As per Intent Market Research, the Urea Cycle Disorder Treatment Market was valued at USD 452.7 million in 2024-e and will surpass USD 983.3 million by 2030; growing at a CAGR of 13.8% during 2025 - 2030.

The urea cycle disorder (UCD) treatment market is expanding due to growing awareness of rare metabolic disorders and advancements in medical research. UCDs are a group of inherited disorders caused by a deficiency in one of the enzymes involved in the urea cycle, the process by which the body eliminates ammonia. Without proper treatment, UCDs can lead to a buildup of toxic levels of ammonia, resulting in serious health complications such as neurological damage, coma, and even death. The market for UCD treatments is driven by the increasing incidence of these rare disorders and the development of novel therapeutic options that offer patients hope for better management and improved outcomes.

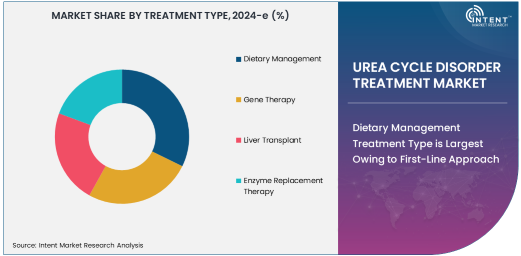

The treatment landscape for UCDs has evolved, with a variety of approaches, including dietary management, gene therapy, liver transplant, and enzyme replacement therapy. These treatments are designed to either directly address the enzyme deficiencies or alleviate the symptoms associated with ammonia toxicity. As healthcare systems and patient advocacy organizations focus on improving the quality of life for individuals with UCDs, the demand for these therapies is expected to continue to rise. Technological advances and ongoing research into gene therapies and enzyme-based treatments further position the UCD treatment market for significant growth in the coming years.

Dietary Management Treatment Type is Largest Owing to First-Line Approach

Dietary management remains the largest treatment approach in the urea cycle disorder treatment market, serving as the cornerstone of UCD management. The primary goal of dietary management is to reduce the levels of ammonia in the blood by carefully controlling protein intake, as protein is broken down into ammonia. For many individuals with UCDs, adhering to a low-protein diet supplemented with specific amino acids is crucial to preventing hyperammonemia and associated complications.

Dietary management is widely adopted due to its non-invasive nature and effectiveness in maintaining ammonia levels within a safe range, particularly in less severe cases or as an adjunct to other treatments. As the most accessible and cost-effective form of treatment, dietary management is often implemented at an early stage of diagnosis and is maintained throughout the patient’s life. While more complex therapies such as gene therapy and enzyme replacement therapy are emerging, dietary management remains the foundation of UCD care, ensuring its dominance in the treatment landscape.

Gene Therapy Treatment Type is Fastest Growing Owing to Breakthrough Innovations

Gene therapy is the fastest-growing treatment type in the urea cycle disorder treatment market, driven by groundbreaking advancements in genetic medicine. Gene therapy aims to address the root cause of UCDs by correcting or replacing the faulty genes responsible for enzyme deficiencies. This approach holds immense promise for providing long-term solutions and potentially curative treatments for patients with UCDs, reducing or even eliminating the need for lifelong dietary management and other therapies.

The development of gene-based therapies for UCDs has seen significant progress in recent years, with clinical trials and early-stage studies showing encouraging results. As gene therapy becomes more accessible and refined, it is expected to revolutionize the treatment landscape, offering a targeted, one-time treatment that addresses the genetic mutations at the heart of the disorder. The potential to alter the disease’s course and provide durable solutions makes gene therapy an exciting and rapidly growing segment within the UCD treatment market.

Citrullinemia Indication is Largest Owing to High Incidence

Citrullinemia is the largest indication in the urea cycle disorder treatment market, driven by its relatively higher incidence compared to other UCDs. Citrullinemia is caused by a deficiency in the enzyme argininosuccinate synthetase, leading to the accumulation of ammonia in the blood. It is one of the more common UCDs, with both acute and chronic forms. The acute form typically manifests in newborns and infants, often leading to life-threatening episodes of hyperammonemia, while the chronic form can present later in childhood or adulthood with milder symptoms.

As the most prevalent UCD, citrullinemia requires comprehensive management strategies, including dietary modifications, medication, and in some cases, liver transplantation. The large number of patients diagnosed with citrullinemia, coupled with the growing availability of innovative therapies, drives the demand for effective treatments. The continued focus on early diagnosis and treatment, along with advancements in genetic research, ensures that citrullinemia will remain the leading indication in the UCD treatment market for the foreseeable future.

Hospitals End-User Segment is Largest Owing to Critical Care and Diagnosis

The hospitals segment is the largest end-user category in the urea cycle disorder treatment market, driven by the critical nature of UCDs and the need for specialized medical care. Hospitals provide the necessary infrastructure for diagnosing and managing UCDs, particularly in severe cases requiring immediate intervention, such as during episodes of hyperammonemia. The availability of specialized healthcare teams, including metabolic specialists, genetic counselors, and dietitians, enables hospitals to offer comprehensive care to patients with UCDs.

In addition to inpatient care, hospitals are also crucial for administering complex treatments such as liver transplants and gene therapy. Patients with severe UCDs often require continuous monitoring and intensive care, which is best provided in a hospital setting. With advancements in diagnostic techniques and an increased focus on rare diseases, hospitals continue to be the primary site for the management and treatment of UCDs, reinforcing their dominance in the market.

North America is the Largest Region Owing to Advanced Healthcare Systems and Research

North America is the largest region for the urea cycle disorder treatment market, primarily due to the advanced healthcare infrastructure, extensive research in genetic disorders, and high healthcare spending in the U.S. and Canada. The region has a well-established network of specialized healthcare providers, including metabolic disease centers and pediatric hospitals, which are equipped to handle complex and rare conditions like UCDs. In addition, North American countries lead in research and development efforts focused on gene therapies, enzyme replacement therapies, and other innovative treatments for UCDs.

The regulatory environment in North America also supports the rapid approval and commercialization of new therapies, further contributing to the growth of the market. Public and private healthcare initiatives focused on rare disease awareness and support for patient advocacy groups are also driving demand for effective treatments. As clinical research continues to make strides, North America remains at the forefront of UCD treatment innovation, making it the largest and most dynamic market for these therapies.

Competitive Landscape: Key Players and Emerging Therapies

The urea cycle disorder treatment market is competitive, with key players such as Vitaflo, Nutricia, and Horizon Therapeutics leading the way in providing dietary solutions and enzyme replacement therapies. These companies focus on developing comprehensive treatment regimens that include specialized nutritional products, amino acid supplements, and other adjunct therapies designed to manage ammonia levels and support metabolic function in UCD patients.

As gene therapy and liver transplant options continue to emerge, biotechnology firms and academic institutions are playing a central role in advancing research and clinical trials. Companies like Synlogic and Regenxbio are at the forefront of developing gene-based treatments, with the potential to transform UCD care. The market is also witnessing strategic collaborations and partnerships between pharmaceutical companies, research institutions, and healthcare providers to accelerate the development of innovative therapies. With a focus on precision medicine and personalized care, the competitive landscape in the UCD treatment market is rapidly evolving, driving new treatment options and improving patient outcomes.

Recent Developments:

- In December 2024, Synlogic Inc. announced promising results from its clinical trial using gene therapy for patients with urea cycle disorders.

- In November 2024, BioMarin Pharmaceutical received approval for a new enzyme replacement therapy for patients with Ornithine Transcarbamylase deficiency.

- In October 2024, Alexion Pharmaceuticals launched a new treatment option that combines dietary management with nitrogen-scavenging therapy for urea cycle disorders.

- In September 2024, Shire Pharmaceuticals initiated a partnership with leading hospitals to provide advanced genetic screening for early detection of urea cycle disorders.

- In August 2024, Nutricia North America expanded its product line for metabolic disorder management, including specialized formulas for urea cycle disorder patients.

List of Leading Companies:

- American Gene Technologies

- Nutricia North America

- Synlogic Inc.

- Sobi (Swedish Orphan Biovitrum AB)

- Alexion Pharmaceuticals

- Baxter International

- Shire Pharmaceuticals

- BioMarin Pharmaceutical

- Genzyme Corporation

- Synthego Corporation

- Amgen Inc.

- AbbVie Inc.

- Regeneron Pharmaceuticals

- Enzo Biochem

- Cytokinetics Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 452.7 million |

|

Forecasted Value (2030) |

USD 983.3 million |

|

CAGR (2025 – 2030) |

13.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Urea Cycle Disorder Treatment Market By Treatment Type (Dietary Management, Gene Therapy, Liver Transplant, Enzyme Replacement Therapy), By Indication (Citrullinemia, Argininosuccinic Aciduria, Ornithine Transcarbamylase Deficiency), By End-User (Hospitals, Specialty Clinics, Homecare Settings) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

American Gene Technologies, Nutricia North America, Synlogic Inc., Sobi (Swedish Orphan Biovitrum AB), Alexion Pharmaceuticals, Baxter International, Shire Pharmaceuticals, BioMarin Pharmaceutical, Genzyme Corporation, Synthego Corporation, Amgen Inc., AbbVie Inc., Regeneron Pharmaceuticals, Enzo Biochem, Cytokinetics Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Urea Cycle Disorder Treatment Market, by Treatment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Dietary Management |

|

4.2. Gene Therapy |

|

4.3. Liver Transplant |

|

4.4. Enzyme Replacement Therapy |

|

5. Urea Cycle Disorder Treatment Market, by Indication (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Citrullinemia |

|

5.2. Argininosuccinic Aciduria |

|

5.3. Ornithine Transcarbamylase Deficiency |

|

5.4. Others |

|

6. Urea Cycle Disorder Treatment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Specialty Clinics |

|

6.3. Homecare Settings |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Urea Cycle Disorder Treatment Market, by Treatment Type |

|

7.2.7. North America Urea Cycle Disorder Treatment Market, by Indication |

|

7.2.8. North America Urea Cycle Disorder Treatment Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Urea Cycle Disorder Treatment Market, by Treatment Type |

|

7.2.9.1.2. US Urea Cycle Disorder Treatment Market, by Indication |

|

7.2.9.1.3. US Urea Cycle Disorder Treatment Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. American Gene Technologies |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Nutricia North America |

|

9.3. Synlogic Inc. |

|

9.4. Sobi (Swedish Orphan Biovitrum AB) |

|

9.5. Alexion Pharmaceuticals |

|

9.6. Baxter International |

|

9.7. Shire Pharmaceuticals |

|

9.8. BioMarin Pharmaceutical |

|

9.9. Genzyme Corporation |

|

9.10. Synthego Corporation |

|

9.11. Amgen Inc. |

|

9.12. AbbVie Inc. |

|

9.13. Regeneron Pharmaceuticals |

|

9.14. Enzo Biochem |

|

9.15. Cytokinetics Inc. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Urea Cycle Disorder Treatment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Urea Cycle Disorder Treatment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Urea Cycle Disorder Treatment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA