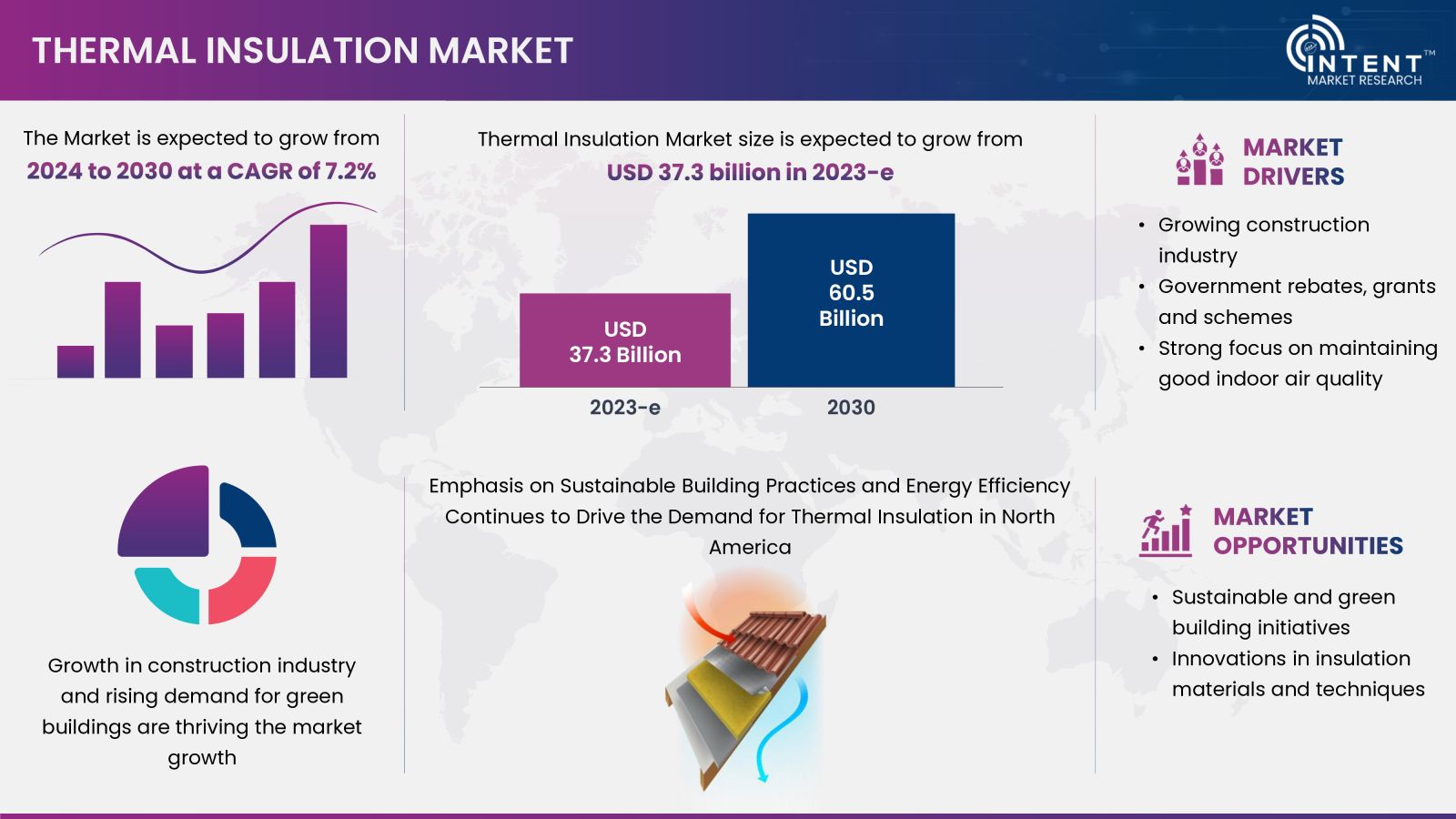

As per Intent Market Research, the Thermal Insulation Market was valued at USD 37.3 billion in 2023 and will surpass USD 60.5 billion by 2030; growing at a CAGR of 7.2% during 2024 - 2030. Sustainable and green building initiatives and technological innovations are driving the market growth.

Thermal insulation refers to the process or materials used to reduce the transfer of heat between objects or environments with different temperatures. The primary purpose of thermal insulation is to maintain a desired temperature by minimizing the loss or gain of heat, thereby improving energy efficiency and comfort. Thermal insulation minimizes heat loss in the winter and heat gain in the summer, reducing the need for heating and cooling systems to work as hard. This results in significant energy savings. Certain insulation materials, such as mineral wool, are non-combustible and can enhance a building's fire resistance, providing additional safety in case of fire.

Thermal Insulation Market Dynamics

Growth in Construction Industry is thriving the Market Growth

The growth in the construction industry is a significant driver of market growth, particularly for sectors like thermal insulation, building materials, and construction equipment. As the construction industry expands, there is a surge in the demand for various building materials, including thermal insulation. New residential, commercial, and industrial projects require substantial amounts of insulation to meet energy efficiency standards and building codes. Large-scale infrastructure projects, such as roads, bridges, and public buildings, also contribute to the increased demand for insulation materials, particularly in regions experiencing rapid urbanization.

Furthermore, many construction projects now aim for certifications like LEED (Leadership in Energy and Environmental Design), which prioritize energy-efficient building practices. This has led to an increased focus on sustainable materials, including advanced thermal insulation solutions. Between 2020 and 2023, global energy efficiency investments surged to USD 1 trillion, including USD 270 billion in direct public spending and USD 740 billion in indirect spending. The International Energy Agency (IEA) projects that these investments must triple to USD 840 billion annually between 2026-2030 to meet global energy goals. This increasing investment highlights the growing demand for energy-efficient infrastructure and advanced thermal insulation materials.

Moreover, the adoption of new construction technologies, such as prefabricated buildings and modular construction, has increased the demand for specialized insulation products that can be easily integrated into these modern structures. Asia-Pacific is witnessing substantial infrastructure growth that demands energy-efficient solutions. In China, this trend is particularly evident, as the demand for thermal insulation materials is anticipated to grow significantly. This surge is driven by sustained increases in building construction and accelerated output in the manufacturing sector, both of which are key factors driving market development across the region.

Hence, the growth of the construction industry directly impacts the market for materials and technologies used in building projects, with thermal insulation being a key beneficiary. As construction activities increase, driven by urbanization, regulatory requirements, and technological advancements, the demand for effective insulation solutions rises, fuelling market growth and creating opportunities for innovation and expansion in related sectors.

Thermal Insulation Market Segmental Insights

Rising Demand for Thermal Insulation in Industrial Application is Thriving the Market Growth

The rising demand for thermal insulation in industrial applications is a key driver of market growth. This trend is fueled by various factors, including the need for energy efficiency, regulatory compliance, operational safety, and cost reduction in industrial processes. In industrial settings, maintaining precise temperature control is critical for many processes. Thermal insulation helps prevent heat loss in equipment such as boilers, furnaces, pipes, and storage tanks, leading to significant energy savings. By conserving energy, thermal insulation reduces the amount of fuel or electricity needed to maintain temperatures, directly lowering operational costs. This is particularly important in energy-intensive industries like manufacturing, chemical processing, and oil & gas.

As industrial sectors expand globally, particularly in emerging markets, there is an increasing need for thermal insulation in new facilities. Industries like steel, cement, glass, and chemicals require extensive insulation to optimize energy use and maintain efficient operations. The construction of new industrial plants and the expansion of existing ones lead to a higher demand for thermal insulation. This includes not only insulation for equipment but also for the buildings themselves, which must be designed to maintain energy efficiency.

.jpg)

Key market players are involved into the launch of new and innovative products to offer better thermal insulation for buildings. For instance, in November 2023, Kingspan Group has launched bio-based insulation product, HemKor insulation. The product range, largely made from hemp, a fast-growing bio-based material. The HemKor Pure product, with a bio-based content of over 95%, has a thermal performance of 0.043 W/mK.

Plastic Foams, Constitutes the Largest Share in the Thermal Insulation Market by Material Type

Plastic foams, as a material type, constitute the largest share in the thermal insulation market due to their unique properties, versatility, and wide range of applications across various industries. Plastic foams, such as polyurethane (PU), polystyrene (both expanded and extruded, EPS and XPS), and polyisocyanurate (PIR), have excellent thermal resistance, characterized by low thermal conductivity. This makes them highly effective in minimizing heat transfer, which is crucial for energy-efficient insulation. Despite their high insulating properties, plastic foams are lightweight, making them easier to handle, transport, and install compared to heavier materials like mineral wool or fiberglass.

Plastic foams are extensively used in residential, commercial, and industrial buildings for insulating walls, roofs, floors, and foundations. Their versatility allows them to be used in various forms, such as rigid boards, spray foam, and insulation panels. The production of plastic foams is generally more cost-effective than other insulation materials, which makes them a popular choice in the construction and manufacturing industries. Their cost-efficiency, combined with their excellent insulating performance, provides a high return on investment.

Innovative technology is being introduced by market participants to make life easier for the disabled. For instance, in February 2024, BASF has launched PIR (Polyisocyanurate) System made with Hydrofluoroolefin (HFO). The new system offers improved thermal conductivity further translates to a more energy-efficient PIR insulation system, which contributes to a reduction in carbon emissions. Such initiatives from key players are propelling the market growth.

High Demand of Thermal Insulation from Commercial sector will Contributing to the Market Growth in Coming Years

The high demand for thermal insulation from the commercial sector is expected to significantly contribute to market growth in the coming years. This trend is driven by several factors, including the increasing emphasis on energy efficiency, the expansion of commercial real estate, and the growing awareness of environmental sustainability. Commercial buildings, such as offices, shopping centers, hotels, and hospitals, consume large amounts of energy for heating, cooling, and maintaining comfortable indoor environments. Thermal insulation plays a critical role in reducing energy consumption by improving the building's ability to retain heat in winter and keep out heat in summer. The commercial real estate sector is expanding globally, driven by urbanization, economic development, and the rise of new business hubs. As new commercial buildings are constructed, the demand for thermal insulation increases to meet modern energy efficiency standards and regulatory requirements.

In addition to new construction, there is a growing trend of renovating and retrofitting existing commercial buildings to improve their energy efficiency. This often involves upgrading insulation systems, further boosting demand in the market. Many corporations are adopting sustainability initiatives that include reducing their carbon footprint and energy consumption. Thermal insulation is a key component in achieving these goals, as it significantly reduces the amount of energy required to heat or cool commercial buildings. Companies are increasingly incorporating CSR strategies that focus on environmental stewardship. Investing in energy-efficient insulation aligns with these strategies, helping businesses meet their sustainability targets while also appealing to environmentally conscious customers and stakeholders.

The high demand for thermal insulation from the commercial sector is a key driver of market growth. As commercial real estate continues to expand, driven by urbanization, stricter energy regulations, and a focus on sustainability, the need for effective thermal insulation will only increase. Technological advancements and the push for energy efficiency and occupant comfort in commercial spaces further fuel this demand, ensuring that thermal insulation remains a critical component in the commercial construction and renovation markets.

Regional Insights

Emphasis on Sustainable Building Practices and Energy Efficiency Continues to Drive the Demand for Thermal Insulation in North America

The emphasis on sustainable building practices and energy efficiency is a major factor driving the demand for thermal insulation in North America. This trend is fueled by various factors, including regulatory pressures, environmental awareness, and economic incentives, all of which are encouraging the adoption of insulation as a key component in both new construction and retrofitting projects. North America, particularly the United States and Canada, has implemented stringent building codes and energy efficiency standards that require the use of thermal insulation in residential, commercial, and industrial buildings. For instance, the International Energy Conservation Code (IECC) and the ASHRAE (American Society of Heating, Refrigerating, and Air-Conditioning Engineers) standards mandate specific insulation levels to reduce energy consumption.

Governments in North America offer various incentives to encourage energy efficiency improvements, including rebates, tax credits, and grants for installing insulation. These financial incentives make insulation upgrades more affordable and attractive to property owners and developers. In addition to federal regulations, many states and municipalities have adopted even stricter energy efficiency requirements. California’s Title 24, for example, is one of the most rigorous energy codes in the United States, driving significant demand for advanced thermal insulation solutions.

As the region continues to prioritize environmental sustainability and energy conservation, the market for thermal insulation is expected to expand, playing a crucial role in the construction and renovation of energy-efficient buildings.

Competitive Landscape

Collaboration is the Key Strategy for the Product Development

Key market players are collaborating to bring innovative technology and solution to launch their product as well as services regionally and globally. For instance, in January 2024, BASF and Carlisle Construction Materials have collaborated and manufactured Lupranate ZERO. The new product is used to produce MDI polyisocyanurate boards (PIR or polyiso) and rigid polyurethane foam for the thermal insulation of buildings.

Similarly, in November 2022, Evonik has developed a new line of thermal insulation products, TEGO Therm. It improves the performance of thermal insulation coatings (TICs). The new product range includes two microporous silica-based granules, TEGO Therm HPG 4000 and TEGO Therm HPG 6806, as well as a heat-resistant, silicone-based binder, TEGO Therm L 300.

Thermal Insulation Market Coverage

The report provides key insights into the thermal insulation market, and it focuses on technological developments, trends, and initiatives taken by the government. In this sector analysis explores market drivers, restraints, opportunities, and other relevant factors. It also examines key players and the competitive landscape within the market for thermal insulation.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 37.3 billion |

|

Forecasted Market Size (2030) |

USD 60.5 billion |

|

CAGR (2024-2030) |

7.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Material Type (Plastic Foam, Fiberglass, Mineral Wool, Cellulose, Aerogel), By Application (Building & Construction, Industrial Applications, HVAC Systems, Aerospace & Defense, Marine, Appliances), By End Use (Residential, Commercial, Industrial, Infrastructure, Power & Energy) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, Italy, UK, Spain, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Rest of Asia-Pacific), Latin America (Brazil, Argentina, Rest of LATAM), Middle East and Africa (Saudi Arabia, UAE, Rest of MEA) |

|

Competitive Landscape |

BASF, DuPont, Evonik, GAF, Kingspan Group, Knauf Insulation, Rockwool, Saint-Gobain, among others. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1. 1.Key Research Objectives |

|

1.2.Market Definition |

|

1.3.Report Scope |

|

1.4.Currency & Conversion |

|

2.Research Methodology |

|

2.1.Research Design |

|

2.2.Market Size Estimation & Data Triangulation |

|

2.3.Key Sources |

|

2.4.Research Assumptions & Limitations |

|

3.Executive Summary |

|

4.Market Insights |

|

4.1.Market Growth Drivers |

|

4.1.1.Growing Construction Industry |

|

4.1.2.Strong Focus on Maintaining Good Indoor Air Quality |

|

4.1.3.Government Rebates, Grants and Schemes |

|

4.2.Market Growth Restraint |

|

4.2.1.High Initial Costs |

|

4.2.2.Lack of Awareness |

|

4.3.Market Growth Opportunity |

|

4.3.1.Sustainable and Green Building Initiatives |

|

4.3.2.Innovations In Insulation Materials and Techniques |

|

5. Thermal Insulation Market Outlook |

|

5.1. Regulatory Analysis |

|

5.1.1.US |

|

5.1.2.Canada |

|

5.1.3.Germany |

|

5.1.4.Japan |

|

6.Global Thermal Insulation Market, by Material Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1.Introduction |

|

6.2.Plastic Foam |

|

6.3.Fiberglass |

|

6.4.Mineral Wool |

|

6.5.Cellulose |

|

6.6.Aerogel |

|

6.7.Others |

|

7.Global Thermal Insulation Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1.Introduction |

|

7.2.Building & Construction |

|

7.3.Industrial Application |

|

7.4.HVAC System |

|

7.5.Automotive |

|

7.6.Aerospace & Defense |

|

7.7.Marine |

|

7.8.Appliances |

|

7.9.Others |

|

8.Global Thermal Insulation Market, by End-Use (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1.Introduction |

|

8.2.Residential |

|

8.3.Commercial |

|

8.4.Industrial |

|

8.5.Infrastructure |

|

8.6.Power & Energy |

|

8.7.Others |

|

9.Global Thermal Insulation Market, by Region (Market Size & Forecast: USD Million, 2022 – 2030) |

|

9.1.Introduction |

|

9.2.North America |

|

9.2.1.North America Thermal Insulation Market, by Material Type |

|

9.2.2.North America Thermal Insulation Market, by Application |

|

9.2.3.North America Thermal Insulation Market, by End-Use |

|

*Similar segmentation will be provided at each regional level |

|

9.2.1.US |

|

9.2.1.1.US Thermal Insulation Market, by Material Type |

|

9.2.1.2.US Thermal Insulation Market, by Application |

|

9.2.1.3.US Thermal Insulation Market, by End-Use |

|

9.2.2.Canada |

|

9.2.3.Mexico |

|

*Similar segmentation will be provided at each country level |

|

9.3.Europe |

|

9.3.1.Germany |

|

9.3.2.France |

|

9.3.3.Italy |

|

9.3.4.United Kingdom |

|

9.3.5.Spain |

|

9.3.6.Rest of Europe |

|

9.4.APAC |

|

9.4.1.China |

|

9.4.2.Japan |

|

9.4.3.South Korea |

|

9.4.4.India |

|

9.4.5.Rest of Asia Pacific |

|

9.5.Latin America |

|

9.5.1.Brazil |

|

9.5.3.Argentina |

|

9.5.4.Rest of Latin America |

|

9.6.Middle East & Africa |

|

9.6.1.Saudi Arabia |

|

9.6.2.United Arab Emirates |

|

9.6.3.Rest of Middle East & Africa |

|

10.Competitive Landscape |

|

10.1.Introduction |

|

10.2. Company Market Share Analysis |

|

10.3. Thermal Insulation Market: Competitive Matrix |

|

10.4. Competitive Scoring Across Different Verticals |

|

10.5. Competitive Strategy Analysis |

|

11.Company Profiles |

|

11.1.Key Market Companies |

|

11.1.1.Asahi Kasei Corporation |

|

11.1.1.1.Business Overview |

|

11.1.1.2.Product Portfolio |

|

11.1.1.3.Recent Developments |

|

11.1.1.4.SWOT Analysis |

|

11.1.1.5.Consultant’s View |

|

*Similar information will be provided for other companies |

|

11.1.2.BASF |

|

11.1.3.Evonik |

|

11.1.4.GAF |

|

11.1.5.Kingspan Group |

|

11.1.6.Knauf Insulation |

|

11.1.7.Owens Corning |

|

11.1.8.Rockwool |

|

11.1.9.DuPont |

|

11.1.10.Saint-Gobain |

|

12.Appendix |

|

12.1.Discussion Guidelines |

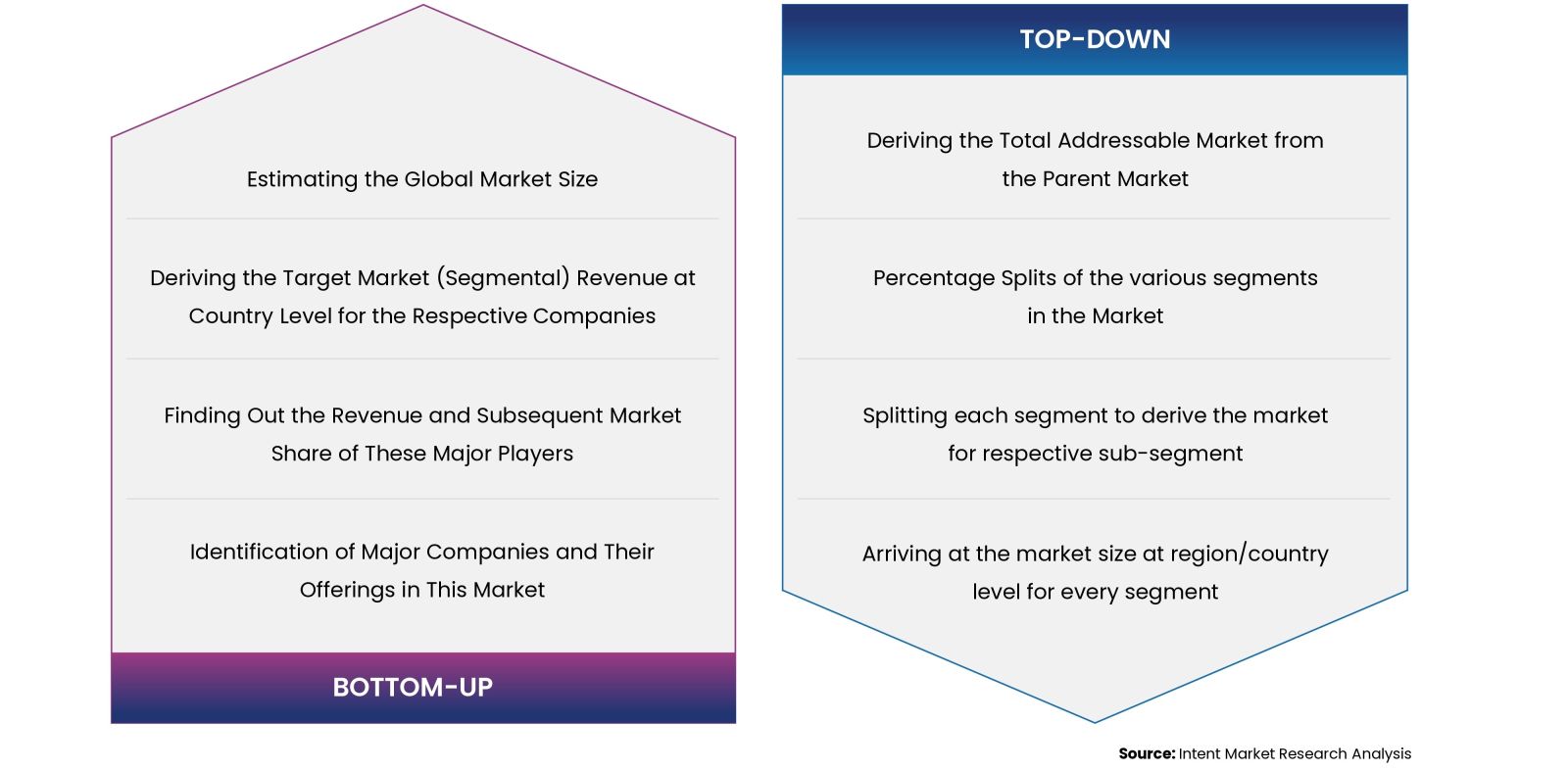

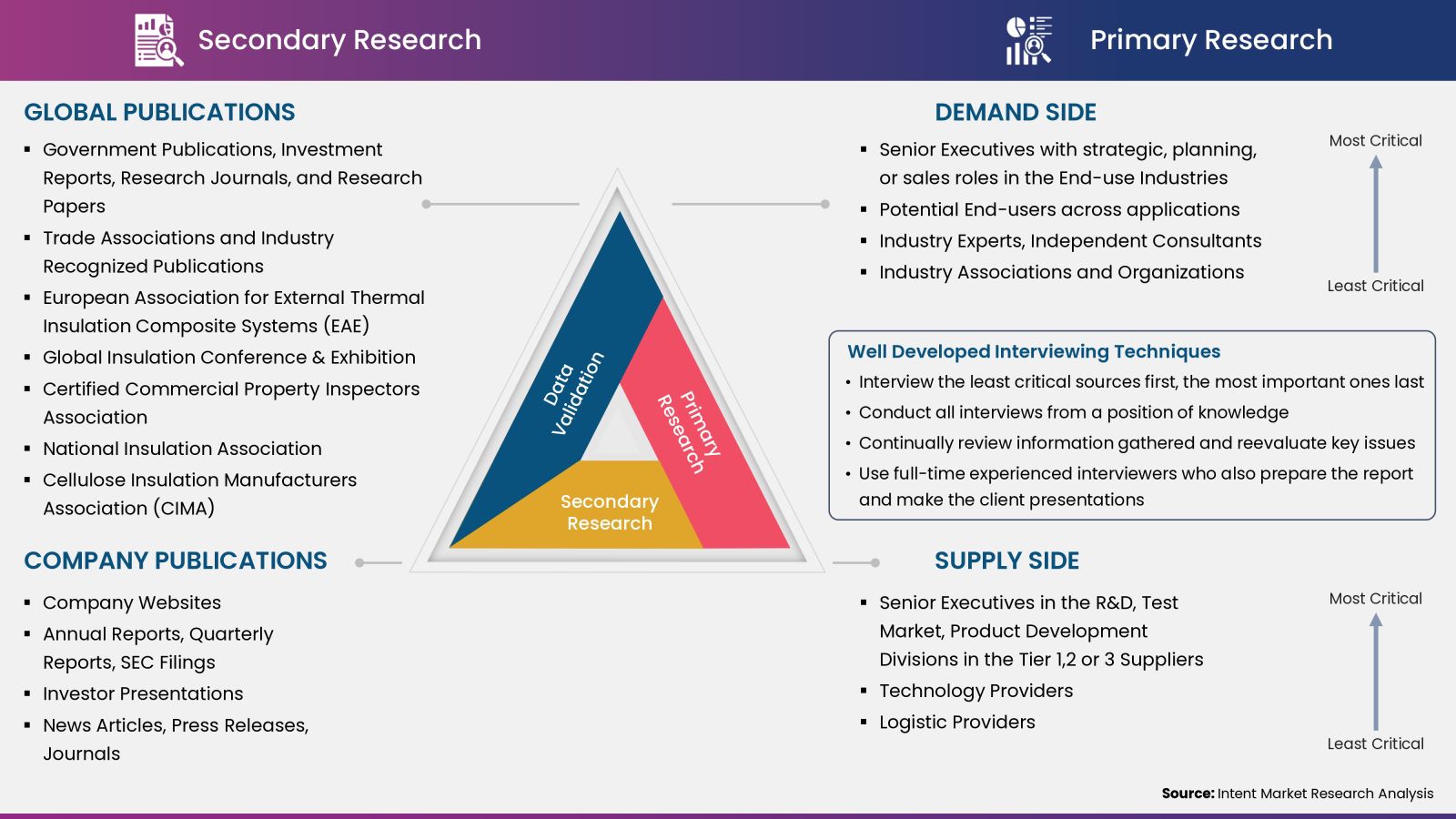

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.