As per Intent Market Research, the Vehicle Roadside Assistance Market was valued at USD 10.1 billion in 2024-e and will surpass USD 19.9 billion by 2030; growing at a CAGR of 11.9% during 2025 - 2030.

The vehicle roadside assistance market has witnessed substantial growth, driven by the increasing reliance on automobiles and the rising number of vehicles on the road. Roadside assistance services, including towing, battery jump-starts, tire changes, lockout assistance, and fuel delivery, are essential for vehicle owners who face breakdowns or accidents while on the road. These services provide a safety net, offering quick solutions to common vehicle-related problems and ensuring minimal disruption to daily activities. With growing consumer demand for convenience and peace of mind, the roadside assistance market is expected to continue expanding globally.

The market is supported by technological advancements, such as mobile apps and telematics, which enable vehicle owners to quickly request roadside help. The increased penetration of smartphones and IoT-based vehicle systems is also transforming the market, allowing for more efficient service delivery. Moreover, partnerships between automotive manufacturers, insurance providers, and third-party service providers have contributed to the growth of roadside assistance programs. The global trend toward integrating connected car technology into vehicles has further enhanced the responsiveness and effectiveness of roadside assistance services.

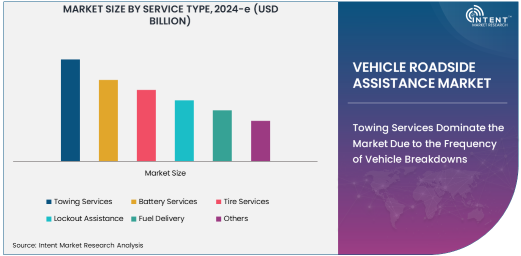

Towing Services Dominate the Market Due to the Frequency of Vehicle Breakdowns

Towing services are the largest service type in the vehicle roadside assistance market. This is due to the high frequency of breakdowns, accidents, and other situations where a vehicle needs to be towed to a repair shop or safe location. Whether due to engine failure, flat tires, or accidents, towing services are a critical component of roadside assistance, ensuring that vehicles are promptly removed from unsafe locations and transported to places where repairs can be made.

Towing services also cover a wide range of vehicle types, from passenger vehicles to commercial trucks and motorcycles. The need for reliable towing services is heightened in areas with heavy traffic or harsh weather conditions, where breakdowns are more likely to occur. Towing service providers are increasingly offering 24/7 availability, ensuring that consumers can access help at any time of day or night, further driving demand for these services.

Passenger Vehicles Lead the Market Due to the High Number of Owners

Passenger vehicles represent the largest share of the vehicle roadside assistance market. With the growing number of vehicles globally, passenger vehicle owners form the core customer base for roadside assistance providers. The increasing number of individuals driving cars and the rise in vehicle ownership across emerging markets have significantly boosted demand for roadside assistance services.

As passenger vehicles become more technologically advanced, the reliance on professional assistance for quick troubleshooting and service becomes more critical. Vehicle owners seek roadside assistance for problems such as flat tires, dead batteries, and fuel shortages, ensuring that their vehicles are back on the road quickly. As such, passenger vehicles will continue to account for the majority of market share in the coming years.

Individual Customers Represent the Largest Customer Type Segment

Individual customers are the largest customer type segment in the vehicle roadside assistance market. Many consumers purchase roadside assistance services either as part of their vehicle insurance policies or as standalone services. The demand from individual vehicle owners is driven by the need for immediate support in case of breakdowns and the convenience of having round-the-clock access to roadside assistance.

As the number of personal vehicles continues to rise globally, individual consumers will remain the dominant source of demand for roadside assistance services. In addition, many individual customers are opting for bundled packages that include towing services, battery assistance, tire changes, and lockout help, making roadside assistance a must-have service for modern vehicle owners.

OEMs Drive Market Growth with Service Integration in New Vehicles

Original Equipment Manufacturers (OEMs) play a significant role in the growth of the vehicle roadside assistance market. Many automakers are incorporating roadside assistance services as part of their vehicle sales packages, offering coverage for new buyers or as an added benefit to attract customers. This integration is particularly common in premium vehicle segments, where buyers are more likely to expect value-added services like roadside assistance as part of their purchase.

OEMs also partner with third-party service providers to offer a seamless experience, allowing vehicle owners to request roadside help via in-car telematics systems or mobile apps. These partnerships with roadside assistance service providers enable OEMs to enhance customer satisfaction and loyalty, further boosting demand for roadside assistance services.

North America Leads the Market Due to High Vehicle Ownership and Well-Established Service Networks

North America is the leading region in the vehicle roadside assistance market, driven by high vehicle ownership and an extensive network of service providers. The United States and Canada have well-established roadside assistance programs, often offered by insurance companies, automobile manufacturers, and independent service providers. The demand for roadside assistance services is particularly high in regions with harsh weather conditions and dense traffic, where vehicle breakdowns and accidents are more frequent.

In addition to vehicle ownership rates, the widespread use of mobile applications and telematics systems has significantly improved the efficiency of roadside assistance services in North America. These technologies allow for rapid service requests and real-time tracking of service providers, contributing to shorter wait times and better customer experiences. As a result, North America is expected to maintain its leadership position in the global vehicle roadside assistance market.

Leading Companies and Competitive Landscape

Key players in the vehicle roadside assistance market include major companies such as AAA (American Automobile Association), Agero, Allstate, and Roadside Assistance Services, Inc. These companies offer a wide range of services, including towing, battery jump-starts, tire changes, and lockout assistance, catering to both individual customers and fleet operators.

The competitive landscape is characterized by a mix of traditional service providers and emerging tech-driven companies. Companies are increasingly focusing on leveraging technology, such as telematics, GPS tracking, and mobile apps, to provide faster and more efficient roadside assistance. Partnerships with automotive manufacturers and insurance companies are crucial for expanding market reach and offering integrated services. The market is highly fragmented, with both global players and regional providers competing for market share.

Recent Developments:

- In February 2025, AAA expanded its roadside assistance services with enhanced tire repair capabilities. This aims to address rising consumer demands for more comprehensive roadside coverage.

- In January 2025, Agero launched a new app allowing real-time tracking of roadside assistance services, improving response times and customer satisfaction.

- In December 2024, Allianz Global Assistance partnered with several ride-sharing companies to offer roadside services to drivers. The move is expected to enhance convenience for gig economy workers.

- In November 2024, RAC Group introduced a subscription-based model for roadside assistance, offering both individual and fleet vehicle coverage. The model is designed to provide flexible coverage options.

- In October 2024, SOS Assistance unveiled its new AI-driven service dispatch platform, aiming to improve operational efficiency and service delivery speed.

List of Leading Companies:

- AAA (American Automobile Association)

- Agero, Inc.

- Allianz Global Assistance

- The Road Rescue Company

- Green Flag

- RAC Group

- British Automobile Association (AA)

- Roadside Assistance Corporation (RAC)

- SOS Assistance

- Allstate Motor Club

- MAPFRE Assistance

- Emergency Roadside Assistance LLC

- QBE Insurance

- Arcadia Group

- National General Insurance

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 10.1 billion |

|

Forecasted Value (2030) |

USD 19.9 billion |

|

CAGR (2025 – 2030) |

11.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Vehicle Roadside Assistance Market By Service Type (Towing Services, Battery Services, Tire Services, Lockout Assistance, Fuel Delivery), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Motorcycles), By End-Use (OEMs, Aftermarket), By Customer Type (Individual Customers, Fleet Operators, Corporate Clients) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

AAA (American Automobile Association), Agero, Inc., Allianz Global Assistance, The Road Rescue Company, Green Flag, RAC Group, British Automobile Association (AA), Roadside Assistance Corporation (RAC), SOS Assistance, Allstate Motor Club, MAPFRE Assistance, Emergency Roadside Assistance LLC, QBE Insurance, Arcadia Group, National General Insurance |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Vehicle Roadside Assistance Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Towing Services |

|

4.2. Battery Services |

|

4.3. Tire Services |

|

4.4. Lockout Assistance |

|

4.5. Fuel Delivery |

|

4.6. Others |

|

5. Vehicle Roadside Assistance Market, by Vehicle Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Passenger Vehicles |

|

5.2. Commercial Vehicles |

|

5.3. Motorcycles |

|

5.4. Others |

|

6. Vehicle Roadside Assistance Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. OEMs |

|

6.2. Aftermarket |

|

7. Vehicle Roadside Assistance Market, by Customer Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Individual Customers |

|

7.2. Fleet Operators |

|

7.3. Corporate Clients |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Vehicle Roadside Assistance Market, by Service Type |

|

8.2.7. North America Vehicle Roadside Assistance Market, by Vehicle Type |

|

8.2.8. North America Vehicle Roadside Assistance Market, by End-Use |

|

8.2.9. North America Vehicle Roadside Assistance Market, by Customer Type |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Vehicle Roadside Assistance Market, by Service Type |

|

8.2.10.1.2. US Vehicle Roadside Assistance Market, by Vehicle Type |

|

8.2.10.1.3. US Vehicle Roadside Assistance Market, by End-Use |

|

8.2.10.1.4. US Vehicle Roadside Assistance Market, by Customer Type |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. AAA (American Automobile Association) |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Agero, Inc. |

|

10.3. Allianz Global Assistance |

|

10.4. The Road Rescue Company |

|

10.5. Green Flag |

|

10.6. RAC Group |

|

10.7. British Automobile Association (AA) |

|

10.8. Roadside Assistance Corporation (RAC) |

|

10.9. SOS Assistance |

|

10.10. Allstate Motor Club |

|

10.11. MAPFRE Assistance |

|

10.12. Emergency Roadside Assistance LLC |

|

10.13. QBE Insurance |

|

10.14. Arcadia Group |

|

10.15. National General Insurance |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Vehicle Roadside Assistance Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Vehicle Roadside Assistance Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Vehicle Roadside Assistance Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA