As per Intent Market Research, the UV Air Purifier Market was valued at USD 1.4 billion in 2024-e and will surpass USD 4.5 billion by 2030; growing at a CAGR of 18.4% during 2025 - 2030.

The UV air purifier market has witnessed significant growth due to the increasing awareness of air pollution and its adverse effects on human health. As environmental concerns rise and the demand for improved indoor air quality grows, UV air purifiers have emerged as an effective solution for eliminating harmful microorganisms and purifying the air. These purifiers use ultraviolet (UV) light to destroy bacteria, viruses, mold, and other pathogens, making them particularly valuable in residential, commercial, and healthcare environments. As the market matures, different segments are showing promising growth, driven by innovations in technology and a broad range of applications.

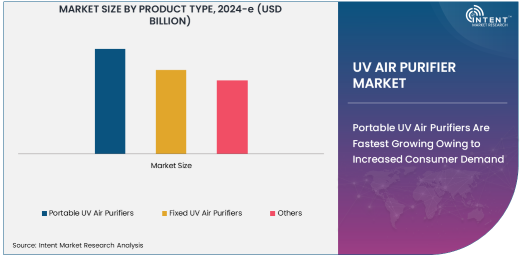

Portable UV Air Purifiers Are Fastest Growing Owing to Increased Consumer Demand

Portable UV air purifiers have emerged as one of the fastest-growing subsegments within the product type category. The demand for portable solutions has surged, especially with consumers looking for flexible air purification options that can be moved from room to room or used in vehicles and personal spaces. These compact devices cater to individuals who are increasingly concerned about indoor air quality, especially in small apartments, offices, and even cars. Their ease of use, lightweight design, and affordability have contributed to their rapid adoption.

The portability factor is driving their growth in both residential and commercial applications. Furthermore, the rise in air pollution levels in urban areas, as well as the ongoing concerns related to airborne diseases like COVID-19, has bolstered the need for portable UV air purifiers. The ability to provide immediate and effective air purification in a variety of settings, including homes, offices, and even public spaces, positions portable UV air purifiers as a significant part of the broader market expansion.

UV-C Technology Is Largest Owing to its Proven Efficacy in Sterilization

In the UV air purifier market, UV-C technology remains the dominant subsegment owing to its proven efficacy in sterilizing air and surfaces. UV-C light, with its germicidal properties, is capable of inactivating a wide range of pathogens, including bacteria, viruses, and molds. Its effectiveness in disinfection has led to its widespread application across various industries, particularly in healthcare and residential settings. The ability of UV-C technology to offer a chemical-free method of purification is a key factor in its growing adoption, especially as consumers and businesses seek sustainable and safe air purification solutions.

UV-C technology is used extensively in both portable and fixed air purifiers, providing consumers with an efficient and reliable method for improving air quality. This technology’s versatility and ability to work in various environmental conditions make it a favorite choice among manufacturers. As public health concerns related to airborne diseases continue to rise, UV-C technology’s importance in ensuring clean, safe air remains unparalleled.

Residential Sector Is Largest End-User Owing to Rising Health Concerns

The residential sector is the largest end-user in the UV air purifier market. As more people become aware of the importance of indoor air quality, particularly in light of the COVID-19 pandemic, residential applications have surged. UV air purifiers provide homeowners with a reliable and cost-effective solution for reducing airborne pathogens, allergens, and pollutants, making them an essential part of modern homes. Additionally, the rise in asthma, allergies, and other respiratory issues has prompted increased adoption of UV air purifiers as part of home health improvement strategies.

With the growing concerns about air quality in urban areas and regions with high pollution levels, residential demand for air purifiers continues to increase. The integration of UV technology into home appliances is further driving this trend, as consumers look for ways to safeguard their health and create a cleaner living environment.

Online Retail Is Fastest Growing Distribution Channel Owing to Convenience

The online retail distribution channel has seen the fastest growth in the UV air purifier market, driven by the convenience of purchasing products online and the increasing reliance on e-commerce platforms. Online retail offers customers the ability to browse various UV air purifiers, compare prices, and access customer reviews, making it an attractive option for tech-savvy consumers. With online retailers like Amazon and specialized e-commerce platforms providing direct access to a wide variety of products, consumers can easily find UV air purifiers that match their needs and preferences.

Moreover, the growing trend of online shopping and the shift toward digital purchasing behaviors during the pandemic have further accelerated the demand for UV air purifiers through online channels. This trend is expected to continue as more consumers opt for the convenience and ease of online purchasing, driving the growth of this segment in the market.

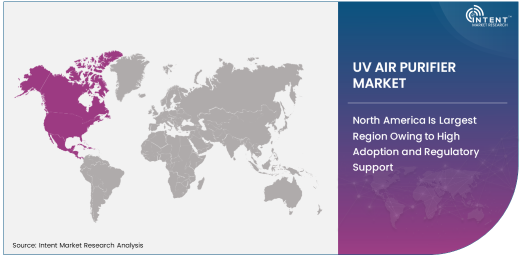

North America Is Largest Region Owing to High Adoption and Regulatory Support

North America stands as the largest region for the UV air purifier market, driven by high adoption rates in both residential and commercial sectors. The region’s strong healthcare infrastructure and increased awareness about air quality issues have positioned it as a leader in adopting air purification solutions. Governments and regulatory bodies in North America, including the U.S. Environmental Protection Agency (EPA), have introduced guidelines supporting air quality improvement, further boosting the demand for UV air purifiers.

In addition, the rise in urbanization, air pollution, and health-conscious consumers in cities like New York, Los Angeles, and Toronto has contributed to the increasing use of air purifiers, including UV-based models. The residential sector, especially, has seen a significant rise in air purifier adoption, with consumers prioritizing products that provide enhanced protection against airborne viruses and contaminants. This trend is expected to continue, making North America a dominant region in the global UV air purifier market.

Leading Companies and Competitive Landscape

The UV air purifier market is highly competitive, with numerous established companies offering advanced solutions to cater to the growing demand for clean air. Leading players in the market include Honeywell, Philips, Xiaomi, Daikin, and Sharp, among others. These companies continue to innovate and expand their product offerings, introducing both portable and fixed UV air purifiers with enhanced features like smart controls, energy efficiency, and quieter operation.

The competitive landscape is characterized by both large multinational corporations and smaller specialized manufacturers, each vying for market share through technological advancements, strategic partnerships, and competitive pricing. As the demand for UV air purifiers rises, companies are focusing on expanding their distribution networks, particularly through online channels, to capitalize on the growing trend of e-commerce. Furthermore, ongoing research and development are expected to drive product innovations, making the market dynamic and competitive.

Recent Developments:

- Philips launched an advanced range of UV-C air purifiers in early 2025, aiming to target both residential and commercial markets with improved efficiency.

- Honeywell announced a partnership with a leading healthcare provider to integrate UV-C technology into hospital air purification systems for enhanced infection control.

- Samsung Electronics expanded its UV air purifier product line, introducing models equipped with smart features like remote monitoring and control via mobile apps.

- Xiaomi entered the UV air purifier market with a new product targeting affordable residential use, leveraging its smart home ecosystem for seamless integration.

- Daikin Industries acquired a leading UV technology company, strengthening its position in the air purification market and expanding its portfolio for both commercial and residential consumers

List of Leading Companies:

- Honeywell International Inc.

- Philips Lighting Holding B.V.

- Xiaomi Corporation

- Sharp Corporation

- Panasonic Corporation

- Daikin Industries Ltd.

- 3M Company

- Coway Co. Ltd.

- Samsung Electronics Co., Ltd.

- LG Electronics Inc.

- Blueair AB

- Austin Air Systems, Ltd.

- Airgle Corporation

- Olansi Healthcare Co

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.4 Billion |

|

Forecasted Value (2030) |

USD 4.5 Billion |

|

CAGR (2025 – 2030) |

18.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

UV Air Purifier Market By Product Type (Portable UV Air Purifiers, Fixed UV Air Purifiers), By Technology (UV-C Technology, UV-A Technology, UV-B Technology, Hybrid Technology), By End-User Industry (Residential, Commercial, Healthcare, Industrial) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Honeywell International Inc., Philips Lighting Holding B.V., Xiaomi Corporation, Sharp Corporation, Panasonic Corporation, Daikin Industries Ltd., 3M Company, Coway Co. Ltd., Samsung Electronics Co., Ltd., LG Electronics Inc., Blueair AB, Austin Air Systems, Ltd., Airgle Corporation, Olansi Healthcare Co, |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. UV Air Purifier Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Portable UV Air Purifiers |

|

4.2. Fixed UV Air Purifiers |

|

4.3. Others |

|

5. UV Air Purifier Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. UV-C Technology |

|

5.2. UV-A Technology |

|

5.3. UV-B Technology |

|

5.4. Hybrid Technology |

|

6. UV Air Purifier Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Residential |

|

6.2. Commercial |

|

6.3. Healthcare |

|

6.4. Industrial |

|

6.5. Others |

|

7. UV Air Purifier Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Online Retail |

|

7.2. Offline Retail |

|

7.3. Direct Sales |

|

7.4. Distributors |

|

7.5. Specialty Stores |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America UV Air Purifier Market, by Product Type |

|

8.2.7. North America UV Air Purifier Market, by Technology |

|

8.2.8. North America UV Air Purifier Market, by End-User Industry |

|

8.2.9. North America UV Air Purifier Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US UV Air Purifier Market, by Product Type |

|

8.2.10.1.2. US UV Air Purifier Market, by Technology |

|

8.2.10.1.3. US UV Air Purifier Market, by End-User Industry |

|

8.2.10.1.4. US UV Air Purifier Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Honeywell International Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Philips Lighting Holding B.V. |

|

10.3. Xiaomi Corporation |

|

10.4. Sharp Corporation |

|

10.5. Panasonic Corporation |

|

10.6. Daikin Industries Ltd. |

|

10.7. 3M Company |

|

10.8. Coway Co. Ltd. |

|

10.9. Samsung Electronics Co., Ltd. |

|

10.10. LG Electronics Inc. |

|

10.11. Blueair AB |

|

10.12. Austin Air Systems, Ltd. |

|

10.13. Airgle Corporation |

|

10.14. Olansi Healthcare Co |

|

10.15. PPG Industries |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the UV Air Purifier Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the UV Air Purifier Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the UV Air Purifier Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA