As per Intent Market Research, the Urea Breath Test Market was valued at USD 972.2 million in 2024-e and will surpass USD 1,935.2 million by 2030; growing at a CAGR of 12.2% during 2025 - 2030.

The global urea breath test (UBT) market is expanding as diagnostic tools for gastrointestinal disorders gain popularity. The UBT is a non-invasive diagnostic test primarily used to detect Helicobacter pylori (H. pylori) infection, a leading cause of peptic ulcers and gastritis. The test involves patients ingesting a substance containing urea, which is metabolized by H. pylori bacteria, producing carbon dioxide that can be detected in a breath sample. With increasing awareness of digestive health, more individuals are opting for quick and efficient diagnostic solutions like the UBT.

Alongside H. pylori detection, the urea breath test is also being explored for other indications such as gastroparesis, where delayed gastric emptying can impact digestion. As healthcare systems prioritize faster and more accurate diagnostic methods, the urea breath test is becoming a preferred choice for clinicians due to its simplicity, speed, and accuracy. Innovations in test formulations and equipment, as well as growing demand for non-invasive procedures, are driving growth in the market. The adoption of UBT is further aided by its suitability for point-of-care testing, allowing for quicker results and better patient outcomes.

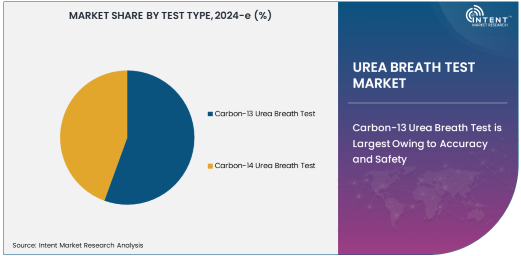

Carbon-13 Urea Breath Test is Largest Owing to Accuracy and Safety

The carbon-13 urea breath test (13C-UBT) segment holds the largest share of the UBT market, primarily due to its superior accuracy and safety profile compared to its counterpart, the carbon-14 urea breath test. The carbon-13 isotope is non-radioactive, making the 13C-UBT a safer option for patients, particularly for repeated testing. This makes it ideal for use in both clinical settings and long-term monitoring, providing reliable results without the risks associated with radioactive exposure.

The 13C-UBT is widely used for diagnosing H. pylori infections, as it is highly sensitive and specific, offering near-instantaneous results in a non-invasive manner. Additionally, the test can be easily performed in various healthcare settings, from hospitals to outpatient clinics, contributing to its widespread adoption. With increasing emphasis on patient safety and convenience, the carbon-13 urea breath test is poised to maintain its market dominance in the coming years.

Helicobacter Pylori Infection Indication is Largest Owing to Prevalence of Infection

The H. pylori infection indication is the largest segment in the urea breath test market, driven by the high global prevalence of this bacterial infection. H. pylori is a major cause of chronic gastritis, peptic ulcers, and is associated with an increased risk of gastric cancer. The global burden of H. pylori infections has led to widespread use of the urea breath test as a non-invasive, effective, and efficient method for diagnosis.

Given its high accuracy and ability to provide rapid results, the UBT is the preferred method for detecting H. pylori in both symptomatic and asymptomatic individuals. The rising awareness of the risks associated with untreated H. pylori infections, as well as the growing availability of UBTs in healthcare settings, continues to drive the growth of this indication. Moreover, as the link between H. pylori and other gastrointestinal conditions becomes better understood, the demand for this diagnostic test is expected to rise.

Hospitals End-User Segment is Largest Owing to Patient Volume and Diagnostic Need

The hospitals segment is the largest end-user category within the urea breath test market, driven by the high volume of patients and the need for accurate diagnostic tests in inpatient and outpatient settings. Hospitals are major centers for diagnosing gastrointestinal conditions, including H. pylori infections, gastroparesis, and other related disorders. The urea breath test provides a quick and reliable way to assess these conditions, making it an integral part of hospital diagnostic workflows.

Hospitals benefit from the ease of integration of UBTs into existing diagnostic platforms, as well as their ability to provide fast results, which are crucial in managing urgent and chronic cases. Additionally, hospitals have the infrastructure and resources to handle larger patient volumes, ensuring the widespread use of UBT for both routine screenings and specialized tests. With a continued focus on improving patient care and diagnostic accuracy, hospitals remain a key driver of growth in the urea breath test market.

North America is the Largest Region Owing to Advanced Healthcare Infrastructure and Awareness

North America is the largest region in the global urea breath test market, largely due to the advanced healthcare infrastructure and high levels of awareness regarding digestive health. The U.S. and Canada are leading the adoption of non-invasive diagnostic tests, driven by robust healthcare systems, high healthcare spending, and well-established medical practices. The rising prevalence of gastrointestinal diseases, including H. pylori infections, among the North American population further contributes to the market's growth.

The regulatory environment in North America also supports the widespread use of UBTs, as both the 13C-UBT and the carbon-14 urea breath test have received regulatory approval from agencies like the FDA. Additionally, increasing efforts from healthcare organizations to promote early detection and preventive care in gastrointestinal health are fostering greater adoption of the UBT in this region. With ongoing research and the development of new, improved diagnostic technologies, North America is expected to remain the largest and most influential market for urea breath tests.

Competitive Landscape: Key Players and Technological Innovation

The urea breath test market is competitive, with key players like Abbott Laboratories, Exalenz Bioscience, and PENTAX Medical leading the way in the development and commercialization of urea breath test devices. These companies focus on expanding their product portfolios, enhancing the accuracy of their tests, and improving ease of use through technological innovations such as portable devices and integrated diagnostic solutions.

Innovation is a significant factor in maintaining competitive advantage, with companies investing in the development of new formulations, such as improved urea solutions, and devices that can provide results even faster and with greater reliability. Additionally, the increasing shift toward point-of-care diagnostics and home testing presents new opportunities for market expansion, with several players exploring ways to make UBTs more accessible to a broader patient base. With a focus on precision, convenience, and cost-efficiency, the competitive landscape remains dynamic, encouraging continuous advancements in the urea breath test market.

Recent Developments:

- In December 2024, Abbott Laboratories introduced a new advanced urea breath test kit that enhances accuracy and reduces testing time.

- In November 2024, Thermo Fisher Scientific partnered with healthcare providers to expand the use of their urea breath test systems across Europe.

- In October 2024, Danaher Corporation launched a next-generation urea breath testing device with improved user interface and test accuracy.

- In September 2024, Merck & Co. received approval for its urea breath test kit in Asia-Pacific markets for broader use in detecting H. pylori.

- In August 2024, Siemens Healthineers developed a new compact urea breath analyzer, making it easier for smaller clinics to implement the test.

List of Leading Companies:

- Abbott Laboratories

- Thermo Fisher Scientific

- Danaher Corporation

- Merck & Co., Inc.

- Siemens Healthineers

- Hikma Pharmaceuticals

- Bio-Rad Laboratories

- General Electric Company (GE Healthcare)

- Agilent Technologies

- F. Hoffmann-La Roche Ltd

- Bruker Corporation

- Cepheid (Danaher)

- Johnson & Johnson

- Becton Dickinson and Company

- Otsuka Pharmaceutical Co., Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 972.2 million |

|

Forecasted Value (2030) |

USD 1,935.2 million |

|

CAGR (2025 – 2030) |

12.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Urea Breath Test Market By Test Type (Carbon-13 Urea Breath Test, Carbon-14 Urea Breath Test), By Indication (Helicobacter Pylori Infection, Gastroparesis), By End-User (Hospitals, Diagnostic Laboratories, Clinics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Abbott Laboratories, Thermo Fisher Scientific, Danaher Corporation, Merck & Co., Inc., Siemens Healthineers, Hikma Pharmaceuticals, Bio-Rad Laboratories, General Electric Company (GE Healthcare), Agilent Technologies, F. Hoffmann-La Roche Ltd, Bruker Corporation, Cepheid (Danaher), Johnson & Johnson, Becton Dickinson and Company, Otsuka Pharmaceutical Co., Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Urea Breath Test Market, by Test Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Carbon-13 Urea Breath Test |

|

4.2. Carbon-14 Urea Breath Test |

|

5. Urea Breath Test Market, by Indication (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Helicobacter Pylori Infection |

|

5.2. Gastroparesis |

|

5.3. Others |

|

6. Urea Breath Test Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Diagnostic Laboratories |

|

6.3. Clinics |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Urea Breath Test Market, by Test Type |

|

7.2.7. North America Urea Breath Test Market, by Indication |

|

7.2.8. North America Urea Breath Test Market, by End-User |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Urea Breath Test Market, by Test Type |

|

7.2.9.1.2. US Urea Breath Test Market, by Indication |

|

7.2.9.1.3. US Urea Breath Test Market, by End-User |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Abbott Laboratories |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Thermo Fisher Scientific |

|

9.3. Danaher Corporation |

|

9.4. Merck & Co., Inc. |

|

9.5. Siemens Healthineers |

|

9.6. Hikma Pharmaceuticals |

|

9.7. Bio-Rad Laboratories |

|

9.8. General Electric Company (GE Healthcare) |

|

9.9. Agilent Technologies |

|

9.10. F. Hoffmann-La Roche Ltd |

|

9.11. Bruker Corporation |

|

9.12. Cepheid (Danaher) |

|

9.13. Johnson & Johnson |

|

9.14. Becton Dickinson and Company |

|

9.15. Otsuka Pharmaceutical Co., Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Urea Breath Test Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Urea Breath Test Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Urea Breath Test Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA