sales@intentmarketresearch.com

+1 463-583-2713

Ultralight and Light Aircraft Market By Component (Airframe, Engines, Propellers, Avionics), By Aircraft Type (Ultralight Aircraft, Light Aircraft), By Propulsion (Conventional Fuel, Electric-Hybrid), By Technology (Manned Aircraft, Unmanned Aircraft), By End-User (Recreational Aviation, Commercial Aviation, Military & Defense), and By Region; Global Insights & Forecast (2024 – 2030)

As per Intent Market Research, the Ultralight and Light Aircraft Market was valued at USD 11.6 billion in 2023 and will surpass USD 22.9 billion by 2030; growing at a CAGR of 10.2% during 2024 - 2030.

The ultralight and light aircraft market has emerged as a pivotal segment within the aviation industry, reflecting a growing demand for efficient, cost-effective flying solutions. This market encompasses a wide range of aircraft, including ultralight planes, light sport aircraft, and light general aviation aircraft, catering to various needs from recreational flying to specialized applications like agriculture and surveillance. As of 2024, the market is poised for significant growth, driven by advancements in technology, increasing disposable incomes, and a rising inclination toward recreational aviation

Ultralight Aircraft Segment is Fastest Growing Owing to Increased Recreational Demand

The ultralight aircraft segment is witnessing rapid expansion, driven primarily by an increased interest in recreational flying. As aviation enthusiasts seek affordable and accessible options, ultralight aircraft have gained popularity due to their lightweight design and ease of operation. These aircraft, which typically weigh less than 254 pounds and require minimal training for pilots, have become the preferred choice for hobbyists and weekend flyers. The combination of low operational costs, simplified regulations, and the thrill of flying contributes to the segment's appeal, making it the fastest-growing area within the ultralight and light aircraft market.

This growing demand is further supported by advancements in technology that enhance the safety and performance of ultralight aircraft. Manufacturers are innovating with composite materials and improved aerodynamics, allowing for better fuel efficiency and higher flight capabilities. Moreover, the increasing availability of pilot training programs specifically designed for ultralight aircraft is expected to bolster the growth of this segment, attracting a new generation of pilots eager to explore the skies. As a result, the ultralight aircraft segment is set to play a crucial role in shaping the future of the aviation industry.

Light Sport Aircraft Segment is Largest Owing to Versatility and Accessibility

The light sport aircraft (LSA) segment stands out as the largest within the ultralight and light aircraft market, owing to its remarkable versatility and accessibility. LSAs are designed to be simple to operate while meeting specific weight and speed criteria, making them suitable for a diverse range of applications, from personal flying to flight training and even aerial photography. Their combination of performance and affordability has made them immensely popular among flying schools, private owners, and recreational pilots alike.

The robust growth of this segment is fueled by the increasing interest in personal aviation and the expanding network of flight training schools offering LSA instruction. The regulatory environment surrounding light sport aircraft has also become more favorable, with streamlined certification processes and reduced training requirements. This accessibility encourages aspiring pilots to enter the aviation field, further solidifying the light sport aircraft segment's status as the largest in the market. The adaptability of LSAs for various missions—such as scenic tours, agricultural tasks, and search and rescue operations—ensures their continued relevance and demand in the evolving aviation landscape.

Light General Aviation Segment is Strongest Owing to Enhanced Operational Efficiency

The light general aviation segment has established itself as a formidable player in the ultralight and light aircraft market, primarily due to its enhanced operational efficiency and broad application range. Light general aviation encompasses a variety of aircraft used for private and business purposes, including single-engine planes and light twin aircraft. This segment benefits from its versatility, catering to diverse needs such as cargo transport, medical evacuation, and personal travel, making it a vital component of the aviation ecosystem.

The growth of this segment is driven by the increasing need for efficient transportation solutions in remote and underserved regions. Light general aviation aircraft offer a practical alternative to commercial flights, enabling businesses and individuals to reach destinations that are otherwise inaccessible. Additionally, advancements in avionics and safety features have made light general aviation aircraft more appealing to pilots and operators, contributing to their market expansion. As the global demand for efficient air travel continues to rise, the light general aviation segment is expected to maintain its strength and prominence in the ultralight and light aircraft market.

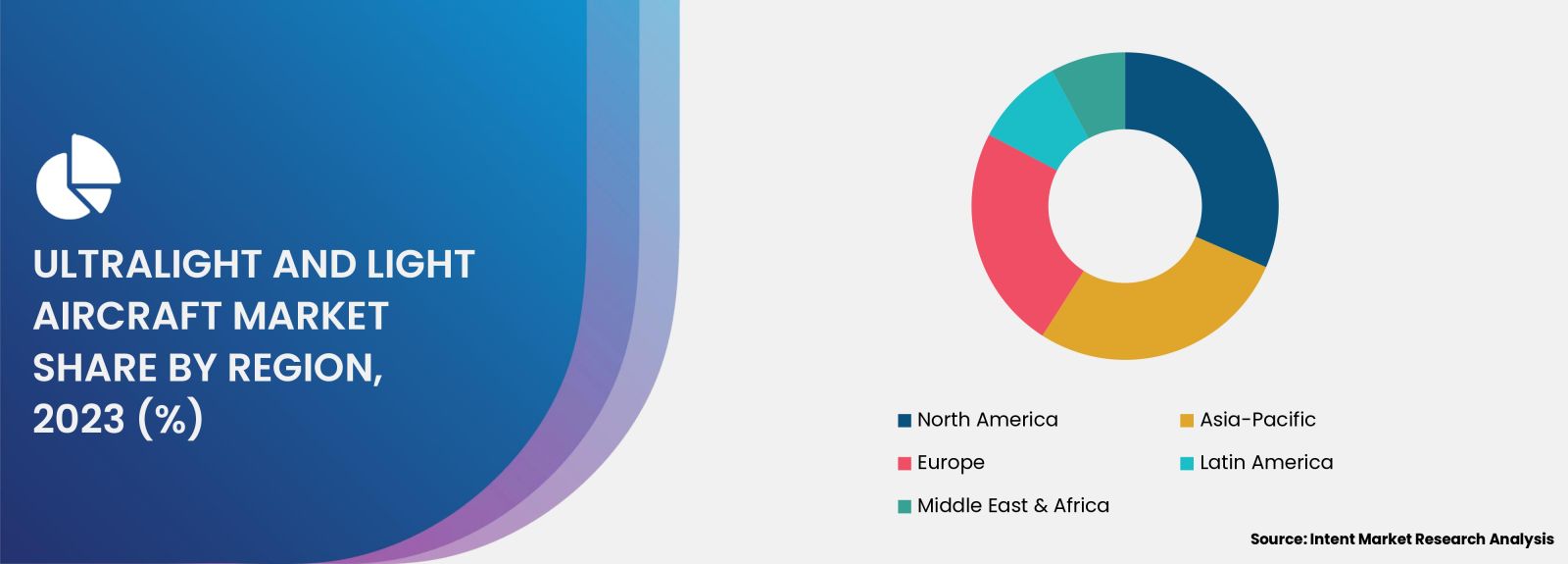

Regional Analysis: North America is the Largest Region Owing to Established Infrastructure

North America is recognized as the largest regional market for ultralight and light aircraft, accounting for a significant share of the global market. The presence of established aviation infrastructure, a well-developed network of flying schools, and a robust regulatory framework contribute to the region's dominance. The United States, in particular, is home to a vast number of recreational pilots and enthusiasts, further bolstering the demand for ultralight and light aircraft. The thriving aviation culture, combined with a high disposable income among consumers, facilitates the purchase and use of these aircraft for both leisure and business purposes.

Moreover, North America’s favorable regulatory environment encourages innovation and the introduction of new aircraft models. As manufacturers invest in developing cutting-edge technologies, such as electric and hybrid propulsion systems, the region is set to maintain its leadership position. The growing interest in sustainable aviation solutions is also expected to impact the market positively, aligning with consumer preferences for environmentally friendly flying options. Consequently, North America's established market dynamics position it as the largest and most influential region in the ultralight and light aircraft sector.

Competitive Landscape: Leading Companies Drive Market Growth through Innovation

The ultralight and light aircraft market is characterized by a competitive landscape featuring several key players who are driving innovation and market growth. Companies such as Textron Aviation, Piper Aircraft, and Flight Design are at the forefront, offering a range of aircraft that cater to different segments of the market. These manufacturers are not only focused on enhancing the performance and safety of their aircraft but also on integrating advanced technologies that improve the overall flying experience.

The competitive dynamics in this market are influenced by factors such as product differentiation, pricing strategies, and customer service excellence. As companies strive to capture a larger market share, they are investing in research and development to introduce new models with enhanced features. Additionally, strategic partnerships and collaborations with aviation training organizations and service providers are becoming increasingly common, allowing manufacturers to strengthen their market presence and reach new customer segments. The emphasis on sustainability and eco-friendly solutions is also shaping the competitive landscape, with companies exploring alternative fuel sources and green technologies to align with emerging consumer preferences.

Report Objectives:

The report will help you answer some of the most critical questions in the Ultralight and Light Aircraft Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Ultralight and Light Aircraft Market?

- What is the size of the Ultralight and Light Aircraft Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 11.6 billion |

|

Forecasted Value (2030) |

USD 22.9 billion |

|

CAGR (2024 – 2030) |

10.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Ultralight and Light Aircraft Market By Component (Airframe, Engines, Propellers, Avionics), By Aircraft Type (Ultralight Aircraft, Light Aircraft), By Propulsion (Conventional Fuel, Electric-Hybrid), By Technology (Manned Aircraft, Unmanned Aircraft), and By End-User (Recreational Aviation, Commercial Aviation, Military & Defense) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Ultralight and Light Aircraft Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Airframe |

|

4.2. Engines |

|

4.3. Propellers |

|

4.4. Avionics |

|

4.5. Others |

|

5. Ultralight and Light Aircraft Market, by Aircraft Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Ultralight Aircraft |

|

5.1.1. Fixed-Wing Ultralight |

|

5.1.2. Powered Paragliders |

|

5.1.3. Others |

|

5.2. Light Aircraft |

|

5.2.1. Light Sport Aircraft (LSA) |

|

5.2.2. Very Light Jet (VLJ) |

|

5.2.3. Others |

|

6. Ultralight and Light Aircraft Market, by Propulsion (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Conventional Fuel |

|

6.2. Electric-Hybrid |

|

7. Ultralight and Light Aircraft Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Manned Aircraft |

|

7.2. Unmanned Aircraft |

|

8. Ultralight and Light Aircraft Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Recreational Aviation |

|

8.2. Commercial Aviation |

|

8.3. Military & Defense |

|

8.4. Others |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Ultralight and Light Aircraft Market, by Component |

|

9.2.7. North America Ultralight and Light Aircraft Market, by Aircraft Type |

|

9.2.8. North America Ultralight and Light Aircraft Market, by Propulsion |

|

9.2.9. North America Ultralight and Light Aircraft Market, by Technology |

|

9.2.10. North America Ultralight and Light Aircraft Market, by End-User |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Ultralight and Light Aircraft Market, by Component |

|

9.2.11.1.2. US Ultralight and Light Aircraft Market, by Aircraft Type |

|

9.2.11.1.3. US Ultralight and Light Aircraft Market, by Propulsion |

|

9.2.11.1.4. US Ultralight and Light Aircraft Market, by Technology |

|

9.2.11.1.5. US Ultralight and Light Aircraft Market, by End-User |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Aeropro |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Airbus |

|

11.3. Cirrus Aircraft |

|

11.4. CubCrafters |

|

11.5. Diamond Aircraft Industries |

|

11.6. Flight Design |

|

11.7. ICON Aircraft |

|

11.8. Pilatus Aircraft |

|

11.9. Tecnam Aircraft |

|

11.10. Textron |

|

12. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Ultralight and Light Aircraft Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Ultralight and Light Aircraft Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Ultralight and Light Aircraft ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Ultralight and Light Aircraft Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats