As per Intent Market Research, the Vascular Grafts Market was valued at USD 6.5 billion in 2024-e and will surpass USD 9.7 billion by 2030; growing at a CAGR of 6.9% during 2025 - 2030.

The vascular grafts market is growing steadily, driven by the increasing prevalence of cardiovascular diseases, diabetes, and vascular complications, which require surgical interventions. Vascular grafts, used in procedures such as coronary artery bypass grafting (CABG) and dialysis access, provide a critical solution for patients with blocked or damaged blood vessels. The demand for vascular grafts is increasing as surgical techniques advance and the need for durable, biocompatible graft materials becomes more critical.

Additionally, the rising aging population, which is more prone to vascular diseases, is also a key driver for the market. Innovations in graft materials and design are improving patient outcomes, making vascular grafts safer, more effective, and longer-lasting. As surgical procedures become more refined and less invasive, the vascular grafts market is expected to expand significantly, with growing applications across various medical fields.

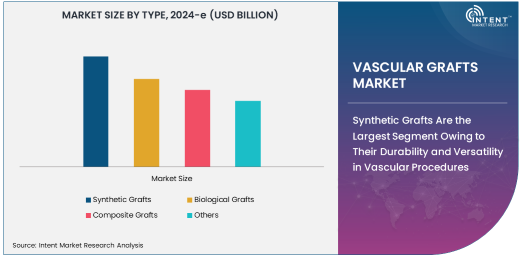

Synthetic Grafts Are the Largest Segment Owing to Their Durability and Versatility in Vascular Procedures

Synthetic grafts represent the largest segment in the vascular grafts market, owing to their durability and versatility in treating a wide range of vascular conditions. Made from materials like polyester and polytetrafluoroethylene (PTFE), synthetic grafts are highly resistant to infection and can withstand the mechanical stresses encountered in vascular procedures. Their ability to be tailored for both arterial and venous applications makes them indispensable in vascular surgeries.

The widespread use of synthetic grafts in coronary bypass surgeries and dialysis access procedures is a key factor behind their dominance in the market. Their availability in a variety of sizes and shapes allows for flexibility in treating different patient needs, ensuring that synthetic grafts continue to be the preferred choice for many vascular procedures. With improvements in material technology, synthetic grafts are expected to maintain their position as the dominant product in the market.

Polyester Is the Largest Material Segment Owing to Its Proven Reliability and Strong Clinical Track Record

Polyester is the largest material segment in the vascular grafts market, primarily due to its proven reliability and strong clinical track record in vascular surgeries. Polyester grafts are widely used in arterial and venous bypass procedures because of their high tensile strength and ability to be easily manipulated during surgery. The material’s ability to resist degradation over time, coupled with its relatively lower cost compared to other synthetic options, has made it a staple in vascular surgery.

As the clinical application of polyester-based grafts continues to expand, they remain a go-to option for many healthcare providers. Their established safety profile and effectiveness in improving patient outcomes ensure their continued dominance in the vascular grafts market.

Arterial Application Is the Largest Segment Owing to the High Incidence of Arterial Diseases and Bypass Surgeries

Arterial applications dominate the vascular grafts market, largely driven by the high incidence of arterial diseases such as atherosclerosis, which often require surgical intervention. Arterial bypass surgeries, such as coronary artery bypass grafting (CABG), use vascular grafts to reroute blood flow around blocked or narrowed arteries. The increasing number of cardiovascular surgeries and advancements in surgical techniques contribute to the dominance of arterial applications in the market.

With cardiovascular disease being a leading cause of death globally, the demand for arterial grafts is expected to remain high. As surgical techniques improve and patient outcomes continue to improve, arterial vascular grafts will continue to be a central component of cardiovascular care.

Hospitals Are the Largest End-Use Industry Owing to the Complexity and Specialization of Vascular Surgeries

Hospitals represent the largest end-use industry for vascular grafts, driven by the complexity and specialization required for vascular surgeries. Hospitals are equipped with the necessary infrastructure, such as specialized surgical teams and advanced imaging technologies, to perform the intricate procedures that involve vascular grafts. The high volume of patients requiring vascular surgery in hospitals, especially those undergoing coronary bypass or dialysis access surgeries, ensures that hospitals remain the primary setting for vascular graft usage.

As the number of patients needing complex vascular procedures increases, hospitals will continue to dominate the market. The growing focus on specialized care and the advancement of minimally invasive surgical techniques further reinforce hospitals as the largest end-use industry for vascular grafts.

North America Leads the Market Owing to Advanced Healthcare Infrastructure and High Surgical Procedure Volume

North America holds the largest share in the vascular grafts market, driven by its advanced healthcare infrastructure, high surgical procedure volume, and the increasing prevalence of vascular diseases. The United States is a key contributor to this market, with a significant number of coronary artery bypass graft (CABG) surgeries, as well as procedures involving vascular grafts for peripheral arterial diseases. The demand for both synthetic and biological grafts is growing as a result of the aging population and the rising incidence of cardiovascular and vascular diseases.

Furthermore, the region benefits from high healthcare expenditure and access to cutting-edge medical technologies, supporting the adoption of advanced vascular grafts. The ongoing development of novel graft materials and the increasing use of minimally invasive surgical techniques are expected to continue propelling North America’s dominance in the vascular grafts market.

Leading Companies and Competitive Landscape

The vascular grafts market is competitive, with several prominent players, including Medtronic, Gore Medical, and Baxter International, leading the way in the development and commercialization of advanced graft products. These companies focus on improving the biocompatibility and durability of graft materials, ensuring better long-term outcomes for patients. Their extensive research and development efforts, coupled with strategic partnerships and acquisitions, enable them to maintain a competitive edge in the market.

The market is also seeing the emergence of smaller biotech firms focusing on developing innovative materials for grafts, such as bioresorbable and tissue-engineered solutions. With advancements in material science and the increasing demand for vascular grafts, the competitive landscape will continue to evolve, with leading companies capitalizing on their expertise to drive growth in the market.

Recent Developments:

- In December 2024, Medtronic launched a new line of synthetic vascular grafts that are designed to enhance long-term patency. This product is expected to improve the outcomes of arterial bypass surgeries.

- In November 2024, Gore Medical received FDA approval for a next-generation bioabsorbable vascular graft that accelerates tissue integration. This approval is set to boost its market share in the vascular grafts sector.

- In October 2024, Baxter International announced a partnership with a biotech company to develop tissue-engineered vascular grafts. The collaboration aims to address the limitations of synthetic grafts and improve patient outcomes.

- In September 2024, Cook Medical introduced a new PTFE vascular graft with enhanced flexibility and durability for better surgical outcomes. The innovation is expected to increase the adoption of their grafts in high-risk surgeries.

- In August 2024, Terumo Corporation expanded its portfolio with a biologically derived vascular graft designed for improved biocompatibility in complex surgeries. This development aims to provide safer options for vascular procedures.

List of Leading Companies:

- Gore Medical

- Medtronic

- Baxter International

- Terumo Corporation

- Boston Scientific

- Endologix

- JOTEC GmbH

- Cook Medical

- CryoLife

- B. Braun Melsungen

- Cardinal Health

- Cardinal Health

- LeMaitre Vascular

- Vascutek Ltd.

- Abbott Laboratories

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 6.5 billion |

|

Forecasted Value (2030) |

USD 9.7 billion |

|

CAGR (2025 – 2030) |

6.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Vascular Grafts Market By Type (Synthetic Grafts, Biological Grafts, Composite Grafts), By Material (Polyester, Polytetrafluoroethylene (PTFE), Biological Materials (e.g., human, animal)), By Application (Arterial, Venous, Coronary), By End-Use (Hospitals, Clinics, Ambulatory Surgical Centers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Gore Medical, Medtronic, Baxter International, Terumo Corporation, Boston Scientific, Endologix, JOTEC GmbH, Cook Medical, CryoLife, B. Braun Melsungen, Cardinal Health, Cardinal Health, LeMaitre Vascular, Vascutek Ltd., Abbott Laboratories |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Vascular Grafts Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Synthetic Grafts |

|

4.2. Biological Grafts |

|

4.3. Composite Grafts |

|

4.4. Others |

|

5. Vascular Grafts Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Polyester |

|

5.2. Polytetrafluoroethylene (PTFE) |

|

5.3. Biological Materials (e.g., human, animal) |

|

5.4. Others |

|

6. Vascular Grafts Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Arterial |

|

6.2. Venous |

|

6.3. Coronary |

|

6.4. Others |

|

7. Vascular Grafts Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Clinics |

|

7.3. Ambulatory Surgical Centers |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Vascular Grafts Market, by Type |

|

8.2.7. North America Vascular Grafts Market, by Material |

|

8.2.8. North America Vascular Grafts Market, by Application |

|

8.2.9. North America Vascular Grafts Market, by End-Use |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Vascular Grafts Market, by Type |

|

8.2.10.1.2. US Vascular Grafts Market, by Material |

|

8.2.10.1.3. US Vascular Grafts Market, by Application |

|

8.2.10.1.4. US Vascular Grafts Market, by End-Use |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Gore Medical |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Medtronic |

|

10.3. Baxter International |

|

10.4. Terumo Corporation |

|

10.5. Boston Scientific |

|

10.6. Endologix |

|

10.7. JOTEC GmbH |

|

10.8. Cook Medical |

|

10.9. CryoLife |

|

10.10. B. Braun Melsungen |

|

10.11. Cardinal Health |

|

10.12. Cardinal Health |

|

10.13. LeMaitre Vascular |

|

10.14. Vascutek Ltd. |

|

10.15. Abbott Laboratories |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Vascular Grafts Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Vascular Grafts Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Vascular Grafts Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA