As per Intent Market Research, the Vascular Access Devices Market was valued at USD 4.8 billion in 2024-e and will surpass USD 8.2 billion by 2030; growing at a CAGR of 8.0% during 2025 - 2030.

The vascular access devices market plays a crucial role in providing effective access to the circulatory system for the administration of fluids, medications, and nutrients, as well as for diagnostic and therapeutic purposes. With increasing healthcare demands and advancements in medical procedures, the market for vascular access devices is expanding globally. These devices are essential for various applications, ranging from oncology to dialysis, and have found widespread usage in hospitals, clinics, and home healthcare settings. The growing incidence of chronic diseases, coupled with an aging population, is driving the demand for these devices across the healthcare industry.

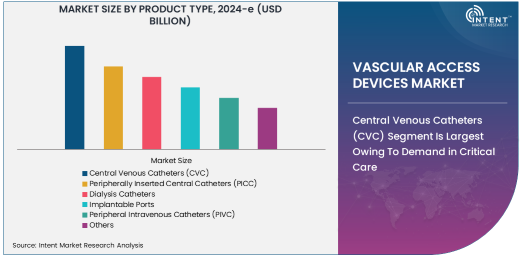

Central Venous Catheters (CVC) Segment Is Largest Owing To Demand in Critical Care

Central venous catheters (CVC) are the largest product segment within the vascular access devices market due to their critical role in managing patients requiring long-term access to veins for therapies such as chemotherapy, antibiotics, and total parenteral nutrition. CVCs are primarily used in intensive care units (ICUs) and critical care settings, where patients require constant monitoring and intravenous treatments. These catheters are designed for the insertion into major veins, such as the subclavian, jugular, or femoral veins, to provide easy access to the bloodstream. The ability to administer medications, blood products, and fluids safely and efficiently is essential, making CVCs a go-to solution in critical care. As the prevalence of conditions requiring long-term intravenous therapy rises, the demand for CVCs is expected to remain strong, securing its position as the largest subsegment.

Dialysis Catheters Segment Is Fastest Growing Owing To Rising Prevalence of Kidney Diseases

The dialysis catheters segment is the fastest growing segment in the vascular access devices market, driven by the increasing prevalence of kidney diseases and the growing demand for dialysis treatments. Dialysis catheters are specifically designed to facilitate the efficient removal of waste and excess fluids from patients suffering from end-stage renal disease (ESRD). The rising incidence of kidney diseases, especially in aging populations, has been a significant driver for the expansion of this market segment. Moreover, advancements in catheter designs that enhance patient comfort, reduce infection risks, and promote long-term usability are contributing to the increasing adoption of dialysis catheters. As healthcare systems focus more on addressing chronic kidney disease, the dialysis catheter market is projected to see significant growth in the coming years.

Hospitals Segment Is Largest End-User Industry Owing To High Volume of Procedures

Hospitals dominate the end-user industry segment of the vascular access devices market due to the high volume of procedures and the diverse range of medical conditions requiring vascular access. Hospitals are the primary setting for the treatment of critical illnesses, trauma, surgeries, and complex procedures such as organ transplants, oncology treatments, and intensive care. As a result, hospitals require a continuous supply of vascular access devices, including central venous catheters, dialysis catheters, and peripheral intravenous catheters. The demand in hospitals is amplified by the increasing complexity of surgeries and the growing need for intravenous drug administration. This trend is expected to continue as hospitals remain the focal point for the management of acute and chronic medical conditions.

Oncology Application Is Largest Owing To Growing Cancer Incidence

The oncology application of vascular access devices is the largest in the market, driven by the rising incidence of cancer worldwide. Cancer treatments, such as chemotherapy, often require the use of central venous catheters (CVCs) or peripherally inserted central catheters (PICC), as these devices allow for the reliable and efficient administration of chemotherapy drugs. As cancer diagnoses increase globally, so does the demand for vascular access devices in oncology. The need for safe and durable access to the bloodstream during chemotherapy and other cancer treatments has made this application the most significant segment in the vascular access devices market. Additionally, the trend toward personalized medicine and targeted therapies is expected to further expand the role of vascular access devices in oncology treatments.

Polyurethane Material Type Is Largest Owing To Durability and Flexibility

Polyurethane is the largest material type used in vascular access devices due to its durability, flexibility, and biocompatibility. It is preferred in applications that require long-term access, such as central venous catheters and dialysis catheters. Polyurethane catheters are known for their strength and resistance to kinking, making them suitable for long-term use in critical patients who need continuous access to the vascular system. The material also offers a high degree of comfort for patients and is less prone to infections when compared to other materials. With its unique properties, polyurethane remains the preferred choice for manufacturers of vascular access devices, ensuring its dominance in the market.

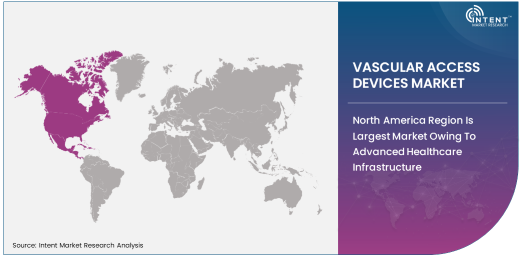

North America Region Is Largest Market Owing To Advanced Healthcare Infrastructure

North America is the largest region in the vascular access devices market, accounting for a significant share of the global market. The region's dominance is attributed to its well-established healthcare infrastructure, advanced medical technology, and high healthcare spending. The U.S. in particular has a large patient population requiring dialysis, oncology treatments, and intravenous therapies, further driving the demand for vascular access devices. Additionally, the presence of key market players in the U.S. and Canada, along with the high adoption rate of advanced medical technologies, contributes to North America's leadership in the market. With increasing healthcare expenditures and ongoing investments in healthcare infrastructure, North America is expected to continue leading the market for vascular access devices.

Competitive Landscape and Leading Companies

The competitive landscape of the vascular access devices market is highly dynamic, with several key players leading the market. Becton Dickinson & Co., Teleflex Incorporated, and Medtronic plc are some of the prominent companies operating in this market. These companies focus on innovation, product development, and strategic acquisitions to expand their market presence. For instance, Becton Dickinson & Co. offers a wide range of vascular access devices, including advanced central venous catheters and peripheral intravenous catheters, while Teleflex is known for its vascular access solutions, such as PICC lines and hemodialysis catheters. Medtronic, on the other hand, is expanding its footprint in the vascular access segment by developing new devices to enhance patient outcomes and minimize infection risks. With the growing need for reliable and safe vascular access devices, the competition among these leading players is expected to intensify, further driving market innovation

Recent Developments:

- Teleflex Incorporated launched an advanced catheter product designed to improve patient comfort during dialysis procedures.

- Medtronic received FDA approval for a new line of vascular access devices aimed at reducing infection rates in central venous access.

- Becton Dickinson & Co. acquired a leading manufacturer of intravenous catheters to expand its portfolio in the vascular access segment.

- Cook Medical announced the launch of a next-generation PICC catheter for long-term drug delivery, offering enhanced durability and ease of use.

- Fresenius Medical Care entered a strategic partnership with a home healthcare provider to expand access to dialysis treatment at home, leveraging its vascular access devices.

List of Leading Companies:

- Becton Dickinson & Co.

- Teleflex Incorporated

- C.R. Bard, Inc. (BD)

- Smiths Medical

- Braun Melsungen AG

- Cook Medical

- Medtronic plc

- Terumo Corporation

- Edwards Lifesciences Corporation

- Fresenius Medical Care AG & Co. KGaA

- Johnson & Johnson

- Nipro Corporation

- Argon Medical Devices, Inc.

- Merit Medical Systems, Inc.

- ConvaTec Group Plc

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.8 Billion |

|

Forecasted Value (2030) |

USD 8.2 Billion |

|

CAGR (2025 – 2030) |

8.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Vascular Access Devices Market by Product Type (Central Venous Catheters, Peripherally Inserted Central Catheters, Dialysis Catheters, Implantable Ports, Peripheral Intravenous Catheters), End-User Industry (Hospitals, Ambulatory Surgical Centers, Clinics, Home Healthcare), Application (Oncology, Dialysis, Parenteral Nutrition, Drug Administration, Blood Sampling), Material Type (Polyurethane, Silicone, PVC) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Becton Dickinson & Co., Teleflex Incorporated, C.R. Bard, Inc. (BD), Smiths Medical, Braun Melsungen AG, Cook Medical, Medtronic plc, Terumo Corporation, Edwards Lifesciences Corporation, Fresenius Medical Care AG & Co. KGaA, Johnson & Johnson, Nipro Corporation, Argon Medical Devices, Inc., Merit Medical Systems, Inc., ConvaTec Group Plc |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Vascular Access Devices Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Central Venous Catheters (CVC) |

|

4.2. Peripherally Inserted Central Catheters (PICC) |

|

4.3. Dialysis Catheters |

|

4.4. Implantable Ports |

|

4.5. Peripheral Intravenous Catheters (PIVC) |

|

4.6. Others |

|

5. Vascular Access Devices Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Hospitals |

|

5.2. Ambulatory Surgical Centers (ASCs) |

|

5.3. Clinics |

|

5.4. Home Healthcare |

|

5.5. Others |

|

6. Vascular Access Devices Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Oncology |

|

6.2. Dialysis |

|

6.3. Parenteral Nutrition |

|

6.4. Drug Administration |

|

6.5. Blood Sampling |

|

6.6. Others |

|

7. Vascular Access Devices Market, by Material Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Polyurethane |

|

7.2. Silicone |

|

7.3. PVC |

|

7.4. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Vascular Access Devices Market, by Product Type |

|

8.2.7. North America Vascular Access Devices Market, by End-User Industry |

|

8.2.8. North America Vascular Access Devices Market, by Application |

|

8.2.9. North America Vascular Access Devices Market, by Material Type |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Vascular Access Devices Market, by Product Type |

|

8.2.10.1.2. US Vascular Access Devices Market, by End-User Industry |

|

8.2.10.1.3. US Vascular Access Devices Market, by Application |

|

8.2.10.1.4. US Vascular Access Devices Market, by Material Type |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Becton Dickinson & Co. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Teleflex Incorporated |

|

10.3. C.R. Bard, Inc. (BD) |

|

10.4. Smiths Medical |

|

10.5. Braun Melsungen AG |

|

10.6. Cook Medical |

|

10.7. Medtronic plc |

|

10.8. Terumo Corporation |

|

10.9. Edwards Lifesciences Corporation |

|

10.10. Fresenius Medical Care AG & Co. KGaA |

|

10.11. Johnson & Johnson |

|

10.12. Nipro Corporation |

|

10.13. Argon Medical Devices, Inc. |

|

10.14. Merit Medical Systems, Inc. |

|

10.15. ConvaTec Group Plc |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Vascular Access Devices Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Vascular Access Devices Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Vascular Access Devices Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA