As per Intent Market Research, the Vegetable Oils Market was valued at USD 250.2 billion in 2024-e and will surpass USD 298.9 billion by 2030; growing at a CAGR of 3.0% during 2025 - 2030.

The vegetable oils market has become an essential segment of the global agricultural and food industries, driven by their versatility and extensive applications. Vegetable oils, extracted from various plant sources such as palm, soybean, sunflower, and olive, play a crucial role in food preparation, biofuel production, cosmetics, and pharmaceuticals. With increasing consumer awareness of healthy lifestyles, demand for oils with low saturated fat content and high nutritional value is rising. Furthermore, the shift toward bio-based and renewable resources is boosting the adoption of vegetable oils in industrial applications.

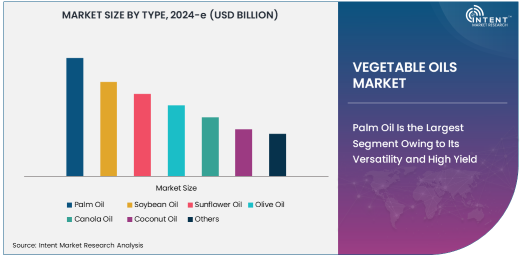

Palm Oil Is the Largest Segment Owing to Its Versatility and High Yield

Palm oil leads the vegetable oils market due to its versatility, cost-effectiveness, and high yield. Widely used in the food and beverage industry, palm oil is a primary ingredient in cooking oils, margarine, and processed foods. Its ability to enhance the texture and shelf life of products makes it indispensable in food manufacturing.

Additionally, palm oil is extensively utilized in biofuels and oleochemicals, which are essential for the production of detergents, cosmetics, and other industrial products. The high productivity of oil palm trees compared to other oil crops further solidifies palm oil’s position as the largest segment. Despite environmental concerns associated with palm oil production, ongoing sustainability efforts are expected to support its continued dominance.

Biofuels Are the Fastest Growing Application Due to Renewable Energy Initiatives

Biofuels represent the fastest-growing application of vegetable oils, driven by the global push for renewable and sustainable energy sources. Governments and organizations worldwide are promoting the use of biodiesel, which is often derived from vegetable oils, to reduce carbon emissions and dependence on fossil fuels.

This demand is particularly strong in regions like Europe and North America, where policies incentivize the use of bio-based fuels. The versatility of vegetable oils in blending with traditional fuels, combined with advancements in biodiesel technology, ensures robust growth in this segment. The focus on green energy and environmental sustainability will likely accelerate the adoption of vegetable oils in biofuel applications.

Refined Oils Are the Largest Processing Method Owing to Their Broad Usability

Refined oils dominate the market due to their broad usability in cooking and food processing. The refining process removes impurities and enhances the oil's flavor, odor, and shelf life, making refined oils suitable for a wide range of culinary applications.

Refined oils are also preferred in industrial applications, including cosmetics and pharmaceuticals, where consistency and stability are critical. Their widespread availability and affordability further contribute to their popularity among both household and commercial users.

Household Sector Leads the End-Use Industry Owing to Rising Demand for Cooking Oils

The household sector is the largest end-use industry for vegetable oils, driven by the growing consumption of cooking oils in everyday food preparation. The increasing trend of home cooking, fueled by health-conscious consumers seeking to prepare meals with healthier oils, supports this dominance.

Vegetable oils are also widely used in various regional cuisines, catering to diverse culinary needs. As the global population continues to grow and consumer awareness of healthy cooking practices increases, the household sector is expected to maintain its position as the largest end-use industry in the vegetable oils market.

Asia-Pacific Leads the Market Owing to Strong Demand from Food, Biofuel, and Industrial Sectors

Asia-Pacific is the largest region in the vegetable oils market, driven by the high consumption of vegetable oils in food applications, biofuels, and industrial uses. The region, particularly countries like China, India, and Indonesia, is a significant producer and consumer of various vegetable oils, such as palm oil, soybean oil, and sunflower oil. The growing population, urbanization, and rising disposable income contribute to an increased demand for vegetable oils in cooking, processed foods, and packaged products. Additionally, the Asia-Pacific region's vast agricultural output supports the continuous availability of raw materials for oil extraction.

Furthermore, the demand for vegetable oils in biofuels is growing, particularly in countries like Indonesia and Malaysia, where palm oil is extensively used in biodiesel production. As a result, Asia-Pacific is expected to maintain its dominance in the vegetable oils market, with strong growth prospects driven by both food-related and non-food applications. The region's key role in both production and consumption ensures its continued leadership in the global market.

Leading Companies and Competitive Landscape

The vegetable oils market is highly competitive, with major players such as Wilmar International, Cargill, Archer Daniels Midland (ADM), and Bunge Limited dominating the landscape. These companies focus on expanding their product portfolios, enhancing processing technologies, and adopting sustainable practices to meet rising consumer demands.

Emerging players are also entering the market, targeting niche segments such as cold-pressed and organic oils. Innovations in packaging, distribution channels, and product formulations are expected to further intensify competition. Sustainability remains a key focus, with companies prioritizing eco-friendly sourcing and production methods to align with consumer preferences for ethical and environmentally responsible products.

Recent Developments:

- In December 2024, Cargill, Incorporated announced an expansion of its palm oil operations with a focus on sustainable sourcing practices. This reflects the company's efforts to address environmental concerns in the industry.

- In November 2024, Wilmar International Ltd. partnered with a major cosmetics company to supply sustainable coconut oil for beauty products. This marks a diversification of vegetable oil applications.

- In October 2024, Bunge Limited launched a new range of cold-pressed oils for the premium health-conscious consumer segment. This aligns with the growing demand for organic and natural products.

- In September 2024, Archer Daniels Midland Company (ADM) acquired a specialty oil processing facility to strengthen its portfolio of refined and specialty oils. This move supports the company's expansion into high-margin markets.

- In August 2024, Sime Darby Plantation Berhad initiated a pilot project for AI-driven palm oil plantation management to improve yield and sustainability. This technological advancement underscores their focus on innovation and sustainability.

List of Leading Companies:

- Wilmar International Ltd.

- Archer Daniels Midland Company (ADM)

- Cargill, Incorporated

- Bunge Limited

- Olam International

- Sime Darby Plantation Berhad

- IOI Corporation Berhad

- Louis Dreyfus Company

- Unilever PLC

- Associated British Foods plc

- CHS Inc.

- The Hain Celestial Group, Inc.

- Fuji Oil Holdings Inc.

- Marico Limited

- Golden Agri-Resources Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 250.2 billion |

|

Forecasted Value (2030) |

USD 298.9 billion |

|

CAGR (2025 – 2030) |

3.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Vegetable Oils Market By Type (Palm Oil, Soybean Oil, Sunflower Oil, Olive Oil, Canola Oil, Coconut Oil), By Application (Food & Beverages, Biofuels, Cosmetics & Personal Care, Pharmaceuticals), By Processing Method (Refined Oils, Cold-Pressed Oils, Hydrogenated Oils), By End-Use Industry (Household, Industrial, Food Service) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Wilmar International Ltd., Archer Daniels Midland Company (ADM), Cargill, Incorporated, Bunge Limited, Olam International, Sime Darby Plantation Berhad, IOI Corporation Berhad, Louis Dreyfus Company, Unilever PLC, Associated British Foods plc, CHS Inc., The Hain Celestial Group, Inc., Fuji Oil Holdings Inc., Marico Limited, Golden Agri-Resources Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Vegetable Oils Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Palm Oil |

|

4.2. Soybean Oil |

|

4.3. Sunflower Oil |

|

4.4. Olive Oil |

|

4.5. Canola Oil |

|

4.6. Coconut Oil |

|

4.7. Others |

|

5. Vegetable Oils Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Food & Beverages |

|

5.2. Biofuels |

|

5.3. Cosmetics & Personal Care |

|

5.4. Pharmaceuticals |

|

5.5. Others |

|

6. Vegetable Oils Market, by Processing Method (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Refined Oils |

|

6.2. Cold-Pressed Oils |

|

6.3. Hydrogenated Oils |

|

7. Vegetable Oils Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Household |

|

7.2. Industrial |

|

7.3. Food Service |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Vegetable Oils Market, by Type |

|

8.2.7. North America Vegetable Oils Market, by Application |

|

8.2.8. North America Vegetable Oils Market, by Processing Method |

|

8.2.9. By Country |

|

8.2.9.1. US |

|

8.2.9.1.1. US Vegetable Oils Market, by Type |

|

8.2.9.1.2. US Vegetable Oils Market, by Application |

|

8.2.9.1.3. US Vegetable Oils Market, by Processing Method |

|

8.2.9.2. Canada |

|

8.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Wilmar International Ltd. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Archer Daniels Midland Company (ADM) |

|

10.3. Cargill, Incorporated |

|

10.4. Bunge Limited |

|

10.5. Olam International |

|

10.6. Sime Darby Plantation Berhad |

|

10.7. IOI Corporation Berhad |

|

10.8. Louis Dreyfus Company |

|

10.9. Unilever PLC |

|

10.10. Associated British Foods plc |

|

10.11. CHS Inc. |

|

10.12. The Hain Celestial Group, Inc. |

|

10.13. Fuji Oil Holdings Inc. |

|

10.14. Marico Limited |

|

10.15. Golden Agri-Resources Ltd. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Vegetable Oils Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Vegetable Oils Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Vegetable Oils Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA