As per Intent Market Research, the Utility Solar PV EPC Market was valued at USD 60.8 Billion in 2024-e and will surpass USD 86.7 Billion by 2030; growing at a CAGR of 6.1% during 2025-2030.

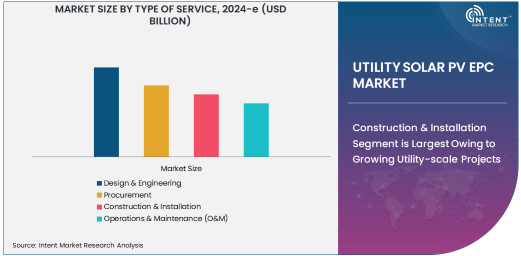

The Utility Solar PV EPC market is driven by various service types, including design and engineering, procurement, construction and installation, and operations and maintenance (O&M). Among these, the construction and installation sub-segment is the largest, primarily due to the increasing demand for large-scale utility solar projects. The growing emphasis on renewable energy and governments' push for sustainability targets have led to a surge in utility-scale solar installations across the globe. This segment includes the physical construction of solar power plants, which involves integrating photovoltaic systems, electrical infrastructure, and compliance with safety and regulatory standards. As a result, the construction and installation market continues to dominate the utility solar sector, driven by accelerated infrastructure development.

Construction & Installation Segment is Largest Owing to Growing Utility-scale Projects

The growth of utility-scale solar plants has been particularly fueled by technological advancements that make large projects more cost-effective. The construction and installation process is critical for ensuring that solar projects meet the desired capacity and performance. Companies are increasingly investing in advanced construction techniques, automation, and skilled labor to reduce installation timeframes and costs. This trend is expected to continue, making construction and installation a key growth driver for the entire EPC market in the solar energy space.

In the technological segment of the Utility Solar PV EPC market, mono-crystalline solar panels have emerged as the dominant technology. This is primarily due to their higher efficiency and better performance in energy generation compared to other technologies. Mono-crystalline panels are known for their ability to convert more sunlight into electricity, making them ideal for utility-scale solar installations where maximizing energy output is crucial. As a result, mono-crystalline panels are highly favored for large solar projects, particularly in regions with limited space for installation, as they require less area for the same amount of energy production.

Advancements in manufacturing processes have also made mono-crystalline panels more affordable over time, contributing to their growing adoption. Their high efficiency and long lifespan make them the preferred choice in utility-scale solar projects, which require long-term reliability and maximum power output. The increasing trend toward green energy adoption and government incentives supporting clean energy have further accelerated the use of mono-crystalline technology in the utility solar sector.

Ground-Mounted Installations Surge Due to Space Efficiency

The ground-mounted application sub-segment of the Utility Solar PV EPC market is experiencing significant growth, owing to its higher scalability and cost-effectiveness in utility-scale solar projects. Ground-mounted systems are typically used in large solar farms where vast, open spaces are available for installation. These systems allow for the optimal orientation and tilt of panels, which maximizes energy production. As governments and corporations focus on meeting renewable energy targets, ground-mounted solar installations are becoming the preferred choice for large-scale energy generation.

Ground-mounted systems offer advantages such as easier maintenance and the ability to scale the system up as needed. They are particularly useful in regions with vast, underutilized land areas, making them a logical choice for utilities and energy developers looking to invest in large solar projects. The flexibility and efficiency of ground-mounted systems make them a key contributor to the growth of the solar PV EPC market, especially in areas like the United States, China, and India.

Utility Segment is Fastest Growing Due to Demand for Large-Scale Projects

The utility end-user segment of the Utility Solar PV EPC market is the fastest growing, driven by the increasing demand for large-scale solar installations. Utilities are rapidly adopting solar power as part of their energy mix to meet government regulations for renewable energy adoption and reduce carbon footprints. This shift is supported by incentives and subsidies from governments around the world, encouraging utilities to invest in solar energy infrastructure. As a result, the utility segment is experiencing an accelerated rate of growth, with investments in large solar plants and utility-scale projects expanding globally.

The utility sector's rapid expansion is also being fueled by the decreasing cost of solar energy, as technological advancements make solar power generation more affordable. Moreover, utilities are looking to diversify their energy sources, and solar power is a key solution for achieving sustainability goals and reducing dependence on fossil fuels. This trend is expected to continue, making the utility segment the fastest-growing sub-segment in the Utility Solar PV EPC market.

Asia-Pacific is the Fastest Growing Region, Driving Solar Energy Adoption

Asia-Pacific (APAC) is the fastest-growing region in the global Utility Solar PV EPC market, owing to the rapid expansion of renewable energy infrastructure in countries like China, India, and Japan. The APAC region benefits from favorable government policies, abundant solar resources, and a growing emphasis on energy security and sustainability. China, in particular, leads the region in terms of solar installations, with large-scale solar projects becoming commonplace. The government’s robust support for solar energy, including subsidies and green energy incentives, has spurred significant investments in solar power infrastructure.

India is also emerging as a major player in the renewable energy sector, with ambitious solar energy targets. The country’s push for solar energy adoption is expected to contribute significantly to the growth of the EPC market. The region's large population, energy demand, and increasing focus on clean energy make APAC a key region for solar energy growth. With increasing investments and the availability of low-cost solar panels, Asia-Pacific is poised to maintain its position as the fastest-growing region in the Utility Solar PV EPC market.

Competitive Landscape: Leading Companies Fuel Market Expansion

The Utility Solar PV EPC market is highly competitive, with several global players leading the charge in solar power plant installations. Companies such as First Solar, Trina Solar, SunPower, and JinkoSolar dominate the market, providing a range of EPC services from design and engineering to construction and operations. These companies are constantly innovating, focusing on improving the efficiency and cost-effectiveness of solar panels and installations. They also engage in strategic partnerships, mergers, and acquisitions to expand their market share and enhance their technological capabilities.

The competitive landscape is characterized by a shift toward integrated solutions, where companies offer end-to-end services that encompass the entire life cycle of solar projects. Leading players are also investing heavily in R&D to develop next-generation solar technologies, such as bifacial panels and energy storage solutions, to meet the growing demand for clean energy. As the market continues to evolve, competition will intensify, and companies with strong technological capabilities and a global reach will be well-positioned to dominate the Utility Solar PV EPC market.

Recent Developments:

- First Solar is expanding its manufacturing capacity in India to support the growing demand for clean energy in the region.

- Trina Solar has signed agreements with several regional developers to expand its footprint in the utility-scale solar PV market, enhancing its EPC capabilities.

- SunPower has acquired a leading solar energy storage company to offer integrated solutions with its solar PV projects.

- JinkoSolar has launched a new line of high-efficiency solar modules designed for utility-scale solar projects, with better performance and lower costs.

- Siemens Gamesa has secured a multi-million-dollar contract to provide EPC services for a large-scale solar PV project in the Middle East, strengthening its regional presence.

List of Leading Companies:

- First Solar, Inc.

- Trina Solar Limited

- SunPower Corporation

- LONGi Green Energy Technology Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- Canadian Solar Inc.

- Goldwind Science & Technology Co., Ltd.

- Sungrow Power Supply Co., Ltd.

- ReneSola Ltd.

- Hanwha Q CELLS

- Siemens Gamesa Renewable Energy

- Vestas Wind Systems A/S

- Suzlon Energy Ltd.

- Enel Green Power

- Iberdrola, S.A.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 60.8 Billion |

|

Forecasted Value (2030) |

USD 86.7 Billion |

|

CAGR (2025 – 2030) |

6.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Utility Solar PV EPC Market by Product Type (Design & Engineering, Procurement, Construction & Installation, Operations & Maintenance), By Technology (Mono-Crystalline, Poly-Crystalline, Thin Film, Concentrated PV), By Application (Ground Mounted, Rooftop Mounted), By End-User Industry (Residential, Commercial & Industrial, Utility) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

First Solar, Inc., Trina Solar Limited, SunPower Corporation, LONGi Green Energy Technology Co., Ltd., JinkoSolar Holding Co., Ltd., Canadian Solar Inc., Goldwind Science & Technology Co., Ltd., Sungrow Power Supply Co., Ltd., ReneSola Ltd., Hanwha Q CELLS, Siemens Gamesa Renewable Energy, Vestas Wind Systems A/S, Suzlon Energy Ltd., Enel Green Power, Iberdrola, S.A. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Utility Solar PV EPC Market, by Type of Service (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Design & Engineering |

|

4.2. Procurement |

|

4.3. Construction & Installation |

|

4.4. Operations & Maintenance (O&M) |

|

5. Utility Solar PV EPC Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Mono-Crystalline |

|

5.2. Poly-Crystalline |

|

5.3. Thin Film |

|

5.4. Concentrated PV |

|

6. Utility Solar PV EPC Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Ground Mounted |

|

6.2. Rooftop Mounted |

|

7. Utility Solar PV EPC Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Residential |

|

7.2. Commercial & Industrial |

|

7.3. Utility |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Utility Solar PV EPC Market, by Type of Service |

|

8.2.7. North America Utility Solar PV EPC Market, by Technology |

|

8.2.8. North America Utility Solar PV EPC Market, by Application |

|

8.2.9. North America Utility Solar PV EPC Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Utility Solar PV EPC Market, by Type of Service |

|

8.2.10.1.2. US Utility Solar PV EPC Market, by Technology |

|

8.2.10.1.3. US Utility Solar PV EPC Market, by Application |

|

8.2.10.1.4. US Utility Solar PV EPC Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. First Solar, Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Trina Solar Limited |

|

10.3. SunPower Corporation |

|

10.4. LONGi Green Energy Technology Co., Ltd. |

|

10.5. JinkoSolar Holding Co., Ltd. |

|

10.6. Canadian Solar Inc. |

|

10.7. Goldwind Science & Technology Co., Ltd. |

|

10.8. Sungrow Power Supply Co., Ltd. |

|

10.9. ReneSola Ltd. |

|

10.10. Hanwha Q CELLS |

|

10.11. Siemens Gamesa Renewable Energy |

|

10.12. Vestas Wind Systems A/S |

|

10.13. Suzlon Energy Ltd. |

|

10.14. Enel Green Power |

|

10.15. Iberdrola, S.A. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Utility Solar PV EPC Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Utility Solar PV EPC Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Utility Solar PV EPC Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA