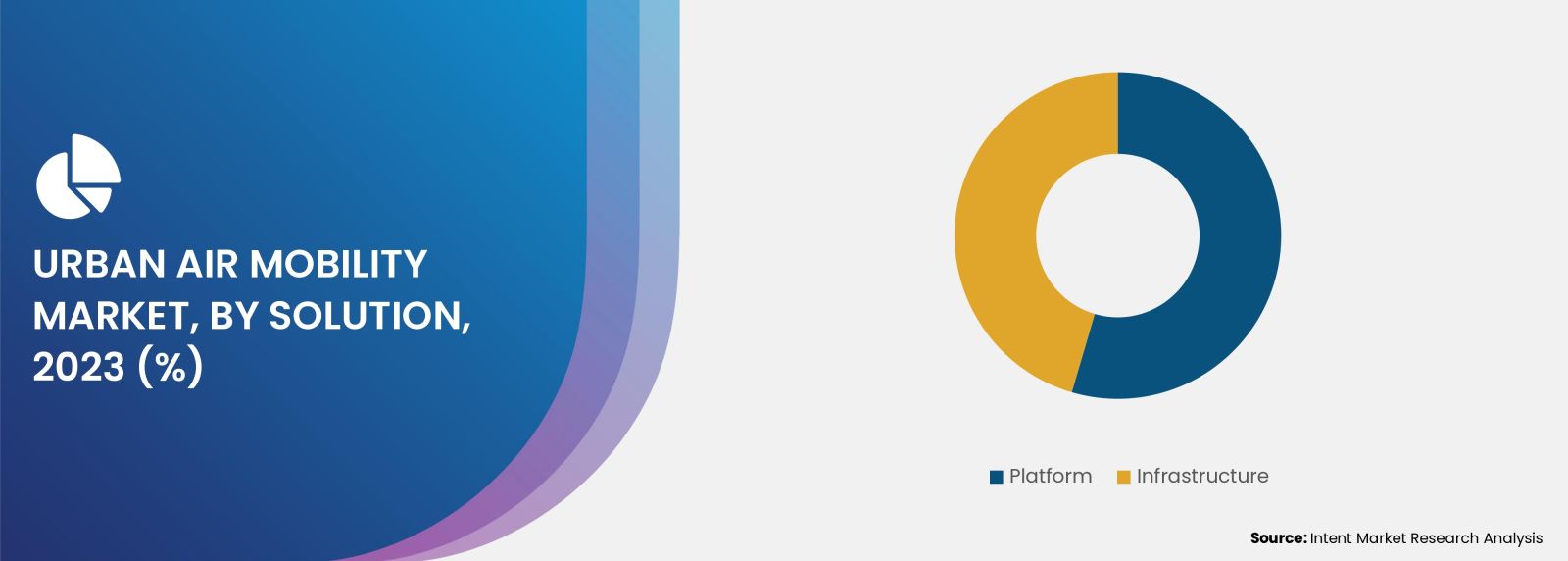

As per Intent Market Research, the Urban Air Mobility Market was valued at USD 1.2 billion in 2023-e and will surpass USD 16.1 billion by 2030; growing at a CAGR of 46.6% during 2024 - 2030. Rising congestion in urban areas and a rising demand for fast and effective transportation drive the market growth. Technological advancements in eVTOL aircraft are anticipated to provide significant growth opportunities for the urban air mobility market.

.jpg)

Click here to: Get FREE Sample Pages of this Report

Urban Air Mobility Market Overview

Urban Air Mobility (UAM) also referred to as Advanced Air Mobility (AAM), is anticipated to revolutionize the transportation industry. It involves the use of small, highly automated aircraft to carry passengers or cargo at lower altitudes in urban and suburban areas. Urban air mobility has the potential to contribute to a multimodal mobility system for cities. UAM can support a wide range of passenger, cargo, and other operations within the urban and semi-urban environment.

Rising demand for fast and effective transportation is driving the market growth

The demand for greener and quieter transportation is driving the emergence of urban air mobility. Trends such as Mobility-as-a-Service (MaaS), ride-sharing, and autonomous vehicles (AVs) contribute to the UAM market. Benefits include reduced travel time, more direct routes, less roadway congestion, and lower aircraft operating costs will offer significant growth opportunities for the market growth.

Segment Analysis

Increasing investment in UAM infrastructure development is driving the growth of vertiport segment

In recent years, several companies have emerged in the UAM market that offer UAM infrastructure solutions to design, engineer, install, and operate UAM infrastructure. Some of the key players in UAM infrastructure solutions are Ferrovial, Groupe ADP, Varon, Vertiport, VPorts, Volatus, Skyports, Skyportz, UrbanV, Urban-Air Port and among others. The key eVTOL manufacturers are actively partnering with UAM infrastructure solution providers to establish their market. For instance, in April 2023, Electro Aero came into partnership with Skyportz to jointly develop “vertiport in a box”. In November 2023, Netherlands Airport Consultants (NACO), a Dutch airport consultancy and engineering firm, came into partnership with Urban-Air Port to support the integration of vertiports into airports. Thus, increasing investment in UAM infrastructure development is driving the growth of the vertiport segment.

Increasing uptake in Lift + Cruise eVTOL aircraft is anticipated to provide significant growth opportunities

The lift + cruise eVTOL aircraft type utilizes separate rotors for forward flight thrust, increasing the complexity of the propulsion system. Transitioning to wing-borne flight reduces power consumption and extends flight duration. Recently, there's been an increase in the development of lift + cruise aircraft types. In February 2022, Autoflight (China) conducted its first eVTOL lift + cruise transition test, and in May 2023, Eve Air Mobility (Brazil) completed wind tunnel testing for its lift + cruise eVTOL aircraft. The increasing adoption of lift + cruise eVTOL aircraft presents significant growth opportunities in the market.

Technological advancements in battery technology is driving the growth of the fully electric segment

The fully electric segment involves aircraft with electric propulsion systems, offering greener alternatives to traditional fuel-powered systems. Advances in lithium-ion batteries have improved specific energy, energy density, and safety, with recent developments enabling super-fast charging. Reduced battery manufacturing costs have fueled the adoption of fully electric urban air mobility vehicles. For instance, in August 2023, Amprius (US) launched a high-power silicon-anode lithium-ion cell for drones and eVTOL aircraft, indicating significant growth opportunities in the urban air mobility market.

Rising popularity of ridesharing and ride-hailing services will drive the air taxi & shuttle segment

Ride-hailing services involve booking customized rides through smartphone apps, connecting commuters with local carpools. The popularity of ridesharing is expected to enhance the cost-effectiveness of urban air mobility services. Key players in the air mobility market are expanding air taxi and shuttle services, with ride-sharing giants such as Uber and Lyft investing in urban air mobility solutions. The growing popularity of ridesharing is driving the air taxi & shuttle segment.

Regional Analysis

Europe is anticipated to grow at a significant pace in the urban air mobility market

Europe's urban air mobility market is growing significantly due to increased emphasis, government initiatives, and collaborations among UAM aircraft manufacturers, cities, and infrastructure companies. Partnerships such as LYTE Aviation (UK) with Volatus Infrastructure & Energy Solutions and Lilium's strategic partnership with Lufthansa in December 2023 showcase the collaborative momentum and to explore commercial eVTOL aircraft operations in Europe. Key players such as Airbus, Lilium, Volocopter, Wingcopter, and Heart Aerospace contribute to Europe's UAM market growth, positioning the region for significant expansion.

Urban air mobility market is highly competitive with the presence of a high number of players

In the urban air mobility market, key players include eVTOL aircraft manufacturers and infrastructure developers. These companies produce various components, including batteries, electrical components, and software. Actively pursuing certifications and expanding portfolios, they face strong competition in a market dominated by a few global players. Notable companies include Airbus, Boeing, EHang, Ferrovial, Joby Aviation, Lilium, Skyports, Volatus, Volocopter, and VPorts, alongside numerous startups.

Following are the key developments in the Urban Air Mobility Market:

- In November 2023, Skyports Infrastructure and ConOps (Japan) came into a partnership to define Japan’s framework for the development and implementation of urban air mobility operations in Japan.

- In March 2023, Ferrovial and Eve Air Mobility partnered to develop urban air mobility solutions in the US and Europe.

Click here to: Get your custom research report today

Urban Air Mobility Market Coverage

The report provides key insights into the urban air mobility market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.2 billion |

|

Forecast Revenue (2030) |

USD 16.1 billion |

|

CAGR (2024-2030) |

46.6% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

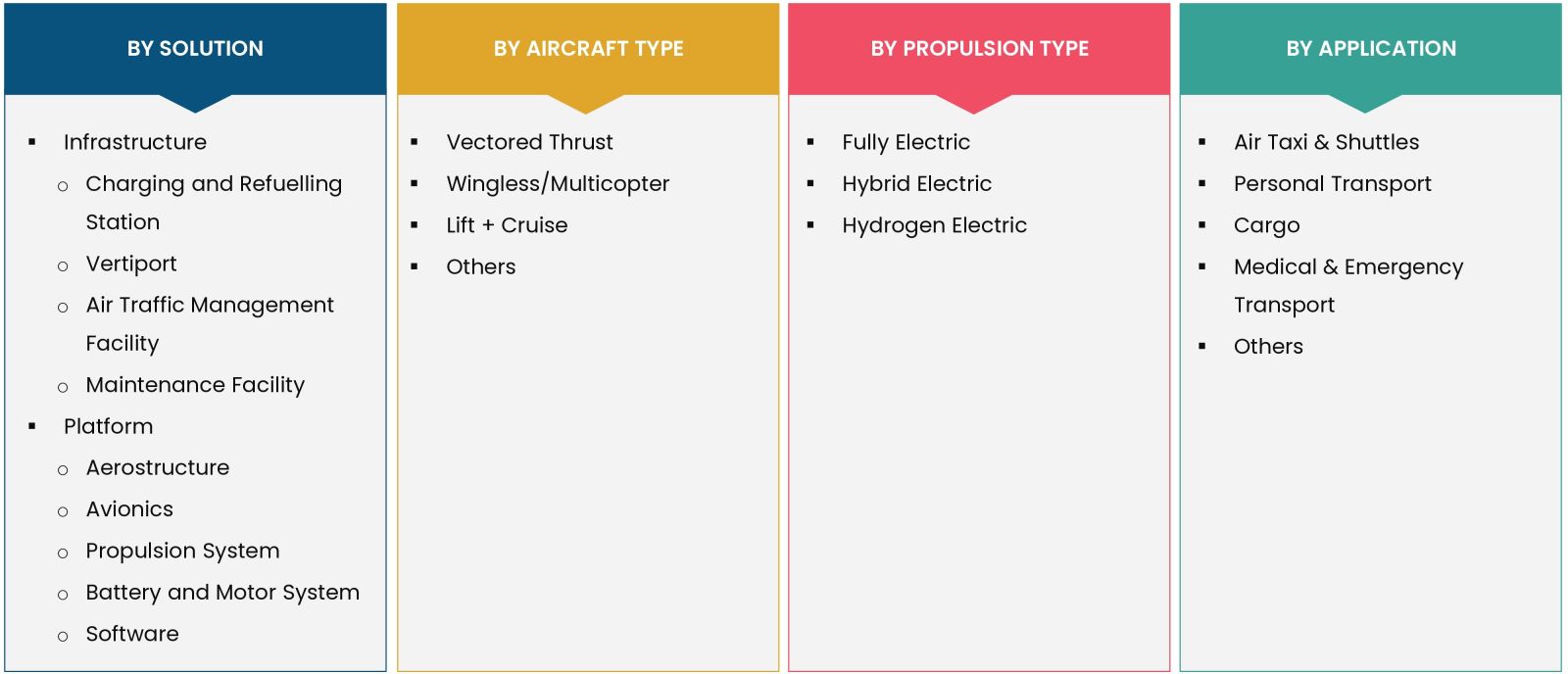

Segments Covered |

Urban Air Mobility Market Size Analysis, By Solution (Infrastructure (Charging Refuelling Station, Vertiport, Air Traffic Management Facility, Maintenance Facility), Platform (Aerostructure, Avionics, Propulsion System, Battery and Motor System, Software), By Aircraft Type (Vectored Thrust, Wingless/Multicopter, Lift + Cruise), By Propulsion Type (Fully Electric, Hybrid Electric, Hydrogen Electric), By Application (Air Taxi & Shuttles, Personal Transport, Cargo, Medical & Emergency Transport), |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico), Middle East and Africa (Saudi Arabia, UAE, South Africa) |

|

Competitive Landscape |

Airbus, Boeing, EHang, Ferrovial, Joby Aviation, Lilium, Skyports, Volatus, Volocopter, and VPorts |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1. Study Assumptions and Market Definition |

|

1.2. Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.1.1. Hugh congestion in urban areas |

|

4.1.2. Rising demand for fast and effective transportation |

|

4.1.3. Rising investments in smart cities |

|

4.2. Market Growth Restraints |

|

4.2.1. Cybersecurity concerns |

|

4.2.2. Regulatory challenges |

|

4.3. Market Growth Opportunities |

|

4.3.1. Technological advancements in UAM aircraft |

|

4.4. Porter’s Five Forces |

|

4.5. PESTLE Analysis |

|

5.Market Outlook |

|

5.1. Supply Chain Analysis |

|

5.2. Regulatory Framework |

|

5.3. Technology Analysis |

|

5.4. Patent Analysis |

|

5.5. Venture Capital Investment Analysis |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1. Segment Synopsis |

|

6.2. By Solution |

|

6.2.1. Infrastructure |

|

6.2.1.1. Charging and Refueling Station |

|

6.2.1.2. Vertiport |

|

6.2.1.3. Air Traffic Management Facility |

|

6.2.1.4. Maintenance Facility |

|

6.2.2. Platform |

|

6.2.2.1. Avionics |

|

6.2.2.2. Aerostructure |

|

6.2.2.3. Propulsion System |

|

6.2.2.4. Battery and Motor System |

|

6.2.2.5. Software |

|

6.3. By Aircraft Type |

|

6.3.1. Vectored Thrust |

|

6.3.2. Wingless/Multicopter |

|

6.3.3. Lift + Cruise |

|

6.3.4. Others |

|

6.4. By Propulsion Type |

|

6.4.1. Fully Electric |

|

6.4.2. Hybrid Electric |

|

6.4.3. Hydrogen Electric |

|

6.5. Application |

|

6.5.1. Air Taxi & Shuttles |

|

6.5.2. Personal Transport |

|

6.5.3. Cargo |

|

6.5.4. Medical & Emergency Transport |

|

6.5.5. Others |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1. Global Market Synopsis |

|

7.2. North America |

|

7.2.1. North America Urban Air Mobility Market Outlook |

|

7.2.2. US |

|

7.2.2.1. US Urban Air Mobility Market, By Solution |

|

7.2.2.2. US Urban Air Mobility Market, By Solution, for Platform |

|

7.2.2.3. US Urban Air Mobility Market, By Solution, for Infrastructure |

|

7.2.2.4. US Urban Air Mobility Market, By Aircraft Type |

|

7.2.2.5. US Urban Air Mobility Market, By Propulsion Type |

|

7.2.2.6. US Urban Air Mobility Market, By Application |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3. Canada |

|

7.3. Europe |

|

7.3.1. Europe Urban Air Mobility Market Outlook |

|

7.3.2. Germany |

|

7.3.3. UK |

|

7.3.4. France |

|

7.3.5. Italy |

|

7.4. Asia-Pacific |

|

7.4.1. Asia-Pacific Urban Air Mobility Market Outlook |

|

7.4.2. China |

|

7.4.3. India |

|

7.4.4. Japan |

|

7.4.5. South Korea |

|

7.5. Middle East & Africa |

|

7.5.1. Middle East & Africa Urban Air Mobility Market Outlook |

|

7.5.2. Saudi Arabia |

|

7.5.3. UAE |

|

7.5.4. South Africa |

|

7.6. Latin America |

|

7.6.1. Latin America Urban Air Mobility Market Outlook |

|

7.6.2. Brazil |

|

7.6.3. Mexico |

|

8.Competitive Landscape |

|

8.1. Market Share Analysis |

|

8.2. Company Strategy Analysis |

|

8.3. Competitive Matrix |

|

9.Company Profiles |

|

9.1. Airbus |

|

9.1.1. Company Synopsis |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

*Note: All the companies in section 9.1 will cover the same sub-chapters as above. |

|

9.2. Boeing |

|

9.3. Eve Holding |

|

9.4. EHang |

|

9.5. Ferrovial |

|

9.6. Joby Aviation |

|

9.7. Lilium |

|

9.8. Skyports |

|

9.9. Volatus |

|

9.10. Volocopter |

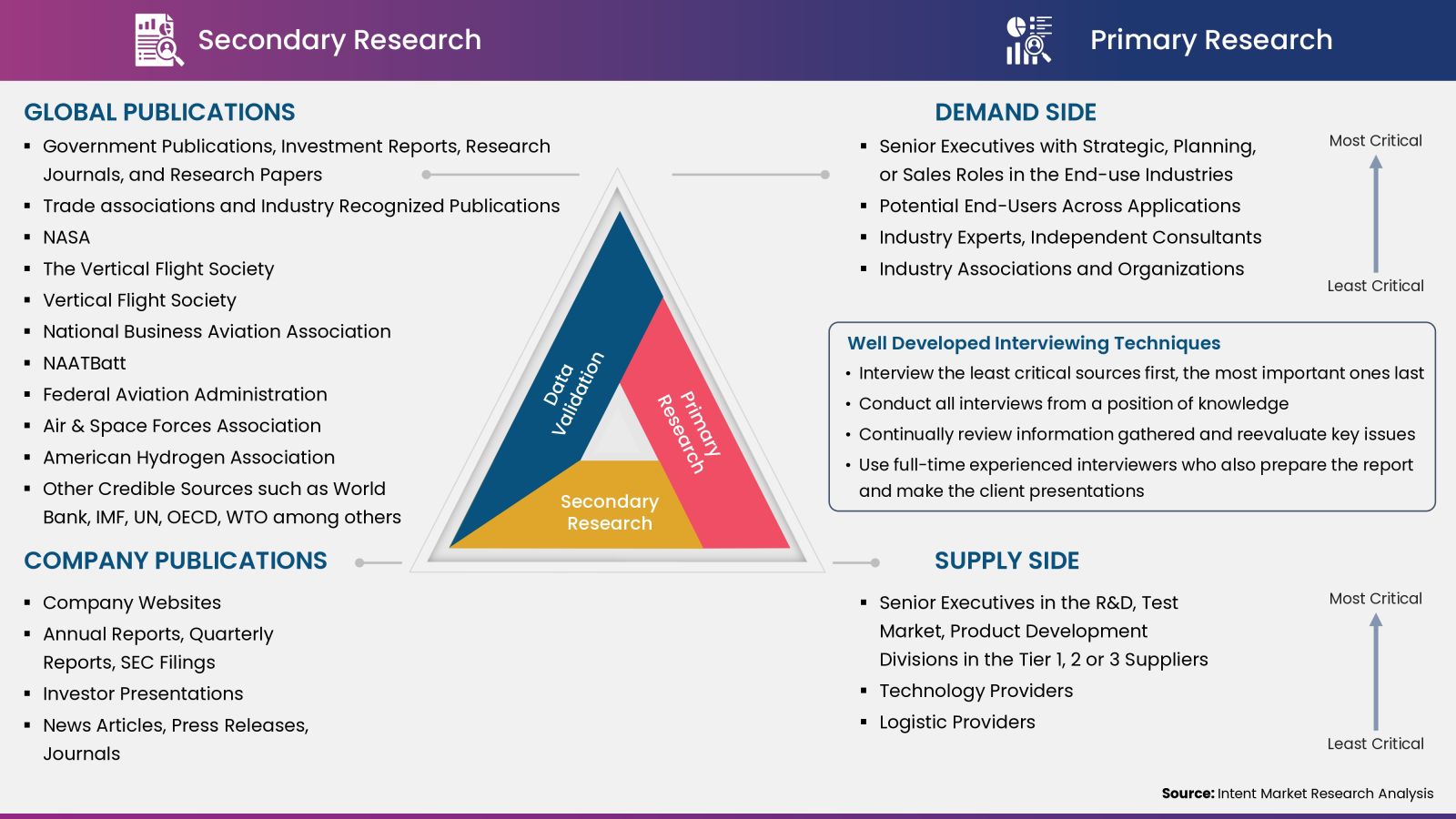

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.