As per Intent Market Research, the Utility Solar EPC Market was valued at USD 7.3 Billion in 2024-e and will surpass USD 12.7 Billion by 2030; growing at a CAGR of 9.6% during 2025-2030.

The global utility solar EPC (Engineering, Procurement, and Construction) market is witnessing significant growth, driven by the increasing adoption of renewable energy and declining costs of solar photovoltaic (PV) systems. Governments worldwide are setting ambitious targets for solar energy generation, leading to a surge in utility-scale solar installations. This growth is further fueled by technological advancements and the rising demand for clean energy solutions across various sectors.

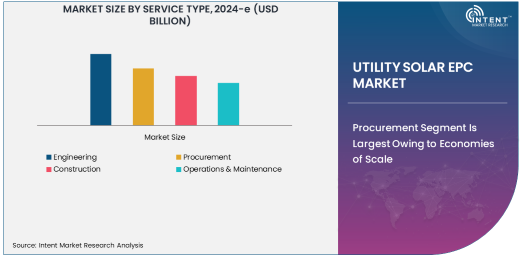

Procurement Segment Is Largest Owing to Economies of Scale

The procurement segment holds the largest share in the utility solar EPC market, driven by the bulk acquisition of solar modules, inverters, and related components. Procurement services are critical in ensuring cost optimization and the timely availability of high-quality materials, which are essential for large-scale projects.

The growing demand for competitive pricing in solar projects has encouraged EPC providers to establish long-term partnerships with manufacturers and suppliers. This approach not only ensures cost-effectiveness but also enhances the efficiency and reliability of solar power plants, making procurement a cornerstone of successful EPC projects.

Tracking Solar Systems Segment Is Fastest Growing Due to Higher Efficiency

Among system types, tracking solar systems are experiencing the fastest growth. These systems enhance energy generation by allowing solar panels to follow the sun's path, significantly improving efficiency compared to fixed-tilt systems. Their adaptability to varying sunlight conditions has made them a preferred choice for utility-scale installations.

The increasing adoption of single-axis and dual-axis tracking systems is transforming the solar industry, particularly in regions with high solar irradiance. As solar developers prioritize maximizing energy output, tracking systems are becoming integral to the design of modern solar farms, driving their rapid expansion in the market.

Utility-Scale Solar Power Plants Segment Is Largest Owing to Renewable Energy Targets

Utility-scale solar power plants dominate the application segment, driven by the global push for renewable energy adoption. These large-scale installations are critical for achieving national and international climate goals, contributing significantly to the transition toward sustainable energy.

The rising investments in utility-scale projects by governments and private entities are propelling the segment's growth. Advanced technologies and innovative financing models are further boosting the development of large solar farms, ensuring their pivotal role in meeting the growing energy demand.

Independent Power Producers Segment Is Fastest Growing Owing to Private Investments

Independent Power Producers (IPPs) represent the fastest-growing end-user segment in the utility solar EPC market. IPPs play a crucial role in accelerating solar adoption by investing heavily in renewable energy projects and leveraging innovative business models.

The increasing participation of private players in solar energy production is reshaping the market dynamics. IPPs are not only enhancing the capacity of solar power generation but also fostering competition and innovation within the industry, driving the segment's remarkable growth.

Asia-Pacific Region Leads Due to Expanding Solar Projects

Asia-Pacific is the largest market for utility solar EPC, with countries like China, India, and Japan spearheading the adoption of solar energy. The region's dominance is attributed to supportive government policies, favorable climatic conditions, and substantial investments in renewable energy infrastructure.

China leads in solar PV installations, while India is rapidly expanding its solar capacity to meet ambitious renewable energy targets. The robust growth in Asia-Pacific underscores its critical role in driving the global solar energy transition.

Competitive Landscape: Innovation and Strategic Partnerships

The utility solar EPC market is highly competitive, with leading companies such as First Solar, Inc., Tata Power Solar Systems Ltd., and Bechtel Corporation shaping the industry landscape. These players are focusing on innovation, strategic partnerships, and geographic expansion to strengthen their market position.

The competitive environment is characterized by advancements in solar technologies, cost optimization strategies, and the pursuit of sustainable energy solutions. As the market continues to grow, collaboration between stakeholders will be key to addressing challenges and unlocking new opportunities in the utility solar EPC sector.

Recent Developments:

- First Solar plans to significantly expand its manufacturing capacity in the United States to meet the growing demand for solar panels for utility-scale projects.

- Enel Green Power has entered into new partnerships with local companies in Latin America to further expand its solar power projects and renewable energy footprint.

- Acciona Energy has signed a large-scale EPC contract with a utility provider in Australia for the construction of a new utility-scale solar PV farm.

- SunPower Corporation unveiled its latest range of high-efficiency solar panels designed specifically for utility-scale solar projects, improving performance and cost-effectiveness.

- Bechtel secured multiple new EPC contracts for solar power plants in the Asia-Pacific region as part of its strategy to expand its renewable energy portfolio globally.

List of Leading Companies:

- First Solar, Inc.

- SunPower Corporation

- JinkoSolar Holding Co., Ltd.

- Trina Solar Limited

- Canadian Solar Inc.

- Tata Power Solar Systems Ltd.

- JA Solar Technology Co., Ltd.

- Hanwha Q CELLS Co., Ltd.

- LONGi Green Energy Technology Co., Ltd.

- Sterling and Wilson Solar Ltd.

- Bechtel Corporation

- Engie SA

- Siemens AG

- Adani Solar

- Risen Energy Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 7.3 Billion |

|

Forecasted Value (2030) |

USD 12.7 Billion |

|

CAGR (2025 – 2030) |

9.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Utility Solar EPC Market By Service Type (Engineering, Procurement, Construction, Operations & Maintenance), By System Type (Ground-Mounted Solar Systems, Fixed-Tilt Solar Systems, Tracking Solar Systems), By Application (Utility-Scale Solar Power Plants, Commercial & Industrial (C&I) Solar Installations, Hybrid Solar Systems), By End-User (Independent Power Producers (IPPs), Utilities, Commercial Enterprises) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

First Solar, Inc., SunPower Corporation, JinkoSolar Holding Co., Ltd., Trina Solar Limited, Canadian Solar Inc., Tata Power Solar Systems Ltd., JA Solar Technology Co., Ltd., Hanwha Q CELLS Co., Ltd., LONGi Green Energy Technology Co., Ltd., Sterling and Wilson Solar Ltd., Bechtel Corporation, Engie SA, Siemens AG, Adani Solar, Risen Energy Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Utility Solar EPC Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Engineering |

|

4.2. Procurement |

|

4.3. Construction |

|

4.4. Operations & Maintenance |

|

5. Utility Solar EPC Market, by System Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Ground-Mounted Solar Systems |

|

5.2. Fixed-Tilt Solar Systems |

|

5.3. Tracking Solar Systems |

|

6. Utility Solar EPC Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Utility-Scale Solar Power Plants |

|

6.2. Commercial & Industrial (C&I) Solar Installations |

|

6.3. Hybrid Solar Systems |

|

7. Utility Solar EPC Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Independent Power Producers (IPPs) |

|

7.2. Utilities |

|

7.3. Commercial Enterprises |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Utility Solar EPC Market, by Service Type |

|

8.2.7. North America Utility Solar EPC Market, by System Type |

|

8.2.8. North America Utility Solar EPC Market, by Application |

|

8.2.9. North America Utility Solar EPC Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Utility Solar EPC Market, by Service Type |

|

8.2.10.1.2. US Utility Solar EPC Market, by System Type |

|

8.2.10.1.3. US Utility Solar EPC Market, by Application |

|

8.2.10.1.4. US Utility Solar EPC Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. First Solar, Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. SunPower Corporation |

|

10.3. JinkoSolar Holding Co., Ltd. |

|

10.4. Trina Solar Limited |

|

10.5. Canadian Solar Inc. |

|

10.6. Tata Power Solar Systems Ltd. |

|

10.7. JA Solar Technology Co., Ltd. |

|

10.8. Hanwha Q CELLS Co., Ltd. |

|

10.9. LONGi Green Energy Technology Co., Ltd. |

|

10.10. Sterling and Wilson Solar Ltd. |

|

10.11. Bechtel Corporation |

|

10.12. Engie SA |

|

10.13. Siemens AG |

|

10.14. Adani Solar |

|

10.15. Risen Energy Co., Ltd. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Utility Solar EPC Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Utility Solar EPC Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Utility Solar EPC Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA