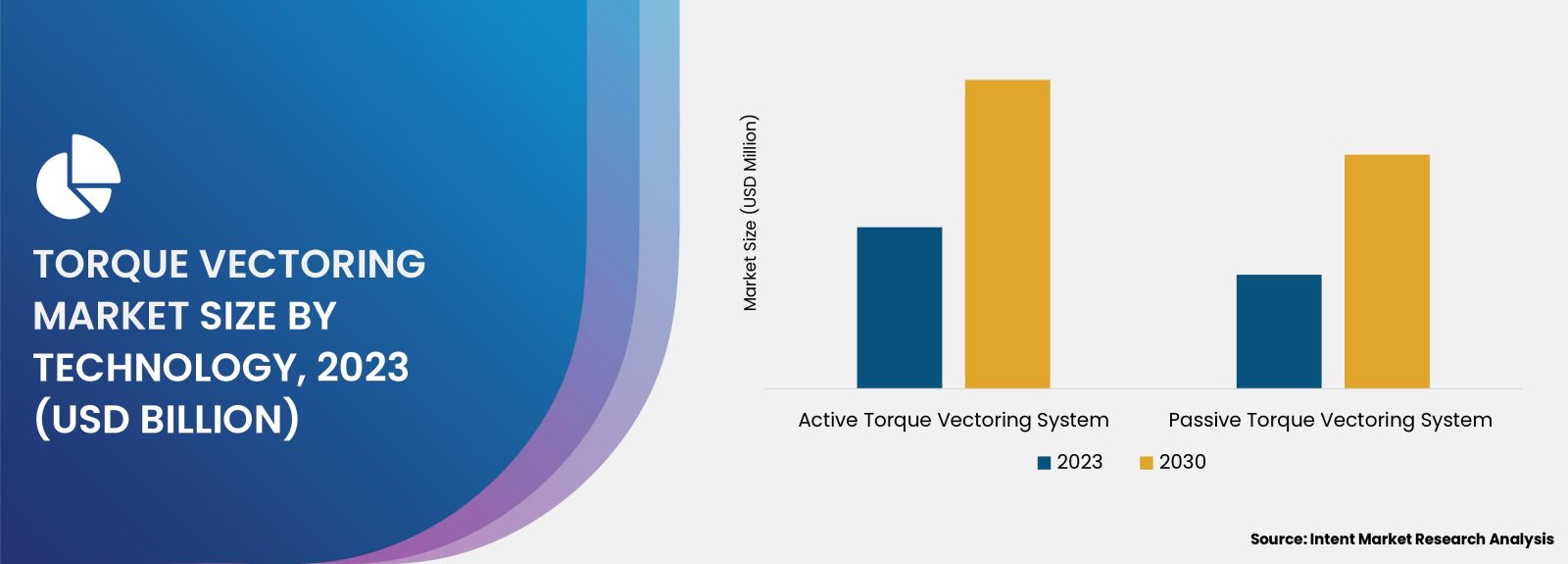

As per Intent Market Research, the Torque Vectoring Market was valued at USD 8.5 billion in 2023 and will surpass USD 26.6 billion by 2030; growing at a CAGR of 17.7% during 2024 - 2030.

The Torque Vectoring Market is witnessing a transformative phase as automakers increasingly focus on enhancing vehicle performance, safety, and driving experience. Torque vectoring is a technology that enables the distribution of torque between the wheels of a vehicle, resulting in improved handling, stability, and traction. This technology is gaining traction in both conventional internal combustion engine vehicles and electric vehicles (EVs), driven by consumer demand for advanced driver assistance systems (ADAS) and enhanced vehicle dynamics. As the automotive industry adapts to changing consumer preferences and regulatory pressures, the torque vectoring market is set to evolve, driven by technological advancements, increasing investments in R&D, and the growing adoption of electric vehicles.

Passenger Vehicle Segment is Fastest Growing Owing to Increased Adoption of ADAS

The passenger vehicle segment is the fastest-growing segment within the torque vectoring market, primarily due to the rising adoption of Advanced Driver Assistance Systems (ADAS). As consumers increasingly prioritize safety and convenience features in their vehicles, automakers are investing heavily in technologies that enhance driving dynamics. Torque vectoring plays a pivotal role in ADAS by providing precise control over wheel torque, thereby improving vehicle stability and handling during critical maneuvers such as cornering and emergency braking.

The integration of torque vectoring systems in passenger vehicles enables manufacturers to offer a superior driving experience, appealing to tech-savvy consumers. This segment is expected to witness a significant increase in demand as electric and hybrid vehicles gain popularity, further bolstered by government initiatives promoting environmentally friendly transportation solutions. With a projected CAGR of 14% during the forecast period, the passenger vehicle segment will continue to lead the way in the torque vectoring market, shaping the future of personal mobility.

Commercial Vehicle Segment is Largest Owing to Growing Demand for Fleet Optimization

The commercial vehicle segment represents the largest share of the torque vectoring market, driven by the increasing demand for fleet optimization and enhanced operational efficiency. As logistics and transportation companies strive to improve fuel efficiency, reduce operational costs, and enhance vehicle safety, torque vectoring technology is becoming an integral part of modern commercial vehicles. By optimizing torque distribution, fleet operators can achieve better handling and stability, particularly when navigating challenging road conditions.

The growth of e-commerce and the need for efficient last-mile delivery solutions are also propelling the demand for advanced torque management systems in commercial vehicles. Additionally, regulatory requirements aimed at reducing emissions and improving vehicle safety are encouraging manufacturers to incorporate torque vectoring technology into their fleets. With a market share of approximately 40% and a steady CAGR of 10% from 2024 to 2030, the commercial vehicle segment will continue to dominate the torque vectoring market.

Electric Vehicle Segment is Fastest Growing Owing to Innovations in EV Technology

The electric vehicle (EV) segment is emerging as the fastest-growing segment in the torque vectoring market, fueled by innovations in EV technology and the increasing focus on enhancing vehicle performance. As electric vehicles become more prevalent, manufacturers are leveraging torque vectoring systems to optimize power distribution between wheels, leading to improved acceleration, handling, and energy efficiency. This capability is especially critical for electric vehicles, where instant torque delivery can significantly enhance driving dynamics.

The growing consumer interest in electric vehicles, coupled with government incentives promoting EV adoption, is driving investments in torque vectoring technologies. Additionally, advancements in battery technology and vehicle architecture are enabling automakers to design more sophisticated torque vectoring systems that can adapt to various driving conditions. The electric vehicle segment is expected to exhibit a remarkable CAGR of 16% during the forecast period, reflecting the increasing demand for performance-oriented EVs equipped with advanced torque vectoring solutions.

Luxury Vehicle Segment is Largest Owing to Premium Features and Technology

The luxury vehicle segment is the largest within the torque vectoring market, driven by the growing demand for premium features and cutting-edge technology in high-end automobiles. Luxury car manufacturers are increasingly incorporating torque vectoring systems to deliver superior driving experiences, characterized by enhanced performance, stability, and comfort. These advanced systems allow for real-time adjustments in torque distribution, providing drivers with unparalleled control and responsiveness.

Furthermore, the emphasis on personalization and unique driving dynamics in luxury vehicles is propelling the adoption of torque vectoring technology. As consumers seek more engaging driving experiences, luxury automakers are investing heavily in research and development to create innovative solutions that set their models apart. With a substantial market share and a steady growth trajectory, the luxury vehicle segment is poised to remain a key driver of the torque vectoring market through 2030.

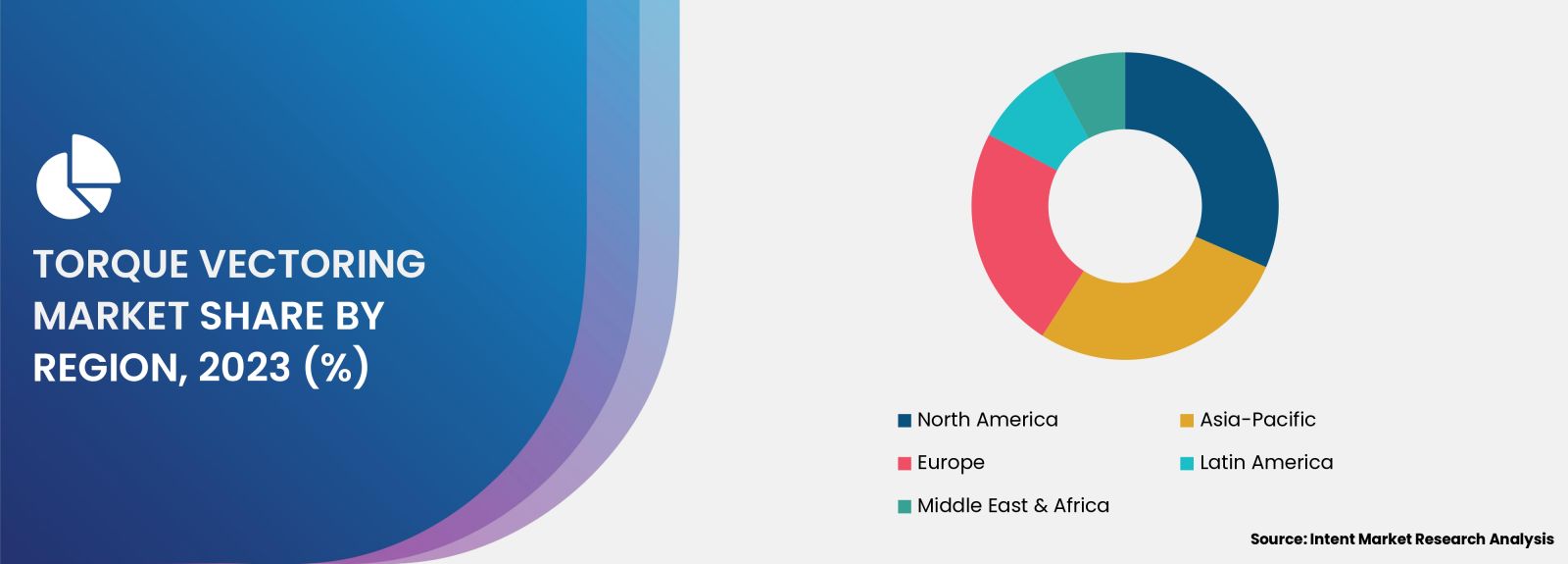

Asia Pacific Region is Fastest Growing Owing to Increasing Vehicle Production and Adoption of EVs

The Asia Pacific region is identified as the fastest-growing market for torque vectoring technology, driven by the increasing vehicle production and a rising shift towards electric vehicles. Countries like China, Japan, and India are at the forefront of automotive manufacturing, leading to a surge in demand for advanced vehicle technologies, including torque vectoring. The robust growth of the automotive sector in this region is supported by favorable government policies promoting EV adoption and investments in smart transportation systems.

Moreover, the growing middle-class population in Asia Pacific is influencing consumer preferences towards modern vehicles equipped with advanced features. This trend is further fueled by the expansion of automotive OEMs in emerging markets, who are integrating torque vectoring systems into their offerings to enhance competitiveness. With a projected CAGR of 15% during the forecast period, the Asia Pacific region is expected to significantly contribute to the overall growth of the torque vectoring market.

Leading Companies and Competitive Landscape

The torque vectoring market is characterized by a competitive landscape featuring several key players dedicated to advancing torque management technologies. Companies such as Bosch, GKN Automotive, and BorgWarner are at the forefront of innovation in this sector, offering a range of torque vectoring solutions tailored to meet the evolving demands of the automotive industry. These companies are investing heavily in research and development to enhance their product offerings and maintain a competitive edge.

Furthermore, strategic partnerships and collaborations among automotive manufacturers and technology providers are becoming increasingly common, enabling companies to leverage each other's strengths and accelerate product development. As the market continues to evolve, the focus on sustainability and the integration of electric vehicle technologies will shape the competitive dynamics within the torque vectoring market, leading to new opportunities for growth and differentiation.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 8.5 billion |

|

Forecasted Value (2030) |

USD 26.6 billion |

|

CAGR (2024 – 2030) |

17.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Torque Vectoring Market By Vehicle Type (Light Commercial Vehicles, Heavy Commercial Vehicles, Passenger Car), By Clutch Actuation Type (Hydraulic Clutch, Electronic Clutch), By Propulsion (Front Wheel Drive, Rear Wheel Drive, All Wheel Drive / Four Wheel Drive), By Technology (Active Torque Vectoring System, Passive Torque Vectoring System) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3.Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Torque Vectoring Market, by Vehicle Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Light Commercial Vehicles |

|

4.2. Heavy Commercial Vehicles |

|

4.3. Passenger Car |

|

5. Torque Vectoring Market, by Clutch Actuation Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Hydraulic Clutch |

|

5.2. Electronic Clutch |

|

6. Torque Vectoring Market, by Propulsion (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Front Wheel Drive (FWD) |

|

6.2. Rear Wheel Drive (RWD) |

|

6.3. All Wheel Drive / Four Wheel Drive (AWD/4WD) |

|

7. Torque Vectoring Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Active Torque Vectoring System (ATVS) |

|

7.2. Passive Torque Vectoring System (PTVS) |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Torque Vectoring Market, by Vehicle Type |

|

8.2.7. North America Torque Vectoring Market, by Clutch Actuation Type |

|

8.2.8. North America Torque Vectoring Market, by Propulsion |

|

8.2.9. North America Torque Vectoring Market, by Technology |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Torque Vectoring Market, by Vehicle Type |

|

8.2.10.1.2. US Torque Vectoring Market, by Clutch Actuation Type |

|

8.2.10.1.3. US Torque Vectoring Market, by Propulsion |

|

8.2.10.1.4. US Torque Vectoring Market, by Technology |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. American Axle & Manufacturing, Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. BorgWarner Inc. |

|

10.3. Bosch |

|

10.4. Continental AG |

|

10.5. Dana Limited |

|

10.6. Eaton |

|

10.7. GKN Automotive Limited |

|

10.8. JTEKT Corporation |

|

10.9. Univance Corporation |

|

10.10. ZF Friedrichshafen |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Torque Vectoring Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Torque Vectoring Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Torque Vectoring ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Torque Vectoring Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA