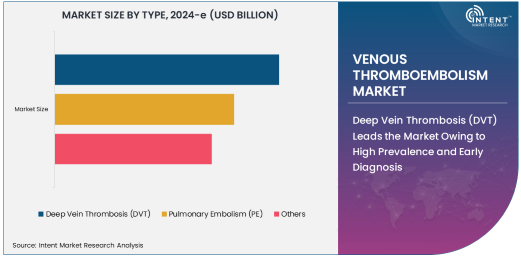

Deep Vein Thrombosis (DVT) Leads the Market Owing to High Prevalence and Early Diagnosis

Deep Vein Thrombosis (DVT) holds the largest market share in the Venous Thromboembolism (VTE) market due to its higher prevalence compared to pulmonary embolism and the ease of early diagnosis. DVT is characterized by blood clot formation in the deep veins, typically in the legs, which can potentially lead to serious complications, including PE. The ability to diagnose DVT through non-invasive imaging techniques such as ultrasound is a key factor driving market demand.

The increasing number of patients with DVT, particularly in hospital settings post-surgery or in those with other risk factors, has contributed significantly to market growth. Additionally, the widespread use of anticoagulants and other treatments in DVT management is also propelling the demand for these products. As healthcare providers continue to focus on improving early detection and treatment outcomes, DVT remains a dominant subsegment within the VTE market.

Pulmonary Embolism (PE) Grows Due to Advances in Diagnosis and Treatment

Pulmonary Embolism (PE), a potentially life-threatening condition that occurs when a clot from deep veins travels to the lungs, is witnessing significant market growth due to advances in diagnosis and treatment. The increasing use of CT Pulmonary Angiography (CTPA) for accurate diagnosis has enabled healthcare professionals to identify PE in its early stages, thereby improving patient outcomes.

The growth of this subsegment is also attributed to the rising number of at-risk populations, including those who are immobile for extended periods, elderly patients, and individuals with cardiovascular conditions. Additionally, the development of more efficient thrombolytics and anticoagulants for treating PE has further spurred market growth. Given the high mortality rate associated with untreated PE, early detection and the availability of effective treatments are key drivers in this segment's growth.

Anticoagulants Dominate the Market Due to Widespread Use in Treatment

Anticoagulants are the most widely used treatment for both Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE), making them the largest segment in the VTE treatment market. These drugs work by preventing further clot formation and allowing the body to naturally dissolve existing clots. The market for anticoagulants is being driven by the high demand for both oral and injectable forms, with newer direct-acting oral anticoagulants (DOACs) gaining popularity due to their ease of use and fewer side effects compared to traditional anticoagulants like warfarin.

The continued development of more efficient, safer, and patient-friendly anticoagulant therapies is expected to drive the growth of this segment. Furthermore, as more individuals are diagnosed with VTE, the need for these therapeutic options will continue to expand, fueling the overall market growth.

Ultrasound and CT Pulmonary Angiography Lead Diagnostic Methods Owing to Effectiveness and Accuracy

Ultrasound and CT Pulmonary Angiography (CTPA) are the most widely used diagnostic methods for detecting VTE, making them the leading diagnostic techniques in the market. Ultrasound is particularly effective for diagnosing Deep Vein Thrombosis (DVT) in the lower extremities, as it is non-invasive, widely accessible, and can quickly detect blood clots. On the other hand, CT Pulmonary Angiography is the gold standard for diagnosing Pulmonary Embolism (PE), providing high-resolution images that help confirm the presence of blood clots in the pulmonary arteries.

Both ultrasound and CTPA are preferred due to their ability to accurately diagnose VTE in a timely manner, enabling prompt treatment. The continued advancement of imaging technologies and the growing focus on improving diagnostic accuracy are driving demand for these methods, contributing to the growth of this segment.

Hospitals Lead the End-User Market Due to High Patient Volumes and Critical Care Needs

Hospitals are the leading end-users in the VTE market, owing to their critical role in the treatment and management of VTE patients. Hospitals treat a large volume of patients with VTE, including those who are post-surgery, elderly, or dealing with chronic medical conditions. The need for specialized diagnostic equipment, effective treatment methods, and highly trained medical professionals is driving the dominance of hospitals in this market.

The increasing number of hospital admissions for surgery, trauma, and other high-risk conditions is contributing to the continued growth of this segment. Furthermore, hospitals are increasingly investing in advanced diagnostic tools, including ultrasound and CT Pulmonary Angiography (CTPA), which is further bolstering the demand for diagnostic equipment in hospital settings.

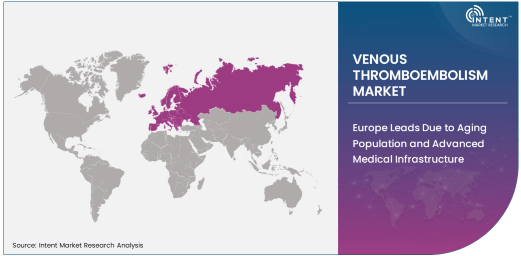

Europe Leads Due to Aging Population and Advanced Medical Infrastructure

Europe holds the largest market share in the venous thromboembolism (VTE) market, largely owing to the region's aging population, which is more susceptible to conditions like deep vein thrombosis (DVT) and pulmonary embolism (PE). Countries such as Germany, France, and the UK are at the forefront, with strong healthcare systems and high healthcare expenditure that support the adoption of advanced diagnostic and treatment options for VTE.

The region's growing emphasis on early diagnosis and preventive care has led to an increased demand for anticoagulants and diagnostic equipment, thereby supporting market growth. Additionally, Europe's high standards for medical treatments and regulatory support for innovative therapies continue to drive the expansion of the VTE market.

Leading Companies and Competitive Landscape

The Venous Thromboembolism market is competitive, with major players such as Bayer AG, Boehringer Ingelheim, and Bristol Myers Squibb leading the charge in research and product development. These companies are at the forefront of developing advanced therapeutic and diagnostic solutions for VTE, with a focus on improving the safety, efficacy, and ease of use of treatments. With the growing demand for anticoagulants, thrombolytics, and diagnostic imaging devices, these companies are expected to maintain their leadership positions by focusing on innovation and market expansion.

Furthermore, collaboration and partnerships among healthcare providers, pharmaceutical companies, and diagnostic firms are becoming increasingly common in the VTE market. These strategic initiatives are aimed at expanding product portfolios, increasing market access, and improving patient outcomes. The competitive landscape is also witnessing a surge in mergers and acquisitions as companies seek to strengthen their position and enhance their R&D capabilities.

Recent Developments:

- In February 2025, Bristol Myers Squibb announced the launch of a new anticoagulant drug aimed at improving patient outcomes in VTE treatment. This launch is expected to address unmet needs in the treatment of blood clots.

- In January 2025, Bayer AG received approval for its new oral anticoagulant for the treatment of deep vein thrombosis and pulmonary embolism. This approval expands their portfolio of VTE treatments.

- In December 2024, Pfizer Inc. announced a collaboration with a global healthcare provider to enhance access to blood clot prevention therapies in emerging markets. The partnership aims to reduce the burden of venous thromboembolism in high-risk populations.

- In November 2024, Medtronic plc unveiled a new thrombectomy device that offers a minimally invasive solution for removing large blood clots. The device is expected to transform treatment for patients with pulmonary embolism.

- In October 2024, Johnson & Johnson launched an innovative VTE management platform combining diagnostics and anticoagulation therapy. This integrated solution aims to streamline treatment and improve patient outcomes.

List of Leading Companies:

- Bristol Myers Squibb Company

- Boehringer Ingelheim International GmbH

- Johnson & Johnson

- Pfizer Inc.

- Sanofi S.A.

- Abbott Laboratories

- Bayer AG

- Medtronic plc

- Fresenius Medical Care AG & Co. KGaA

- AstraZeneca PLC

- GlaxoSmithKline plc

- Takeda Pharmaceutical Company Limited

- Stryker Corporation

- C.R. Bard, Inc.

- Boston Scientific Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.8 billion |

|

Forecasted Value (2030) |

USD 3.4 billion |

|

CAGR (2025 – 2030) |

10.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Venous Thromboembolism Market By Type (Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE)), By Treatment (Anticoagulants, Thrombolytics, Compression Stockings, Inferior Vena Cava (IVC) Filters), By Diagnosis (Ultrasound, CT Pulmonary Angiography, D-dimer Testing), By End-User (Hospitals, Ambulatory Surgical Centers, Clinics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Bristol Myers Squibb Company, Boehringer Ingelheim International GmbH, Johnson & Johnson, Pfizer Inc., Sanofi S.A., Abbott Laboratories, Bayer AG, Medtronic plc, Fresenius Medical Care AG & Co. KGaA, AstraZeneca PLC, GlaxoSmithKline plc, Takeda Pharmaceutical Company Limited, Stryker Corporation, C.R. Bard, Inc., Boston Scientific Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Venous Thromboembolism Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Deep Vein Thrombosis (DVT) |

|

4.2. Pulmonary Embolism (PE) |

|

4.3. Others |

|

5. Venous Thromboembolism Market, by Treatment (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Anticoagulants |

|

5.2. Thrombolytics |

|

5.3. Compression Stockings |

|

5.4. Inferior Vena Cava (IVC) Filters |

|

5.5. Others |

|

6. Venous Thromboembolism Market, by Diagnosis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Ultrasound |

|

6.2. CT Pulmonary Angiography |

|

6.3. D-dimer Testing |

|

6.4. Others |

|

7. Venous Thromboembolism Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Ambulatory Surgical Centers |

|

7.3. Clinics |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Venous Thromboembolism Market, by Type |

|

8.2.7. North America Venous Thromboembolism Market, by Treatment |

|

8.2.8. North America Venous Thromboembolism Market, by Diagnosis |

|

8.2.9. North America Venous Thromboembolism Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Venous Thromboembolism Market, by Type |

|

8.2.10.1.2. US Venous Thromboembolism Market, by Treatment |

|

8.2.10.1.3. US Venous Thromboembolism Market, by Diagnosis |

|

8.2.10.1.4. US Venous Thromboembolism Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Bristol Myers Squibb Company |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Boehringer Ingelheim International GmbH |

|

10.3. Johnson & Johnson |

|

10.4. Pfizer Inc. |

|

10.5. Sanofi S.A. |

|

10.6. Abbott Laboratories |

|

10.7. Bayer AG |

|

10.8. Medtronic plc |

|

10.9. Fresenius Medical Care AG & Co. KGaA |

|

10.10. AstraZeneca PLC |

|

10.11. GlaxoSmithKline plc |

|

10.12. Takeda Pharmaceutical Company Limited |

|

10.13. Stryker Corporation |

|

10.14. C.R. Bard, Inc. |

|

10.15. Boston Scientific Corporation |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Venous Thromboembolism Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Venous Thromboembolism Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Venous Thromboembolism Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA