As per Intent Market Research, the Spinal Implants Market was valued at USD 9.8 billion in 2024-e and will surpass US 16.9 billion by 2030; growing at a CAGR of 8.1% during 2025 - 2030.

The spinal implants market is expanding rapidly, driven by the rising prevalence of spinal disorders such as degenerative disc disease, scoliosis, and spinal trauma, coupled with advancements in implant technology. Spinal implants play a crucial role in stabilizing the spine, alleviating pain, and improving mobility, making them an integral part of modern orthopedic and neurosurgical practices. The market is segmented by device type, material, procedure type, end-users, and applications, each addressing specific patient needs, from those requiring minimally invasive surgery to complex spinal reconstructions.

With increasing demand for effective treatments for spine-related disorders, technological innovations in implant materials and designs are leading to better patient outcomes, faster recovery times, and reduced complication rates. Minimally invasive surgery (MIS) techniques, which allow for smaller incisions and faster recovery, are particularly influencing the market’s trajectory, leading to more efficient and patient-friendly solutions. The growing aging population and the increase in spinal trauma cases are driving the need for both fusion and non-fusion spinal devices, ensuring continued market growth.

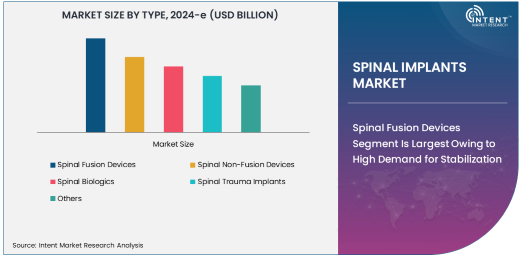

Spinal Fusion Devices Segment Is Largest Owing to High Demand for Stabilization

Spinal fusion devices are the largest segment within the spinal implants market, primarily due to their widespread use in treating degenerative disc disease, spinal trauma, and deformities such as scoliosis. Spinal fusion surgery involves fusing two or more vertebrae to eliminate motion at the affected segment, providing stability and reducing pain. The high demand for spinal fusion devices can be attributed to the growing number of patients suffering from degenerative spine conditions, which require surgical stabilization.

These devices are commonly made of metal, such as titanium or stainless steel, offering durability and support. The segment is further strengthened by the adoption of innovative fusion techniques, such as the use of interbody cages, plates, and screws, which enhance the efficacy of the procedure. Additionally, the increasing prevalence of conditions like osteoarthritis, which accelerates degenerative disc disease, contributes to the dominance of spinal fusion devices in the market.

Spinal Biologics Segment Is Fastest Growing Due to Advances in Regenerative Medicine

The spinal biologics segment is the fastest growing, fueled by advancements in regenerative medicine and the increasing adoption of biologic implants to support spinal healing and recovery. Spinal biologics, including bone morphogenetic proteins (BMPs), growth factors, and stem cells, promote tissue regeneration and healing after spinal surgery. These biologics are increasingly being integrated into spinal fusion procedures to enhance the effectiveness of bone grafting, reduce healing times, and improve fusion rates.

The shift towards biologic materials also reflects the growing trend of patient-centric care, as biologics aim to reduce complications associated with traditional metal implants. The segment’s growth is driven by ongoing research into biologics that can accelerate bone regeneration, improve spinal stability, and minimize the need for additional surgeries. The potential for biologics to revolutionize spinal treatments, combined with their effectiveness in complex spinal conditions, positions them as a key growth driver in the market.

Minimally Invasive Surgery Segment Is Fastest Growing Due to Patient Demand for Faster Recovery

The minimally invasive surgery (MIS) procedure type is the fastest growing in the spinal implants market, driven by patient demand for less invasive treatments that offer quicker recovery times, reduced hospital stays, and fewer complications. MIS techniques involve smaller incisions, which help preserve muscle and tissue, minimizing trauma to the body and allowing patients to return to normal activities more quickly.

MIS spinal procedures are increasingly preferred for conditions such as degenerative disc disease and spinal trauma, as they result in less blood loss, reduced post-operative pain, and lower infection rates compared to traditional open spine surgery. Technological advancements, including robotic-assisted surgeries and real-time imaging, are improving the precision and outcomes of MIS, further boosting its adoption. As healthcare providers and patients alike seek more efficient, cost-effective, and less painful solutions, MIS is set to continue growing in popularity within the spinal implants market.

Hospitals Segment Is Largest End-User Due to Comprehensive Care and Advanced Facilities

Hospitals represent the largest end-user segment in the spinal implants market, owing to their advanced surgical facilities, specialized staff, and comprehensive care options. Hospitals are the primary setting for complex spinal surgeries, including both fusion and non-fusion procedures, as they have the necessary infrastructure to handle critical spinal conditions.

Hospitals also offer the ability to manage complicated cases that may require multidisciplinary teams, including orthopedic surgeons, neurosurgeons, and rehabilitation specialists. With increasing demand for spinal surgeries due to aging populations and the prevalence of spinal disorders, hospitals are expected to maintain their dominant position in the spinal implants market. Moreover, their capacity for high-volume surgeries and access to cutting-edge technologies makes hospitals a key player in the market’s growth.

Degenerative Disc Disease Segment Is Largest Application Due to High Incidence Rate

Degenerative disc disease (DDD) is the largest application in the spinal implants market, driven by the high incidence rate of age-related spinal degeneration. DDD is a common condition that occurs when the intervertebral discs lose hydration and elasticity over time, leading to pain, inflammation, and mobility issues. Surgical treatments often require the use of spinal implants, including fusion devices, to stabilize the spine and alleviate symptoms.

The aging population, coupled with increasing sedentary lifestyles, is fueling the rise in DDD cases, particularly among older adults. As a result, the demand for spinal implants designed to treat degenerative conditions is significant. Advances in implant materials and surgical techniques, such as biologic integration with fusion devices, are further enhancing treatment outcomes for patients suffering from DDD, ensuring that this segment continues to be a major contributor to the market.

North America Leads the Market Due to Advanced Healthcare Systems and High Surgical Volumes

North America holds the largest market share in the spinal implants market, driven by its advanced healthcare infrastructure, high surgical volumes, and widespread adoption of innovative spinal implant technologies. The region is home to a large aging population that requires advanced spinal treatments for conditions like degenerative disc disease, scoliosis, and trauma-related spinal injuries. Additionally, North American hospitals and surgical centers are equipped with state-of-the-art technologies, enabling them to perform complex spinal procedures with high precision and efficiency.

The demand for spinal implants in North America is also influenced by the growing prevalence of lifestyle-related conditions, such as obesity, which contribute to spinal disorders. Furthermore, the region’s strong focus on medical research and development ensures that new and improved spinal implant technologies are rapidly integrated into clinical practice.

Competitive Landscape: Key Players Drive Innovation and Global Expansion

The spinal implants market is highly competitive, with major players like Medtronic, Stryker, Zimmer Biomet, and Johnson & Johnson leading the way in terms of innovation and market share. These companies are at the forefront of developing advanced spinal implant solutions, including minimally invasive devices, biologics, and next-generation fusion technologies.

Strategic collaborations, mergers and acquisitions, and continuous R&D investments are driving market expansion and innovation. Companies are also focusing on expanding their global presence, particularly in emerging markets, to capitalize on the increasing demand for spinal surgeries in these regions. As technological advancements continue to improve treatment outcomes, the competitive landscape of the spinal implants market is expected to remain dynamic, with ongoing efforts to enhance patient care, reduce recovery times, and optimize surgical procedures.

Recent Developments:

- In December 2024, Medtronic launched a new spinal fusion system aimed at reducing patient recovery times.

- In November 2024, Stryker Corporation acquired a spinal robotics company to enhance its minimally invasive spinal implant offerings.

- In October 2024, Globus Medical received FDA approval for its latest spinal non-fusion device.

- In September 2024, DePuy Synthes (Johnson & Johnson) expanded its spinal biologics portfolio with a new product for degenerative disc disease.

- In August 2024, Zimmer Biomet announced a strategic partnership to develop advanced spinal trauma implants.

List of Leading Companies:

- Medtronic

- Stryker Corporation

- Zimmer Biomet

- DePuy Synthes (Johnson & Johnson)

- NuVasive, Inc.

- Globus Medical

- Spineology

- Orthofix Medical Inc.

- K2M (now part of Stryker)

- Baxter International

- Siemens Healthineers

- Integra LifeSciences

- Xtant Medical

- RTI Surgical

- Alphatec Spine

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 9.8 Billion |

|

Forecasted Value (2030) |

USD 16.9 Billion |

|

CAGR (2025 – 2030) |

8.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Spinal Implants Market by Type (Spinal Fusion Devices, Spinal Non-Fusion Devices, Spinal Biologics, Spinal Trauma Implants), Material (Metal, Polymeric Materials, Biodegradable Materials, Composite Materials), Procedure Type (Minimally Invasive Surgery, Open Spine Surgery), End-User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers), Application (Degenerative Disc Disease, Spinal Trauma, Scoliosis, Spinal Tumors) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Medtronic, Stryker Corporation, Zimmer Biomet, DePuy Synthes (Johnson & Johnson), NuVasive, Inc., Globus Medical, Spineology, Orthofix Medical Inc., K2M (now part of Stryker), Baxter International, Siemens Healthineers, Integra LifeSciences, Xtant Medical, RTI Surgical, Alphatec Spine |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Spinal Implants Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Spinal Fusion Devices |

|

4.2. Spinal Non-Fusion Devices |

|

4.3. Spinal Biologics |

|

4.4. Spinal Trauma Implants |

|

4.5. Others |

|

5. Spinal Implants Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Metal |

|

5.2. Polymeric Materials |

|

5.3. Biodegradable Materials |

|

5.4. Composite Materials |

|

6. Spinal Implants Market, by Procedure Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Minimally Invasive Surgery |

|

6.2. Open Spine Surgery |

|

7. Spinal Implants Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Specialty Clinics |

|

7.3. Ambulatory Surgical Centers |

|

7.4. Others |

|

8. Spinal Implants Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Degenerative Disc Disease |

|

8.2. Spinal Trauma |

|

8.3. Scoliosis |

|

8.4. Spinal Tumors |

|

8.5. Others |

|

8.6. Others |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Spinal Implants Market, by Type |

|

9.2.7. North America Spinal Implants Market, by |

|

9.2.8. North America Spinal Implants Market, by |

|

9.2.9. North America Spinal Implants Market, by |

|

9.2.10. By Country |

|

9.2.10.1. US |

|

9.2.10.1.1. US Spinal Implants Market, by Type |

|

9.2.10.1.2. US Spinal Implants Market, by |

|

9.2.10.1.3. US Spinal Implants Market, by |

|

9.2.10.1.4. US Spinal Implants Market, by |

|

9.2.10.2. Canada |

|

9.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. 1. Medtronic |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. 2. Stryker Corporation |

|

11.3. 3. Zimmer Biomet |

|

11.4. 4. DePuy Synthes (Johnson & Johnson) |

|

11.5. 5. NuVasive, Inc. |

|

11.6. 6. Globus Medical |

|

11.7. 7. Spineology |

|

11.8. 8. Orthofix Medical Inc. |

|

11.9. 9. K2M (now part of Stryker) |

|

11.10. 10. Baxter International |

|

11.11. 11. Siemens Healthineers |

|

11.12. 12. Integra LifeSciences |

|

11.13. 13. Xtant Medical |

|

11.14. 14. RTI Surgical |

|

11.15. 15. Alphatec Spine |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Spinal Implants Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Spinal Implants Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Spinal Implants Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA