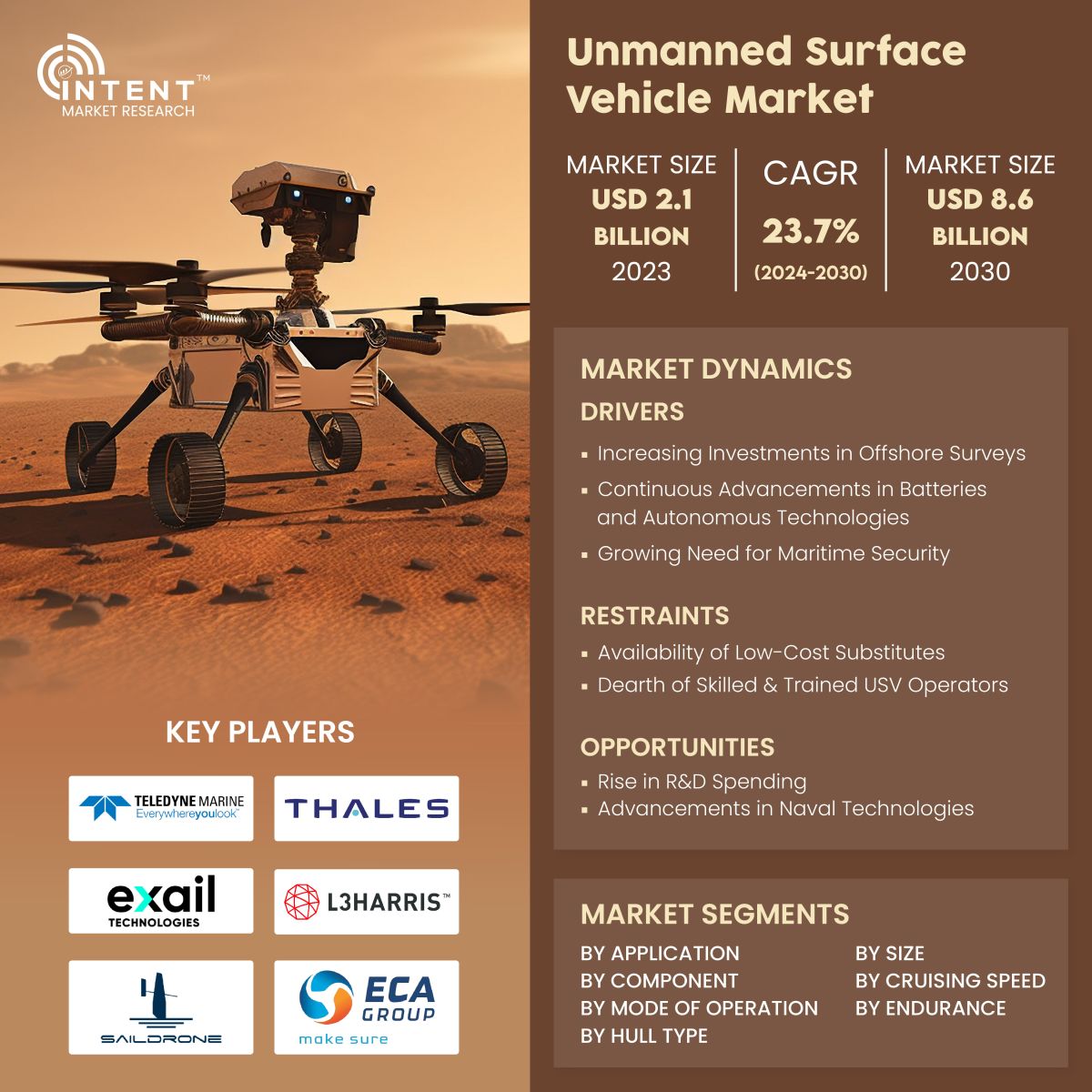

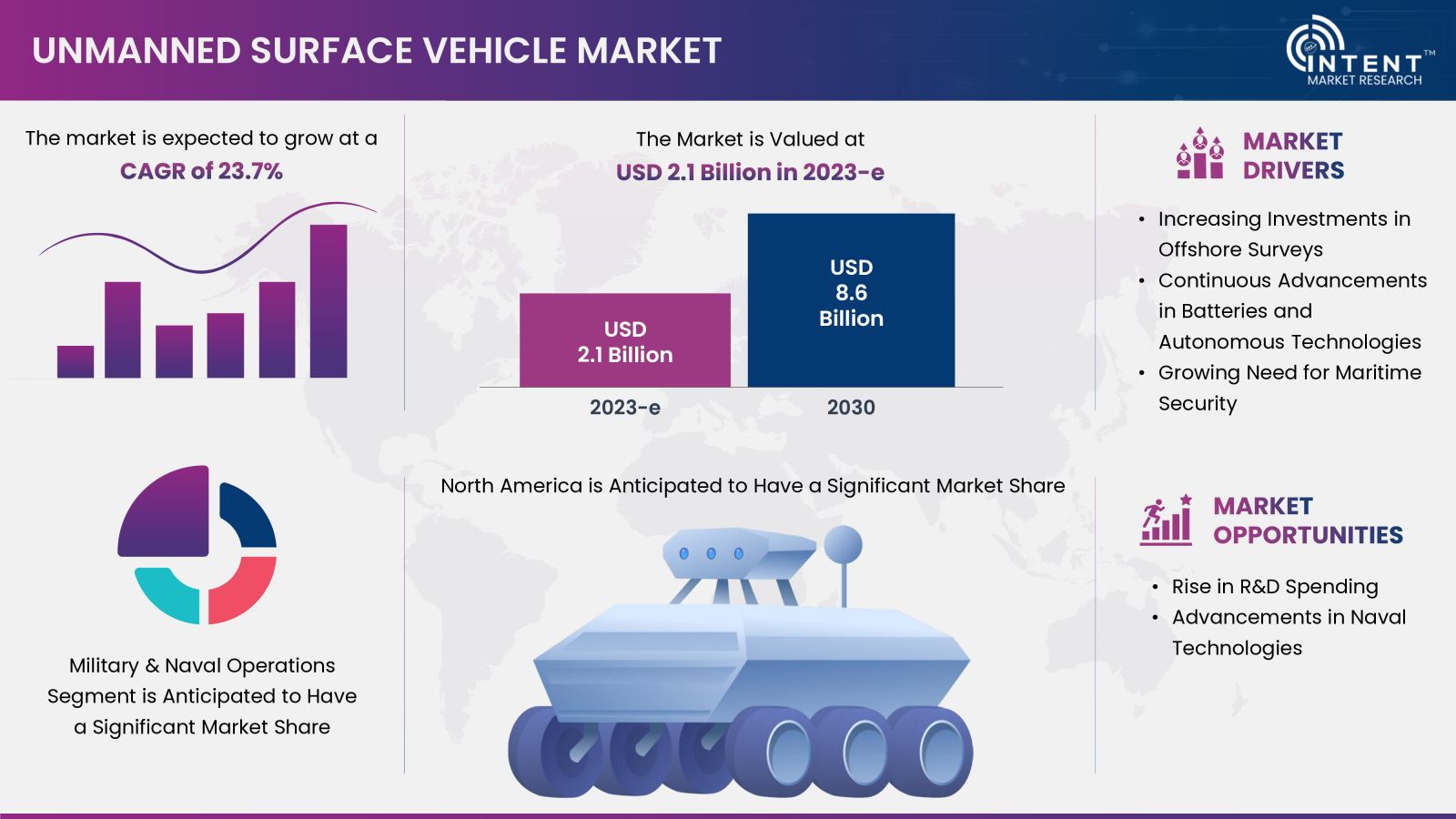

According to Intent Market Research, the Unmanned Surface Vehicle Market is expected to grow from USD 2.1 billion in 2023-e at a CAGR of 23.7% to touch USD 8.6 billion by 2030. The unmanned surface vehicle market is competitive, the prominent players in the global market include CHC Navigation, ECA Group, Elbit Systems, Exail Technologies, Fugro, L3Harris, Saildrone, Teledyne Marine, Textron, and Thales. USVs are new-age, intelligent systems that can navigate on the water surface partially or completely autonomously. These systems are equipped with a variety of sensors, special equipment, and weapons to perform a range of tasks such as anti-mine, anti-submarine, anti-ship, maritime security, and electronic warfare on the water surface.

Click here to: Get FREE Sample Pages of this Report

As a novel type of surface mobile platform, USVs can complete tasks partially or completely autonomously, making them a valuable asset for long-term research tasks and engineering projects in a large area on the water surface. Compared to other conventional marine equipment, USVs have the characteristics of low maintenance cost, low energy consumption, and long continuous operation time. They are the perfect solution for those who want to get the job done efficiently and effectively.

Increasing Investments in Offshore Surveys is Driving the Market

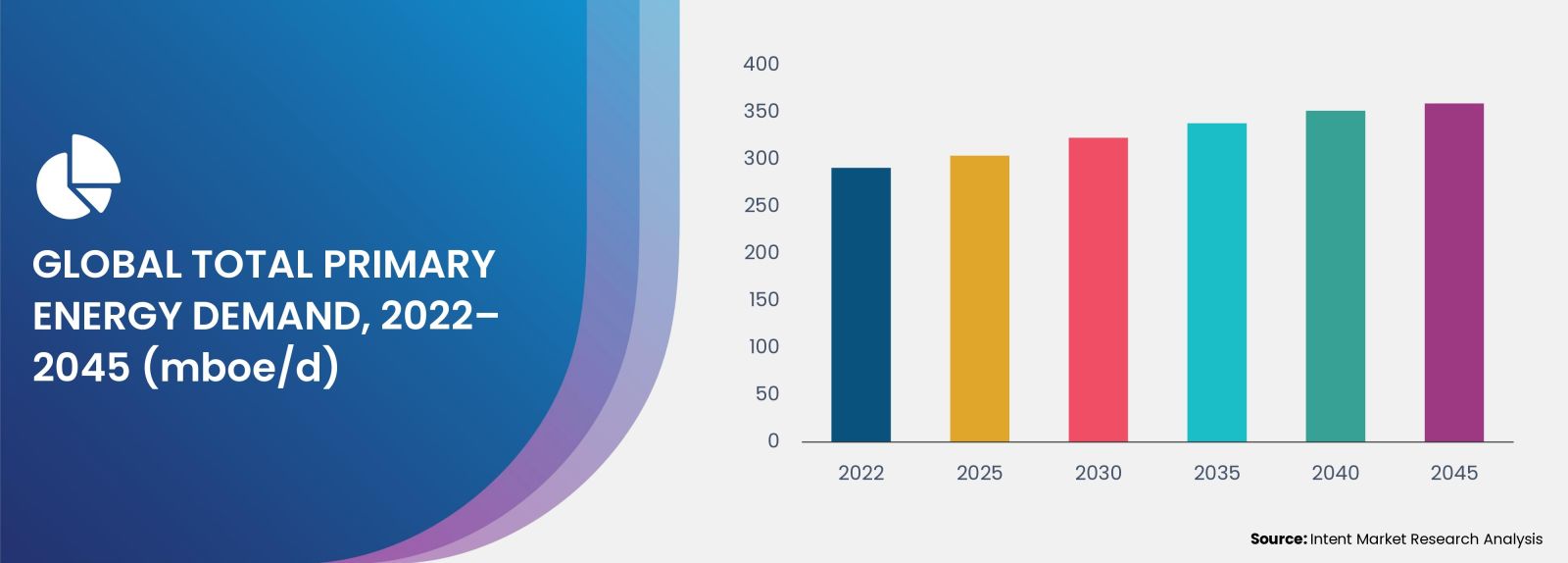

Offshore seismic surveys, also known as marine seismic surveys are critical surveys for oil & gas exploration. The offshore surveys are primarily used to discover mineral reserves and natural gas and are driven by the surging demand for oil & gas. According to the OPEC World Oil Outlook 2023, global primary energy demand is anticipated to increase from around 291 million barrels of oil equivalent per day (mboe/d) in 2022 to around 359 mboe/d in 2045, an increase of about 23% over the forecast period.

There is a strong non-OECD oil demand growth owing to the rising population and urbanization, expansion of the middle-class population, robust economic growth, vehicle fleet growth, and agriculture sector shifts. Owing to the above factors, seismic and surveying companies are actively investing in USVs for offshore surveys. Thus, surging demand for oil & gas is driving demand for unmanned surface vehicles.

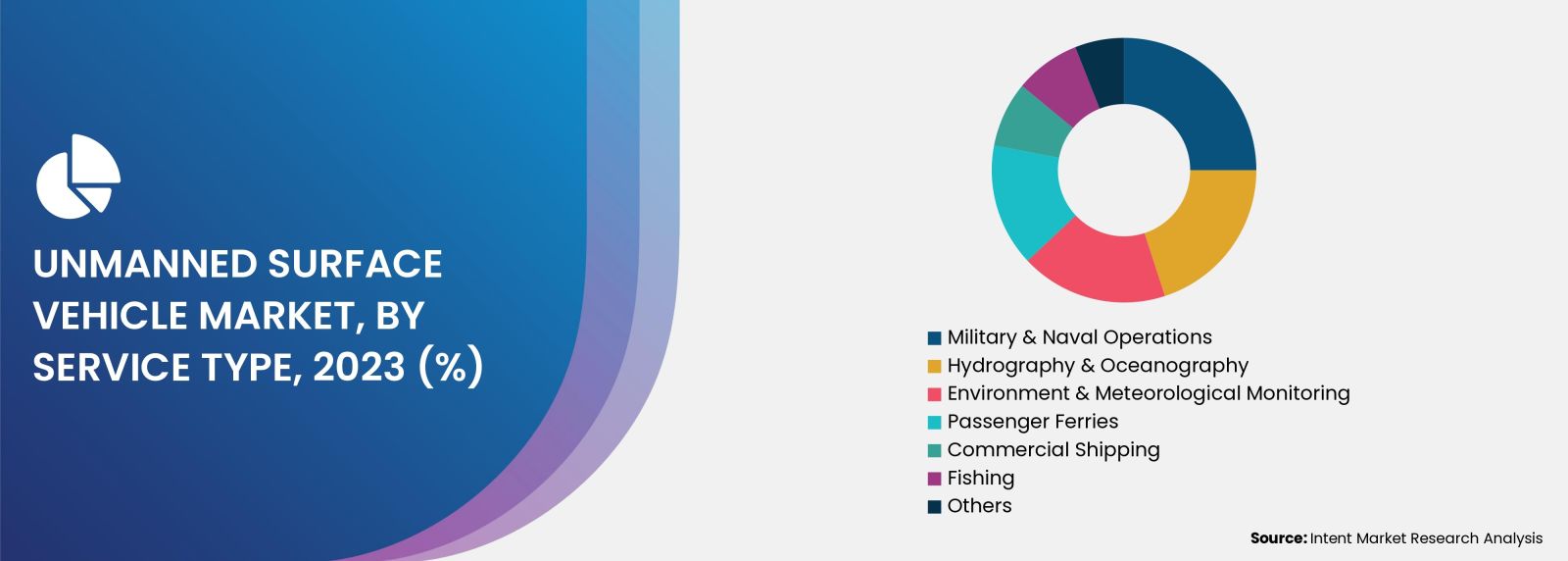

Segment Analysis

Growing Offshore Infrastructure Investments is Driving Demand for Hydrographic Surveys

The global infrastructure sector is set for significant expansion, driven by increasing investments in offshore wind infrastructure, offshore oil and gas infrastructure, construction services, and water infrastructure. Hydrographic surveys are critical for such offshore infrastructure development. According to the Global Wind Energy Council, the global offshore wind capacity reached 64.3 GW across three continents and 19 countries in 2022, accounting for 7.1% of global wind power installation. With an anticipated offshore wind capacity surpassing 380 GW by 2030, the global surge in infrastructure investments is propelling the demand for hydrographic surveys.

In February 2021, Sonardyne collaborated with HydroSurv Unmanned Survey to develop and demonstrate seabed-to-shore technologies for the offshore wind industry. Thus, increasing developments in offshore infrastructure projects are driving the USV market.

Innovations in Power & Propulsion Systems are Augmenting the USV Market Growth

In recent years, there have been significant advancements in power and propulsion systems that have transformed the use of USVs. The batteries now have improved specific energy and energy density, offer longer lifetimes, and have increased safety. The companies are actively developing USVs with greener alternatives to the traditional fuel-powered propulsion systems.

For instance, in June 2023 Ørsted launched USV for offshore wind farms. It is powered by solar panels and small wind turbines. In August 2023, RC Dock (Netherlands), a marine robotics manufacturer and shipyard launched a USV powered by a combination of 100% biofuel and a hybrid propulsion system. Thus, innovations in power & propulsion systems are augmenting the USV market growth.

Advances in Autonomous Technologies are Anticipated to Provide Significant Opportunities for the Adoption of USVs

The ever-evolving automation is leading to a rise in adoption of the USVs for commercial and industrial use. Autonomous USVs can operate without a crew and are expected to bring safer and more efficient operations. Autonomous USVs can reduce accidents, alleviate seafarer shortages, save fuel, and improve productivity. Autonomous USVs also find an increase in demand for military & navy operations. Thus, advances in autonomous technologies are anticipated to provide significant opportunities for the adoption of USVs.

Increasing Product Launches with Double-Hull Designs are Driving the Segment’s Growth

Double-hull ships offer several advantages over conventional displacement hulls. They tend to have greater stability, higher speeds, and increased fuel efficiency. Additionally, they usually are less deep and suit small boats for offshore or lake hydrographic and bathymetry surveying. Increasing product launches with double-hull designs are driving the segment’s growth. For instance, in November 2023, Unique Group launched Uni-Max with the double-hull design. Thus, the double-hull segment is anticipated to have a significant market share.

Increasing Demand for Heavy Payload Capacity Unmanned Surface Vehicle is Driving Demand for Large USV

The Large Unmanned Surface Vessel (LUSV) is a class of optionally or lightly manned vessels that are between 200 to 300 ft. in length. There’s an increasing demand for heavy payload capacity USVs. There’s an increasing investment by the military for LUSV which is driving the market growth. For instance, in July 2022, Naval Sea Systems Command (NAVSEA) awarded contract modifications to the six contracts involving LUSV concept refinement and design specification study to Huntington Ingalls, Lockheed Martin, Bollinger Shipyards Lockport, Marinette Marine, Gibbs & Cox and Austal USA. As technology continues to evolve, companies are launching larger USVs with higher payload capacity to meet the demand. Thus, increasing developments in improving the payload capacity are driving the market growth.

Advances in Power and Propulsion Technology Are Expected to Provide Significant Growth Opportunities for Extended Endurance USVs

There’s an increasing demand for long-range unmanned surface vehicles owing to a need for efficient and affordable parcel transportation over long distances. Long-range autonomous USVs can help in the transportation of cargo, conducting extended hydrographic and oceanic surveys, and intelligence, surveillance, and reconnaissance (IRS) missions. They can be used for access to difficult-to-reach locations.

Technological advances are driving the endurance time for the USVs. For instance, Saildrone offers Explorer SD 1045 USV that can operate in maritime areas to perform data collection missions with an endurance of 365 days. Thus, the need for long-range autonomous USVs is expected to drive the segment growth.

Growing Demand for High-Performance USVs is Driving Market Growth

Speeds greater than 30 knots are considered to be fast USVs. In recent years, there has been increasing demand by the military and navy for fast USVs. The companies are actively launching products to meet the demand. For instance, in June 2023, MARTAC launched the Devil Ray T24, the newest Autonomous Surface Vehicle (ASV) system in their portfolio of Multi-Domain, High-Performance USVs. Thus, growing demand for high-speed USVs is driving the market growth.

Regional Analysis

Growing Domestic Military Capabilities in Asia-Pacific is Anticipated to Provide Lucrative Growth Opportunities

Asia-Pacific has a huge potential in the unmanned surface vehicle market owing to the robust growth in economies and rising focus on growing domestic military capabilities. The growing military power of China has been a source of increasing concern in the Indo-Pacific region driving the market growth.

In addition, there has been an uptick in USV manufacturing capabilities in the region. For instance, in February 2023, Poly Technologies (China) unveiled a brand new unmanned surface vehicle, A45 at NAVDEX 2023 exhibition in Abu Dhabi, UAE. In July 2023, the Indian Navy tested its first indigenously developed unmanned surface vessel for surveillance and minesweeping. Thus, Asia-Pacific is anticipated to be among the fastest-growing regions in the unmanned surface vehicle market.

Unmanned Surface Vehicle Market is Highly Competitive

Companies operating within the unmanned surface vehicle market are primarily USV manufacturers, shipbuilders and shipyards, surveying companies, and military shipbuilding companies. The companies are expanding their product portfolios with the growing demand for USVs. The USV market is highly competitive with few big global players and a rising number of startups entering the market. The key companies in the market are CHC Navigation, ECA Group, Elbit Systems, Exail Technologies, Fugro, L3Harris, Saildrone, Teledyne Marine, Textron, Thales, among others.

Following are some key developments in the unmanned surface vehicle market:

- In November 2023, CHC Navigation (CHCNAV) launched the Apache 3 Pro, a compact hydrographic USV designed for autonomous bathymetric surveys in shallow waters.

- In September 2022, Exail Technologies was awarded a contract by DGA for USV as part of the future hydrographic and oceanographic capability (CHOF) program for the French Navy

Click here to: Get your custom research report today

Unmanned Surface Vehicle Market Coverage

The report provides key insights into the unmanned surface vehicle market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 2.1 billion |

|

Forecast Revenue (2030) |

USD 8.6 billion |

|

CAGR (2024-2030) |

23.7% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

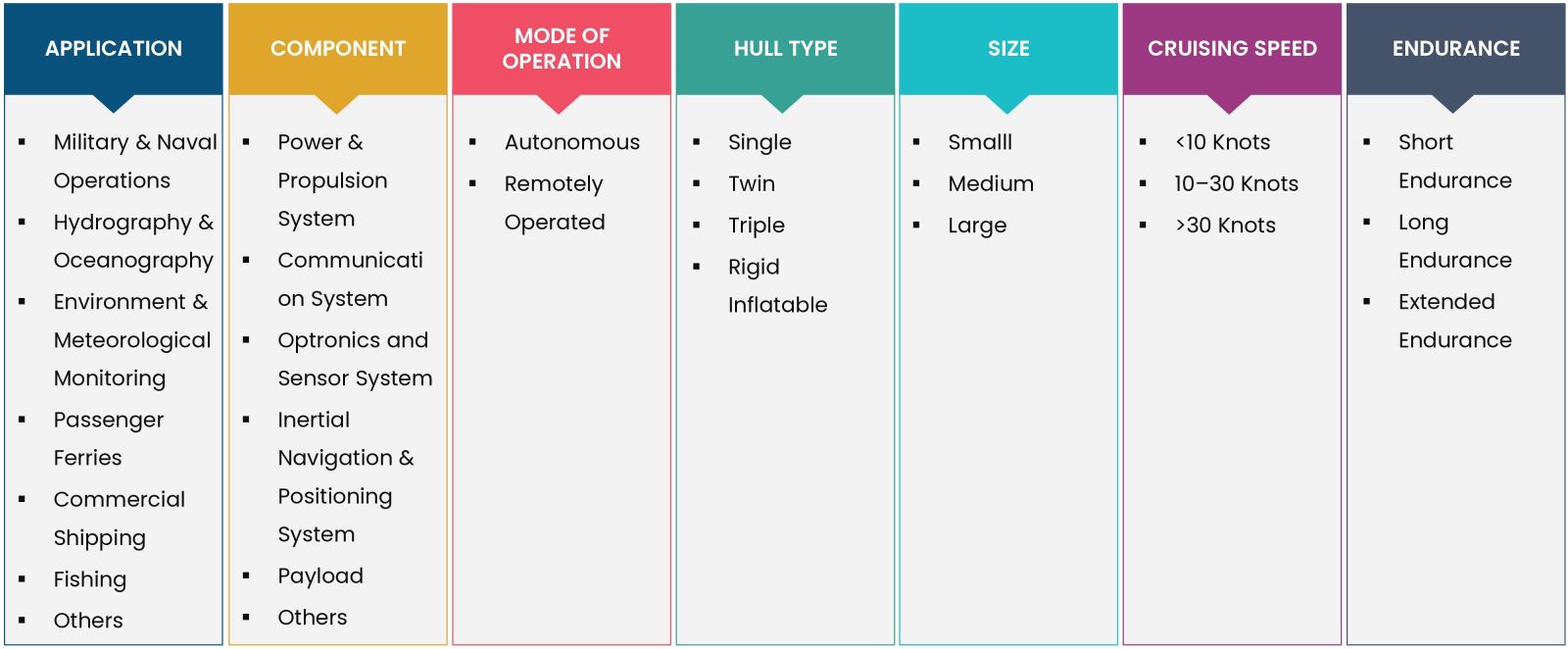

By Application (Military & Naval Operations, Hydrography & Oceanography, Environment & Meteorological Monitoring, Commercial Shipping, Passenger Ferries, Fishing, Others), By Component (Power & Propulsion System, Communication System, Optronics and Sensor System, Inertial Navigation & Positioning System, Payload, Others), By Mode of Operation (Autonomous, Remotely Operated), By Hull Type (Single, Twin, Triple, Rigid Inflatable), By Size (Small, Medium, Large), By Cruising Speed (<10 Knots, 10–30 Knots, >30 Knots), By Endurance (Short Endurance, Long Endurance, Extended Endurance) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia-Pacific (China, India, Japan, South Korea, Australia), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, UAE, South Africa) |

|

Competitive Landscape |

CHC Navigation, ECA Group, Elbit Systems, Exail Technologies, Fugro, L3Harris, Saildrone, Teledyne Marine, Textron, and Thales |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

|

|

1.1.Study Assumptions and Market Definition |

|

|

|

1.2.Scope of the Study |

|

|

|

2.Research Methodology |

|

|

|

3.Executive Summary |

|

|

|

4.Market Dynamics |

|

|

|

4.1.Market Growth Drivers |

|

|

|

4.1.1.Increasing Investments in Offshore Surveys |

|

|

|

4.1.2.Continuous Advancements in Batteries and Autonomous Technologies |

|

|

|

4.1.3.Growing Need for Maritime Security |

|

|

|

4.1.4.Favorable Regulatory Changes |

|

|

|

4.2.Market Growth Restraints |

|

|

|

4.2.1.The Dearth of Skilled & Trained USV operators |

|

|

|

4.3.Market Growth Opportunities |

|

|

|

4.3.1.Rise in R&D Spending |

|

|

|

4.3.2.Advancements in Naval Technologies |

|

|

|

4.4.Porter’s Five Forces |

|

|

|

4.5.PESTLE Analysis |

|

|

|

5.Market Outlook |

|

|

|

5.1.Supply Chain Analysis |

|

|

|

5.2.Regulatory Framework |

|

|

|

5.3.Technology Analysis |

|

|

|

5.4.Patent Analysis |

|

|

|

5.5.Startup Ecosystem |

|

|

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

|

|

6.1.Segment Synopsis |

|

|

|

6.2.By Application |

|

|

|

6.2.1.Military & Naval Operations |

|

|

|

6.2.2.Hydrography & Oceanography |

|

|

|

6.2.3.Environment & Meteorological Monitoring |

|

|

|

6.2.4.Passenger Ferries |

|

|

|

6.2.5.Commercial Shipping |

|

|

|

6.2.6.Fishing |

|

|

|

6.2.7.Others |

|

|

|

6.3.By Component |

|

|

|

6.3.1.Power & Propulsion System |

|

|

|

6.3.2.Communication System |

|

|

|

6.3.3.Optronics and Sensor System |

|

|

|

6.3.4.Inertial Navigation & Positioning System |

|

|

|

6.3.5.Payload |

|

|

|

6.3.6.Others |

|

|

|

6.4.By Mode of Operation |

|

|

|

6.4.1.Autonomous |

|

|

|

6.4.2.Remotely Operated |

|

|

|

6.5.By Hull Type |

|

|

|

6.5.1.Single |

|

|

|

6.5.2.Twin |

|

|

|

6.5.3.Triple |

|

|

|

6.5.4.Rigid Inflatable |

|

|

|

6.6.By Size |

|

|

|

6.6.1.Smalll |

|

|

|

6.6.2.Medium |

|

|

|

6.6.3.Large |

|

|

|

6.7.By Cruising Speed |

|

|

|

6.7.1.<10 Knots |

|

|

|

6.7.2.10–30 Knots |

|

|

|

6.7.3.>30 Knots |

|

|

|

6.8.By Endurance |

|

|

|

6.8.1.Short Endurance |

|

|

|

6.8.2.Long Endurance |

|

|

|

6.8.3.Extended Endurance |

|

|

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

|

|

7.1.Global Market Synopsis |

|

|

|

7.2.North America |

|

|

|

7.2.1.North America Unmanned Surface Vehicle Market Outlook |

|

|

|

7.2.2.US |

|

|

|

|

7.2.2.1.US Unmanned Surface Vehicle Market, By Application |

|

|

|

7.2.2.2.US Unmanned Surface Vehicle Market, By Component |

|

|

|

7.2.2.3.US Unmanned Surface Vehicle Market, By Mode of Operation |

|

|

|

7.2.2.4.US Unmanned Surface Vehicle Market, By Hull Type |

|

|

|

7.2.2.5.US Unmanned Surface Vehicle Market, By Size |

|

|

|

7.2.2.6.US Unmanned Surface Vehicle Market, By Cruising Speed |

|

|

|

7.2.2.7.US Unmanned Surface Vehicle Market, By Endurance |

|

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

|

|

7.2.3.Canada |

|

|

|

7.3.Europe |

|

|

|

7.3.1.Europe Unmanned Surface Vehicle Market Outlook |

|

|

|

7.3.2.Germany |

|

|

|

7.3.3.UK |

|

|

|

7.3.4.France |

|

|

|

7.3.5.Italy |

|

|

|

7.3.6.Spain |

|

|

|

7.4.Asia-Pacific |

|

|

|

7.4.1.Asia-Pacific Unmanned Surface Vehicle Market Outlook |

|

|

|

7.4.2.China |

|

|

|

7.4.3.India |

|

|

|

7.4.4.Japan |

|

|

|

7.4.5.South Korea |

|

|

|

7.4.6.Australia |

|

|

|

7.5.Latin America |

|

|

|

7.5.1.Latin America Unmanned Surface Vehicle Market Outlook |

|

|

|

7.5.2.Brazil |

|

|

|

7.5.3.Mexico |

|

|

|

7.6.Middle East & Africa |

|

|

|

7.6.1.Middle East & Africa Unmanned Surface Vehicle Market Outlook |

|

|

|

7.6.2.Saudi Arabia |

|

|

|

7.6.3.UAE |

|

|

|

7.6.4.South Africa |

|

|

|

8.Competitive Landscape |

|

|

|

8.1.Market Share Analysis |

|

|

|

8.2.Company Strategy Analysis |

|

|

|

8.3.Competitive Matrix |

|

|

|

9.Company Profiles |

|

|

|

9.1.CHC Navigation |

|

|

|

9.1.1.Company Synopsis |

|

|

|

9.1.2.Company Financials |

|

|

|

9.1.3.Product/Service Portfolio |

|

|

|

9.1.4.Recent Developments |

|

|

|

*Note: All the companies in section 9.1 will cover the same sub-chapters as above. |

|

|

|

9.2.ECA Group |

|

|

|

9.3.Elbit Systems |

|

|

|

9.4.Exail Technologies |

|

|

|

9.5.Fugro |

|

|

|

9.6.L3Harris |

|

|

|

9.7.Saildrone |

|

|

|

9.8.Teledyne Marine |

|

|

|

9.9.Textron |

|

|

|

9.10. Thales |

|

|

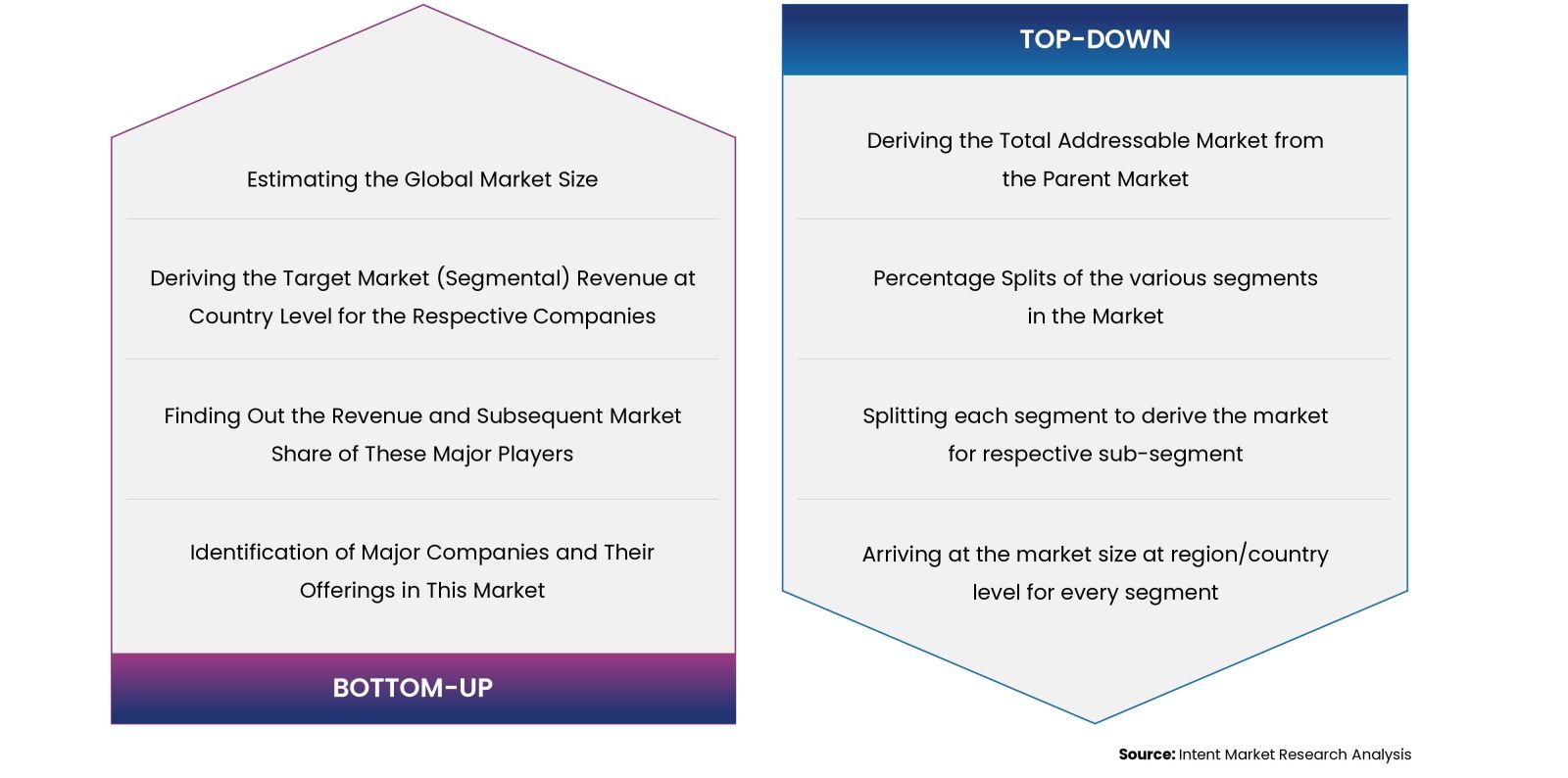

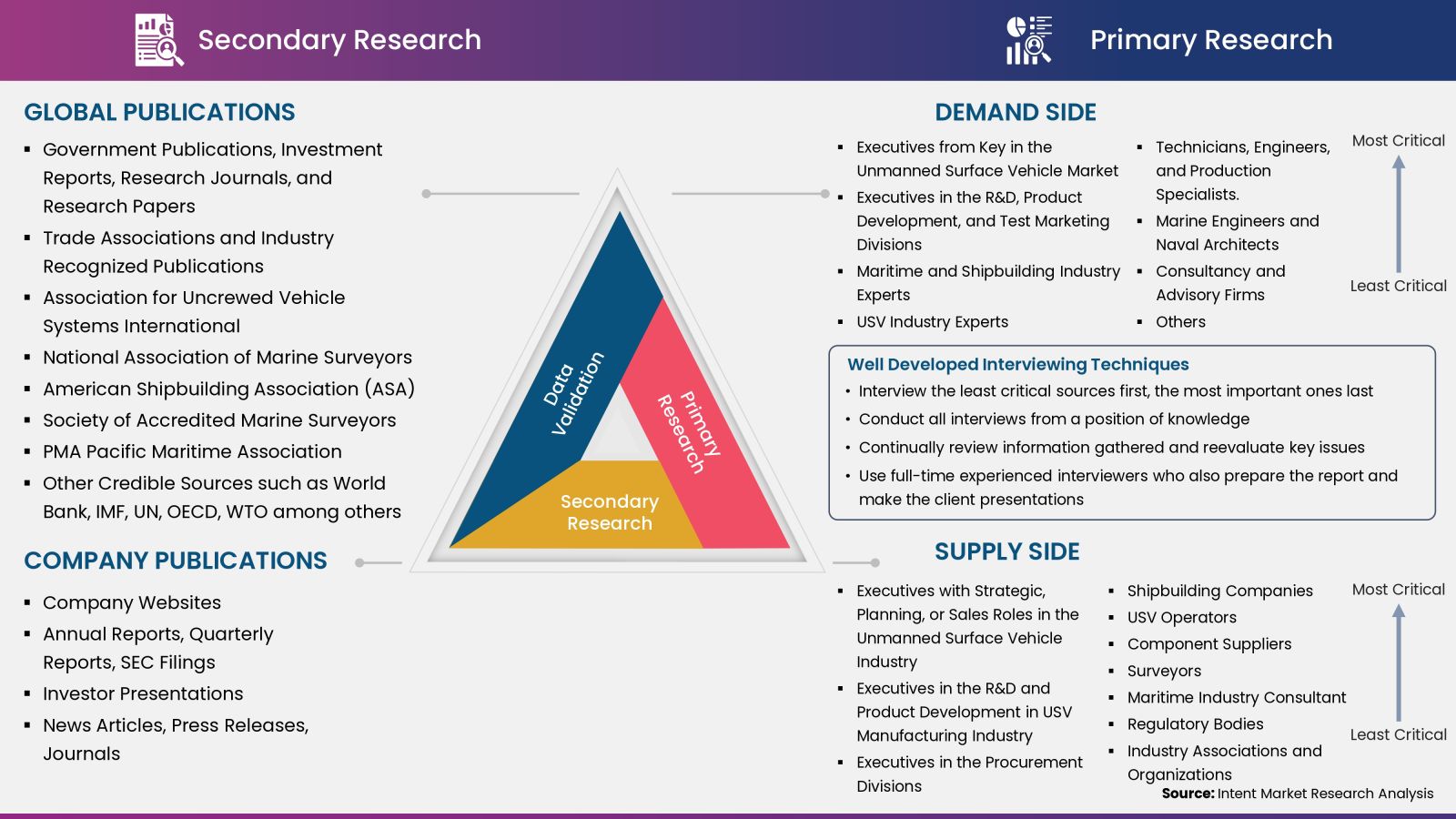

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.