As per Intent Market Research, the Vasculitis Treatment Market was valued at USD 1.5 billion in 2024-e and will surpass USD 2.8 billion by 2030; growing at a CAGR of 10.6% during 2025 - 2030.

The vasculitis treatment market is driven by the rising prevalence of vasculitis diseases, which involve inflammation of blood vessels, leading to potential organ damage and life-threatening complications. These conditions, such as Giant Cell Arteritis, Granulomatosis with Polyangiitis, and Takayasu Arteritis, require specialized treatments to control inflammation and prevent further vascular damage. Advances in immunology and biologic therapies are transforming the way vasculitis is treated, offering patients more targeted and effective treatment options.

The market for vasculitis treatment is expanding as new therapies and drugs are introduced, providing more options for patients and healthcare providers. With a growing understanding of the underlying causes of vasculitis and innovations in treatment modalities, there is an increasing demand for both traditional and biologic treatments to manage these chronic conditions. The development of more personalized treatment approaches is expected to enhance patient outcomes, driving further growth in the market.

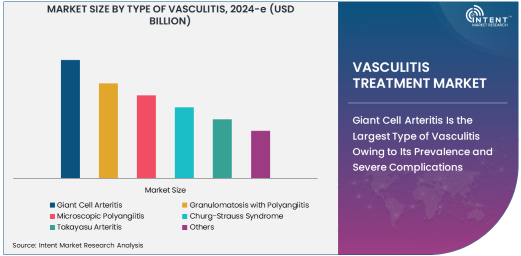

Giant Cell Arteritis Is the Largest Type of Vasculitis Owing to Its Prevalence and Severe Complications

Giant Cell Arteritis (GCA) is the largest type of vasculitis in the treatment market due to its high prevalence and the severity of its complications. GCA primarily affects older adults and involves the inflammation of large blood vessels, especially the temporal arteries, which can lead to blindness, stroke, and other severe complications if left untreated. Early diagnosis and intervention are crucial for preventing irreversible damage, making the treatment of GCA a significant focus within the vasculitis treatment market.

The large patient population, coupled with the severity of the disease, ensures that GCA remains the dominant form of vasculitis treated in the market. The demand for effective corticosteroid treatments, immunosuppressants, and biologic therapies continues to drive the growth of the GCA segment, as healthcare providers strive to manage this condition more effectively.

Biologic Therapies Are the Fastest Growing Treatment Type Owing to Their Targeted Action and Efficacy

Biologic therapies are the fastest-growing treatment type in the vasculitis treatment market due to their targeted action against the underlying causes of inflammation in vasculitis diseases. These therapies, including monoclonal antibodies and other biologic agents, have shown significant efficacy in managing conditions like Granulomatosis with Polyangiitis and Microscopic Polyangiitis. Unlike traditional corticosteroids and immunosuppressants, biologics specifically target immune system components that drive the inflammatory response, offering patients a more precise and effective treatment.

The increasing success of biologic therapies in clinical trials, coupled with their ability to minimize side effects compared to steroids, is making them a preferred treatment choice. As new biologics are developed and approved, the demand for these therapies is expected to grow rapidly, further accelerating their role in treating vasculitis.

Oral Administration Is the Largest Route of Administration Owing to Convenience and Ease of Use

Oral administration is the largest route of administration in the vasculitis treatment market due to its convenience, ease of use, and patient preference. Oral medications, including corticosteroids and immunosuppressants, are commonly prescribed for long-term management of vasculitis, allowing patients to adhere to treatment regimens without the need for frequent hospital visits or injections. This makes oral therapies particularly suitable for conditions that require chronic management, such as Microscopic Polyangiitis and Takayasu Arteritis.

The ability to administer treatment at home and the reduction in healthcare costs associated with oral therapies contribute to their widespread use. As the focus shifts toward patient-centered care and long-term disease management, oral medications will continue to dominate the treatment landscape for vasculitis.

Hospitals Are the Largest End-Use Industry Owing to Their Specialized Care and Comprehensive Treatment Options

Hospitals are the largest end-use industry for vasculitis treatment due to their capacity to provide specialized care and comprehensive treatment options for patients with severe forms of vasculitis. These institutions are equipped with advanced diagnostic tools, multidisciplinary medical teams, and access to a wide range of therapies, including biologics and plasma exchange treatments. Hospitals are also the preferred setting for patients requiring intensive monitoring, particularly during the initiation of treatment or when complications arise.

As the complexity of treating vasculitis increases, particularly in cases where organ damage is present, hospitals remain the primary center for managing these conditions. With their ability to provide the necessary expertise and infrastructure, hospitals continue to lead the way in delivering effective vasculitis treatments.

North America Leads the Market Owing to Advanced Healthcare Facilities and High Adoption of Biologic Therapies

North America leads the vasculitis treatment market, driven by its advanced healthcare facilities and the widespread adoption of biologic therapies for conditions such as Giant Cell Arteritis and Granulomatosis with Polyangiitis. The United States, in particular, has seen significant growth in the use of targeted biologic therapies, such as TNF inhibitors and interleukin inhibitors, which have shown efficacy in treating various forms of vasculitis. The region's robust healthcare infrastructure, high research and development investments, and regulatory support for new biologic drugs further accelerate the adoption of these advanced treatments.

Additionally, North America benefits from a high level of awareness and early diagnosis of vasculitis, leading to increased treatment demand. The growing prevalence of autoimmune diseases and the increasing focus on personalized medicine are expected to continue driving the growth of the vasculitis treatment market in North America, further solidifying its leadership in the global market.

Leading Companies and Competitive Landscape

The vasculitis treatment market is competitive, with major pharmaceutical companies such as Roche, GlaxoSmithKline, and Bristol-Myers Squibb leading the development of biologic therapies and immunosuppressants. These companies are focused on expanding their portfolios with novel biologic agents that target specific immune pathways involved in vasculitis. Ongoing research and clinical trials are crucial for the development of new treatments aimed at improving patient outcomes and minimizing side effects.

In addition to the large players, smaller biotechnology firms are also contributing to the innovation in the market, particularly with the development of specialized biologics and other targeted therapies. The competitive landscape is characterized by continuous investment in research and development, as well as partnerships between pharmaceutical companies and academic institutions to accelerate the discovery of new treatments for vasculitis.

Recent Developments:

- In November 2024, Bristol Myers Squibb announced the successful clinical trial results of a new biologic drug for treating granulomatosis with polyangiitis. This marks a significant advancement in personalized treatment for autoimmune diseases.

- In October 2024, Pfizer launched a new oral steroid-free treatment for vasculitis, significantly reducing the side effects seen in long-term steroid therapy. This is expected to improve patient compliance and outcomes.

- In September 2024, Novartis received FDA approval for a new biologic therapy to treat giant cell arteritis, promising improved efficacy in reducing inflammation. The approval strengthens their position in the vasculitis treatment market.

- In August 2024, Roche announced a collaboration with Regeneron Pharmaceuticals to develop a new monoclonal antibody targeting vasculitis-associated inflammation. This partnership is poised to accelerate the development of innovative treatments.

- In July 2024, Merck & Co. released findings showing their latest combination therapy significantly improves outcomes in patients with severe vasculitis. This new therapy is set to change the management of the disease.

List of Leading Companies:

- Pfizer

- Novartis

- Johnson & Johnson

- Bristol Myers Squibb

- GlaxoSmithKline

- AbbVie

- Sanofi

- Eli Lilly and Co.

- Amgen

- Boehringer Ingelheim

- Roche

- Merck & Co.

- Celgene Corporation

- Regeneron Pharmaceuticals

- Gilead Sciences

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.5 billion |

|

Forecasted Value (2030) |

USD 2.8 billion |

|

CAGR (2025 – 2030) |

10.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Vasculitis Treatment Market By Type of Vasculitis (Giant Cell Arteritis, Granulomatosis with Polyangiitis, Microscopic Polyangiitis, Churg-Strauss Syndrome, Takayasu Arteritis), By Treatment Type (Steroids and Immunosuppressants, Biologic Therapies, Plasma Exchange Therapy), By Route of Administration (Oral, Intravenous, Subcutaneous), By End-Use Industry (Hospitals, Clinics, Outpatient Centers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Pfizer, Novartis, Johnson & Johnson, Bristol Myers Squibb, GlaxoSmithKline, AbbVie, Sanofi, Eli Lilly and Co., Amgen, Boehringer Ingelheim, Roche, Merck & Co., Celgene Corporation, Regeneron Pharmaceuticals, Gilead Sciences |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Vasculitis Treatment Market, by Type of Vasculitis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Giant Cell Arteritis |

|

4.2. Granulomatosis with Polyangiitis |

|

4.3. Microscopic Polyangiitis |

|

4.4. Churg-Strauss Syndrome |

|

4.5. Takayasu Arteritis |

|

4.6. Others |

|

5. Vasculitis Treatment Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Steroids and Immunosuppressants |

|

5.2. Biologic Therapies |

|

5.3. Plasma Exchange Therapy |

|

5.4. Others |

|

6. Vasculitis Treatment Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Oral |

|

6.2. Intravenous |

|

6.3. Subcutaneous |

|

7. Vasculitis Treatment Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Clinics |

|

7.3. Outpatient Centers |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Vasculitis Treatment Market, by Type of Vasculitis |

|

8.2.7. North America Vasculitis Treatment Market, by Treatment Type |

|

8.2.8. North America Vasculitis Treatment Market, by Route of Administration |

|

8.2.9. North America Vasculitis Treatment Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Vasculitis Treatment Market, by Type of Vasculitis |

|

8.2.10.1.2. US Vasculitis Treatment Market, by Treatment Type |

|

8.2.10.1.3. US Vasculitis Treatment Market, by Route of Administration |

|

8.2.10.1.4. US Vasculitis Treatment Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Pfizer |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Novartis |

|

10.3. Johnson & Johnson |

|

10.4. Bristol Myers Squibb |

|

10.5. GlaxoSmithKline |

|

10.6. AbbVie |

|

10.7. Sanofi |

|

10.8. Eli Lilly and Co. |

|

10.9. Amgen |

|

10.10. Boehringer Ingelheim |

|

10.11. Roche |

|

10.12. Merck & Co. |

|

10.13. Celgene Corporation |

|

10.14. Regeneron Pharmaceuticals |

|

10.15. Gilead Sciences |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Vasculitis Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Vasculitis Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Vasculitis Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA