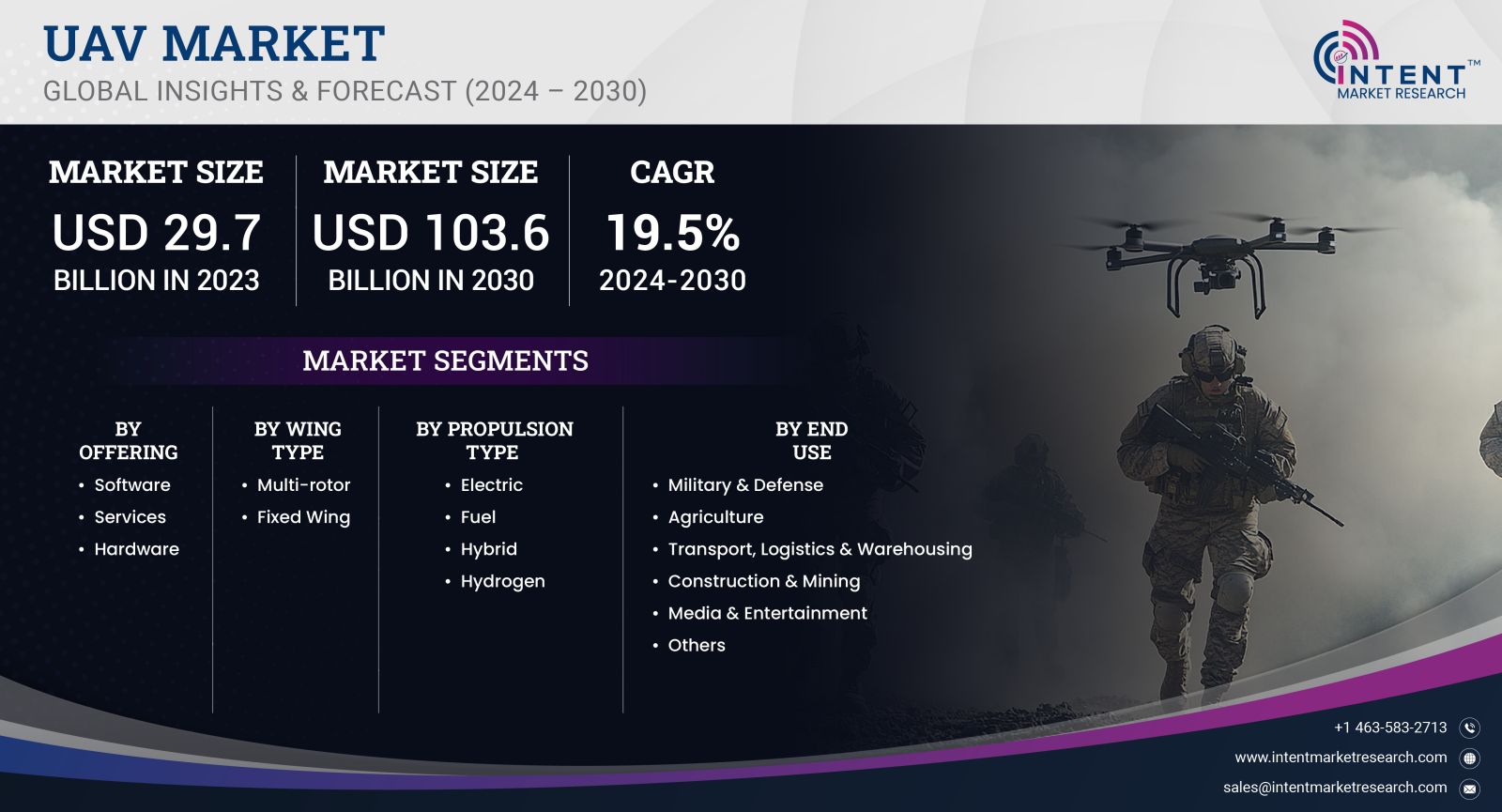

As per Intent Market Research, the UAV Market was valued at USD 29.7 billion in 2023-e and will surpass USD 103.6 billion by 2030; growing at a CAGR of 19.5% during 2024 - 2030.

The Unmanned Aerial Vehicle (UAV) market has witnessed remarkable growth over the past few years, primarily driven by advancements in drone technology and increasing applications across various sectors. Unmanned Aerial Vehicles, commonly known as drones, have transitioned from military applications to commercial and consumer markets, offering versatile solutions for tasks such as aerial surveillance, delivery services, agricultural monitoring, and infrastructure inspection.

Commercial UAV Segment is Largest Owing to Expanding Applications

The commercial UAV segment is the largest within the UAV market, driven by the increasing adoption of drones across various industries. Key applications in agriculture, construction, and logistics have been pivotal in propelling this segment's growth. In agriculture, UAVs are utilized for crop monitoring, precision agriculture, and pesticide spraying, enhancing productivity and efficiency. The construction industry leverages drones for site surveying, project monitoring, and safety inspections, reducing operational costs and improving project timelines. The logistics sector is also capitalizing on drones for last-mile delivery solutions, ensuring faster and more efficient shipping processes.

Furthermore, regulatory frameworks and technological advancements have played a significant role in the expansion of the commercial UAV segment. As governments worldwide develop regulations that support Unmanned Aerial Vehicle operations, businesses are increasingly incorporating drones into their workflows. With the growing demand for aerial data collection and analysis, the commercial Unmanned Aerial Vehicle segment is anticipated to maintain its dominance in the market, making it a focal point for stakeholders and investors looking to capitalize on the UAV industry's growth.

Military UAV Segment is Fastest Growing Owing to Enhanced Surveillance Needs

The military UAV segment is the fastest growing segment within the Unmanned Aerial Vehicle market, primarily driven by the rising demand for advanced surveillance and reconnaissance capabilities. Armed forces globally are increasingly adopting Unmanned Aerial Vehicles for intelligence, surveillance, and reconnaissance (ISR) missions, which are essential for modern warfare. The ability of drones to gather real-time data from remote locations allows military personnel to make informed decisions swiftly, enhancing operational efficiency and effectiveness.

Moreover, the ongoing geopolitical tensions and the need for national security have accelerated investments in military UAV technology. Drones are being equipped with advanced sensors and weaponry, making them essential tools for combat operations. As defense budgets increase and countries prioritize military modernization, the military UAV segment is expected to witness robust growth, outpacing other segments in terms of market expansion.

Consumer UAV Segment is Fastest Growing Owing to Increasing Hobbyist Demand

The consumer UAV segment is experiencing rapid growth due to the rising interest in drone technology among hobbyists and enthusiasts. This segment encompasses recreational drones, which are increasingly popular for aerial photography, videography, and recreational flying. As manufacturers introduce user-friendly models with advanced features, more consumers are investing in drones for personal use. The availability of affordable drones equipped with high-resolution cameras has opened new avenues for content creation and social sharing, further boosting demand in this segment.

Additionally, the rise of social media platforms has significantly contributed to the growth of the consumer UAV segment. Users are eager to capture unique aerial footage to enhance their online presence, leading to an increase in drone sales. With continuous advancements in drone technology, including improved battery life and flight capabilities, the consumer UAV segment is projected to maintain its momentum as a key driver of the overall UAV market.

Agricultural UAV Segment is Largest Owing to Precision Farming Trends

The agricultural UAV segment is the largest subsegment within the UAV market, primarily attributed to the growing trend of precision farming. Farmers are increasingly leveraging UAVs for crop monitoring, yield estimation, and soil analysis. Drones equipped with multispectral sensors enable farmers to collect valuable data regarding crop health, helping them make informed decisions that enhance productivity and reduce resource waste. This shift towards data-driven agriculture is significantly enhancing crop yields and minimizing environmental impact, making UAVs an indispensable tool in modern farming practices.

Moreover, the integration of UAVs with artificial intelligence (AI) and machine learning technologies is further driving growth in the agricultural UAV segment. These technologies allow for the analysis of vast amounts of data collected by drones, providing actionable insights that optimize farming operations. As the global population continues to rise, the demand for efficient agricultural practices will propel the agricultural UAV segment, solidifying its position as a leader in the UAV market.

Infrastructure UAV Segment is Fastest Growing Owing to Asset Inspection Needs

The infrastructure UAV segment is the fastest growing segment within the UAV market, fueled by the increasing need for asset inspection and maintenance. Drones are being utilized to inspect critical infrastructure such as bridges, pipelines, and power lines, providing detailed aerial views that facilitate timely maintenance and repairs. The ability to conduct inspections remotely and safely reduces risks for personnel and minimizes downtime for assets, making UAVs an attractive solution for infrastructure management.

Furthermore, advancements in drone technology, such as high-resolution imaging and thermal imaging capabilities, have enhanced the accuracy and efficiency of infrastructure inspections. The growing emphasis on asset sustainability and safety regulations is further driving the demand for UAVs in this sector. As infrastructure investments continue to rise globally, the infrastructure UAV segment is poised for significant growth, becoming a key area of focus within the broader UAV market.

UAV Market by Region: North America is Largest Owing to Technological Advancements

North America stands out as the largest region in the Unmanned Aerial Vehicle market, primarily due to significant technological advancements and a favorable regulatory environment. The United States, in particular, has been at the forefront of UAV innovation, with a well-established drone manufacturing industry and a robust ecosystem supporting Unmanned Aerial Vehicle applications. The adoption of UAVs across various sectors, including agriculture, construction, and military, has been accelerated by governmental initiatives promoting drone usage for commercial and recreational purposes.

Moreover, the presence of leading Unmanned Aerial Vehicle manufacturers and technology companies in North America has fostered continuous innovation and development in drone capabilities. As industries increasingly recognize the value of Unmanned Aerial Vehicle technology, the demand for drones is expected to continue growing in the region. North America's strong market presence positions it as a leader in the global Unmanned Aerial Vehicle landscape, making it an attractive destination for investments and strategic partnerships.

Competitive Landscape and Leading Companies

The Unmanned Aerial Vehicle (UAV) market is characterized by intense competition among several key players striving to capture market share through innovation and technological advancements. Leading companies in this sector include DJI, Parrot Drones, AeroVironment, Northrop Grumman, and Boeing, each offering a diverse range of UAV solutions tailored to various applications. These companies invest heavily in research and development to enhance drone capabilities, improve safety features, and expand their product portfolios.

The competitive landscape is also shaped by strategic partnerships and collaborations among industry players. Companies are increasingly teaming up with software developers and data analytics firms to enhance UAV functionalities and create integrated solutions that meet the evolving demands of the market. As the UAV market continues to mature, companies that can adapt to changing consumer preferences and technological advancements will likely emerge as leaders, driving innovation and shaping the future of the industry.

Report Objectives

The report will help you answer some of the most critical questions in the UAV Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the UAV Market?

- What is the size of the UAV Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa?

- What are the market opportunities for stakeholders after analysing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 29.7 billion |

|

Forecasted Value (2030) |

USD 103.6 billion |

|

CAGR (2024-2030) |

19.5% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

UAV Market By Offering (Software, Services, Hardware), By Wing Type (Multi-rotor, Fixed Wing), By Propulsion Type (Electric, Fuel, Hybrid, Hydrogen), By End Use (Military & Defense, Agriculture, Transport, Logistics & Warehousing, Construction & Mining, Media & Entertainment) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Israel, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.UAV Market, by Offering (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Software |

|

4.2.Services |

|

4.3.Hardware |

|

5.UAV Market, by Wing Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Multi-rotor |

|

5.2.Fixed Wing |

|

6.UAV Market, by Propulsion Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Electric |

|

6.2.Fuel |

|

6.3.Hybrid |

|

6.4.Hydrogen |

|

7.UAV Market, by End Use (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Military & Defense |

|

7.2.Agriculture |

|

7.3.Transport, Logistics & Warehousing |

|

7.4.Construction & Mining |

|

7.5.Media & Entertainment |

|

7.6.Others |

|

8.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Regional Overview |

|

8.2.North America |

|

8.2.1.Regional Trends & Growth Drivers |

|

8.2.2.Barriers & Challenges |

|

8.2.3.Opportunities |

|

8.2.4.Factor Impact Analysis |

|

8.2.5.Technology Trends |

|

8.2.6.North America UAV Market, by Offering |

|

8.2.7.North America UAV Market, by Wing Type |

|

8.2.8.North America UAV Market, by Propulsion Type |

|

8.2.9.North America UAV Market, by End Use |

|

*Similar Segmentation will be provided at each regional level |

|

8.3.By Country |

|

8.3.1.US |

|

8.3.1.1.US UAV Market, by Offering |

|

8.3.1.2.US UAV Market, by Wing Type |

|

8.3.1.3.US UAV Market, by Propulsion Type |

|

8.3.1.4.US UAV Market, by End Use |

|

8.3.2.Canada |

|

8.3.1.Mexico |

|

*Similar Segmentation will be provided at each country level |

|

8.4.Europe |

|

8.5.APAC |

|

8.6.Latin America |

|

8.7.Middle East & Africa |

|

9. Competitive Landscape |

|

9.1.Overview of the Key Players |

|

9.2.Competitive Ecosystem |

|

9.2.1.Platform Manufacturers |

|

9.2.2.Subsystem Manufacturers |

|

9.2.3.Service Providers |

|

9.3.Company Share Analysis |

|

9.4.Company Benchmarking Matrix |

|

9.4.1.Strategic Overview |

|

9.4.2.Product Innovations |

|

9.5.Start-up Ecosystem |

|

9.6.Strategic Competitive Insights/ Customer Imperatives |

|

9.7.ESG Matrix/ Sustainability Matrix |

|

9.8.Manufacturing Network |

|

9.9.1.Locations |

|

9.9.2.Supply Chain and Logistics |

|

9.9.3.Product Flexibility/Customization |

|

9.9.4.Digital Transformation and Connectivity |

|

9.9.5.Environmental and Regulatory Compliance |

|

9.9.Technology Readiness Level Matrix |

|

9.10.Technology Maturity Curve |

|

9.9.Buying Criteria |

|

11.Company Profiles |

|

11.1.AeroVironment |

|

11.1.1.Company Overview |

|

11.1.2.Company Financials |

|

11.1.3.Product/Service Portfolio |

|

11.1.4.Recent Developments |

|

11.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2.AgEagle |

|

11.3.DJI |

|

11.4.Lockheed Martin |

|

11.5.Northrop Grumman |

|

11.6.Parrot Drone |

|

11.7.PrecisionHawk |

|

11.8.Teledyne |

|

11.9.Trimble |

|

11.10.Textron |

|

12.Appendix |

A comprehensive market research approach was employed to gather and analyse data on the UAV Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to measure the impact of them on the UAV Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the UAV ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the UAV Market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA