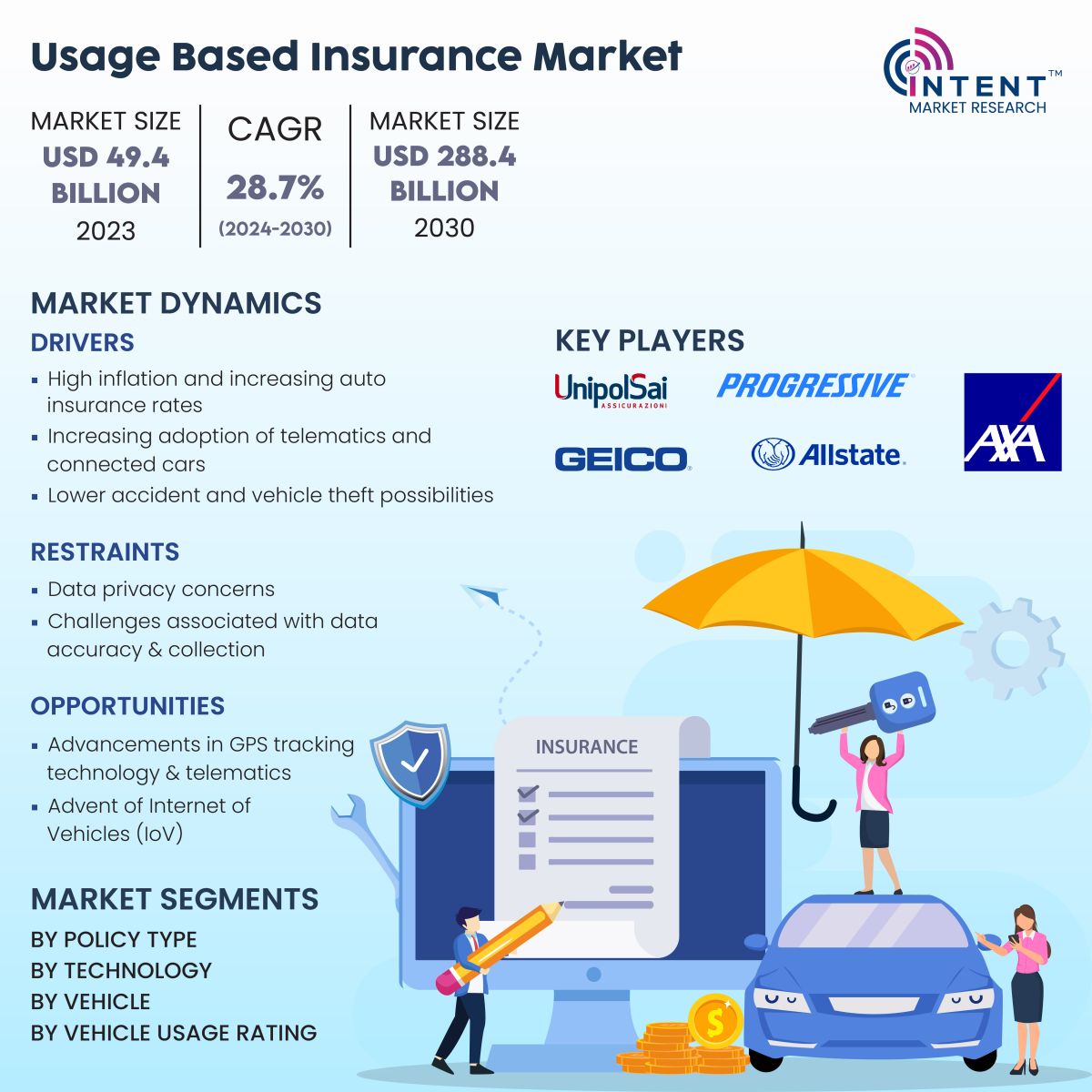

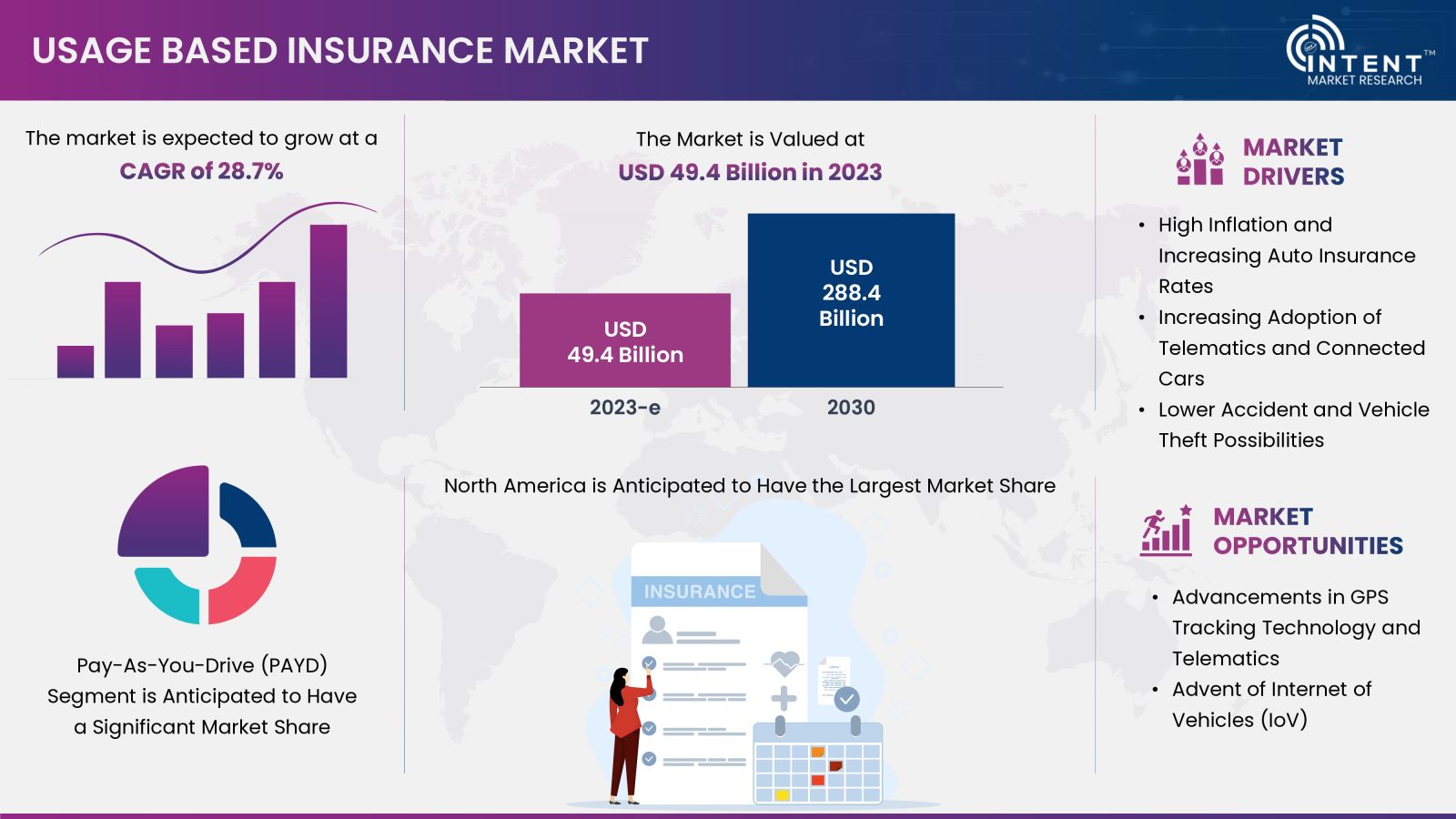

According to Intent Market Research, the Usage-Based Insurance Market is expected to grow from USD 49.4 billion in 2023-e at a CAGR of 28.7% to touch USD 288.4 billion by 2030. The usage-based insurance market is competitive, the prominent players in the global market include Allstate, AXA, GEICO, Liberty Mutual, Mapfre, Progressive, State Farm, Travelers, Unipolsai, and USAA. Increasing adoption of telematics and connected cars drives the market growth. The reduction in insurance premium costs and lower accident and vehicle theft possibilities through usage-based insurance to drive the market growth. Advancements in GPS tracking technology & telematics and the advent of Internet of Vehicles (IoV) are anticipated to provide significant growth opportunities for the usage-based insurance market.

Click here to: Get FREE Sample Pages of this Report

Usage-Based Insurance Market Overview

Usage-based insurance utilizes telematics to collect data on automotive vehicles such as driving habits, including speeding, braking, distance driven, time of day, and other behaviors. This data is used to provide usage-based insurance by the insurance companies for the consumers. The data is used to evaluate and determine rates and any other discounts or program benefits that the insured is eligible for.

High Inflation and Increasing Auto Insurance Rates are Driving the Usage-Based Insurance Market

There has been an increasing trend of rise in auto insurance rates. According to Consumer Price Index report, in August 2023, the cost of car insurance rose by 19% in comparison to 2022 across the US. Usage-based insurance has emerged as one of the potential solutions for a reduction in insurance premium costs. An increasing number of car owners are opting for usage-based insurance to reap the benefits of lower premium costs.

Moreover, increasing inflation is also one of the macro factors that is driving consumer behavior toward approaching cost-saving solutions. According to the US Bureau of Labor Statistics, the Consumer Price Index increased from 3.2% to 3.7% in the last 12 months ending in August 2023. Individual drivers as well as fleet owners are increasingly adopting telematics for the potential of cost savings. Thus, high inflation and increasing auto insurance rates are driving the adoption of usage-based insurance.

Segment Analysis

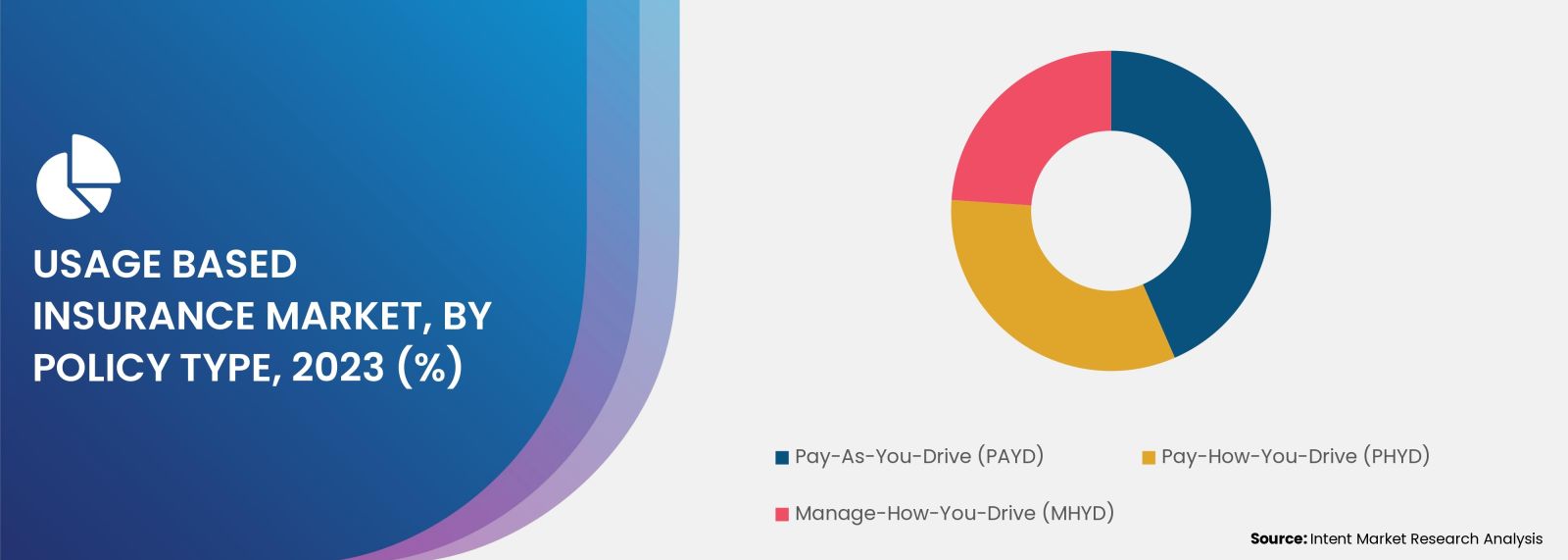

Increasing Number of Insurers are Launching Pay-As-You-Drive (PAYD) Models

An increasing number of insurers are starting to launch PAYD models globally. For instance, in November 2022, One Call Insurance (UK) in partnership with Trakm8, launched PAYD car insurance. In November 2022, Marmalade (Germany) launched a PAYD usage-based policy for newly qualified drivers. There’s an increasing popularity of PAYD insurance owing to the benefits it offers to the car owners such as lower premiums, coverage customization, and installation of free telematics devices. Moreover, allowing people to pay for insurance according to their use also results in lower driving distances and higher safety and environmental benefits.

Key Benefits Offered by the OBD Device Such as Reliability, Accuracy & Security will Drive Their Demand

OBD devices are installed in the OBD-II port that provides full access to the data collected by the vehicle sensors, including engine speed, intake manifold pressure, oil temperature, and more. OBD device offers several advantages such as high reliability, accurate vehicle identification and trip detection, high accuracy and security. The use of OBD devices also ensures that the data collected will be fair and unbiased across all demographics, vehicle types, vehicle uses, and drivers. In addition, it can also provide value-added services such as maintenance reminders, roadside assistance, crash notification, and car diagnostics. Thus, owing to the advantages it offers, there’s an increasing adoption of OBD devices.

Increasing Popularity of UBI Policies Among Millennials and Gen-Z is Driving the Market from New Vehicles Segment

The awareness of UBI policies is higher among the Millennials and Gen-Z. Several surveys have reported that Millennials and Gen-Z are more interested in taking out a policy based on usage-based insurance. For instance, according to a consumer study published in February 2023 by Zuno General Insurance, in India, about 70% of respondents showed a strong intention to buy UBI over other insurance options. As this age group is buying new vehicles, and increasingly opting for UBI policies, the market from new vehicle segment is expected to witness significant growth.

Rising Popularity of Ridesharing and Ride-Hailing Services is Driving the Business Segment

Ride-hailing and ride-sharing services involve booking customized rides through smartphone apps and connecting commuters with local carpools. In recent years, ridesharing and ride-hailing services have exploded in demand globally. The popularity of ridesharing is expected to enhance the cost-effectiveness of usage-based insurance.

There are an increasing number of drivers opting for ridesharing and ride-hailing services. Several auto insurers offer customized UBI policies for ridesharing drivers to provide personal and commercial coverage. For instance, Key players in the usage-based insurance market are expanding products for business use. In April 2021, Farmers Insurance launched its new usage-based commercial auto insurance program, FairMile indicates growing popularity of UBI from ridesharing business segment.

Regional Analysis

Presence of Key Players in the Region Drives the Market in North America

The US is among the early adopters of the UBI policies and has a significant market share. The presence of key insurance companies is one of the core driving factors for the growth of usage-based insurance market in the region. Key players includes Progressive, Allstate, GEICO, Liberty Mutual, Nationwide, Allianz, Esurance, State Farm, Nationwide, Travelers, and USAA contribute to North America’s market growth, positioning the region for significant expansion.

Several other insurance companies are actively expanding their product portfolio to capture market share. For instance, in November 2022, CerebrumX, an AI-driven automotive data services & management company, came into partnership with Ford to incorporate Ford Connected vehicle data to support its data-driven usage-based insurance (UBI)-as-a-service model for insurers. Thus, the presence of key players in the region is driving the usage-based insurance market in the region.

Usage-based Insurance Market is Highly Competitive

In the usage-based insurance market, key players include insurance providers and insurtech companies. These companies provide customized usage-based insurance for car owners. The companies are actively launching and expanding UBI policies to capture market share. The market is highly competitive with the presence of dominant global players. Notable companies include Allstate, AXA, GEICO, Liberty Mutual, Mapfre, Progressive, State Farm, Travelers, Unipolsai, and USAA.

Following are the key developments in the usage-based insurance market:

- In September 2023, Definity (Canada) launched a new usage-based insurance (UBI) offering to provide drivers.

- In June 2023, UnipolSai launched BeRebel, a new car insurance policy based on the pay-per-use model.

- In January 2023, New India Assurance (NIA) launched its Pay-As-You-Drive (PAYD) policies in India.

Click here to: Get your custom research report today

Usage-based Insurance Market Coverage

The report provides key insights into the usage-based insurance market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 49.4 billion |

|

Forecast Revenue (2030) |

USD 288.4 billion |

|

CAGR (2024-2030) |

28.7% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Policy Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD)), By Technology (Smartphone, OBD Dongle, Embedded), By Vehicle (New Vehicle, Old Vehicle), By Vehicle Usage Rating (Pleasure, Business, Commuter) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, India, Japan, South Korea, Australia), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, UAE, South Africa) |

|

Competitive Landscape |

Allstate, AXA, GEICO, Liberty Mutual, Mapfre, Progressive, State Farm, Travelers, Unipolsai, and USAA |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Study Assumptions and Market Definition |

|

1.2.Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Market Growth Drivers |

|

4.1.1.High Inflation and Increasing Auto Insurance Rates |

|

4.1.2.Rising Adoption of Telematics and Connected Cars |

|

4.1.3.Lower Accident and Vehicle Theft Possibilities |

|

4.2.Market Growth Restraints |

|

4.2.1.Data Privacy Concerns |

|

4.2.2.Challenges Associated with Data Accuracy & Collection |

|

4.3.Market Growth Opportunities |

|

4.3.1.Advancements in GPS Tracking Technology and Telematics |

|

4.3.2.Advent of Internet of Vehicles (IoV) |

|

4.4.Porter’s Five Forces |

|

4.5.PESTLE Analysis |

|

5.Market Outlook |

|

5.1.Supply Chain Analysis |

|

5.2.Regulatory Framework |

|

5.3.Technology Analysis |

|

5.4.Patent Analysis |

|

5.5.Consumer Behavior Analysis |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Segment Synopsis |

|

6.2.By Policy Type |

|

6.2.1.Pay-As-You-Drive |

|

6.2.2.Pay-How-You-Drive |

|

6.2.3.Manage-How-You-Drive |

|

6.3.By Technology |

|

6.3.1.Smartphone |

|

6.3.2.OBD Device |

|

6.3.3.Embedded |

|

6.4.By Vehicle |

|

6.4.1.New Vehicle |

|

6.4.2.Old Vehicle |

|

6.5.By Vehicle Usage Rating |

|

6.5.1.Pleasure |

|

6.5.2.Business |

|

6.5.3.Commuter |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Global Market Synopsis |

|

7.2.North America |

|

7.2.1.North America Usage-based Insurance Market Outlook |

|

7.2.2.US |

|

7.2.2.1.US Usage-based Insurance Market, By Policy Type |

|

7.2.2.2.US Usage-based Insurance Market, By Technology |

|

7.2.2.3.US Usage-based Insurance Market, By Vehicle |

|

7.2.2.4.US Usage-based Insurance Market, By Vehicle Usage Rating |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3.Canada |

|

7.3.Europe |

|

7.3.1.Europe Usage-based Insurance Market Outlook |

|

7.3.2.Germany |

|

7.3.3.UK |

|

7.3.4.France |

|

7.3.5.Italy |

|

7.3.6.Spain |

|

7.4.Asia-Pacific |

|

7.4.1.Asia-Pacific Usage-based Insurance Market Outlook |

|

7.4.2.China |

|

7.4.3.India |

|

7.4.4.Japan |

|

7.4.5.South Korea |

|

7.4.6.Australia |

|

7.5.Latin America |

|

7.5.1.Latin America Usage-based Insurance Market Outlook |

|

7.5.2.Brazil |

|

7.5.3.Mexico |

|

7.6.Middle East & Africa |

|

7.6.1.Middle East & Africa Usage-based Insurance Market Outlook |

|

7.6.2.Saudi Arabia |

|

7.6.3.UAE |

|

7.6.4.South Africa |

|

8.Competitive Landscape |

|

8.1.Market Share Analysis |

|

8.2.Company Strategy Analysis |

|

8.3.Competitive Matrix |

|

9.Company Profiles |

|

9.1.Allstate |

|

9.1.1.Company Synopsis |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

*Note: All the companies in section 9.1 will cover the same sub-chapters as above. |

|

9.2.AXA |

|

9.3.GEICO |

|

9.4.Liberty Mutual |

|

9.5.Mapfre |

|

9.6.Progressive |

|

9.7.State Farm |

|

9.8.Travelers |

|

9.9.Unipolsai |

|

9.10. USAA |

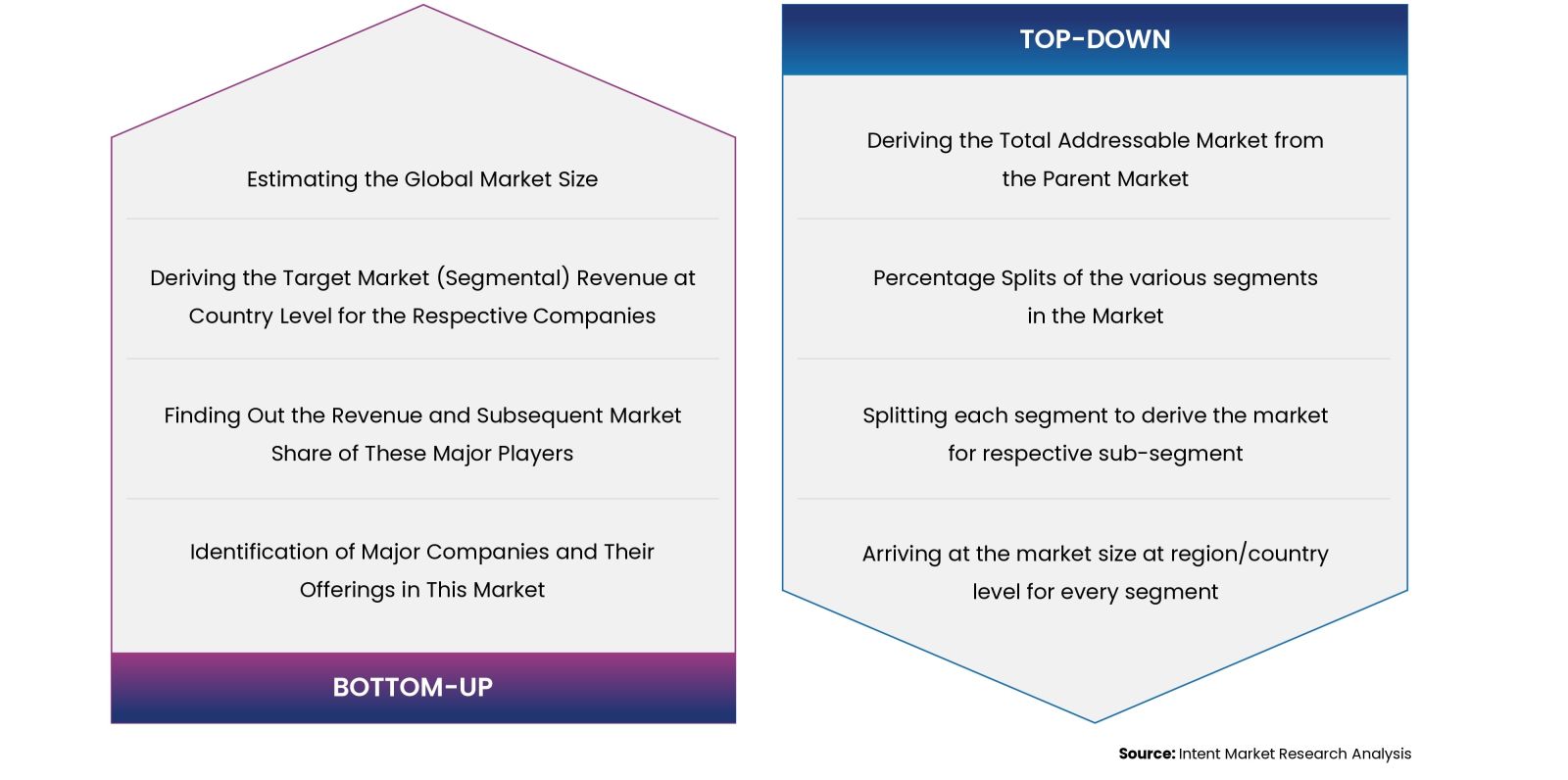

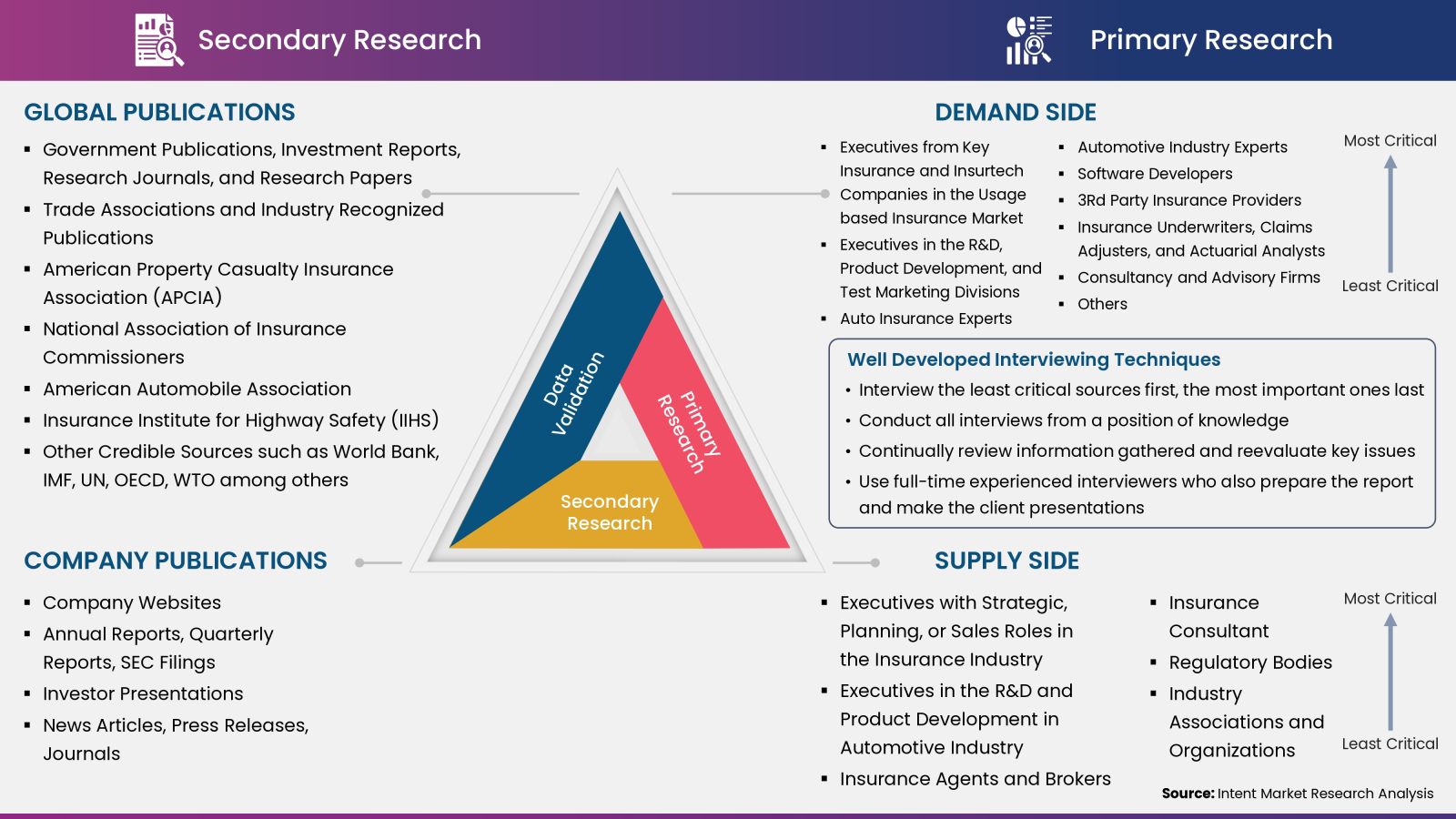

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.