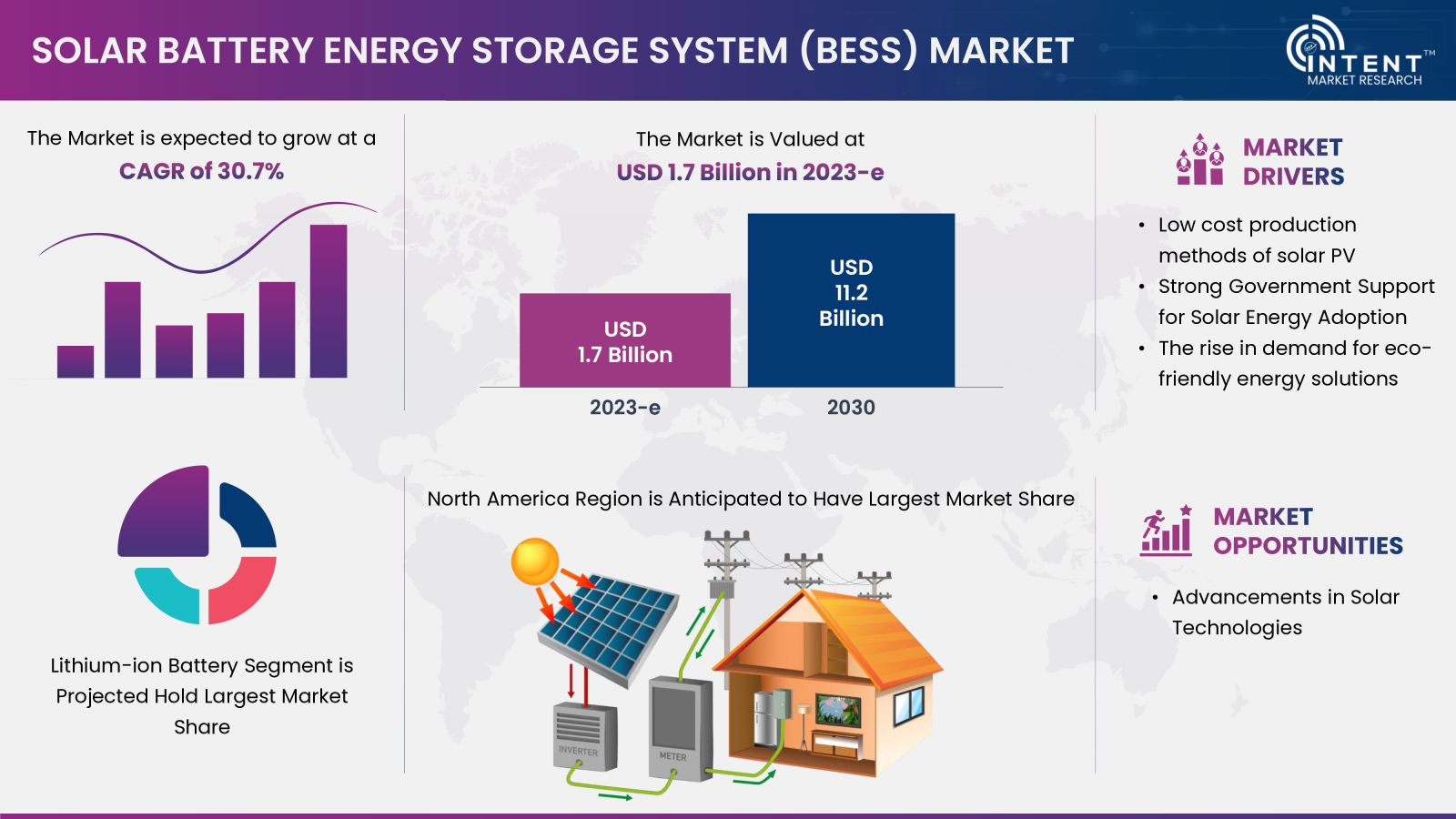

According to Intent Market Research, the Solar Battery Energy Storage System (BESS) Market is expected to grow from USD 1.7 billion in 2023-e at a CAGR of 30.7% to touch USD 11.2 billion by 2030. The solar BESS market is dominated by key players such as ABB, BYD, EVE Energy, Fluence Energy, General Electric, Huawei, Samsung SDI, Siemens Energy, SunGrow, among others. Low cost production methods of solar PV are expected to propel the market growth.

Click here to: Get FREE Sample Pages of this Report

The Solar Battery Energy Storage System (BESS) market is anticipated to grow significantly as they are instrumental in capturing and storing energy generated by sunlight, allowing for its release during peak demand periods. These systems are used in residential and commercial settings to store excess solar energy for later use, providing advantages such as cost savings, energy independence, and grid stability. They can also serve as reliable backup power sources during grid outages, ensuring uninterrupted operations.

The increasing demand for solar BESS is driven by the need for sustainable and clean energy solutions. This trend is fueling continuous research and innovation in the industry.

Solar BESS Market Dynamics

Strong Government Support for Solar Energy Adoption to Propel the Market Growth

Government support through policies such as feed-in tariffs, subsidies, and tax incentives has played a crucial role in driving the market growth. Countries such as India, China, Germany, and the US are providing funding support in research and development of solar energy storage systems. These policies have helped make solar energy more economically viable and have incentivized investment in solar energy projects with battery storage integration. This has contributed to the transition towards a more sustainable and resilient energy system.

High Upfront Cost May Hinder the Solar BESS Market Growth

The upfront costs associated with installing solar BESS remain a significant barrier to adoption for many consumers and businesses. The cost of batteries, inverters, balance of system components, and installation can be substantial, making it difficult for some stakeholders to justify the investment.

Batteries represent one of the most substantial costs in a solar BESS installation Lithium batteries, which are commonly used in BESS applications due to their high energy density and efficiency, can be expensive to procure. The cost per kilowatt-hour (kWh) of storage capacity varies depending on factors such as battery chemistry, manufacturer, and technology advancements.

Solar BESS Market Segment Insights

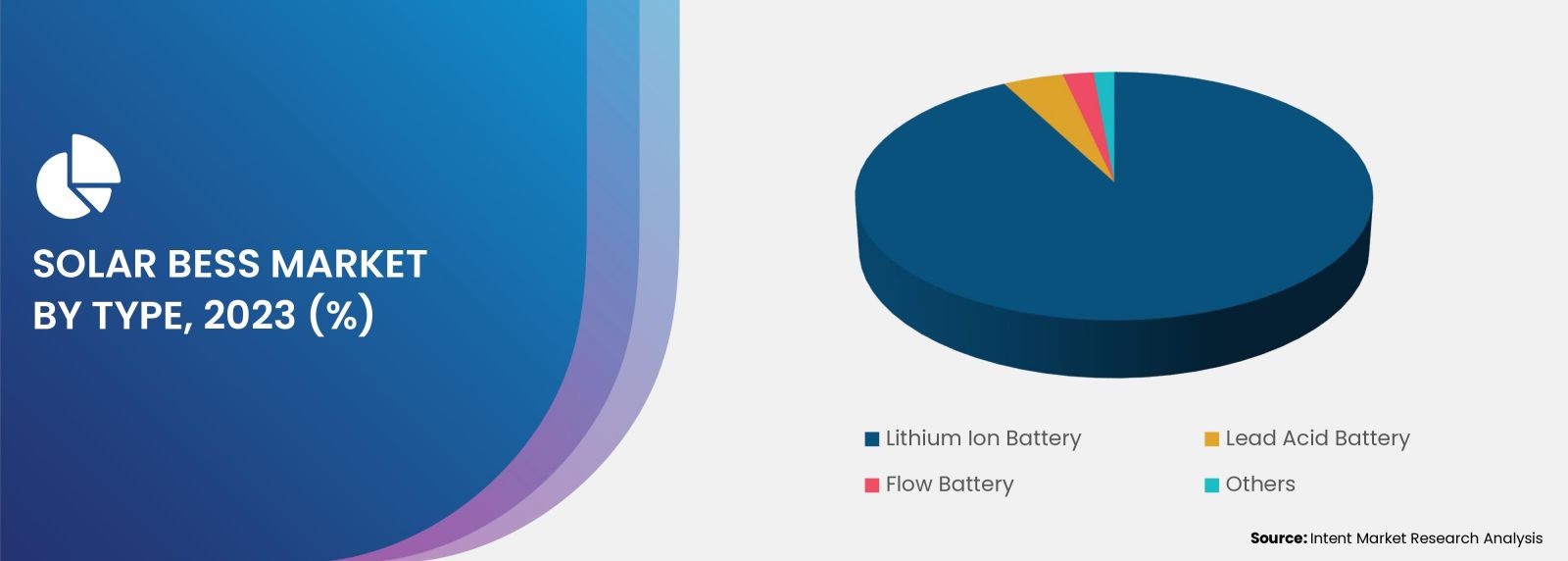

Lithium-ion Battery Segment Held the Largest Market Share

The lithium-ion battery stands as the prevailing commercial rechargeable battery, widely embraced in portable electronics and electrified transportation. In contrast to other top-tier rechargeable battery technologies like nickel-cadmium, nickel-metal-hydride, or lead-acid, Li-ion batteries offer several advantages.

Key players in the market are developing Li-ion batteries designed for solar energy storage for residential and commercial use. For instance, in June 2022, Natural Battery Technologies, an India-based Li-ion battery manufacturing company launched Li-ion inverter batteries with solar power storage. The lithium-ion-based inverter batteries store high volumes of power with a remarkable efficiency. They are designed for use in conjunction with solar power systems, offering a reliable and eco-friendly energy storage solution.

Utility Owned Segment Captured Largest Share in Solar BESS Market

Utility-owned solar energy storage batteries are energy storage systems that utility companies own and operate. These batteries are typically used to store excess energy generated by utility-scale solar power plants. The stored energy can then be discharged during periods of high demand or low solar energy production to stabilize the grid and enhance overall system reliability.

The advantages of utility-owned solar energy storage batteries for businesses include their ability to stabilize the grid, improve reliability, and manage peak demand effectively. By storing excess solar energy, these batteries help balance supply and demand, reducing the risk of outages and enhancing the overall stability of the electricity grid. Additionally, they can help businesses reduce their electricity costs by discharging stored energy during times of high demand, reducing peak demand charges. Moreover, these batteries enable better integration of renewable energy sources into the grid, supporting businesses in their sustainability goals.

On Grid Segment Held the Major Share in Solar BESS Market

An on-grid solar battery system is a solar energy setup connected to the main electricity grid. It includes solar panels, inverters, and a battery bank for energy storage. During the day, the solar panels generate electricity, which can be used to power the home or business. Any excess electricity produced can be stored in the battery bank or fed back into the grid for credit. At night or when solar energy production is low, electricity can be drawn from the grid or the battery bank.

Key players in the market are partnering to develop solar energy and energy storage solutions. In February 2024, Å Entelios, a Norway-based electricity company announced its partnership with Solar Power Accelerator, a Sweden-based solar power solutions company to offer energy as a service (EaaS). EaaS presents a comprehensive suite of services designed for commercial and industrial real estate owners and industries. This system provides grid support by reducing peak demand and stabilizing grid voltage, as well as backup power during grid outages, ensuring uninterrupted operations for users.

Large Scale (>1MW) Segment to Drive the Solar BESS Market

Large-scale solar energy storage systems are energy storage solutions with a capacity exceeding 1 megawatt (MW). These systems are engineered to store surplus energy produced by large solar power plants, ensuring grid stability and enhancing overall system dependability. Large-scale solar BESS is integrated with utility-scale solar installations. These solar BESS optimize energy utilization and provide a reliable power source even during periods of low solar energy production.

Large scale energy storage systems play a crucial role in balancing energy supply and demand by storing excess energy generated during sunny periods and releasing it as needed. Large-scale storage solutions facilitate the seamless integration of renewable energy sources, such as solar power, into the grid. This compensates for fluctuations and supports the transition from fossil fuels to cleaner energy sources. Strategically locating solar energy storage systems near demand centers reduces transmission losses, as energy does not have to travel long distances from remote solar farms to urban areas.

Industrial Applications Segment held the Largest Share in Solar BESS Market

Industrial application segment held largest market share due to use of solar BESS in various industrial process. Solar BESS is used in water desalination, enhanced oil recovery, food processing, chemical production, and mineral processing, among others. Solar energy applications are promising solution for meeting global electricity demands, especially with fossil fuels depleting and environmental concerns rising. Solar power, particularly through concentrating solar-thermal power (CSP) technology, offers a cost-effective and eco-friendly alternative. CSP systems use mirrors to concentrate sunlight onto receivers, generating electricity for various industrial applications. This versatile technology is revolutionizing the way to generate and utilize electricity.

The rising focus on clean energy generation is driving the demand for solar energy in industrial sector. For instance, in July 2023, according to International Energy Agency, a France-based government organization in energy sector, published a report on solar PV generation. According to report, in 2022, solar photovoltaic (PV) generation saw a remarkable increase of 270 terawatt-hours (TWh), marking a 26% growth and reaching nearly 1,300 TWh. This growth represents the largest absolute increase in generation among all renewable technologies in 2022, surpassing wind power.

Asia-Pacific held the Largest Share in Solar BESS Market

The growth of the solar energy storage market in Asia Pacific is primarily attributed to the growing adoption of solar energy storage solutions and rising energy demand from sustainable sources. This trend is propelled by factors such as ample sunlight, decreasing costs of solar technology, and a growing demand for renewable energy sources to lessen dependence on fossil fuels. Consequently, businesses, governments, and communities in the Asia Pacific are increasingly adopting solar power as a clean, sustainable, and economically viable energy solution.

Research and Innovation is the Major Focus Area of Key Industry Players

The market faces intense competition from a multitude of international and domestic players. The solar BESS market is dominated by key players such as ABB, BYD, EVE Energy, Fluence Energy, General Electric, Huawei, Samsung SDI, Siemens Energy, SolarEdge, SunGrow, Tesla, and VRB Energy, among others. These industry leaders are primarily focused on research collaboration and partnerships to develop advance solar battery systems in the solar BESS market.

- In November 2023, General Electric, announced its collaboration with Our Next Energy, an US-based renewable energy storage product manufacturing company. The partnership entails supplying ONE's battery modules, which include U.S. made lithium iron phosphate (LFP) cells, for GE Vernova's Solar & Storage Solutions projects nationwide

- In February 2022, Siemens Energy has partnered with Desert Technologies, a Saudi Arabia-based solar PV and smart infrastructure company, to develop and launch Capton Energy. This platform is aimed at fostering the development and investment in solar and intelligent infrastructure. Capton Energy seeks to invest in projects totaling over 1 gigawatt (GW) and enhance the provision of clean, reliable, and cost-effective electricity in underserved markets

Get your custom research report today

Solar BESS Market Coverage

The report provides key insights into the solar BESS market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market. The report offers the market size and forecasts for the solar BESS market in value (USD million) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.7 billion |

|

Forecast Revenue (2030) |

USD 11.2 billion |

|

CAGR (2024-2030) |

30.7% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

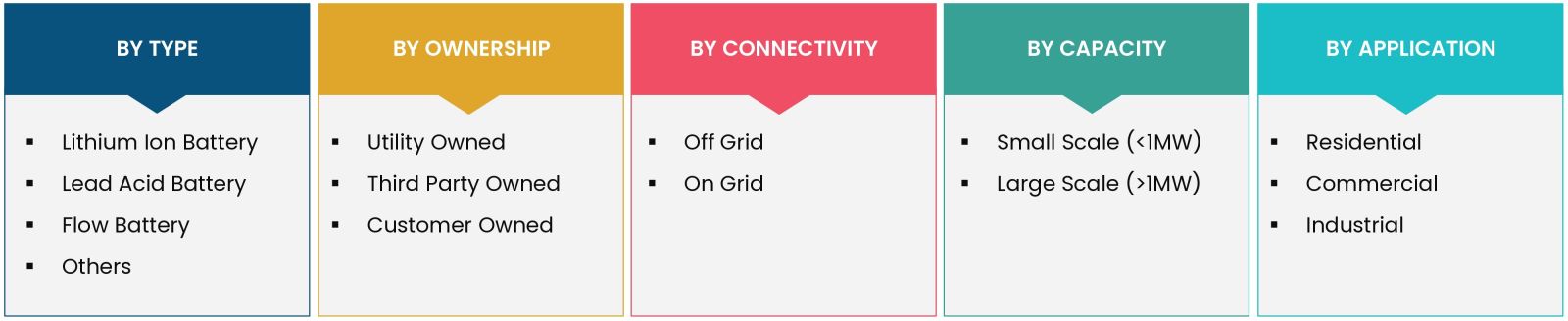

Segments Covered |

Solar Battery Energy Storage System (BESS) Market By Type (Lithium Ion Battery, Lead Acid Battery, Flow Battery, Others), By Ownership (Utility Owned, Third Party Owned, Customer Owned), By Connectivity (Off Grid, On Grid), By Capacity (Small Scale (<1MW), Large Scale (>1MW)), By Applications (Residential, Commercial, Industrial, Utilities) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates) |

|

Competitive Landscape |

ABB, BYD, EVE Energy, General Electric, Huawei, Siemens Energy, SolarEdge, SunGrow, Tesla, Fluence Energy, Samsung SDI |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Key Research Objectives |

|

1.2.Market Definition |

|

1.3.Report Scope |

|

1.4.Currency & Conversion |

|

2.Research Methodology |

|

2.1.Research Design |

|

2.2.Market Size Estimation & Data Triangulation |

|

2.3.Key Sources |

|

2.4.Research Assumptions & Limitations |

|

3.Executive Summary |

|

4.Market Insights |

|

4.1.Market Drivers |

|

4.1.1.Low Cost Production Methods Of Solar PV |

|

4.1.2.Strong Government Support For Solar Energy Adoption |

|

4.1.3.Rise In Demand For Eco-Friendly Energy Solutions |

|

4.2.Market Restraints |

|

4.2.1High Upfront Cost |

|

4.3.Market Opportunities |

|

4.3.1.Advancement In Solar Technologies |

|

4.4.Challenges |

|

4.4.1.High Climate Dependency |

|

5.Market Outlook |

|

5.1.Regulatory Analysis |

|

6.Solar BESS Market, by Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Li-Ion Battery |

|

6.2.Lead Acid Battery |

|

6.3.Flow Battery |

|

6.4.Others |

|

7.Solar BESS Market, by Ownership (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Utility Owned |

|

7.2.Customer Owned |

|

7.3.Third Party Owned |

|

8.Solar BESS Market, by Connectivity (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Off Grid |

|

8.2.On Grid |

|

9.Solar BESS Market, by Capacity (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.1. Small Scale (<1 MW) |

|

9.2. Large Scale (>1 MW) |

|

10.Solar BESS Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

10.1.Residential |

|

10.2.Commercial |

|

10.3.Industrial |

|

10.4.Utilities |

|

11.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

11.1.Regional Overview |

|

11.2.North America |

|

11.2.1.Regional Trends & Growth Drivers |

|

11.2.2.Barriers & Challenges |

|

11.2.3.Opportunities |

|

11.2.4.Factor Impact Analysis |

|

11.2.5.Technology Trends |

|

11.2.6.North America Solar BESS Market, by Type |

|

11.2.7.North America Solar BESS Market, by Ownership |

|

11.2.8.North America Solar BESS Market, by Connectivity |

|

11.2.9.North America Solar BESS Market, by Capacity |

|

11.2.10.North America Solar BESS Market, by Application |

|

*Similar segmentation will be provided at each regional level |

|

11.3.By Country |

|

11.3.1.US |

|

11.3.1.1.US Solar BESS Market, by Type |

|

11.3.1.2.US Solar BESS Market, by Ownership |

|

11.3.1.3.US Solar BESS Market, by Connectivity |

|

11.3.1.4.US Solar BESS Market, by Capacity |

|

11.3.1.5.US Solar BESS Market, by Application |

|

11.3.2.Canada |

|

11.3.3.Mexico |

|

*Similar segmentation will be provided at each country level |

|

11.4.Europe |

|

11.5.APAC |

|

11.6.Latin America |

|

11.7.Middle East & Africa |

|

12.Competitive Landscape |

|

12.1.Overview of the Key Players |

|

12.2.Competitive Ecosystem |

|

12.2.1.Platform Manufacturers |

|

12.2.2.Subsystem Manufacturers |

|

12.2.3.Service Providers |

|

12.2.4.Software Providers |

|

12.3.Company Share Analysis |

|

12.4.Company Benchmarking Matrix |

|

12.4.1.Strategic Overview |

|

12.4.2.Product Innovations |

|

12.5.Start-up Ecosystem |

|

12.6.Strategic Competitive Insights/ Customer Imperatives |

|

12.7.ESG Matrix/ Sustainability Matrix |

|

12.8.Manufacturing Network |

|

12.8.1.Locations |

|

12.8.2.Supply Chain and Logistics |

|

12.8.3.Product Flexibility/Customization |

|

12.8.4.Digital Transformation and Connectivity |

|

12.8.5.Environmental and Regulatory Compliance |

|

12.9.Technology Readiness Level Matrix |

|

12.10.Technology Maturity Curve |

|

12.11.Buying Criteria |

|

13.Company Profiles |

|

13.1.Solar BESS Leading Companies |

|

13.1.1.ABB |

|

13.1.1.1.Company Overview |

|

13.1.1.2.Company Financials |

|

13.1.1.3.Product/Service Portfolio |

|

13.1.1.4.Recent Developments |

|

13.1.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

13.1.2.BYD Company Limited |

|

13.1.3.EVE Energy Co. |

|

13.1.4.Fluence Energy |

|

13.1.5.General Electric |

|

13.1.6.Huawei |

|

13.1.7.VRB Energy |

|

13.1.8.Samsung SDI |

|

13.1.9.Siemens Energy |

|

13.1.10.SolarEdge |

|

13.1.11.SunGrow |

|

13.1.12.Tesla |

|

13.2. Solar BESS Start-Ups |

|

13.2.1.Alpha ESS Co. |

|

13.2.2.Blue Sky Energy |

|

13.2.3.Energy Vault |

|

13.2.4.FlexGen |

|

13.2.5.Form Energy |

|

13.2.6.Primus Power |

|

13.2.7.Redback Technologies |

|

13.2.8.SENEC |

|

13.2.9.Solarwatt |

|

13.2.10.sonnenBatterie |

|

14.Appendix |

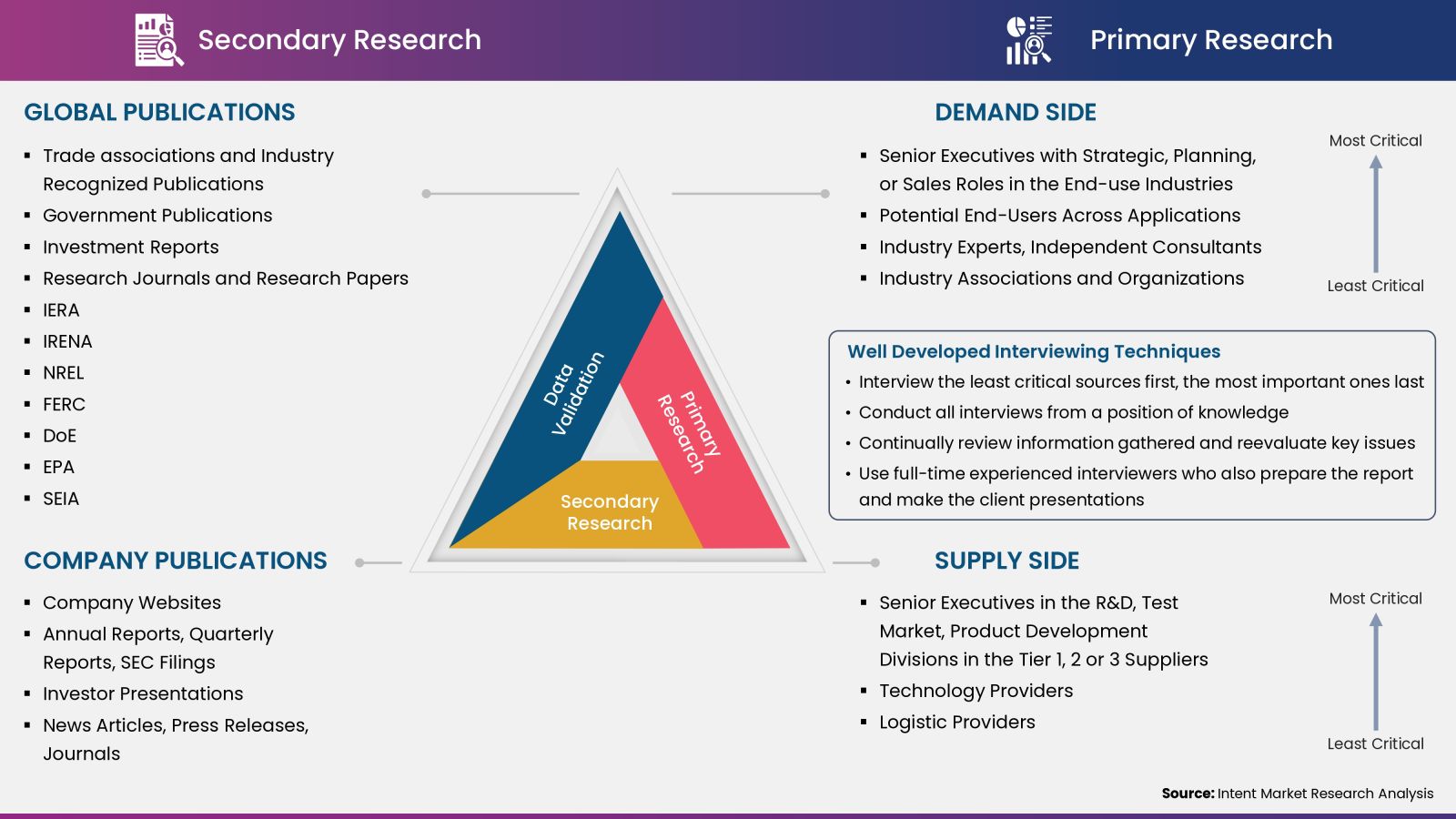

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.