As per Intent Market Research, the Urgent Care Center Market was valued at USD 48.7 billion in 2024-e and will surpass USD 96.9 billion by 2030; growing at a CAGR of 12.2% during 2025 - 2030.

The urgent care center market is expanding rapidly, driven by the growing demand for immediate, non-emergency healthcare services that offer more convenience and accessibility than traditional emergency rooms or primary care offices. Urgent care centers provide a wide range of medical services, including treatment for injuries, infections, diagnostics, and preventive care, with shorter wait times and extended hours compared to hospitals. This model of care has become increasingly popular among patients who seek quick, affordable, and high-quality medical attention without the need for an appointment or long wait times.

Several factors are contributing to the growth of the urgent care center market. The increasing healthcare costs and overcrowding in emergency rooms have encouraged more patients to turn to urgent care centers for conditions that are not life-threatening but still require prompt attention. Additionally, the rising prevalence of chronic conditions, a focus on preventive care, and a growing aging population are all driving more people to seek urgent care services. The market is further supported by technological advancements, such as telemedicine, which enables urgent care centers to offer virtual consultations, broadening access and convenience for patients.

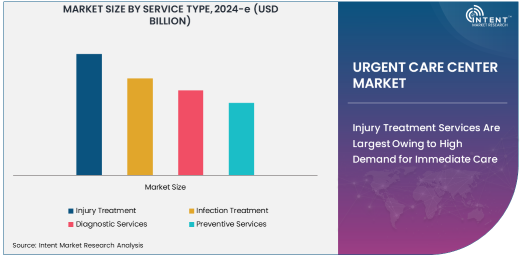

Injury Treatment Services Are Largest Owing to High Demand for Immediate Care

Injury treatment services are the largest segment in the urgent care center market, as these centers are frequently sought for immediate medical attention for minor injuries, including sprains, strains, fractures, and cuts. Unlike emergency rooms, urgent care centers focus on non-life-threatening conditions, making them an ideal choice for individuals seeking quick treatment for injuries that require prompt attention but are not severe enough to warrant a hospital visit. The rapid response time and convenience offered by urgent care centers for treating injuries are key factors driving the demand for these services.

Moreover, the ability of urgent care centers to handle a variety of minor injuries with on-site diagnostics and treatment further solidifies their position as the preferred destination for injury-related care. With the increasing number of active individuals, sports-related injuries, workplace accidents, and accidents during daily activities, the demand for injury treatment services continues to rise. As a result, injury treatment remains the largest service type offered by urgent care centers and is expected to maintain its dominance in the market.

Preventive Services Are Fastest Growing Owing to Rising Focus on Health and Wellness

Preventive services are the fastest-growing service type in the urgent care center market, reflecting a growing emphasis on proactive health management and wellness. These services include routine vaccinations, health screenings, physical exams, and wellness checks aimed at preventing illnesses or detecting them early. As patients become more health-conscious and seek ways to avoid costly medical treatments in the future, urgent care centers have increasingly expanded their offerings to include a broad range of preventive care options.

The rise of chronic diseases, such as diabetes, hypertension, and cardiovascular conditions, has fueled the demand for regular health monitoring and screenings, which are often available at urgent care centers. Additionally, the convenience and accessibility of urgent care centers make them an attractive option for individuals seeking preventive care without the need for long wait times or appointments. The increasing integration of preventive services into the urgent care model is expected to drive significant market growth in this segment, as patients look for cost-effective and timely ways to manage their health and well-being.

Private Ownership Type Is Largest Owing to Increased Investment and Operational Flexibility

Private ownership dominates the urgent care center market, driven by the flexibility, autonomy, and increased investment opportunities it offers. Private urgent care centers are typically owned and operated by healthcare entrepreneurs, physicians, or private equity firms, allowing for more nimble decision-making, tailored services, and a stronger focus on patient satisfaction. These centers often have the freedom to expand quickly, open new locations, and implement innovative care models without the constraints that public ownership may impose.

The growth of private urgent care centers is further fueled by a rising interest in healthcare entrepreneurship and the growing demand for urgent care services. Investors are increasingly recognizing the lucrative potential of urgent care centers as an alternative to the traditional healthcare model, where patients are looking for more accessible, efficient, and affordable care. Additionally, private centers tend to offer more personalized care, which helps attract a loyal patient base. As a result, private ownership remains the largest segment in the urgent care center market and is expected to continue its growth trajectory.

Individual Patients Are Largest End-User Segment Owing to Rising Demand for Accessible Healthcare

Individual patients represent the largest end-user segment in the urgent care center market, driven by the increasing need for accessible, immediate healthcare services. As more people seek convenient care for non-emergency medical issues, individual patients have become the primary users of urgent care centers, utilizing these facilities for a wide range of conditions, including minor injuries, infections, and diagnostic services. Urgent care centers are particularly popular among individuals who do not have access to primary care providers or who require quick treatment outside of normal office hours.

The growing number of individuals without insurance or those with high-deductible insurance plans also contributes to the rise of urgent care center visits, as these centers often provide more affordable care compared to emergency rooms or hospitals. Additionally, as healthcare costs rise, patients are seeking lower-cost alternatives for urgent but non-life-threatening conditions. The ability of urgent care centers to meet the needs of individual patients in a convenient, cost-effective manner ensures that this segment remains the largest and continues to expand.

North America Is the Largest Region Owing to High Demand for Convenient Healthcare

North America is the largest region in the urgent care center market, particularly driven by the United States, where there is a high demand for accessible, immediate healthcare services. The growing number of urgent care centers across the region is reflective of the increasing patient preference for convenient, walk-in care, particularly for non-emergency conditions. In addition, the rising demand for urgent care services is supported by the growing aging population, an increase in chronic diseases, and a greater focus on preventive care.

North America also benefits from a well-established healthcare infrastructure and a relatively high level of awareness among consumers regarding urgent care services. With a large number of private health insurance providers and high patient expectations for fast, affordable, and quality care, the region remains a strong market for urgent care centers. Furthermore, the integration of telemedicine services in urgent care centers has allowed for broader access to healthcare, further solidifying North America's leadership in the urgent care market.

Competitive Landscape: Key Players and Innovations

The urgent care center market is highly competitive, with major players such as HCA Healthcare, American Family Care, and NextCare Urgent Care leading the charge in providing a wide range of urgent care services. These companies are focusing on expanding their network of centers, adopting advanced healthcare technologies, and enhancing the patient experience to stay ahead of the competition. Innovations such as telemedicine services, electronic health records (EHR), and AI-based diagnostics are becoming integral to the urgent care model, allowing companies to offer more efficient, accurate, and patient-centered care.

In addition to large chains, smaller regional players are also gaining traction in the market, focusing on niche services or unique business models to cater to specific patient needs. The competitive landscape is evolving as new entrants continue to open urgent care centers, driven by growing consumer demand for quick and affordable healthcare. Companies are also exploring partnerships with insurance providers and corporate employers to offer integrated care solutions, ensuring continued growth and innovation in the market.

Recent Developments:

- In December 2024, MedExpress Urgent Care announced an expansion plan to add 20 new centers across the U.S. in the next year.

- In November 2024, NextCare Urgent Care launched a new telehealth service to provide virtual consultations to patients.

- In October 2024, American Family Care introduced an updated pricing structure for insurance-covered urgent care services.

- In September 2024, GoHealth Urgent Care partnered with CVS Health to expand their urgent care services across 50 new locations.

- In August 2024, CityMD expanded its presence in the New York area with five new urgent care centers to accommodate growing patient demand.

List of Leading Companies:

- American Family Care, Inc.

- Concentra, Inc.

- NextCare Urgent Care

- FastMed Urgent Care

- MedExpress Urgent Care

- GoHealth Urgent Care

- The Urgent Care Group

- CVS MinuteClinic

- Urgent Care Centers of America

- HCA Healthcare

- CityMD

- Walgreens Healthcare

- Urgent Care Extra

- PhysicianOne Urgent Care

- Centura Health

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 48.7 billion |

|

Forecasted Value (2030) |

USD 96.9 billion |

|

CAGR (2025 – 2030) |

12.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Urgent Care Center Market By Service Type (Injury Treatment, Infection Treatment, Diagnostic Services, Preventive Services), By Ownership Type (Private, Public), By End-User (Individual Patients, Insurance Providers, Corporations and Employers) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

American Family Care, Inc., Concentra, Inc., NextCare Urgent Care, FastMed Urgent Care, MedExpress Urgent Care, GoHealth Urgent Care, The Urgent Care Group, CVS MinuteClinic, Urgent Care Centers of America, HCA Healthcare, CityMD, Walgreens Healthcare, Urgent Care Extra, PhysicianOne Urgent Care, Centura Health |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Urgent Care Center Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Injury Treatment |

|

4.2. Infection Treatment |

|

4.3. Diagnostic Services |

|

4.4. Preventive Services |

|

5. Urgent Care Center Market, by Ownership Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Private |

|

5.2. Public |

|

6. Urgent Care Center Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Individual Patients |

|

6.2. Insurance Providers |

|

6.3. Corporations and Employers |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Urgent Care Center Market, by Service Type |

|

7.2.7. North America Urgent Care Center Market, by Ownership Type |

|

7.2.8. North America Urgent Care Center Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Urgent Care Center Market, by Service Type |

|

7.2.9.1.2. US Urgent Care Center Market, by Ownership Type |

|

7.2.9.1.3. US Urgent Care Center Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. American Family Care, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Concentra, Inc. |

|

9.3. NextCare Urgent Care |

|

9.4. FastMed Urgent Care |

|

9.5. MedExpress Urgent Care |

|

9.6. GoHealth Urgent Care |

|

9.7. The Urgent Care Group |

|

9.8. CVS MinuteClinic |

|

9.9. Urgent Care Centers of America |

|

9.10. HCA Healthcare |

|

9.11. CityMD |

|

9.12. Walgreens Healthcare |

|

9.13. Urgent Care Extra |

|

9.14. PhysicianOne Urgent Care |

|

9.15. Centura Health |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Urgent Care Center Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Urgent Care Center Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Urgent Care Center Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA