As per Intent Market Research, the Software Defined Radio Market was valued at USD 11.6 billion in 2023 and will surpass USD 20.8 billion by 2030; growing at a CAGR of 8.7% during 2024 - 2030.

The Software Defined Radio (SDR) market is at the forefront of transforming the telecommunications and defense sectors, driven by the increasing demand for flexible and adaptable communication systems. SDR technology allows radio components to be implemented in software, enabling the easy adaptation of radio devices to different frequencies and standards without the need for physical hardware changes. This adaptability is crucial in a rapidly evolving technological landscape where communication standards are constantly changing. The market is witnessing significant growth as industries recognize the benefits of SDR, including enhanced performance, reduced costs, and increased operational efficiency.

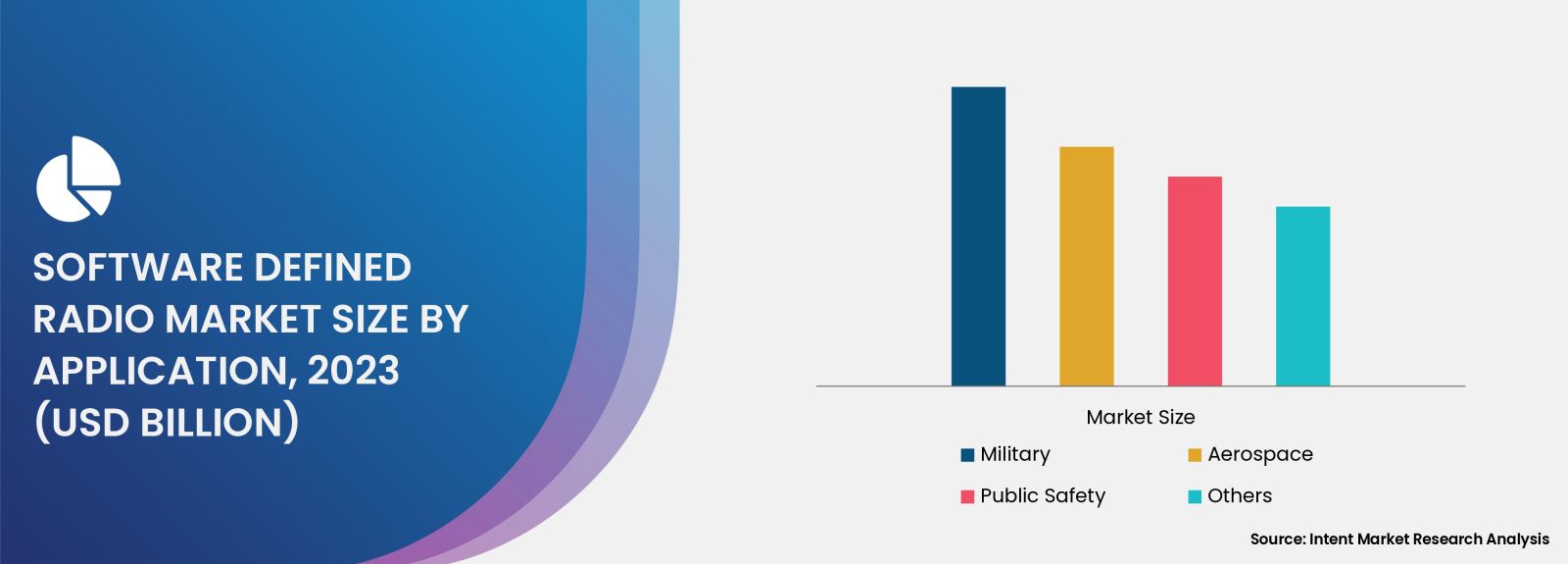

Military Segment is Largest Owing to Strategic Defense Investments

Within the Software Defined Radio market, the military segment stands out as the largest due to heightened defense expenditures globally. Nations are increasingly investing in advanced communication technologies to enhance national security and military operations. SDR enables seamless communication across various platforms, allowing military units to maintain operational superiority in diverse environments. The military's demand for secure, reliable, and interoperable communication systems fuels the growth of this segment, as SDR provides capabilities for both terrestrial and satellite communications.

Additionally, the complexity of modern warfare necessitates the use of versatile communication systems that can be quickly reconfigured for different mission requirements. This need is driving the adoption of SDR technology within military applications. The increasing focus on joint operations among allied forces further underscores the importance of SDR, as it allows different military branches to communicate effectively across varying platforms and frequencies. As a result, the military segment is expected to maintain its dominance in the SDR market through 2030.

Commercial Segment is Fastest Growing Owing to Rising Demand for Mobility

The commercial segment of the Software Defined Radio market is the fastest-growing sector, driven by the rising demand for mobile communication solutions and the proliferation of smart devices. The advent of 5G technology and the increasing need for efficient bandwidth utilization are propelling the adoption of SDR in commercial applications. As businesses and consumers alike demand faster, more reliable communication, companies are turning to SDR solutions to enhance their operational capabilities and user experiences.

Moreover, the growing trend of IoT (Internet of Things) and the need for connected devices in various industries, such as transportation and healthcare, are further contributing to the growth of this segment. SDR technology facilitates the integration of multiple communication standards, enabling businesses to deploy versatile and adaptive systems that meet the needs of an increasingly connected world. This adaptability positions the commercial segment as a key driver of growth within the Software Defined Radio market, with significant opportunities for innovation and expansion in the coming years.

Public Safety Segment is Largest Owing to Enhanced Communication Needs

The public safety segment of the Software Defined Radio market is characterized by its substantial size, driven by the increasing demand for effective communication solutions among emergency services and law enforcement agencies. With the rising frequency of natural disasters and security threats, public safety organizations are recognizing the need for reliable and resilient communication systems. SDR offers the flexibility and interoperability required for seamless communication among different agencies, enhancing coordination during critical incidents.

Furthermore, the ability of SDR systems to operate across multiple frequency bands ensures that public safety personnel can communicate effectively, regardless of the challenges posed by the environment or operational circumstances. As cities continue to grow and face complex safety challenges, the public safety segment will likely continue to expand, with SDR technology playing a vital role in improving emergency response and management.

Transportation Segment is Fastest Growing Owing to Smart Mobility Trends

The transportation segment is witnessing rapid growth within the Software Defined Radio market, fueled by the emergence of smart mobility solutions. As urban areas evolve and the demand for efficient transportation systems increases, SDR technology is becoming essential for enhancing communication among vehicles, infrastructure, and control centers. The integration of SDR in transportation systems enables real-time data exchange, improving traffic management and ensuring safer travel for commuters.

Moreover, the growing interest in autonomous vehicles is further driving the demand for SDR technology in this segment. As self-driving cars and connected vehicles require reliable communication systems to operate effectively, the adoption of SDR solutions is expected to surge. This shift toward intelligent transportation systems highlights the importance of SDR in facilitating advanced connectivity and operational efficiency, positioning the transportation segment as a key player in the future of the Software Defined Radio market.

Aerospace Segment is Largest Owing to Extensive Aviation Applications

The aerospace segment of the Software Defined Radio market is the largest due to its extensive applications in commercial and military aviation. The demand for enhanced communication systems in aviation, driven by regulatory requirements and the need for improved passenger safety, is pushing airlines and manufacturers to adopt SDR technology. SDR allows for the integration of multiple communication protocols and enhances the capabilities of in-flight communication systems.

Additionally, as the aerospace industry moves towards more advanced and efficient technologies, SDR plays a crucial role in enabling seamless communication between aircraft and ground control. The ability to operate across different frequency bands and adapt to various communication standards positions the aerospace segment as a leader in the Software Defined Radio market. As airlines and manufacturers continue to invest in innovative communication solutions, the aerospace segment is set to remain a significant contributor to market growth.

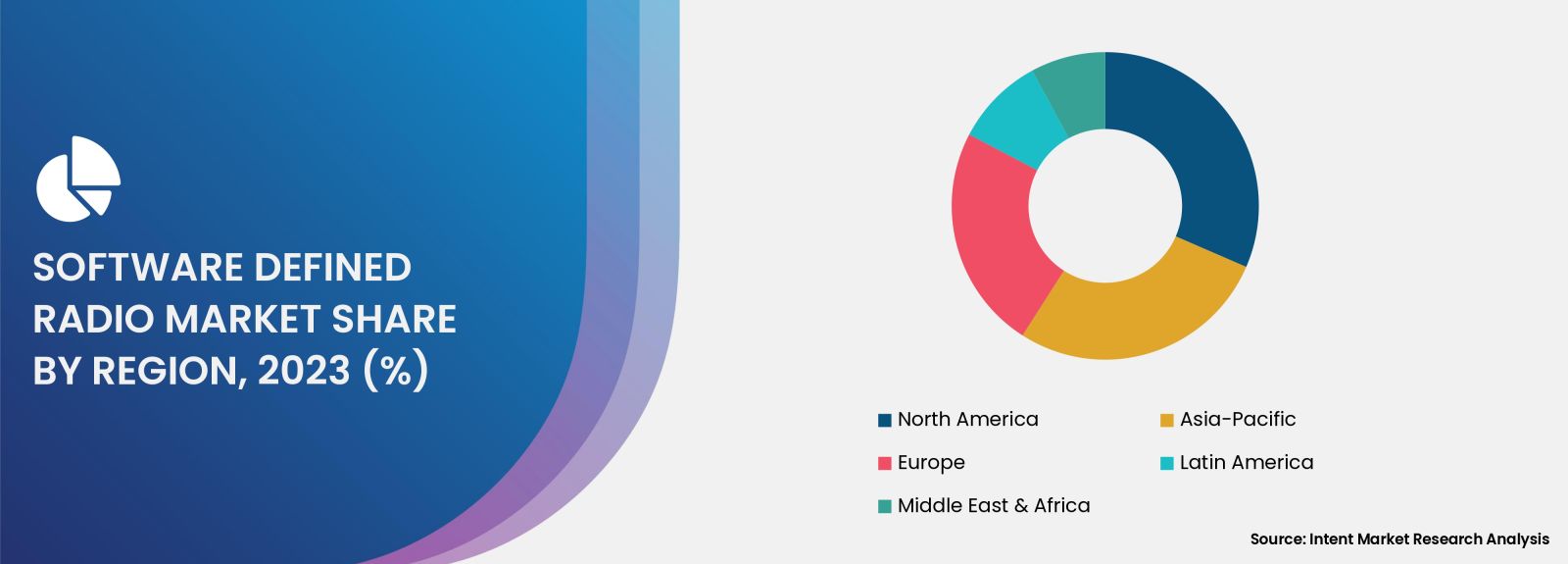

North America is the Largest Region Owing to Technological Advancements

North America is the largest region in the Software Defined Radio market, primarily due to its advanced technological infrastructure and significant investments in defense and telecommunications. The presence of key industry players and research institutions in this region has facilitated rapid innovation and development in SDR technology. Moreover, the growing focus on modernizing communication systems within military and commercial sectors has further bolstered market growth in North America.

Additionally, the increasing adoption of SDR solutions in public safety and transportation sectors highlights the region's commitment to enhancing communication capabilities across various domains. As government agencies and private companies continue to prioritize technological advancements, North America is expected to maintain its leadership position in the Software Defined Radio market throughout the forecast period.

Competitive Landscape and Leading Companies

The Software Defined Radio market is characterized by a competitive landscape, with several key players driving innovation and growth. Leading companies such as Harris Corporation, Thales Group, and Rockwell Collins are at the forefront of the market, leveraging their technological expertise and industry experience to deliver advanced SDR solutions. These companies are continuously investing in research and development to enhance their product offerings and maintain a competitive edge in the market.

Moreover, strategic partnerships, collaborations, and mergers and acquisitions are prevalent among industry players as they seek to expand their market presence and tap into emerging opportunities. The competitive landscape of the Software Defined Radio market is expected to evolve further as new entrants emerge, bringing innovative solutions and challenging established players. As the demand for SDR technology continues to grow across various sectors, companies that can offer adaptive, reliable, and cost-effective solutions will be well-positioned to succeed.

Report Objectives:

The report will help you answer some of the most critical questions in the Software Defined Radio Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Software Defined Radio Market?

- What is the size of the Software Defined Radio Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 11.6 billion |

|

Forecasted Value (2030) |

USD 20.8 billion |

|

CAGR (2024 – 2030) |

8.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Software Defined Radio Market By Component (Hardware, Software & Services), By Application (Military, Aerospace, Public Safety), By Frequency (HF (High Frequency), VHF (Very High Frequency), UHF (Ultra High Frequency), SHF (Super High Frequency), EHF (Extremely High Frequency)), By Deployment Type (On-Premises, Cloud-Based) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Software Defined Radio Market, by Component (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Hardware |

|

4.1.1. Transmitters |

|

4.1.2. Receivers |

|

4.1.3. Antennas |

|

4.1.4. Processors |

|

4.1.5. Others |

|

4.2. Software & Services |

|

5. Software Defined Radio Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Military |

|

5.1.1. Tactical Communications |

|

5.1.2. Strategic Communications |

|

5.1.3. Intelligence Surveillance Reconnaissance (ISR) |

|

5.1.4. Others |

|

5.2. Aerospace |

|

5.2.1. Aircraft Communications |

|

5.2.2. Satellite Communications |

|

5.2.3. Unmanned Aerial Vehicles (UAVs) |

|

5.3. Public Safety |

|

5.4. Others |

|

6. Software Defined Radio Market, by Frequency (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. HF (High Frequency) |

|

6.2. VHF (Very High Frequency) |

|

6.3. UHF (Ultra High Frequency) |

|

6.4. SHF (Super High Frequency) |

|

6.5. EHF (Extremely High Frequency) |

|

7. Software Defined Radio Market, by Deployment Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. On-Premises |

|

7.2. Cloud-Based |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Software Defined Radio Market, by Component |

|

8.2.7. North America Software Defined Radio Market, by Application |

|

8.2.8. North America Software Defined Radio Market, by Frequency |

|

8.2.9. North America Software Defined Radio Market, by Deployment Type |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Software Defined Radio Market, by Component |

|

8.2.10.1.2. US Software Defined Radio Market, by Application |

|

8.2.10.1.3. US Software Defined Radio Market, by Frequency |

|

8.2.10.1.4. US Software Defined Radio Market, by Deployment Type |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Airbus |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. CesiumAstro |

|

10.3. Elbit Systems |

|

10.4. General Dynamics |

|

10.5. L3Harris |

|

10.6. Northrop Grumman |

|

10.7. Rockwell Collins |

|

10.8. Rohde & Schwarz |

|

10.9. RTX Corporation |

|

10.10. Thales |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Software Defined Radio Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Software Defined Radio Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Software Defined Radio ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Software Defined Radio Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA