As per Intent Market Research, the Uterine Fibroid Treatment Market was valued at USD 4.2 billion in 2024-e and will surpass USD 7.6 billion by 2030; growing at a CAGR of 9.0% during 2025 - 2030.

The uterine fibroid treatment market is experiencing significant growth, driven by the increasing prevalence of uterine fibroids among women of reproductive age. Uterine fibroids, non-cancerous tumors that develop in the uterus, affect a large proportion of women worldwide and can cause symptoms such as heavy menstrual bleeding, pelvic pain, and infertility. As awareness around fibroid symptoms and their impact on women’s health grows, there is increasing demand for effective treatments. The market encompasses a range of treatment options, from medication-based treatments, such as hormonal therapies and non-hormonal drugs, to advanced surgical techniques like myomectomy and hysterectomy.

Non-invasive procedures like uterine artery embolization (UAE) and MRI-guided focused ultrasound have also gained traction, offering women alternatives to surgery with fewer risks and shorter recovery times. As healthcare providers continue to adopt a more personalized approach to fibroid management, the market is expected to witness continued expansion. The increasing demand for both medical and surgical treatment options is shaping the dynamics of this market, which is expected to grow due to the broad range of available therapies and innovations in treatment methods.

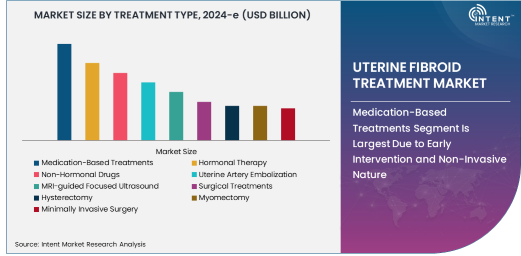

Medication-Based Treatments Segment Is Largest Due to Early Intervention and Non-Invasive Nature

The medication-based treatments segment holds the largest share in the uterine fibroid treatment market, primarily because these treatments offer a non-invasive approach to managing symptoms. Hormonal therapies, such as birth control pills, progestins, and GnRH agonists, are commonly prescribed to regulate menstrual cycles and reduce fibroid size. Non-hormonal drugs, including anti-inflammatory medications, are also used to alleviate pain and discomfort caused by fibroids.

These medications are often the first line of treatment, particularly for women who wish to avoid invasive procedures or surgery. Given their lower risk profile, ease of administration, and ability to be used in the early stages of fibroid diagnosis, medication-based treatments continue to dominate the market. Furthermore, the increasing availability of these medications through both prescription and over-the-counter options helps drive growth, solidifying medication-based treatments as the largest segment in the uterine fibroid treatment market.

MRI-guided Focused Ultrasound Is Fastest Growing Treatment Due to Non-Invasive Advantages

MRI-guided focused ultrasound (MRgFUS) is the fastest growing treatment option in the uterine fibroid treatment market due to its non-invasive nature and high patient satisfaction rates. MRgFUS uses focused ultrasound waves guided by MRI to target and destroy fibroid tissue without the need for incisions. This technique provides a minimally invasive option with shorter recovery times, reduced risk of complications, and preserved fertility for women who wish to retain their reproductive potential.

As patient preference shifts towards non-invasive treatments that offer faster recovery and fewer side effects, MRgFUS is gaining popularity among women who are seeking alternatives to traditional surgery. The increasing number of clinical studies validating the effectiveness of MRgFUS, along with its growing adoption in leading healthcare centers, positions it as the fastest growing treatment option in the uterine fibroid treatment market.

Hospitals Segment Is Largest End-User Due to Comprehensive Care and Surgical Capabilities

The hospitals segment is the largest end-user in the uterine fibroid treatment market, driven by the need for comprehensive care, advanced diagnostic tools, and surgical capabilities. Hospitals provide a range of treatment options, from medication-based therapies to more complex surgical procedures such as myomectomy and hysterectomy. Given the severity of symptoms in some women, hospitals are the preferred choice for those requiring in-depth care, including specialized imaging and surgical interventions.

Additionally, hospitals are equipped with the necessary infrastructure to perform advanced treatments like uterine artery embolization and MRI-guided focused ultrasound. They also provide critical post-treatment care, ensuring that women recover safely after surgery or other procedures. The high availability of skilled healthcare professionals and state-of-the-art equipment makes hospitals the leading end-user segment in this market, particularly for women requiring more advanced or invasive treatments for uterine fibroids.

Direct Sales Segment Is Fastest Growing Distribution Channel Due to Convenience and Accessibility

The direct sales distribution channel is the fastest growing segment in the uterine fibroid treatment market, primarily because it offers convenience and better accessibility for healthcare providers. Direct sales allow hospitals and clinics to procure treatment options, including medications and medical devices, directly from manufacturers, eliminating intermediaries and reducing supply chain complexities. Pharmaceutical companies and medical device manufacturers increasingly recognize the importance of building direct relationships with healthcare providers to ensure the timely availability of treatments.

In addition, direct sales enable manufacturers to provide value-added services, such as training and support for medical staff, which contributes to the efficient use of advanced treatments like MRI-guided focused ultrasound and uterine artery embolization. As healthcare systems around the world prioritize improved access to effective treatments for uterine fibroids, the direct sales channel is becoming the preferred option, driving the fastest growth in distribution.

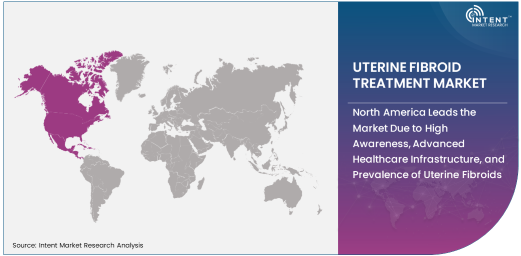

North America Leads the Market Due to High Awareness, Advanced Healthcare Infrastructure, and Prevalence of Uterine Fibroids

North America is the leading region in the uterine fibroid treatment market, driven by high awareness of uterine fibroids, advanced healthcare infrastructure, and a large number of women seeking treatment for fibroid-related symptoms. The United States, in particular, has a significant number of women diagnosed with uterine fibroids, with a large proportion seeking treatment due to symptoms like heavy menstrual bleeding and pelvic pain.

In addition to the high rate of fibroid diagnoses, North America boasts a robust healthcare system that offers access to cutting-edge treatment options, including surgical procedures, uterine artery embolization, and MRI-guided focused ultrasound. The region also benefits from extensive research into fibroid treatment options and high levels of healthcare insurance coverage, which contribute to the adoption of advanced therapies. As such, North America continues to dominate the uterine fibroid treatment market, with growth driven by increasing demand for a wide range of treatment options.

Competitive Landscape: Leading Companies Focus on Innovation and Expanding Treatment Access

The uterine fibroid treatment market is highly competitive, with a range of pharmaceutical and medical device companies vying for market share. Leading companies such as AbbVie, Bayer, and Medtronic are focused on expanding their product portfolios, innovating treatment options, and improving patient access to care. These companies are investing heavily in research and development to introduce new therapies that offer improved outcomes, shorter recovery times, and fewer side effects for patients.

Moreover, collaboration between medical device manufacturers and healthcare providers is accelerating the adoption of advanced non-invasive treatments like MRI-guided focused ultrasound and uterine artery embolization. As the demand for personalized and minimally invasive treatments grows, the competitive landscape will continue to evolve, with companies focusing on enhancing the patient experience and expanding the accessibility of treatment options for uterine fibroids.

Recent Developments:

- In December 2024, Medtronic launched a new minimally invasive tool for treating uterine fibroids, improving patient outcomes with less recovery time.

- In November 2024, Johnson & Johnson introduced a new drug for hormonal treatment of uterine fibroids aimed at reducing symptoms.

- In October 2024, Siemens Healthineers unveiled a new MRI-guided focused ultrasound system designed for non-invasive fibroid treatment.

- In September 2024, Myovant Sciences presented positive clinical trial results for a new oral medication targeting uterine fibroid symptom management.

- In August 2024, Bayer AG expanded its portfolio with a new uterine fibroid embolization device aimed at increasing procedure efficiency.

List of Leading Companies:

- AbbVie

- Bayer AG

- Johnson & Johnson

- Merck & Co.

- GSK (GlaxoSmithKline)

- Pfizer Inc.

- Siemens Healthineers

- Medtronic

- Hologic Inc.

- Boston Scientific

- Cook Medical

- AbbVie

- Myovant Sciences

- Neomedic International

- Acelity (now part of 3M)

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.2 Billion |

|

Forecasted Value (2030) |

USD 7.6 Billion |

|

CAGR (2025 – 2030) |

9.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Uterine Fibroid Treatment Market by Treatment Type (Medication-Based Treatments, Hormonal Therapy, Non-Hormonal Drugs, Uterine Artery Embolization, MRI-guided Focused Ultrasound, Surgical Treatments, Hysterectomy, Myomectomy, Minimally Invasive Surgery), End-User (Hospitals, Clinics, Ambulatory Surgical Centers), Distribution Channel (Direct Sales, Pharmacies, Online Pharmacies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

AbbVie, Bayer AG, Johnson & Johnson, Merck & Co., GSK (GlaxoSmithKline), Pfizer Inc., Siemens Healthineers, Medtronic, Hologic Inc., Boston Scientific, Cook Medical, AbbVie, Myovant Sciences, Neomedic International, Acelity (now part of 3M) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Uterine Fibroid Treatment Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Medication-Based Treatments |

|

4.2. Hormonal Therapy |

|

4.3. Non-Hormonal Drugs |

|

4.4. Uterine Artery Embolization |

|

4.5. MRI-guided Focused Ultrasound |

|

4.6. Surgical Treatments |

|

4.7. Hysterectomy |

|

4.8. Myomectomy |

|

4.9. Minimally Invasive Surgery |

|

5. Uterine Fibroid Treatment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Hospitals |

|

5.2. Clinics |

|

5.3. Ambulatory Surgical Centers |

|

6. Uterine Fibroid Treatment Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Direct Sales |

|

6.2. Pharmacies |

|

6.3. Online Pharmacies |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Uterine Fibroid Treatment Market, by Treatment Type |

|

7.2.7. North America Uterine Fibroid Treatment Market, by End-User |

|

7.2.8. North America Uterine Fibroid Treatment Market, by Distribution Channel |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Uterine Fibroid Treatment Market, by Treatment Type |

|

7.2.9.1.2. US Uterine Fibroid Treatment Market, by End-User |

|

7.2.9.1.3. US Uterine Fibroid Treatment Market, by Distribution Channel |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. AbbVie |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Bayer AG |

|

9.3. Johnson & Johnson |

|

9.4. Merck & Co. |

|

9.5. GSK (GlaxoSmithKline) |

|

9.6. Pfizer Inc. |

|

9.7. Siemens Healthineers |

|

9.8. Medtronic |

|

9.9. Hologic Inc. |

|

9.10. Boston Scientific |

|

9.11. Cook Medical |

|

9.12. AbbVie |

|

9.13. Myovant Sciences |

|

9.14. Neomedic International |

|

9.15. Acelity (now part of 3M) |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Uterine Fibroid Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Uterine Fibroid Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Uterine Fibroid Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA