As per Intent Market Research, the Uveitis Treatment Market was valued at USD 0.6 billion in 2024-e and will surpass USD 1.1 billion by 2030; growing at a CAGR of 8.3% during 2025 - 2030.

The global uveitis treatment market is seeing significant growth, driven by rising awareness of eye health and the increasing prevalence of uveitis, an inflammatory condition affecting the middle layer of the eye. As an autoimmune or infectious condition, uveitis can lead to complications like glaucoma, cataracts, and even permanent vision loss if left untreated. The market for uveitis treatment includes a range of therapies, from corticosteroids to biologics, aimed at reducing inflammation and preventing further damage. The advancement in therapeutic options, including biologics and immunosuppressive drugs, has led to better management of uveitis, expanding market potential in various regions.

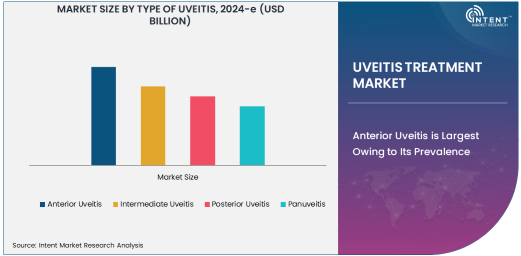

Anterior Uveitis is Largest Owing to Its Prevalence

Among the different types of uveitis, anterior uveitis holds the largest share of the market, primarily due to its higher incidence rate. Anterior uveitis, which affects the front part of the eye, is the most commonly diagnosed type of uveitis. This form of uveitis is more frequently seen in patients with autoimmune diseases such as rheumatoid arthritis or ankylosing spondylitis. The ease of diagnosing anterior uveitis, with symptoms such as eye redness, pain, and blurred vision, has contributed to the wide treatment options available, which further fuels its dominant position in the market.

The treatment landscape for anterior uveitis primarily involves corticosteroids, which are the mainstay therapy due to their ability to rapidly reduce inflammation. The effectiveness of corticosteroids and the frequent occurrence of anterior uveitis lead to a continuous demand for these medications, bolstering the market growth for this subsegment.

Biologics is Fastest Growing Treatment Type

Among various treatment types, biologics are the fastest-growing segment in the uveitis treatment market. Biologics are increasingly being recognized as highly effective for treating both anterior and posterior uveitis, particularly for patients who do not respond well to corticosteroids or other conventional therapies. These treatments target specific components of the immune system to reduce inflammation, offering a more precise approach to managing the disease.

The use of biologics has seen a surge due to their ability to minimize side effects and provide long-term management of uveitis. Key biologic drugs such as adalimumab and infliximab have gained approval for use in treating uveitis, making them a popular choice for clinicians. As the adoption of biologics increases, driven by the push for more effective and personalized treatments, this segment is poised for robust growth in the coming years.

Hospitals Dominate as Leading End-User

In terms of end-users, hospitals constitute the largest share of the uveitis treatment market. Hospitals are central hubs for diagnosing and treating uveitis, as they offer a wide range of diagnostic tools, therapeutic options, and multidisciplinary care. Given the severity of uveitis and its potential to lead to permanent vision loss, patients often seek treatment in hospital settings where specialized care is available.

Hospitals have also become the preferred choice for uveitis treatment due to the comprehensive range of services they provide, including access to advanced biologics, immunosuppressive therapies, and specialized ophthalmologists. The increasing number of hospital-based ophthalmology departments, along with advancements in hospital infrastructure for treating complex diseases, continues to fuel the demand for uveitis treatments within this segment.

North America Leads in Uveitis Treatment Market

North America is currently the largest region for the uveitis treatment market, driven by factors such as high healthcare spending, strong healthcare infrastructure, and increased awareness of eye diseases. The United States, in particular, is a key player in the market due to the prevalence of autoimmune diseases, which are often linked to uveitis. Moreover, North America benefits from advanced medical research, allowing for the rapid adoption of new treatments, including biologics and immunosuppressive drugs, which have significantly improved patient outcomes.

The region also boasts a strong pharmaceutical sector, with several companies conducting clinical trials for new therapies to treat uveitis. This has enabled North America to maintain a leadership position in both the development and availability of innovative uveitis treatments.

Competitive Landscape and Leading Companies

The uveitis treatment market is highly competitive, with several global pharmaceutical companies investing heavily in research and development to improve treatment options. Leading players such as Novartis, AbbVie, and Roche are at the forefront of developing biologic therapies and corticosteroid-based treatments. Additionally, pharmaceutical companies are exploring combination therapies to provide more effective management of uveitis.

The market is characterized by a mix of large multinational companies and specialized biotechnology firms. With the rising demand for biologics and advanced treatment options, competition is expected to intensify. Companies are increasingly focusing on partnerships, mergers, and acquisitions to expand their portfolios and accelerate the development of innovative therapies. As the market continues to evolve, these companies will play a critical role in shaping the future of uveitis treatment.

Recent Developments:

- Novartis received FDA approval for its latest biologic, a treatment for posterior uveitis, offering an innovative approach for managing chronic inflammation in the eye.

- AbbVie Inc. announced the completion of its acquisition of a uveitis treatment-focused biopharma company, expanding its pipeline for ocular diseases.

- Regeneron Pharmaceuticals launched a new clinical trial for its investigational biologic aimed at treating both anterior and intermediate uveitis, targeting more effective long-term results.

- Santen Pharmaceutical launched a new corticosteroid-based drug for managing uveitis flare-ups, addressing unmet needs in the treatment of ocular inflammation.

- Bristol-Myers Squibb reported a breakthrough in research for a new treatment option that combines biologic therapy and immunosuppressants for managing severe uveitis cases.

List of Leading Companies:

- Novartis International AG

- Johnson & Johnson

- Roche Holding AG

- AbbVie Inc.

- Bayer AG

- Regeneron Pharmaceuticals, Inc.

- Amgen Inc.

- GlaxoSmithKline PLC

- Bristol-Myers Squibb

- Sanofi S.A.

- Eli Lilly and Co.

- Santen Pharmaceutical Co., Ltd.

- UCB Pharma

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.6 Billion |

|

Forecasted Value (2030) |

USD 1.1 Billion |

|

CAGR (2025 – 2030) |

8.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Uveitis Treatment Market By Type (Anterior Uveitis, Intermediate Uveitis, Posterior Uveitis, Panuveitis), By Treatment Type (Corticosteroids, Immunosuppressive Drugs, Biologics, NSAIDs, DMARDs), By End-User (Hospitals, Ophthalmology Clinics, Ambulatory Surgical Centers, Homecare Settings, Research Institutes) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Novartis International AG, Johnson & Johnson, Roche Holding AG, AbbVie Inc., Bayer AG, Regeneron Pharmaceuticals, Inc., Amgen Inc., GlaxoSmithKline PLC, Bristol-Myers Squibb, Sanofi S.A., Eli Lilly and Co., Santen Pharmaceutical Co., Ltd., UCB Pharma, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Uveitis Treatment Market, by Type of Uveitis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Anterior Uveitis |

|

4.2. Intermediate Uveitis |

|

4.3. Posterior Uveitis |

|

4.4. Panuveitis |

|

5. Uveitis Treatment Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Corticosteroids |

|

5.2. Immunosuppressive Drugs |

|

5.3. Biologics |

|

5.4. Non-Steroidal Anti-Inflammatory Drugs (NSAIDs) |

|

5.5. Disease-Modifying Antirheumatic Drugs (DMARDs) |

|

5.6. Other Treatment Types |

|

6. Uveitis Treatment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Ophthalmology Clinics |

|

6.3. Ambulatory Surgical Centers |

|

6.4. Homecare Settings |

|

6.5. Research Institutes |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Uveitis Treatment Market, by Type of Uveitis |

|

7.2.7. North America Uveitis Treatment Market, by Treatment Type |

|

7.2.8. North America Uveitis Treatment Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Uveitis Treatment Market, by Type of Uveitis |

|

7.2.9.1.2. US Uveitis Treatment Market, by Treatment Type |

|

7.2.9.1.3. US Uveitis Treatment Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Novartis International AG |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Johnson & Johnson |

|

9.3. Roche Holding AG |

|

9.4. AbbVie Inc. |

|

9.5. Bayer AG |

|

9.6. Regeneron Pharmaceuticals, Inc. |

|

9.7. Amgen Inc. |

|

9.8. GlaxoSmithKline PLC |

|

9.9. Bristol-Myers Squibb |

|

9.10. Sanofi S.A. |

|

9.11. Eli Lilly and Co. |

|

9.12. Santen Pharmaceutical Co., Ltd. |

|

9.13. UCB Pharma |

|

9.14. Takeda Pharmaceutical Company Limited |

|

9.15. Boehringer Ingelheim International |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Uveitis Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Uveitis Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Uveitis Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA