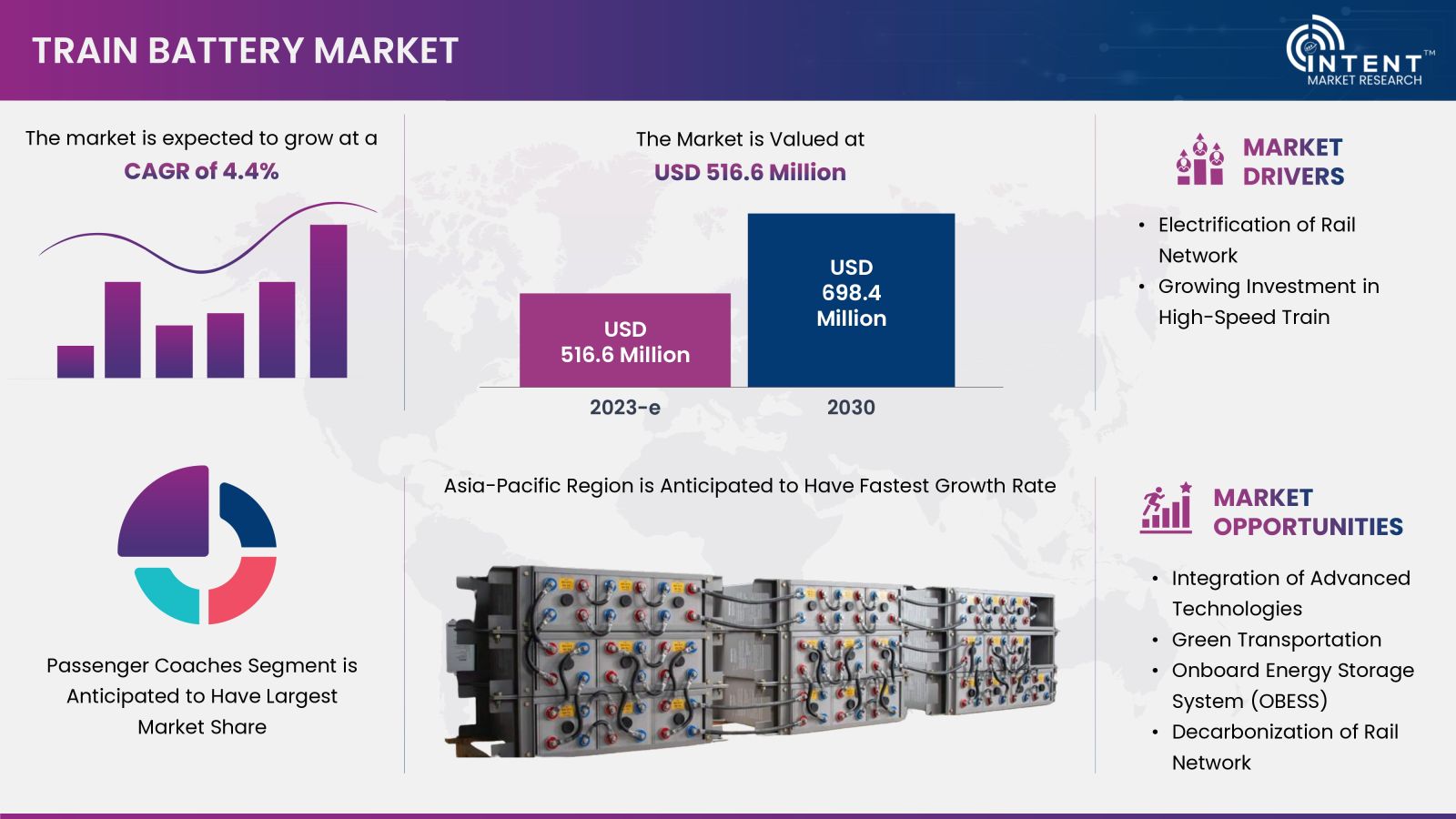

According to Intent Market Research, the Train Battery Market is expected to grow from USD 516.6 million in 2023-e at a CAGR of 4.4% to touch USD 698.4 million by 2030. The train battery market is competitive, the prominent players in the global market include ABB, Amara Raja, East Penn Manufacturing, ENERSYS, Exide Industries, HBL, Hitachi Rail, Hoppecke Batteries, Saft, Siemens Mobility, among others. The growth of this market is attributed to the increasing electrification of rail network across the world. Integration of advanced technologies such as IoT, AI, and driver advisory system (DAS) are expected to offer several growth opportunities to the market stakeholders.

Click here to: Get FREE Sample Pages of this Report

Increasing Electrification of Rail Network to Boost Train Battery Market

Rail network electrification is crucial for the sustainable development. As per IEA, CO2 emissions from diesel rail operations increased by 0.6% on average annually. To achieve Net Zero Emissions by 2050 (NZE) Scenario, emissions will need to decline by about 5% annually to 2030. For this, electrification of diesel train operations needs to be reduced wherever possible.

China, India, and the UK are heavily investing in rail network electrification. India is rapidly moving towards its target of 100% rail track electrification by 2024. In 2022-23, about 3,375 Route Kilometer (RKM) has been electrified compared to 2,452 Route Kilometers in 2021-22. From 45% in 2015, India’s track electrification increased up to 80% by 2022 indicates high growth opportunities for train battery market.

Furthermore, China, and Europe are also speeding their rail electrification. As of 2023, China has achieved over 70% and Europe over 60% of their rail network electrification. The growing investment in rail network electrification is driving the demand for train batteries, thereby, driving the market growth.

Key Findings of the Train Battery Market Study

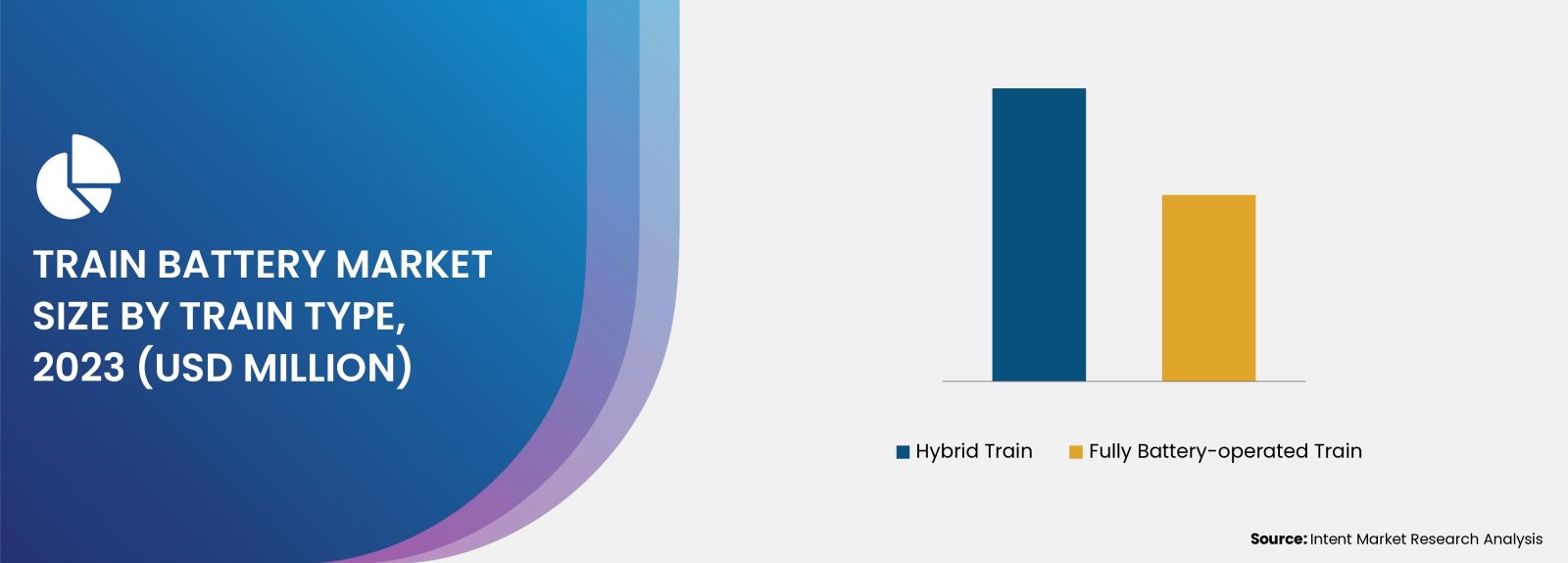

Fully Battery-operated Train Segment Expected to Grow with the Significant CAGR from 2024 to 2030

Based on train type, the train battery market is segmented into fully battery-operated train, hybrid train. In 2023, hybrid train segment has recorded the significant share of the market. These type of trains use a batteries as well as diesel to power their loads. Compare to fully battery-operated trains, hybrid trains are larger in number this has accounted for the larger share of the segment. However, the fully battery-operated train segment is expected to grow with the higher CAGR during the forecast period.

Passenger Coaches are Driving the Rolling Stock Segment of Train Battery Market

The train battery market is segmented into freight wagon, locomotive, metro, monorail, passenger coaches and tram. Growing focus towards comfort enhancement in passenger coaches such as AC, mobile charging infrastructure, lights, sliding doors, CCTV cameras, etc. have accounted for the largest share of this segment.

Nickel-Cadmium Sees Future Offers Lower Maintenance

The train battery market is segmented into: lead acid, lithium-ion, and nickel-cadmium (Ni-Cd). Lead acid battery is less expensive, has low energy density and are heavy. However, they require regular maintenance. Lithium-ion battery system offers a high degree of flexibility through the use of high-power and high-energy modules. Based on which, the voltage, current, power and energy characteristics of the battery system can be individually scaled.

However, in extreme conditions such as very high or very low temperatures or in a strong vibrations, Nickel-cadmium (Ni-Cd) batteries are preferred for rail transport. In railways, Ni-Cd batteries are used for emergency power and as starter batteries for starting diesel engines as well.

Starter Batteries Accounted for the Larger Share

Starter batteries are crucial part of providing power to perform pre-start functions such as powering up hydraulic pumps, air compressors, brake systems, etc., These functions are mandatory for smooth engine starting without any damage to engine components. In 2023, starter batteries accounted for the larger share and expected to witness significant growth over the projected period.

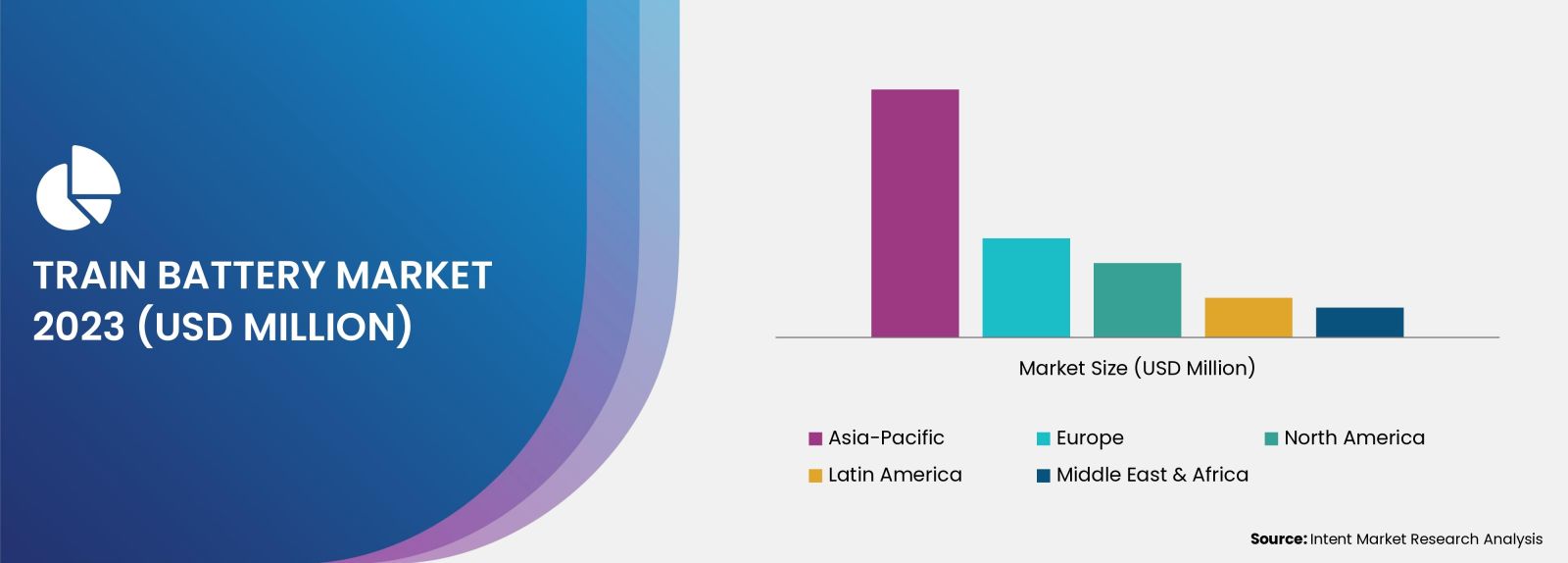

Asia-Pacific Leads the Market

Many countries in the Asia Pacific region have been actively promoting the adoption of clean and sustainable energy solutions to address environmental concerns and reduce dependency on fossil fuels. Government incentives, subsidies, and policies supporting electric transportation drives the train battery market.

Investments from both public and private sectors in the development and deployment of electric trains and associated battery technologies can significantly contribute to market growth. This includes investments in research & development, manufacturing facilities, and the establishment of charging infrastructure.

Asia-Pacific is the leading region in terms of rail network electrification. As of 2023, more than 79,000 Km of rail projects planned or under construction in the region. Additionally, the regional countries are heavily investing in electrification of the rail network, further boosting the market growth. In 2022, China opened over 4,100 Km of new railways, including a 915 Km double-track electrified route from Chengdu to Kunming. The growing electrification among regional countries have accounted for the significant share of the Asia-Pacific market.

Key players operating in the global train battery market are ABB, Amara Raja, East Penn Manufacturing, ENERSYS, Exide Industries, HBL, Hitachi Rail, Hoppecke Batteries, Saft, Siemens Mobility, among others. To tap the potential of this growing market, market players have started adopting several strategies to improve their market share. In January 2022, Alstom and Deutsche Bahn tested their first battery train with passenger on-board in Germany. In December 2022, Amara Raja has announced its plan to invest USD 1,139.7 million (INR 9,500 Crore or INR 95,000 million) in battery manufacturing and R&D.

Click here to: Get your custom research report today

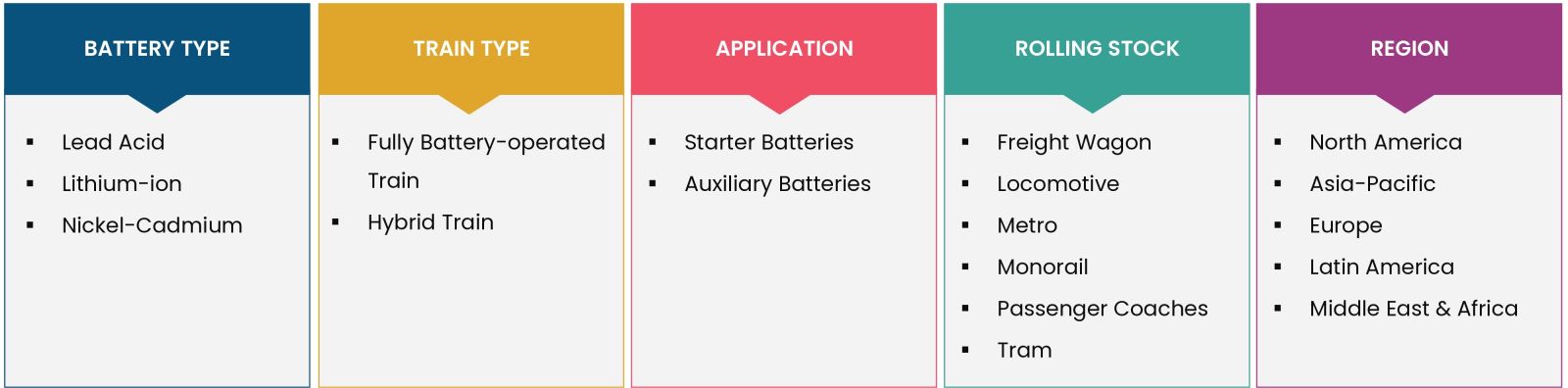

Train Battery Market Coverage

The report provides key insights into the train battery market, and it focuses on technological developments, trends, and initiatives taken by the government and private players. It delves into market drivers, restraints, opportunities, and challenges that are impacting the market growth. It analyses key players as well as the competitive landscape within the global market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 516.6 million |

|

Forecast Revenue (2030) |

USD 698.4 million |

|

CAGR (2024-2030) |

4.4% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Train Battery Market by Battery Type (Lead Acid, Lithium-ion, Nickel-Cadmium); by Train Type (Fully Battery-operated Train, Hybrid Train); by Application (Starter Batteries, Auxiliary Batteries); by Rolling Stock (Freight Wagon, Locomotive, Metro, Monorail, Passenger Coaches, Tram) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America and Middle East & Africa |

|

Competitive Landscape |

ABB, Amara Raja, East Penn Manufacturing, ENERSYS, Exide Industries, HBL, Hitachi Rail, Hoppecke Batteries, Saft, Siemens Mobility, among others |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Key Stakeholders of the Market |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.2.Data Collection |

|

2.3.Market Assessment |

|

2.4.Assumptions & Limitations for the Study |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Drivers |

|

4.1.1.Electrification of Rail Network |

|

4.1.2.Growing Investment in High-Speed Train |

|

4.2.Restraints |

|

4.2.1.High Capital Investment in Battery-Powered Rail Network |

|

4.3.Opportunities |

|

4.3.1.Integration of Advanced Technologies |

|

4.3.2.Green Transportation |

|

4.4.Threats or Challenges |

|

4.4.1.Need of Longer Range Batteries |

|

4.5.Trends |

|

4.5.1.Onboard Energy Storage System (OBESS) |

|

4.5.2.Decarbonization of Rail Network |

|

5.Market Outlook |

|

5.1.PORTER’S Five Forces Analysis |

|

5.2.PESTLE Analysis |

|

5.3.Case Studies |

|

6.Market Size by Battery Type, (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Lead Acid |

|

6.2.Lithium-ion |

|

6.3.Nickel-Cadmium |

|

7.Market Size by Train Type, (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Fully Battery-operated Train |

|

7.2.Hybrid Train |

|

8.Market Size by Application, (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Starter Batteries |

|

8.2.Auxiliary Batteries |

|

9.Market Size by Rolling Stock, (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.1.Freight Wagon |

|

9.2.Locomotive |

|

9.3.Metro |

|

9.4.Monorail |

|

9.5.Passenger Coaches |

|

9.6.Tram |

|

10.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

10.1. North America |

|

10.1.1. US |

|

10.1.1.1. US Market Outlook by Battery Type |

|

10.1.1.2. US Market Outlook by Train Type |

|

10.1.1.3. US Market Outlook by Application |

|

10.1.1.4. US Market Outlook by Rolling Stock |

|

Note: Similar Cross-segmentation for each country will be covered as shown above |

|

10.1.2. Canada |

|

10.2. Asia-Pacific |

|

10.2.1. China |

|

10.2.2. Japan |

|

10.2.3. South Korea |

|

10.2.4. India |

|

10.3. Europe |

|

10.3.1. UK |

|

10.3.2. Germany |

|

10.3.3. France |

|

10.3.4. Italy |

|

10.4. Latin America |

|

10.5. Middle East & Africa |

|

11.Competitive Landscape |

|

11.1. Market Share Analysis |

|

11.2. Key Market Growth Strategies |

|

11.3. Company Strategy Analysis |

|

11.4. Competitive Benchmarking |

|

12.Company Profile |

|

12.1. ABB |

|

12.2. Amara Raja Batteries |

|

12.3. East Penn Manufacturing |

|

12.4. ENERSYS |

|

12.5. Exide Industries |

|

12.6. HBL Power Systems |

|

12.7. Hitachi Rail |

|

12.8. Hoppecke Batteries |

|

12.9. Saft |

|

12.10. Siemens Mobility |

|

13.Appendix |

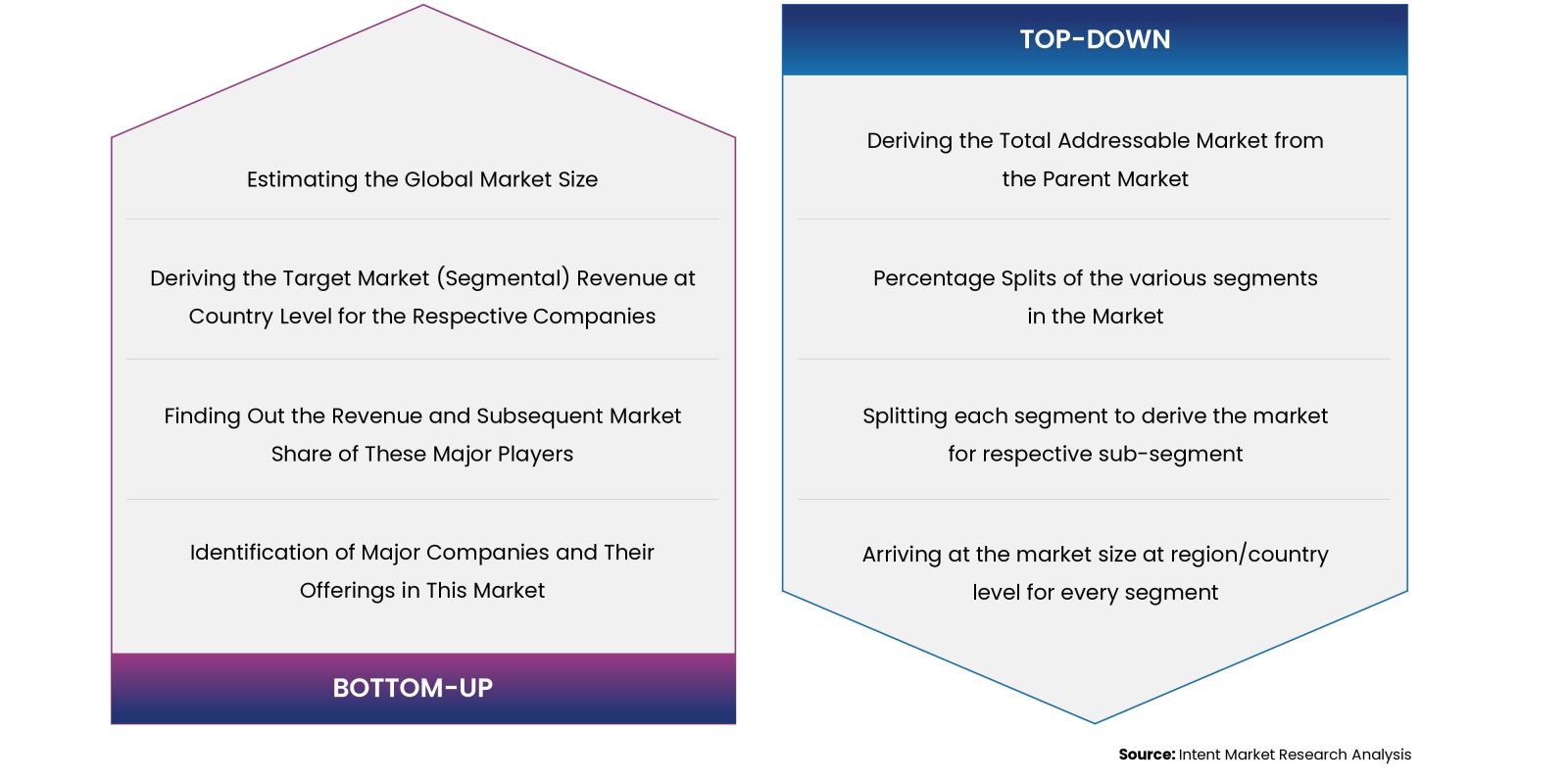

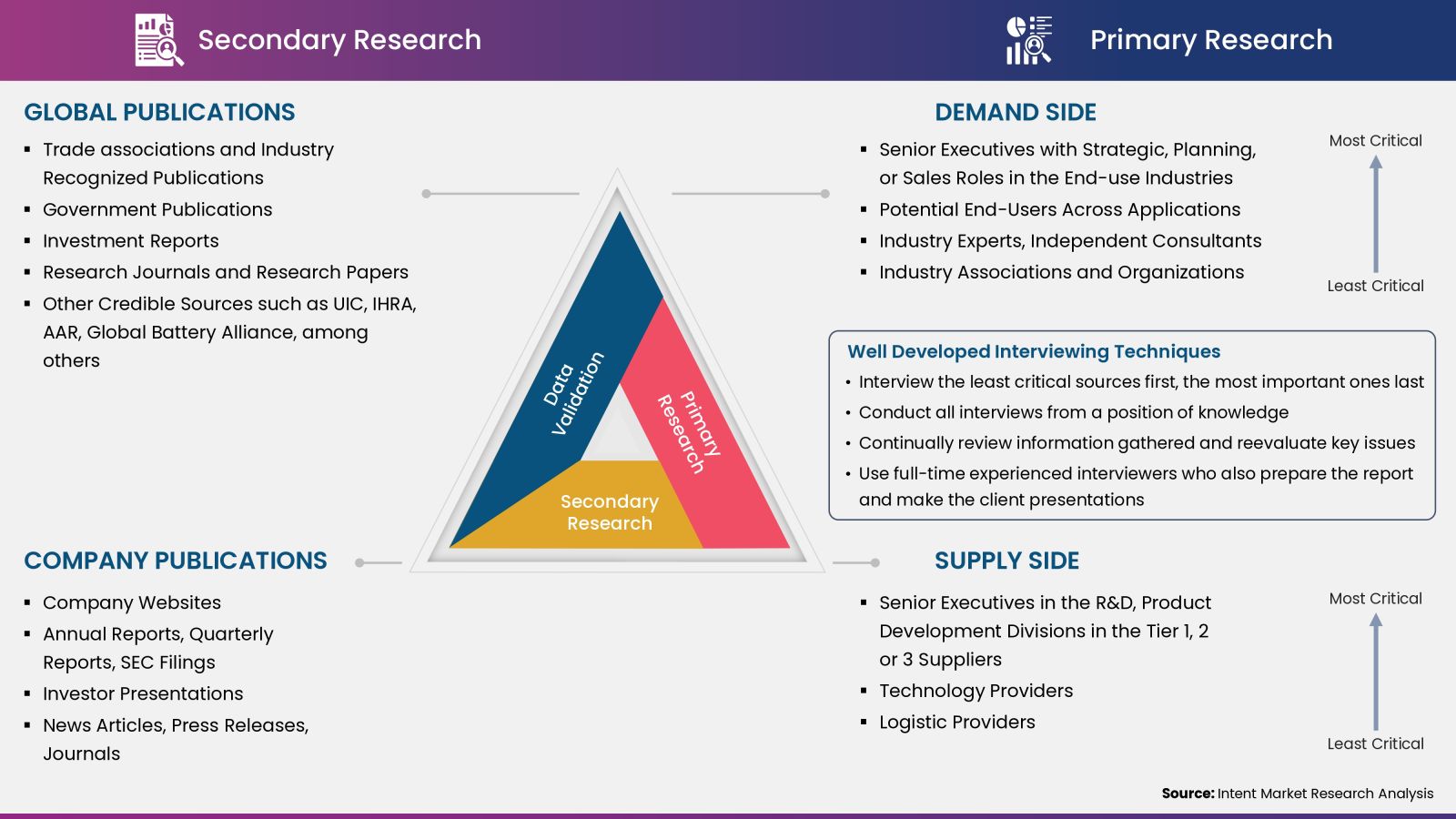

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analysed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.