As per Intent Market Research, the Vein Finder Market was valued at USD 332.3 million in 2024-e and will surpass USD 597.3 million by 2030; growing at a CAGR of 10.3% during 2025 - 2030.

The Vein Finder market has witnessed significant growth as the need for accurate and efficient venipuncture, blood collection, and infusion therapy procedures rises across healthcare settings. Vein finders utilize advanced technologies like Near Infrared (NIR), ultrasound, and laser to enhance the visibility of veins, making it easier for healthcare professionals to locate veins quickly and reduce patient discomfort. These devices are used extensively in hospitals, clinics, ambulatory surgical centers, and blood donation centers to improve the success rates of intravenous procedures and minimize the need for repeated needle insertions. As the demand for minimally invasive medical procedures grows, vein finders play a crucial role in improving patient care and enhancing procedural efficiency.

Advancements in vein-finding technologies, along with increased healthcare awareness, have contributed to the rising adoption of these devices. The growth of the global healthcare infrastructure, increasing awareness about patient safety, and rising incidences of conditions requiring frequent venipuncture, such as chronic diseases, further propel market demand. As medical procedures evolve, the Vein Finder market is set to expand significantly, catering to diverse applications and a wide array of medical professionals seeking precision in their practices.

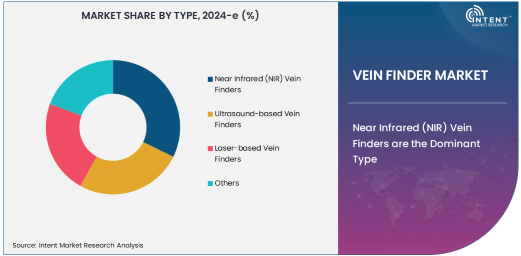

Near Infrared (NIR) Vein Finders are the Dominant Type

Near Infrared (NIR) vein finders dominate the market, primarily due to their ability to quickly and accurately visualize veins beneath the skin's surface. NIR vein finders use infrared light to detect differences in the absorption of light by blood vessels, providing a non-invasive method for locating veins. The ease of use, portability, and high accuracy of NIR vein finders make them the preferred choice for healthcare professionals in various settings. These devices are commonly used for venipuncture procedures, blood collection, and IV insertions, especially in cases where veins are difficult to locate due to factors such as obesity, dehydration, or low blood pressure.

The growing emphasis on patient comfort and safety has also contributed to the widespread adoption of NIR vein finders. They reduce the need for multiple needle insertions, thereby minimizing patient distress and improving overall treatment outcomes. The cost-effectiveness and efficiency of NIR vein finders have positioned them as the most widely used technology in vein locating, making them the largest segment in the Vein Finder market.

Non-contact Technology in Vein Finders Gaining Traction

The non-contact technology segment is experiencing rapid growth due to its benefits in enhancing patient comfort and safety. Non-contact vein finders utilize infrared light or other imaging technologies to detect veins without requiring direct contact with the patient's skin. This reduces the risk of cross-contamination and ensures a hygienic and sterile procedure. Non-contact technology is particularly advantageous in high-volume healthcare settings such as emergency rooms, pediatric units, and blood donation centers, where quick, safe, and efficient procedures are required.

As the healthcare industry increasingly prioritizes infection control and patient comfort, non-contact vein finders are gaining popularity. Their ability to provide a more comfortable and hygienic experience for both patients and healthcare providers is driving their adoption in various healthcare environments.

Hospitals Lead the End-Use Industry

Hospitals are the leading end-user in the vein finder market, owing to their high demand for precision in venipuncture, blood collection, and infusion therapy procedures. Hospitals, especially emergency departments, pediatric units, and oncology departments, require reliable and accurate vein locating devices to improve patient care. The rising number of patients with chronic diseases, the aging population, and the increasing need for frequent intravenous procedures contribute to the demand for vein finders in these settings.

Hospitals benefit from using vein finders as they help reduce the time spent on vein location, leading to better patient experiences and reducing the risk of complications. The improved accuracy and efficiency offered by these devices are essential for optimizing hospital workflows, reducing procedure times, and improving patient outcomes. As a result, hospitals continue to dominate the market share of the Vein Finder market.

North America Holds the Largest Market Share

North America leads the Vein Finder market, driven by the region's advanced healthcare infrastructure, high adoption of medical technologies, and a large population requiring intravenous procedures. The United States, in particular, is a major market for vein finders, owing to the widespread use of these devices across hospitals, clinics, ambulatory centers, and blood donation centers.

The growing emphasis on patient safety, infection control, and the increasing number of chronic diseases, which require frequent venipuncture, have fueled demand in this region. Additionally, the high healthcare expenditure and a well-established medical device industry further support the growth of the Vein Finder market in North America. Government initiatives aimed at improving healthcare services and reducing patient discomfort are also contributing to the market's growth in this region.

Leading Companies and Competitive Landscape

The Vein Finder market is competitive, with major players such as AccuVein, Venoscope, and VEINWATCH leading the charge in the development of innovative and effective vein-finding technologies. These companies offer a range of products utilizing NIR, ultrasound, and laser technologies to cater to various medical applications. They also focus on creating portable, user-friendly devices that healthcare professionals can integrate into their workflows seamlessly.

As the demand for advanced healthcare technologies grows, leading players in the Vein Finder market are investing heavily in research and development to improve the precision and functionality of their devices. Market players are also expanding their presence through partnerships and collaborations with hospitals, clinics, and blood donation centers, helping to drive the adoption of vein finders across different healthcare segments. Continued product innovation, along with a focus on patient safety and comfort, will likely keep competition high in the coming years.

Recent Developments:

- In March 2025, AccuVein Inc. launched its upgraded vein finder device featuring enhanced near infrared technology for more accurate vein visualization. This innovation improves blood collection accuracy in challenging cases.

- In February 2025, Veinlite LLC introduced a new laser-based vein finder designed for use in ambulatory surgical centers. The device aims to assist healthcare professionals in difficult venipuncture procedures.

- In January 2025, Siemens Healthineers expanded its vein finding portfolio with a contact-based technology that promises higher precision for blood collection in pediatric patients. This release targets the pediatric healthcare market.

- In December 2024, VeinVision International Pty Ltd entered into a partnership with hospitals in Europe to enhance the adoption of its advanced infrared vein finders. This collaboration aims to increase the device's use in emergency care units.

- In November 2024, Masimo Corporation revealed a new ultrasound vein finder system with added 3D visualization features. This innovation aims to improve the user experience and vein detection accuracy.

List of Leading Companies:

- AccuVein Inc.

- Veinlite LLC

- Medical Designs LLC

- Hitachi Ltd.

- Masimo Corporation

- VeinVision International Pty Ltd

- Phoenix Medical Systems

- Spectramed Technologies Pvt. Ltd.

- TransLite, LLC

- Siemens Healthineers

- Inov8 Medical

- OptiVein Medical

- Natus Medical Incorporated

- InfuSystem Holdings, Inc.

- Shenzhen Weierwei Technology Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 332.3 million |

|

Forecasted Value (2030) |

USD 597.3 million |

|

CAGR (2025 – 2030) |

10.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Vein Finder Market By Type (Near Infrared (NIR) Vein Finders, Ultrasound-based Vein Finders, Laser-based Vein Finders), By Technology (Non-contact Technology, Contact-based Technology), By Application (Patient Venipuncture, Blood Collection, Infusion Therapy), By End-Use Industry (Hospitals, Clinics, Ambulatory Surgical Centers, Blood Donation Centers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

AccuVein Inc., Veinlite LLC, Medical Designs LLC, Hitachi Ltd., Masimo Corporation, VeinVision International Pty Ltd, Phoenix Medical Systems, Spectramed Technologies Pvt. Ltd., TransLite, LLC, Siemens Healthineers, Inov8 Medical, OptiVein Medical, Natus Medical Incorporated, InfuSystem Holdings, Inc., Shenzhen Weierwei Technology Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Vein Finder Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Near Infrared (NIR) Vein Finders |

|

4.2. Ultrasound-based Vein Finders |

|

4.3. Laser-based Vein Finders |

|

4.4. Others |

|

5. Vein Finder Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Non-contact Technology |

|

5.2. Contact-based Technology |

|

6. Vein Finder Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Patient Venipuncture |

|

6.2. Blood Collection |

|

6.3. Infusion Therapy |

|

6.4. Others |

|

7. Vein Finder Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Clinics |

|

7.3. Ambulatory Surgical Centers |

|

7.4. Blood Donation Centers |

|

7.5. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Vein Finder Market, by Type |

|

8.2.7. North America Vein Finder Market, by Technology |

|

8.2.8. North America Vein Finder Market, by Application |

|

8.2.9. North America Vein Finder Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Vein Finder Market, by Type |

|

8.2.10.1.2. US Vein Finder Market, by Technology |

|

8.2.10.1.3. US Vein Finder Market, by Application |

|

8.2.10.1.4. US Vein Finder Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. AccuVein Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Veinlite LLC |

|

10.3. Medical Designs LLC |

|

10.4. Hitachi Ltd. |

|

10.5. Masimo Corporation |

|

10.6. VeinVision International Pty Ltd |

|

10.7. Phoenix Medical Systems |

|

10.8. Spectramed Technologies Pvt. Ltd. |

|

10.9. TransLite, LLC |

|

10.10. Siemens Healthineers |

|

10.11. Inov8 Medical |

|

10.12. OptiVein Medical |

|

10.13. Natus Medical Incorporated |

|

10.14. InfuSystem Holdings, Inc. |

|

10.15. Shenzhen Weierwei Technology Co., Ltd. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Vein Finder Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Vein Finder Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Vein Finder Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA