UV Adhesives Market By Product Type (Single Component UV Adhesives, Two Component UV Adhesives, Light Cured UV Adhesives), By Application (Automotive, Electronics, Industrial Manufacturing, Medical Devices, Packaging, Consumer Goods), By End-User Industry (Automotive, Electronics, Healthcare & Medical, Packaging, Consumer Goods, Industrial), and By Distribution Channel (Direct Sales, Online Retail, Distributors, Specialty Stores, Wholesale Markets); Global Insights & Forecast (2023 – 2030)

As per Intent Market Research, the UV Adhesives Market was valued at USD 2.9 billion in 2024-e and will surpass USD 6.8 billion by 2030; growing at a CAGR of 13.1% during 2025 - 2030.

The UV adhesives market has witnessed significant growth in recent years, driven by their ability to deliver fast curing times, precise application, and strong bonds in various industries such as automotive, electronics, and medical devices. UV adhesives, which cure and bond when exposed to ultraviolet (UV) light, have gained popularity due to their excellent performance in demanding applications that require high-speed production and strong bonding. As industries increasingly seek efficient, eco-friendly, and high-performance adhesive solutions, the UV adhesives market is poised for continued expansion, with several product types, applications, and distribution channels catering to different end-user needs.

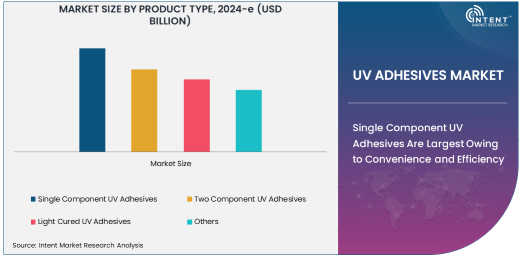

Single Component UV Adhesives Are Largest Owing to Convenience and Efficiency

Among the various product types of UV adhesives, single-component UV adhesives dominate the market due to their ease of use and reliability in diverse applications. These adhesives require no mixing, making them highly convenient for high-volume manufacturing environments. The simplicity of their application, combined with their fast curing times under UV light, ensures strong bonding for a wide range of materials, including plastics, metals, and glass. Single-component UV adhesives are primarily used in electronics, automotive, and medical devices, where efficient and consistent bonding is critical. This segment is the largest due to the substantial demand from industries looking for hassle-free adhesive solutions that provide quick turnaround times in production processes.

In addition, single-component UV adhesives contribute significantly to minimizing human error during the adhesive application process, ensuring uniformity in bonding quality across products. With ongoing advancements in UV adhesive formulations, this product segment continues to benefit from innovations that enhance curing speed, strength, and versatility, reinforcing its position as the largest and most preferred product type in the market.

Medical Devices Application Is Fastest Growing Owing to Advancements in Healthcare

The application of UV adhesives in medical devices is witnessing rapid growth, driven by increasing demand for precise, reliable, and safe bonding solutions in the healthcare sector. UV adhesives are especially valuable in medical device manufacturing due to their ability to bond delicate materials without the need for high heat or pressure, which is critical for maintaining the integrity of sensitive components. This makes them ideal for use in items such as syringes, diagnostic equipment, and implantable devices. Moreover, the trend towards minimally invasive medical devices that require lightweight, durable bonding further fuels the demand for UV adhesives in this application.

As the global healthcare industry continues to grow, with advancements in medical technology and rising healthcare needs, the demand for UV adhesives in medical devices is expected to accelerate. These adhesives provide exceptional benefits, including sterilization compatibility, precise control over curing times, and resistance to chemicals and temperature fluctuations—features essential for medical applications. With stringent regulatory requirements driving the need for high-quality adhesives, this application segment is positioned to expand rapidly in the coming years.

Automotive End-User Industry Is Largest Due to the Growing Demand for Lightweight, Durable Materials

The automotive industry is the largest end-user of UV adhesives, primarily due to the ongoing trend towards lightweight, durable materials that require efficient bonding solutions. UV adhesives offer significant advantages in automotive manufacturing, including fast curing times, high-strength bonding, and compatibility with a range of materials such as plastics, composites, and metals. These adhesives are used in various automotive applications, including window bonding, headlamp assembly, and interior trim installation, where strong and quick bonding is essential. Furthermore, the increasing focus on vehicle weight reduction, which is crucial for improving fuel efficiency and reducing carbon emissions, drives the demand for UV adhesives in this sector.

Automakers are also increasingly adopting UV adhesives as part of their push toward more sustainable production processes. UV adhesives are considered more environmentally friendly compared to traditional adhesives because they do not require solvents and cure quickly, reducing energy consumption during manufacturing. As a result, the automotive end-user industry remains the largest segment in the UV adhesives market, supported by ongoing trends in vehicle manufacturing and technological advancements.

Online Retail Distribution Channel Is Fastest Growing Owing to Consumer Demand for Convenience

The online retail segment has emerged as the fastest-growing distribution channel for UV adhesives, driven by the increasing preference for e-commerce shopping and the convenience it offers to both industrial buyers and consumers. As industries and individual buyers seek quick access to high-quality UV adhesives, online platforms provide a convenient and efficient way to purchase these products. E-commerce platforms offer a wide variety of adhesive solutions, including product specifications, reviews, and pricing, enabling customers to make informed purchasing decisions without the need for physical store visits.

The shift towards online retail is particularly noticeable in industries where businesses and professionals need to replenish adhesives quickly to keep production lines running smoothly. The ease of ordering, the ability to compare products, and home or business delivery options are further contributing to the fast growth of the online retail segment. As e-commerce continues to expand globally, online retail is expected to play a key role in the continued development of the UV adhesives market, especially in regions with high internet penetration and industrial activity.

North America Is Largest Region Due to Strong Demand in Automotive and Electronics Industries

North America holds the largest market share in the UV adhesives sector, driven by the strong demand from key industries such as automotive, electronics, and healthcare. The region is home to several leading manufacturers of UV adhesives and has a well-established industrial base that requires advanced adhesive solutions for efficient manufacturing processes. The United States, in particular, is a major contributor to the market, where automotive manufacturers and electronics companies rely on UV adhesives for a variety of applications, from automotive parts assembly to electronics device production.

In addition, the growing healthcare sector in North America is further boosting the demand for UV adhesives in medical device manufacturing, where safety, precision, and reliability are paramount. The strong regulatory environment and ongoing technological advancements in adhesive formulations contribute to the region's dominant position in the global market.

Competitive Landscape

The UV adhesives market is highly competitive, with several established players focusing on product innovation, strategic collaborations, and geographic expansion to maintain market leadership. Companies like Henkel AG, 3M Company, Dymax Corporation, and H.B. Fuller Company are leading the market with their advanced UV adhesive solutions and extensive distribution networks. These companies invest heavily in research and development to introduce new adhesive formulations that meet the evolving needs of industries such as automotive, healthcare, and electronics.

The competitive landscape is also shaped by the increasing adoption of online retail and the growing emphasis on sustainability and eco-friendly products. Market players are adapting to these trends by offering environmentally friendly UV adhesives and expanding their online presence to capture the growing demand from industrial and individual customers. As the UV adhesives market continues to expand, companies will need to stay agile, focusing on innovation and customer-centric solutions to gain a competitive edge.

Recent Developments:

- Henkel AG & Co. KGaA announced the launch of a new range of UV curing adhesives specifically for the electronics market, improving bond strength and heat resistance in critical components.

- Dymax Corporation unveiled a new UV adhesive designed for automotive assembly, which offers enhanced flexibility and durability for bonding plastics and metals.

- 3M expanded its portfolio with the introduction of a new UV-curable adhesive that is ideal for high-precision medical device manufacturing.

- Sika AG entered into a strategic partnership with a global packaging company to provide UV adhesive solutions that enhance packaging durability and shelf appeal.

- Permabond received regulatory approval for its latest UV adhesive formulation used in medical device assembly, which complies with ISO and FDA standards for medical adhesives.

List of Leading Companies:

- Henkel AG & Co. KGaA

- 3M Company

- Loctite

- Dymax Corporation

- H.B. Fuller Company

- Permabond

- Bostik

- Sika AG

- Mitsubishi Chemical Corporation

- UV Bonding Ltd.

- LORD Corporation

- Cyberbond LLC

- Adhesive Technologies

- Panacol-Elosol GmbH

- PPG Industries

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.9 Billion |

|

Forecasted Value (2030) |

USD 6.8 Billion |

|

CAGR (2025 – 2030) |

13.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

UV Adhesives Market By Product Type (Single Component UV Adhesives, Two Component UV Adhesives, Light Cured UV Adhesives), By Application (Automotive, Electronics, Industrial Manufacturing, Medical Devices, Packaging, Consumer Goods), By End-User Industry (Automotive, Electronics, Healthcare & Medical, Packaging, Consumer Goods, Industrial), and By Distribution Channel (Direct Sales, Online Retail, Distributors, Specialty Stores, Wholesale Markets) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Henkel AG & Co. KGaA, 3M Company, Loctite, Dymax Corporation, H.B. Fuller Company, Permabond, Bostik, Sika AG, Mitsubishi Chemical Corporation, UV Bonding Ltd., LORD Corporation, Cyberbond LLC, Adhesive Technologies, Panacol-Elosol GmbH, PPG Industries |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. UV Adhesives Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Single Component UV Adhesives |

|

4.2. Two Component UV Adhesives |

|

4.3. Light Cured UV Adhesives |

|

4.4. Others |

|

5. UV Adhesives Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Automotive |

|

5.2. Electronics |

|

5.3. Industrial Manufacturing |

|

5.4. Medical Devices |

|

5.5. Packaging |

|

5.6. Consumer Goods |

|

6. UV Adhesives Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Automotive |

|

6.2. Electronics |

|

6.3. Healthcare & Medical |

|

6.4. Packaging |

|

6.5. Consumer Goods |

|

6.6. Industrial |

|

7. UV Adhesives Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Sales |

|

7.2. Online Retail |

|

7.3. Distributors |

|

7.4. Specialty Stores |

|

7.5. Wholesale Markets |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America UV Adhesives Market, by Product Type |

|

8.2.7. North America UV Adhesives Market, by Application |

|

8.2.8. North America UV Adhesives Market, by End-User Industry |

|

8.2.9. North America UV Adhesives Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US UV Adhesives Market, by Product Type |

|

8.2.10.1.2. US UV Adhesives Market, by Application |

|

8.2.10.1.3. US UV Adhesives Market, by End-User Industry |

|

8.2.10.1.4. US UV Adhesives Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Henkel AG & Co. KGaA |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. 3M Company |

|

10.3. Loctite |

|

10.4. Dymax Corporation |

|

10.5. H.B. Fuller Company |

|

10.6. Permabond |

|

10.7. Bostik |

|

10.8. Sika AG |

|

10.9. Mitsubishi Chemical Corporation |

|

10.10. UV Bonding Ltd. |

|

10.11. LORD Corporation |

|

10.12. Cyberbond LLC |

|

10.13. Adhesive Technologies |

|

10.14. Panacol-Elosol GmbH |

|

10.15. PPG Industries |

|

11. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the UV Adhesives Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the UV Adhesives Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the UV Adhesives Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats