As per Intent Market Research, the Urinary Tract Infection Treatment Market was valued at USD 7.5 Billion in 2024-e and will surpass USD 11.8 Billion by 2030; growing at a CAGR of 7.8% during 2025 - 2030.

The urinary tract infection (UTI) treatment market is driven by the increasing incidence of urinary tract infections, particularly among women, as well as the rising awareness of UTI management. UTIs are common infections that affect the urinary system, including the bladder, kidneys, and urethra. The market includes a variety of treatment options, with antibiotics being the most commonly prescribed drugs. Given the nature of UTIs, treatments generally focus on eliminating the infection and alleviating symptoms, with antibiotics, antiseptics, and urinary analgesics being the primary drug types. The market is experiencing growth as healthcare providers continue to focus on effective treatment protocols, and the development of new and more targeted therapies contributes to improved patient outcomes.

The rise of antibiotic resistance is an emerging challenge in UTI management, driving the need for innovative drug therapies. Additionally, with the increasing prevalence of antibiotic-resistant strains of bacteria, the market is expected to witness a shift towards alternative treatment options, such as antiseptics and urinary analgesics. Advancements in drug formulations and delivery mechanisms are expected to further drive the market's growth, improving the efficiency of UTI treatment and patient compliance.

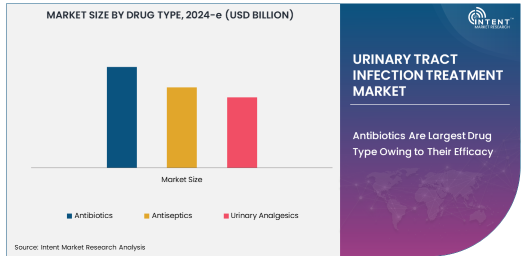

Antibiotics Are Largest Drug Type Owing to Their Efficacy

Antibiotics are the largest drug type in the urinary tract infection treatment market, accounting for the largest share of the market due to their proven efficacy in treating bacterial infections, including UTIs. Common antibiotics used to treat UTIs include trimethoprim-sulfamethoxazole, ciprofloxacin, and nitrofurantoin, which are effective against common uropathogens such as Escherichia coli, the primary cause of most UTIs. Antibiotics are the first line of treatment for UTIs, and they help to eradicate the bacterial infection and prevent complications like kidney damage or sepsis.

The dominance of antibiotics is due to their broad-spectrum effectiveness in treating a wide range of bacterial infections, including cystitis, pyelonephritis, and urethritis. As antibiotic resistance continues to rise, however, there is an increasing focus on the development of new antibiotics or alternative treatments that can effectively target resistant strains. Despite the challenges posed by resistance, antibiotics continue to be the most widely used and trusted treatment option for UTIs, making them the largest drug type in the market.

Cystitis Is Largest Indication Owing to Prevalence

Cystitis (bladder infection) is the largest indication in the urinary tract infection treatment market, primarily due to its high prevalence. Cystitis occurs when the bladder becomes infected, causing inflammation and irritation, with symptoms such as frequent urination, pain, and discomfort. It is more common in women than men, which is why cystitis is often seen in the broader population. Most cases of cystitis are caused by bacterial infections, which are usually treatable with antibiotics.

Cystitis is the most common type of UTI, accounting for a large proportion of UTI cases seen in both primary and secondary care settings. Due to its frequency and the relatively straightforward nature of treatment, cystitis remains the largest indication in the UTI treatment market. The availability of effective antibiotics to treat this condition has contributed to the steady demand for treatments targeting cystitis, making it the dominant indication in the market.

Oral Route of Administration Is Largest Due to Patient Convenience

The oral route of administration is the largest in the urinary tract infection treatment market, driven by its convenience and ease of use. Oral antibiotics are widely prescribed for treating uncomplicated UTIs, as they offer a simple and non-invasive treatment option for patients. Medications such as nitrofurantoin and trimethoprim-sulfamethoxazole are commonly taken orally and are effective in treating infections that affect the lower urinary tract, such as cystitis.

The oral route is the preferred choice for many patients due to its non-invasive nature, allowing individuals to take the medication at home without the need for injections or hospital visits. Furthermore, the ease of administration contributes to higher patient compliance, especially in outpatient settings. With oral antibiotics being effective in treating most UTIs, the oral route of administration continues to be the largest in the market.

Hospitals Are Largest End-Use Industry Owing to Acute Care Needs

Hospitals are the largest end-use industry in the urinary tract infection treatment market, driven by the high volume of patients requiring urgent and specialized care for severe cases of UTIs. Hospitals are typically the setting for more complicated or advanced infections, such as pyelonephritis (kidney infections), which may require intravenous antibiotics or more intensive treatment. Hospitals also play a crucial role in diagnosing and managing UTIs, especially in immunocompromised patients or those with underlying health conditions that may increase the risk of infection.

The large patient pool and the need for more comprehensive care, including the administration of intravenous antibiotics for severe UTIs, make hospitals the largest end-use segment in the UTI treatment market. Additionally, hospitals are key players in UTI research, contributing to the development of more effective treatment protocols. The demand for specialized care in hospitals ensures that this segment remains the largest in the market.

North America Is Largest Region Owing to Healthcare Infrastructure

North America is the largest region in the urinary tract infection treatment market, driven by its advanced healthcare infrastructure and high healthcare spending. The United States, in particular, accounts for a significant portion of the market due to the availability of high-quality medical care and a large population affected by UTIs. Additionally, North America has an established pharmaceutical industry, with major companies producing a wide range of antibiotics and other UTI treatment medications.

The region's large aging population, combined with a high rate of healthcare access, has led to an increasing number of UTI cases, especially among elderly individuals. The effectiveness of UTI treatments, such as antibiotics, and the ease of obtaining prescriptions for such treatments further contribute to North America's dominance in the market. As a result, North America remains the largest market for UTI treatment drugs globally.

Leading Companies and Competitive Landscape

The urinary tract infection treatment market is competitive, with several key players leading the industry in the development and distribution of UTI treatment drugs. Leading companies in this market include Pfizer Inc., Bayer AG, Johnson & Johnson, GlaxoSmithKline, and Sanofi. These companies produce a range of antibiotics, antiseptics, and other drugs that are widely used in the treatment of UTIs.

The competitive landscape is shaped by factors such as product innovation, market penetration, and pricing strategies. Companies are increasingly focusing on developing drugs that can address the rising issue of antibiotic resistance, with new formulations and alternative treatments such as antiseptics and urinary analgesics gaining attention. Strategic partnerships, mergers, and acquisitions are also common in the market, as companies strive to strengthen their portfolios and expand their market reach. As the UTI treatment market evolves, these leading companies continue to drive advancements in treatment options and patient care.

Recent Developments:

- Pfizer Inc. launched a new extended-release antibiotic for the treatment of recurrent urinary tract infections.

- GlaxoSmithKline received regulatory approval for a novel UTI treatment combining an antibiotic and an antiseptic for broader infection control.

- AbbVie Inc. acquired a biotech firm with a promising new UTI drug currently in late-stage clinical trials.

- AstraZeneca announced a partnership with a leading urology care provider to develop new therapies for antibiotic-resistant UTIs.

- Fresenius Kabi launched an intravenous formulation of a leading antibiotic for severe UTIs in hospitalized patients.

List of Leading Companies:

- Pfizer Inc.

- GlaxoSmithKline plc

- Johnson & Johnson (Janssen Pharmaceuticals)

- Sanofi S.A.

- AbbVie Inc.

- Novartis International AG

- Mylan N.V. (Pfizer subsidiary)

- Merck & Co.

- Bayer AG

- AstraZeneca plc

- Fresenius Kabi AG

- Sandoz (Novartis subsidiary)

- Aurobindo Pharma

- Zydus Cadila

- Cipla Limited

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 7.5 Billion |

|

Forecasted Value (2030) |

USD 11.8 Billion |

|

CAGR (2025 – 2030) |

7.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Urinary Tract Infection Treatment Market by Drug Type (Antibiotics, Antiseptics, Urinary Analgesics), by Indication (Cystitis, Pyelonephritis, Urethritis), by Route of Administration (Oral, Intravenous), by End-Use Industry (Hospitals, Outpatient Care), and by Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Pfizer Inc., GlaxoSmithKline plc, Johnson & Johnson (Janssen Pharmaceuticals), Sanofi S.A., AbbVie Inc., Novartis International AG, Merck & Co., Bayer AG, AstraZeneca plc, Fresenius Kabi AG, Sandoz (Novartis subsidiary), Aurobindo Pharma, Cipla Limited |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Urinary Tract Infection Treatment Market, by Drug Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Antibiotics |

|

4.2. Antiseptics |

|

4.3. Urinary Analgesics |

|

5. Urinary Tract Infection Treatment Market, by Indication (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Cystitis (Bladder Infection) |

|

5.2. Pyelonephritis (Kidney Infection) |

|

5.3. Urethritis |

|

6. Urinary Tract Infection Treatment Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Oral |

|

6.2. Intravenous |

|

7. Urinary Tract Infection Treatment Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Outpatient Care |

|

7.3. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Urinary Tract Infection Treatment Market, by Drug Type |

|

8.2.7. North America Urinary Tract Infection Treatment Market, by Indication |

|

8.2.8. North America Urinary Tract Infection Treatment Market, by Route of Administration |

|

8.2.9. North America Urinary Tract Infection Treatment Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Urinary Tract Infection Treatment Market, by Drug Type |

|

8.2.10.1.2. US Urinary Tract Infection Treatment Market, by Indication |

|

8.2.10.1.3. US Urinary Tract Infection Treatment Market, by Route of Administration |

|

8.2.10.1.4. US Urinary Tract Infection Treatment Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Pfizer Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. GlaxoSmithKline plc |

|

10.3. Johnson & Johnson (Janssen Pharmaceuticals) |

|

10.4. Sanofi S.A. |

|

10.5. AbbVie Inc. |

|

10.6. Novartis International AG |

|

10.7. Mylan N.V. (Pfizer subsidiary) |

|

10.8. Merck & Co. |

|

10.9. Bayer AG |

|

10.10. AstraZeneca plc |

|

10.11. Fresenius Kabi AG |

|

10.12. Sandoz (Novartis subsidiary) |

|

10.13. Aurobindo Pharma |

|

10.14. Zydus Cadila |

|

10.15. Cipla Limited |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Urinary Tract Infection Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Urinary Tract Infection Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Urinary Tract Infection Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA