As per Intent Market Research, the Vacuum Packaging Market was valued at USD 29.7 billion in 2024-e and will surpass USD 47.9 billion by 2030; growing at a CAGR of 7.1% during 2025 - 2030.

The vacuum packaging market is a vital segment in the global packaging industry, driven by the need for longer shelf life and protection of goods from external environmental factors. Vacuum packaging involves removing air from the package to prevent the growth of microorganisms, reduce oxidation, and preserve the product's integrity. This technology is widely utilized in sectors such as food, pharmaceuticals, and electronics. The growing demand for convenience, coupled with rising consumer preferences for fresh and long-lasting products, has led to the rapid expansion of this market. Technological advancements, including smarter vacuum sealing solutions and eco-friendly materials, are further fueling this growth.

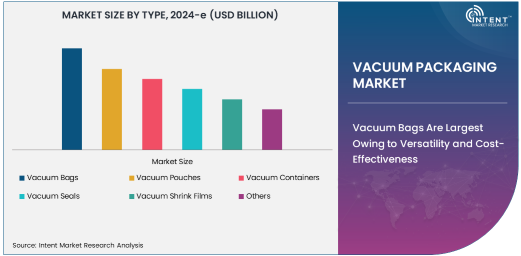

Vacuum Bags Are Largest Owing to Versatility and Cost-Effectiveness

Vacuum bags are the largest subsegment in the vacuum packaging market. These bags are widely used in food packaging, medical, and industrial applications due to their simplicity, cost-effectiveness, and high functionality. The flexibility of vacuum bags allows for easy storage and transportation of a wide range of products, making them the preferred packaging solution across industries. Vacuum bags provide an airtight seal that prevents spoilage and extends product shelf life by limiting exposure to oxygen, moisture, and contaminants.

The food packaging industry, in particular, accounts for the highest demand for vacuum bags due to the increasing need for extended freshness in meat, dairy, and other perishable items. The continuous growth of the global food trade has further driven the adoption of vacuum bags, making them an essential packaging component. Furthermore, the increased awareness of sustainability is prompting the development of eco-friendly vacuum bags, boosting market demand even further.

Plastic Material Is Largest Due to Durability and Cost-Effectiveness

Plastic continues to dominate the material segment in the vacuum packaging market, largely due to its excellent durability, cost-effectiveness, and versatile properties. Plastic materials such as polyethylene (PE) and polypropylene (PP) are commonly used in vacuum bags, pouches, and films, offering superior protection against moisture and contamination. Additionally, plastic materials are lightweight, flexible, and easy to mold, which makes them ideal for large-scale commercial applications.

Plastic is also favored for its ability to create strong seals that prevent leaks, making it an indispensable material in the food and pharmaceutical sectors. The low manufacturing cost of plastic products combined with their ability to preserve the freshness of products has made it a top choice in the packaging industry. The material’s capacity to offer multiple barrier layers and customization for various applications further enhances its demand.

Food Packaging Is Fastest Growing Due to Health and Safety Trends

The food packaging application is growing at the fastest rate in the vacuum packaging market, driven by rising consumer demand for healthier, fresher, and longer-lasting food products. As food safety and quality become more critical to consumers, vacuum packaging plays a crucial role in reducing food waste, maintaining the taste and texture of perishable goods, and preventing contamination. Vacuum sealing food products, such as meat, seafood, fruits, and vegetables, has become a standard practice, particularly as the demand for convenience food increases.

The increasing preference for ready-to-eat, frozen, and packaged foods is also contributing to the market's expansion. Vacuum packaging in food helps to preserve nutrients, prolong shelf life, and maintain the appearance and flavor of the product. The growing adoption of sustainable packaging practices in the food industry is also driving innovation in vacuum packaging technologies, as more companies focus on using recyclable plastic and biodegradable materials.

Food & Beverage Industry Is Largest End-User Due to Growing Packaging Demand

The food and beverage industry is the largest end-user segment in the vacuum packaging market. With an ever-expanding global population and increasing urbanization, the demand for packaged food products has surged, making food packaging a critical component of the supply chain. Vacuum packaging helps to keep food fresh, retain nutritional value, and extend shelf life, which is vital for the food and beverage sector. The industry’s growth is also being fueled by the increased demand for frozen foods, snacks, and ready-to-eat meals.

Moreover, food safety regulations in developed regions are becoming stricter, prompting manufacturers to adopt vacuum packaging solutions to comply with these standards. The ability of vacuum packaging to reduce food spoilage, prevent bacterial growth, and ensure safe transportation has made it indispensable in food packaging. With the rapid growth of the convenience food sector, the food and beverage industry will continue to drive the demand for vacuum packaging solutions.

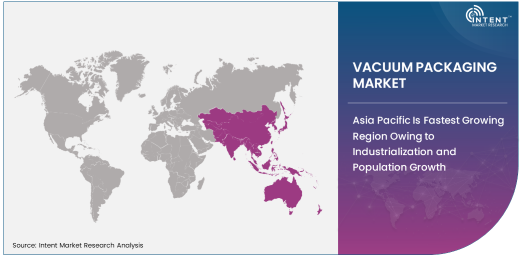

Asia Pacific Is Fastest Growing Region Owing to Industrialization and Population Growth

The Asia Pacific region is the fastest growing market for vacuum packaging, owing to the rapid industrialization, population growth, and expanding food and beverage sector in countries such as China, India, and Japan. As consumer demand for packaged food, especially in urban areas, continues to rise, vacuum packaging solutions have become essential for preserving the quality and freshness of products. Additionally, the rising disposable income and the increasing popularity of convenience foods in this region are contributing to the market's growth.

The pharmaceutical and electronics sectors in Asia Pacific are also expanding, further increasing the need for vacuum packaging. Moreover, the region's growing focus on sustainable packaging and the implementation of stricter food safety regulations are driving the demand for vacuum packaging solutions. With key manufacturers expanding their presence in the region and innovations in packaging materials, Asia Pacific is expected to remain a significant player in the global vacuum packaging market.

Competitive Landscape: Leading Companies and Market Dynamics

The vacuum packaging market is competitive, with several large players such as Sealed Air Corporation, Multivac Inc., Amcor Limited, and Berry Global Inc. leading the way in innovation and market share. These companies have a strong presence in various end-user industries, including food & beverage, pharmaceuticals, and electronics, and continue to introduce new products and technologies to meet growing consumer demands. Strategic mergers, acquisitions, and partnerships are common as companies aim to expand their product portfolios and regional presence.

The market is also witnessing a shift towards sustainable and eco-friendly vacuum packaging solutions, with many companies focusing on biodegradable and recyclable materials. The emphasis on reducing plastic waste and improving packaging efficiency is encouraging further innovation in the sector. Overall, the competitive landscape is shaped by the need for continuous product development, cost-effectiveness, and the ability to meet consumer demands for longer product shelf life and environmentally friendly solutions.

Recent Developments:

- Sealed Air Corporation announced the launch of a new vacuum-sealing machine designed to improve product freshness while reducing plastic usage by 20%.

- Amcor Limited introduced a new vacuum pouch material that enhances product shelf life and is fully recyclable, catering to the growing demand for sustainable packaging solutions.

- Multivac Inc. expanded its production line with advanced vacuum packaging equipment that uses AI for automated sealing, improving operational efficiency in food processing plants.

- FlexPak, Inc. acquired a leading European vacuum packaging company, allowing the company to strengthen its market position and diversify its product offerings across different industries.

- Winpak Ltd. received FDA approval for a new vacuum packaging solution designed for pharmaceutical applications, offering enhanced protection for sensitive medical products during transport.

List of Leading Companies:

- Sealed Air Corporation

- Multivac Inc.

- ULMA Packaging

- Amcor Limited

- Berry Global Inc.

- Mitsubishi Chemical Corporation

- Koch Industries, Inc.

- Fres-co System USA, Inc.

- Winpak Ltd.

- VacPak-It

- FlexPak, Inc.

- Coveris

- Interpack

- Johnson & Johnson Packaging Solutions

- Pactiv Evergreen

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 29.7 Billion |

|

Forecasted Value (2030) |

USD 47.9 Billion |

|

CAGR (2025 – 2030) |

7.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Vacuum Packaging Market By Product Type (Vacuum Bags, Vacuum Pouches, Vacuum Containers, Vacuum Seals, Vacuum Shrink Films), By Material (Plastic, Paper, Aluminum), By Application (Food Packaging, Pharmaceutical Packaging, Electronics Packaging, Industrial Packaging), By End-User Industry (Food & Beverage, Pharmaceuticals, Electronics, Healthcare, Retail, Automotive, Consumer Goods) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Sealed Air Corporation, Multivac Inc., ULMA Packaging, Amcor Limited, Berry Global Inc., Mitsubishi Chemical Corporation, Koch Industries, Inc., Fres-co System USA, Inc., Winpak Ltd., VacPak-It, FlexPak, Inc., Coveris, Interpack, Johnson & Johnson Packaging Solutions, Pactiv Evergreen |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Vacuum Packaging Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Vacuum Bags |

|

4.2. Vacuum Pouches |

|

4.3. Vacuum Containers |

|

4.4. Vacuum Seals |

|

4.5. Vacuum Shrink Films |

|

4.6. Others |

|

5. Vacuum Packaging Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Plastic |

|

5.2. Paper |

|

5.3. Aluminum |

|

5.4. Others |

|

6. Vacuum Packaging Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Food Packaging |

|

6.2. Pharmaceutical Packaging |

|

6.3. Electronics Packaging |

|

6.4. Industrial Packaging |

|

6.5. Others |

|

7. Vacuum Packaging Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Food & Beverage |

|

7.2. Pharmaceuticals |

|

7.3. Electronics |

|

7.4. Healthcare |

|

7.5. Retail |

|

7.6. Automotive |

|

7.7. Consumer Goods |

|

7.8. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Vacuum Packaging Market, by Type |

|

8.2.7. North America Vacuum Packaging Market, by Material |

|

8.2.8. North America Vacuum Packaging Market, by Application |

|

8.2.9. North America Vacuum Packaging Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Vacuum Packaging Market, by Type |

|

8.2.10.1.2. US Vacuum Packaging Market, by Material |

|

8.2.10.1.3. US Vacuum Packaging Market, by Application |

|

8.2.10.1.4. US Vacuum Packaging Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Sealed Air Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Multivac Inc. |

|

10.3. ULMA Packaging |

|

10.4. Amcor Limited |

|

10.5. Berry Global Inc. |

|

10.6. Mitsubishi Chemical Corporation |

|

10.7. Koch Industries, Inc. |

|

10.8. Fres-co System USA, Inc. |

|

10.9. Winpak Ltd. |

|

10.10. VacPak-It |

|

10.11. FlexPak, Inc. |

|

10.12. Coveris |

|

10.13. Interpack |

|

10.14. Johnson & Johnson Packaging Solutions |

|

10.15. Pactiv Evergreen |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Vacuum Packaging Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Vacuum Packaging Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Vacuum Packaging Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA