As per Intent Market Research, the Variable Data Printing Labels Market was valued at USD 11.5 billion in 2024-e and will surpass USD 17.9 billion by 2030; growing at a CAGR of 6.5% during 2025 - 2030.

The variable data printing (VDP) labels market has witnessed rapid growth as businesses increasingly demand customized and efficient labeling solutions. Variable data printing enables the creation of unique labels, each with different information, including text, images, and barcodes, all from the same printing press. This ability to personalize labels on demand is transforming packaging and labeling industries, especially in sectors where product differentiation is key. The market is driven by advancements in printing technologies such as inkjet, laser, and thermal transfer printing, alongside growing demand for automation and digital solutions. These factors collectively fuel the adoption of variable data printing labels across several industries.

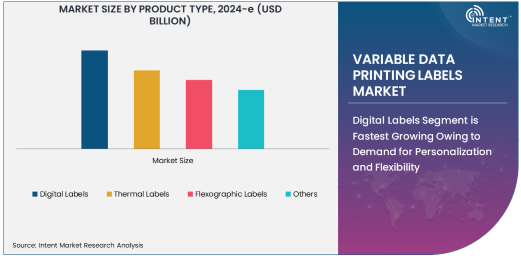

Digital Labels Segment is Fastest Growing Owing to Demand for Personalization and Flexibility

The digital labels segment has emerged as the fastest-growing subsegment within the variable data printing labels market. Digital printing offers significant advantages over traditional methods, including the ability to print customized, on-demand labels with varying data without the need for plates or extensive setup. This is particularly valuable in industries where short print runs and frequent label changes are needed. The increasing demand for personalized products in consumer goods and the expansion of e-commerce platforms are major contributors to the growth of digital labels. Companies are also focusing on digital printing technologies to improve efficiency, reduce waste, and offer greater flexibility in label design.

As consumers continue to seek personalized and unique product packaging, businesses are increasingly turning to digital label printing to meet these needs. Additionally, digital printing technologies offer faster turnaround times and lower production costs, which makes them ideal for small to medium-sized businesses aiming to stay competitive. The widespread adoption of digital labels is anticipated to accelerate further due to continuous innovations in printing technology, which promise even more versatile applications and higher-quality outputs.

Consumer Goods Segment is Largest Owing to High Demand for Label Customization

Among the various applications of variable data printing labels, the consumer goods segment holds the largest share. This is primarily driven by the growing consumer preference for customized products and packaging. Brands in the consumer goods sector are leveraging variable data printing to create personalized labels that reflect brand identity and cater to consumer demands for unique, attractive packaging. Additionally, the rise of product personalization in areas such as beverages, cosmetics, and household goods has significantly boosted the adoption of variable data printing labels in this sector.

Consumer goods companies use these labels for product identification, marketing, and enhancing the consumer experience. With the rise of online shopping and direct-to-consumer sales channels, personalized labels are becoming essential for improving customer engagement and boosting sales. As the trend for product personalization continues to grow, the demand for variable data printing labels in the consumer goods industry is expected to maintain its dominance in the global market.

Packaging Segment is Largest End-User Industry Due to Widespread Use in Product Identification

The packaging industry is the largest end-user of variable data printing labels, as these labels are widely used for product identification, branding, and regulatory compliance. The rapid growth of e-commerce and retail packaging demands high-quality, customizable, and efficient labeling solutions, which variable data printing readily provides. These labels are often used to convey important information such as barcodes, expiry dates, batch numbers, and ingredients, which are critical for product traceability and safety. Additionally, the ability to quickly change designs or update product information with digital printing has become an essential factor for companies in the packaging industry.

As packaging needs continue to evolve with increasing environmental concerns, there is also a significant focus on sustainable labeling solutions. The packaging industry is responding by adopting eco-friendly materials and processes in conjunction with variable data printing technologies to reduce waste and improve efficiency. The growth of the packaging sector, especially in consumer goods and e-commerce, will likely continue to drive demand for variable data printing labels.

Inkjet Printing Technology is Fastest Growing Technology Due to Versatility and Speed

Inkjet printing has emerged as the fastest-growing printing technology in the variable data printing labels market. Inkjet printers are widely favored for their ability to produce high-quality, detailed prints on a variety of substrates with minimal setup time. This technology is particularly valuable in industries where flexibility, speed, and the ability to print on-demand are crucial. Inkjet printing offers the advantage of high resolution, vibrant color reproduction, and compatibility with a wide range of materials, which makes it ideal for use in applications such as consumer goods, food and beverages, and pharmaceuticals.

Inkjet printers are increasingly being used to produce variable data on labels because they provide fast and cost-effective solutions for small batch runs, making them highly suitable for industries where product labeling needs to be frequently updated. The rising demand for high-quality printed labels and the benefits of inkjet technology, such as reduced operational costs and faster production times, will contribute to the growing popularity of this technology in the global variable data printing labels market.

Asia Pacific is the Fastest Growing Region Owing to Strong Demand in Manufacturing and Retail

Asia Pacific has become the fastest-growing region in the variable data printing labels market, driven by the rapid expansion of manufacturing and retail sectors in countries like China, India, and Japan. The region's growing middle class, combined with an increasing preference for branded and customized products, has led to a rise in demand for variable data printing labels. Additionally, the growth of e-commerce platforms in the region has further accelerated the need for efficient and flexible labeling solutions. The expanding manufacturing base in Asia Pacific also means an increased requirement for packaging and labeling solutions that ensure product differentiation and regulatory compliance.

In particular, countries like China and India are witnessing a rise in consumer spending, which has significantly boosted the demand for customized labeling in packaging. The growth of the pharmaceutical and food and beverage industries in Asia Pacific also drives the need for high-quality variable data printing labels. As a result, the region is expected to maintain its position as the fastest-growing market for variable data printing labels in the coming years.

Competitive Landscape and Leading Companies

The variable data printing labels market is highly competitive, with key players striving to enhance their product offerings through technological innovations and strategic acquisitions. Leading companies such as HP Inc., Avery Dennison Corporation, and Xerox Corporation are at the forefront of this market, constantly innovating to offer new, efficient, and cost-effective printing solutions. These companies are focused on providing high-quality variable data printing labels across various industries, with a strong emphasis on sustainability and efficiency.

The competitive landscape is characterized by the introduction of advanced printing technologies such as inkjet and digital printing, which have become increasingly popular due to their speed, versatility, and customization options. Additionally, companies are also focusing on partnerships and mergers to expand their market presence and improve their technological capabilities. The continued innovation in digital printing technologies and the expansion of manufacturing facilities in emerging markets will likely drive further competition and growth in the variable data printing labels market.

Recent Developments:

- Philips launched its newest portable vaporizer designed for medical cannabis patients, featuring enhanced temperature control and better efficiency for a smoother vaping experience.

- PAX Labs entered a partnership with a leading cannabis producer to co-develop a new line of cannabis vaporizers optimized for medicinal cannabis use.

- Storz & Bickel GmbH released a new vaporizer model, the "Crafty+", which improves upon its previous design with faster heat-up times and an improved battery life.

- Arizer expanded its product range by releasing a new vaporizer series aimed at the food and beverage industry, designed to extract essential oils for culinary applications.

- Grenco Science completed a major acquisition of a vape accessory brand, enhancing its product lineup and expanding its footprint in the global vaporizer market.

List of Leading Companies:

- Philips

- Storz & Bickel GmbH & Co. KG

- Vaporesso

- Da Vinci Vaporizers

- Firefly Vapor

- PAX Labs, Inc.

- Arizer

- Grenco Science

- KandyPens

- The Kind Pen

- Wulf Mods

- Cloudious9

- Linx Vapor

- Mig Vapor

- Haze Technologies

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 11.5 Billion |

|

Forecasted Value (2030) |

USD 17.9 Billion |

|

CAGR (2025 – 2030) |

6.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Variable Data Printing Labels Market By Product Type (Digital Labels, Thermal Labels, Flexographic Labels), By Application (Consumer Goods, Food & Beverages, Pharmaceuticals, Industrial Products, Retail & Apparel), By End-User Industry (Packaging, Healthcare, Food & Beverages, Pharmaceuticals, Consumer Electronics, Automotive), and By Printing Technology (Inkjet Printing, Laser Printing, Thermal Transfer Printing, Flexographic Printing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

HP Inc., Xerox Corporation, Sato Holdings Corporation, Avery Dennison Corporation, Zebra Technologies, Canon Solutions America, Inc., Durable, Printronix, Konica Minolta, Inc., Epson America, Inc., Brother Industries, Markem-Imaje, TSC Auto ID Technology Co., Ltd., NiceLabel, Fujifilm Holdings Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Variable Data Printing Labels Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Digital Labels |

|

4.2. Thermal Labels |

|

4.3. Flexographic Labels |

|

4.4. Others |

|

5. Variable Data Printing Labels Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Consumer Goods |

|

5.2. Food & Beverages |

|

5.3. Pharmaceuticals |

|

5.4. Industrial Products |

|

5.5. Retail & Apparel |

|

5.6. Others |

|

6. Variable Data Printing Labels Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Packaging |

|

6.2. Healthcare |

|

6.3. Food & Beverages |

|

6.4. Pharmaceuticals |

|

6.5. Consumer Electronics |

|

6.6. Automotive |

|

6.7. Others |

|

7. Variable Data Printing Labels Market, by Printing Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Inkjet Printing |

|

7.2. Laser Printing |

|

7.3. Thermal Transfer Printing |

|

7.4. Flexographic Printing |

|

7.5. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Variable Data Printing Labels Market, by Product Type |

|

8.2.7. North America Variable Data Printing Labels Market, by Application |

|

8.2.8. North America Variable Data Printing Labels Market, by End-User Industry |

|

8.2.9. North America Variable Data Printing Labels Market, by Printing Technology |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Variable Data Printing Labels Market, by Product Type |

|

8.2.10.1.2. US Variable Data Printing Labels Market, by Application |

|

8.2.10.1.3. US Variable Data Printing Labels Market, by End-User Industry |

|

8.2.10.1.4. US Variable Data Printing Labels Market, by Printing Technology |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. HP Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Xerox Corporation |

|

10.3. Sato Holdings Corporation |

|

10.4. Avery Dennison Corporation |

|

10.5. Zebra Technologies |

|

10.6. Canon Solutions America, Inc. |

|

10.7. Durable |

|

10.8. Printronix |

|

10.9. Konica Minolta, Inc. |

|

10.10. Epson America, Inc. |

|

10.11. Brother Industries |

|

10.12. Markem-Imaje |

|

10.13. TSC Auto ID Technology Co., Ltd. |

|

10.14. NiceLabel |

|

10.15. Fujifilm Holdings Corporation |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Variable Data Printing Labels Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Variable Data Printing Labels Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Variable Data Printing Labels Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA