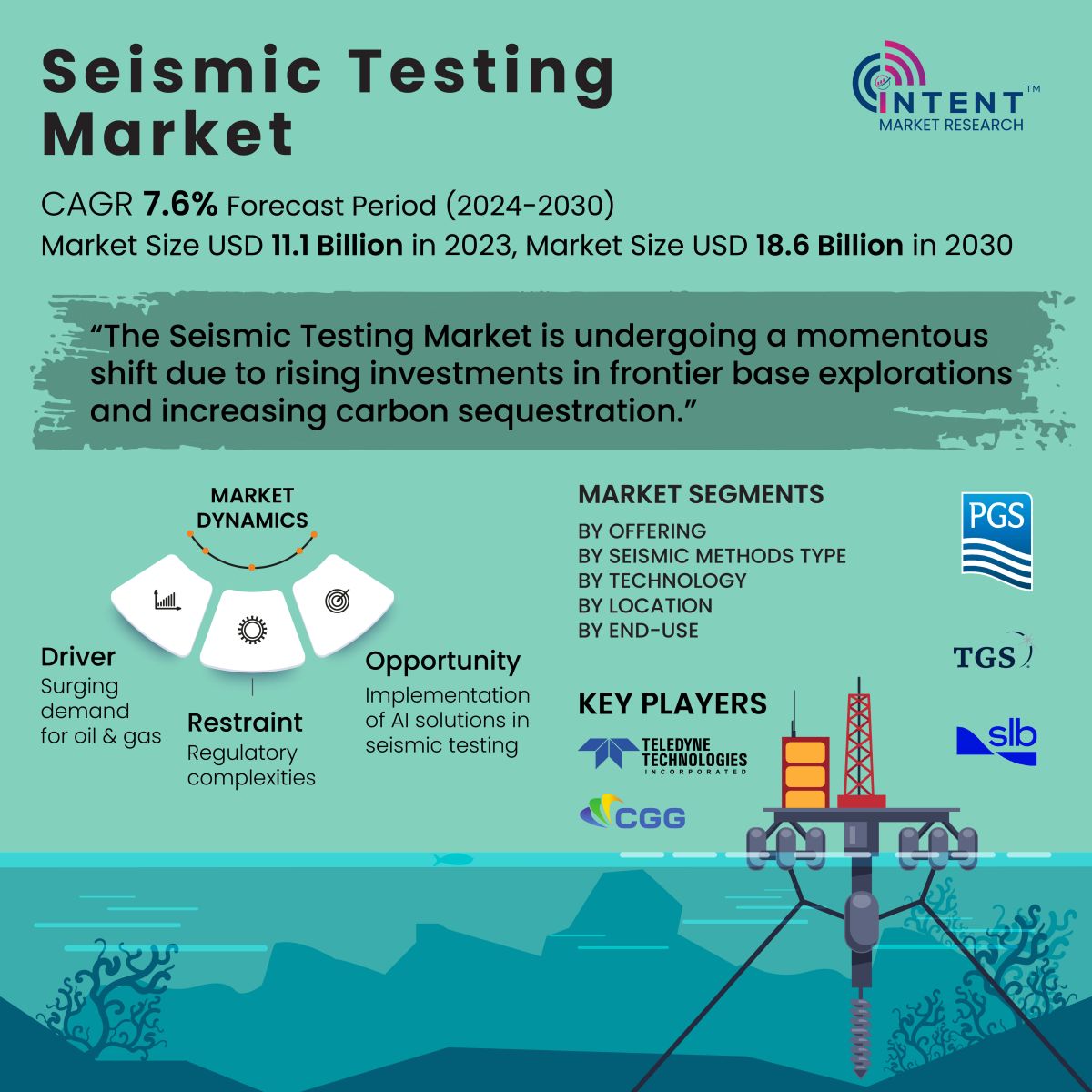

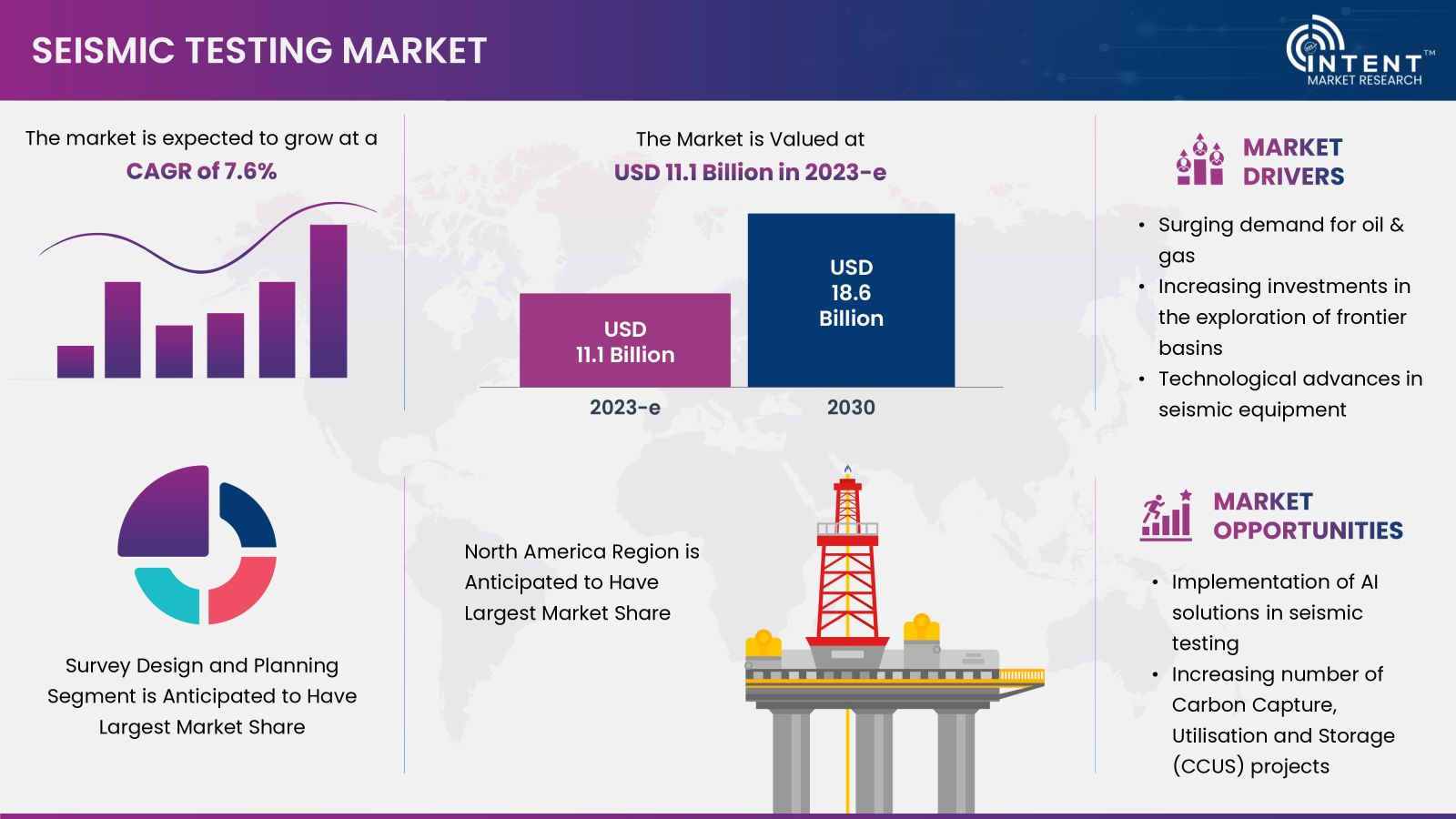

The Seismic Testing Market is expected to grow from USD 11.1 billion in 2023-e to USD 18.6 billion by 2030, at a CAGR of 7.6% during the forecast period. The seismic testing is competitive market, the prominent players in the global market include BGP, CGG, Emerson, Fugro, Geospace Technologies, Halliburton, INOVA Geophysical, ION Geophysical, PGS, AExploration, Schlumberger, Shearwater GeoServices, Teledyne, Terraseis, and TGS. The market is driven by surging demand for oil & gas and increasing investments in the exploration of frontier basins. Technological advancements in nodal land seismic acquisition systems contribute significantly to market growth.

Click here to: Get FREE Sample Pages of this Report

Seismic Testing Market Overview

Seismic testing uses sound waves to study the earth’s subsurface by producing seismic images of the earth through a series of recorded data. Seismic testing measures the elastic properties of soils and rocks that are measured by generating data on the physical properties such as seismic velocity, density, and shear modulus. One of the primary applications of seismic testing is to discover natural gas and mineral reserves.

Seismic testing helps to reduce the industry footprint and maximize production from individual wells and mines. In addition, seismic testing also has several applications in other industries such as analysis of groundwater, stability analysis of landfills, and detection of stratigraphic structures underneath the seafloor for offshore wind farms.

Surging Demand for Oil & Gas is Driving the Seismic Testing Market

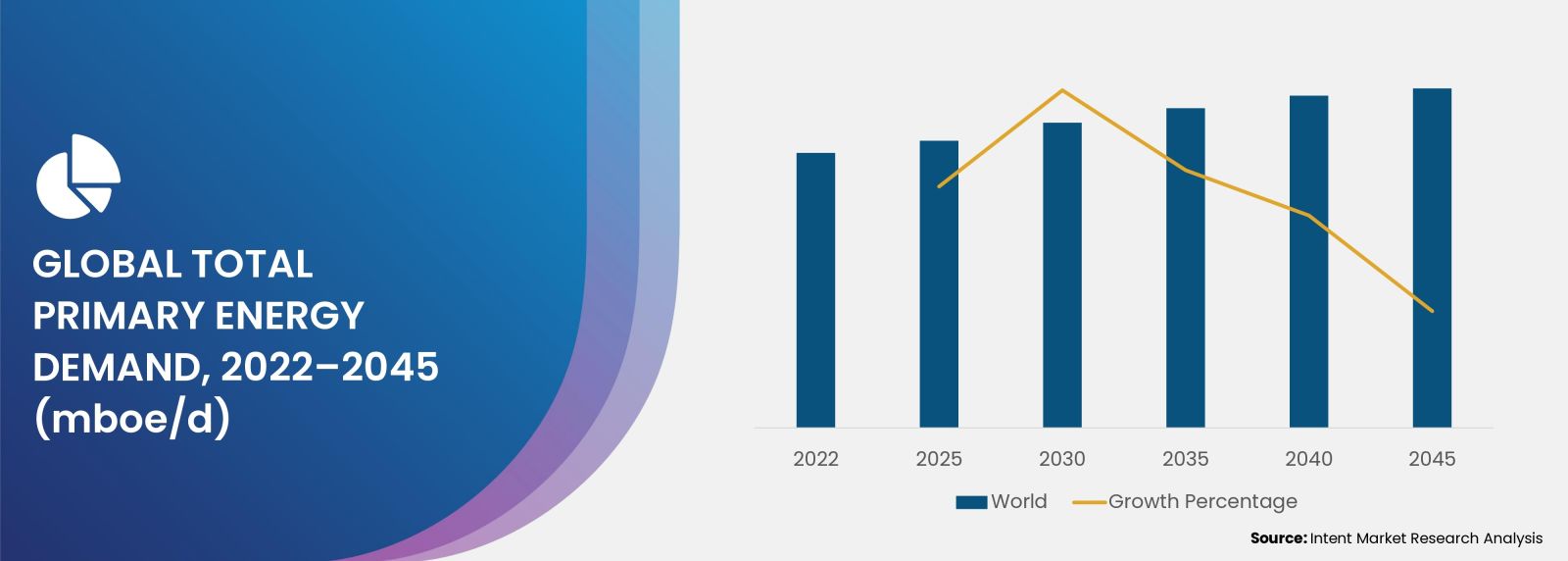

The seismic testing is primarily used to discover mineral reserves and natural gas and is driven by the surging demand for oil & gas. According to the OPEC World Oil Outlook 2023, global primary energy demand is anticipated to increase from around 291 million barrels of oil equivalent per day (mboe/d) in 2022 to around 359 mboe/d in 2045, an increase of about 23% over the forecast period.

There is a strong non-OECD oil demand growth owing to the rising population and urbanization, the strong expansion of the middle-class population, robust economic growth potential, strong vehicle fleet growth, and agriculture sector shifts. The oil demand in non-OECD regions is expected to increase by 25.7 mb/d between 2022 and 2045. Thus, surging demand for oil & gas is driving seismic testing market growth.

The increasing number of carbon capture, utilization, and storage (CCUS) projects are providing lucrative growth opportunities

There is an increasing number of carbon capture, utilization, and storage (CCUS) projects under development where the use of seismic data is needed. According to the International Energy Agency (IEA), around 40 commercial facilities are already in operation applying CCUS to industrial processes, fuel transformation, and power generation. Several key seismic testing companies are partnering with the industries to expedite the adoption of CCUS projects. For instance, in 2022 PGS (Norway) completed four CCUS acquisition projects, Northern Lights CCUS 4D baseline, Endurance CCUS, Smeaheia CCUS, and Snøhvit 4D. PGS is actively establishing its position in the carbon storage geo services market. Thus, an increasing number of CCUS projects are anticipated to provide significant growth opportunities for the seismic testing market.

Segment Analysis

Seismic source segment is anticipated to hold a significant market share owing to the technological advancements

A seismic source is a device that generates controlled seismic energy used to perform seismic testing. There are several different types of seismic sources by technology including simple seismic source tools, such as dynamite and sledgehammer, specialized air gun. The companies are constantly updating their portfolios with more advanced newer technologies to cater to the market's demands.

For instance, in October 2021, Shearwater launched a new seismic source technology, ‘Harmony’ for marine surveys. It provides seismic surveys with enhanced low frequencies enabling better decisions for exploration, development, and carbon storage monitoring applications. Thus, increasing product launches are anticipated to drive the market growth.

Surface-Wave Analysis Segment is Anticipated to be the Fastest-Growing Segment

Surface waves are critical to near-surface geophysics studies both for geotechnical goals and seismic-hazard studies. One of the widely used methods, Multichannel Analysis of Surface Waves (MASW) is a geophysical method that uses surface wave (Rayleigh wave) propagation to profile the subsurface. MASW survey profiles can be designed to provide high-resolution near-surface results up to 60 meters in depth.

Advances in geophysical survey techniques resulted in the emergence of MASW as one of the common techniques used for shallow subsurface profiling. Surface waves are used for several applications including Vs30 survey, ground stiffness evaluations, liquefaction assessment, site reconnaissance, in-situ testing, bedrock or glacial till mapping, dam and levee investigations, and linear structure foundation evaluations, among others. Thus, surface-wave analysis is a powerful, accurate, and cost-effective tool for imaging the subsurface and shear-wave velocity of structures.

Increasing Uptake of 4D Seismic is Driving the Market Growth

4D seismic has emerged as a valuable reservoir management tool. The technology can lead to lowering the cost of deep-sea exploration activities. It can help with the analysis of the static and dynamic behavior of an oil & gas field to improve the production strategy and optimize the reservoir management decision process. Although 4D seismic technology is old, it has gained significant momentum in adoption in recent years.

For instance, between 2018-2022, PGS did about 25 surveys with GeoStreamer 4D. Likewise, several oil & gas companies are increasingly investing in 4D surveys. For instance, in August 2023, PXGEO (U.S.) secured a contract with Petrobras to start a 4D Nodes seismic survey in the Sapinhoá field. In May 2023, Shearwater secured two 4D seismic survey contracts with TotalEnergies covering the Laggan, Tormore, and Edradour offshore gas fields, west of Shetland, in the UK. Consequently, the increasing adoption of 4D seismic surveys and the growing investment by the oil & gas industry are propelling the 4D seismic segment to be the fastest-growing technology segment in the seismic testing market.

Increasing Investments in Offshore Surveys is Driving the Offshore Segment

Offshore seismic surveys are also known as marine seismic surveys. These are critical surveys for oil & gas exploration. Some of the key offshore regions that are in focus are the Gulf of Mexico, the North Sea, and Norway. In addition, key companies are actively investing in seismic data for offshore surveys. These are further anticipated to drive the seismic testing market.

For instance, in June 2023, TGS came into a strategic collaboration with SLB (U.S.) to start the Engagement 4 Ocean Bottom Node (OBN) multi-client acquisition in the U.S. Gulf of Mexico. In March 2022, Searcher Seismic (Australia) entered into an agreement with BP Canada and Hess Canada for the Tangier 3D seismic survey offshore Nova Scotia. Thus, rising investments in the offshore segment drive the segment’s growth.

Oil & gas segment is anticipated to be the largest segment in the seismic testing market

Seismic testing is the first step in oil & gas exploration. The oil & gas industries actively invest in seismic testing. The growing demand for oil and gas and increasing production are further driving the market growth. For instance, in April 2023, Equinor and YPF received environmental approvals to acquire 3D seismic across three blocks offshore Argentina. The conflict between Russia and Ukraine has prompted significant spending from major and national oil companies. Consequently, the seismic testing market is expected to see the oil & gas segment emerge as the largest.

Regional Analysis

North America accounted for the largest share in the seismic testing market

The rise in U.S. Oil production capacity is augmenting the growth of seismic data acquisitions for the mature and frontier bases in the region. Moreover, high spending on seismic data by the governments in the region is the major factor driving the seismic testing market growth. For instance, in August 2023, Kinemetrics (U.S.) was awarded USD 25 million in contracts by the California Geological Survey (CGS). In August 2022, KBR (U.S.) was awarded a USD 20 million contract by the United States Geological Survey (USGS) Albuquerque Seismological Laboratory (ASL) for sustained support of more than 330 operational or proposed stations in 69 countries, including approximately 230 stations in the continental U.S. Thus, North America is the largest region in the seismic testing market.

Seismic testing market is highly competitive

The companies involved in the industry manufacture seismic testing equipment and provide exploration services. The companies also provide seismic data information from their repository to other industries. Seismic surveying companies and seismic equipment manufacturers are actively expanding their portfolios with the growing oil and gas industry. The seismic testing market is dominated by a key global market players having a significant market share. The market is also highly competitive with the number of regional and local players present in the market. The key players in the market are BGP, CGG, Emerson, Fugro, Geospace Technologies, Halliburton, INOVA Geophysical, ION Geophysical, PGS, AExploration, Schlumberger, Shearwater GeoServices, Teledyne, Terraseis, and TGS.

Following are the key developments in the seismic testing market:

- In August 2023, TGS, came into an exclusive collaboration agreement with Apparition Geoservices (Switzerland). During the agreement term of 4 years, TGS and Apparition will collaborate through joint research, development, and testing to fully commercialize Apparition technology in ocean bottom nodes, towed streamers, and XHR data acquisition programs.

- PGS came into a strategic collaboration with inApril (Norway), an independent supplier of OBS technology, to provide ocean bottom node (OBN) and hybrid-towed streamer services. This is a one-year partnership for multi-client and contracted surveys to discover and monitor hydrocarbons.

Click here to: Get your custom research report today

Seismic Testing Market Coverage

The report provides key insights into the seismic testing market, and it focuses on technological developments, trends, and initiatives taken by the government in this sector. The report delves into market drivers, restraints, and opportunities, and analyzes key players as well as the competitive landscape within the market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 11.1 billion |

|

Forecast Revenue (2030) |

USD 18.6 billion |

|

CAGR (2024-2030) |

7.6% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

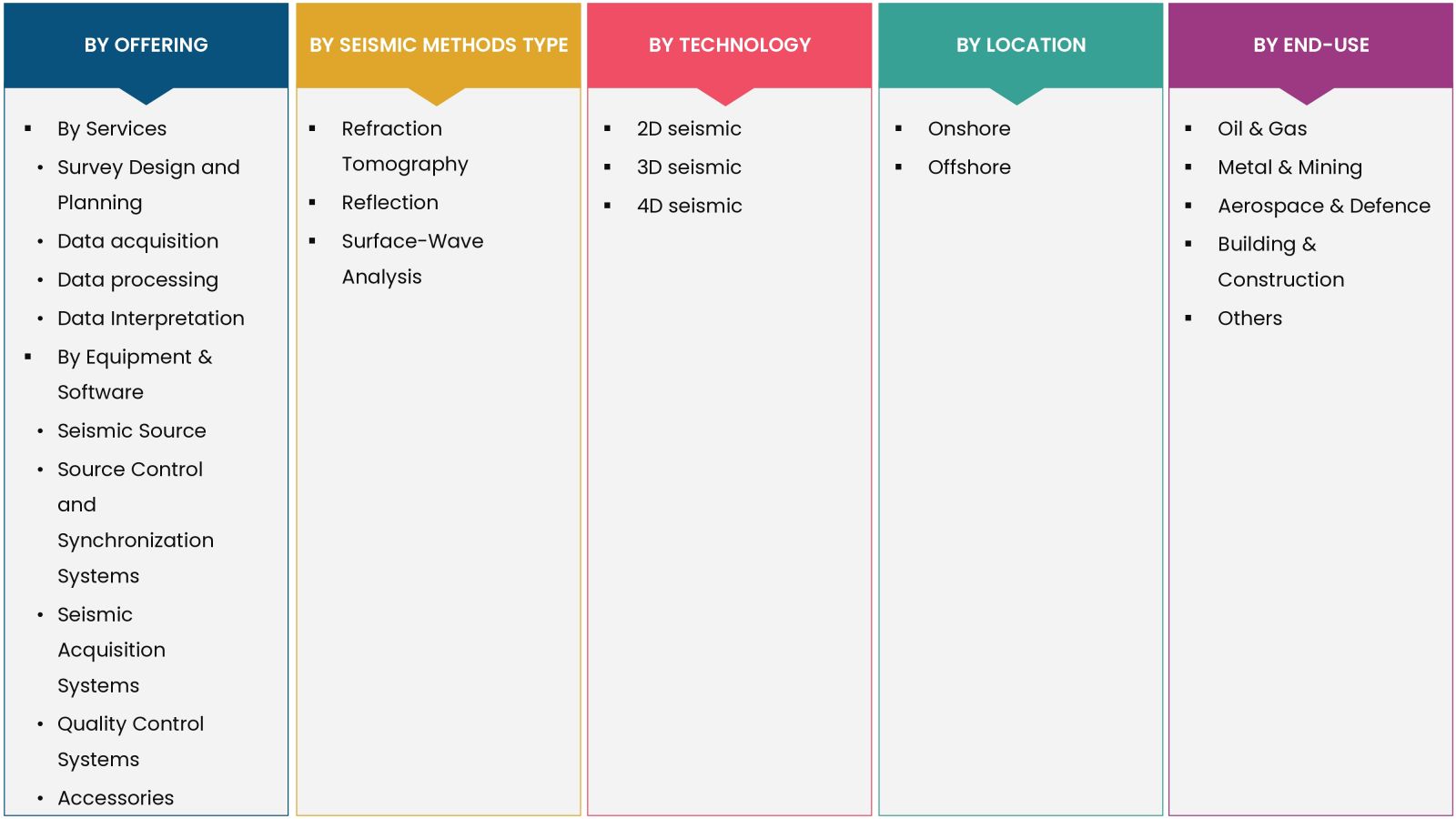

By Offering (By Services, By Equipment & Software), By Seismic Methods Type (Refraction Tomography, Reflection, and Surface-Wave Analysis), By Technology (2D Seismic, 3D Seismic, 4D Seismic), By Location (Onshore, Offshore), By End Use (Oil & Gas, Metal & Mining, Aerospace & Defense, Building & Construction) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy), Asia Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, UAE, South Africa) |

|

Competitive Landscape |

BGP, CGG SA, Emerson, Fugro, Geospace Technologies, Halliburton, INOVA Geophysical, ION Geophysical, PGS, AExploration, Schlumberger, Shearwater GeoServices, Teledyne, Terraseis, and TGS |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1. Study Assumptions and Market Definition |

|

1.2. Scope of the Study |

|

2.Research Methodology |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1. Market Drivers |

|

4.1.1. Surging demand for seismic testing in oil & gas sector |

|

4.1.2. Increasing investments in the exploration of frontier basins |

|

4.1.3. Technological advances in seismic equipment |

|

4.2. Market Restraints |

|

4.2.1. Regulatory complexities |

|

4.2.2. High cost associated with the seismic testing |

|

4.3. Market Opportunities |

|

4.3.1. Implementation of AI solutions in seismic testing |

|

4.3.2. Growing implementation of carbon capture, utilization, and storage (CCUS) projects |

|

5.Market Outlook |

|

5.1. Supply Chain Analysis |

|

5.2. Advances in Marine Vibroseis |

|

5.3. Technology Trends |

|

5.4. Patent Analysis |

|

5.5. Impact of COVID-19 and Russia-Ukraine conflict on the seismic testing market |

|

6.Market Segment Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1. Segment Synopsis |

|

6.2. By Offering |

|

6.2.1. By Service |

|

6.2.1.1. Survey Design and Planning |

|

6.2.1.2. Data acquisition |

|

6.2.1.3. Data processing |

|

6.2.1.4. Data Interpretation |

|

6.2.2. By Equipment & Software |

|

6.2.2.1. Seismic Source |

|

6.2.2.2. Source Control and Synchronization Systems |

|

6.2.2.3. Seismic Acquisition Systems |

|

6.2.2.4. Quality Control Systems |

|

6.2.2.5. Accessories |

|

6.3. By Seismic Method Type |

|

6.3.1. Refraction Tomography |

|

6.3.2. Reflection |

|

6.3.3. Surface-Wave Analysis |

|

6.4. By Technology |

|

6.4.1. 2D seismic |

|

6.4.2. 3D seismic |

|

6.4.3. 4D seismic |

|

6.5. By Location |

|

6.5.1. Onshore |

|

6.5.2. Offshore |

|

6.6. By End Use |

|

6.6.1. Oil & Gas |

|

6.6.2. Metal & Mining |

|

6.6.3. Aerospace & Defence |

|

6.6.4. Building & Construction |

|

6.6.5. Others |

|

7.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1. Global Market Synopsis |

|

7.2. North America |

|

7.2.1. North America Seismic Testing Market Outlook |

|

7.2.2. USA |

|

7.2.2.1. USA Seismic Testing Market, By Offering |

|

7.2.2.2. USA Seismic Testing Market, By Seismic Method Type |

|

7.2.2.3. USA Seismic Testing Market, By Technology |

|

7.2.2.4. USA Seismic Testing Market, By Location |

|

7.2.2.5. USA Seismic Testing Market, By End Use |

|

*Note: Cross-segmentation by segments for each country will be covered as shown above. |

|

7.2.3. Canada |

|

7.2.4. Mexico |

|

7.3. Europe |

|

7.3.1. Europe Seismic Testing Market Outlook |

|

7.3.2. Germany |

|

7.3.3. UK |

|

7.3.4. France |

|

7.3.5. Spain |

|

7.3.6. Italy |

|

7.4. Asia-Pacific |

|

7.4.1. Asia-Pacific Seismic Testing Market Outlook |

|

7.4.2. China |

|

7.4.3. India |

|

7.4.4. Japan |

|

7.4.5. South Korea |

|

7.4.6. Australia |

|

7.5. Latin America |

|

7.5.1. Latin America Seismic Testing Market Outlook |

|

7.5.2. Brazil |

|

7.5.3. Argentina |

|

7.6. Middle East & Africa |

|

7.6.1. Middle East & Africa Seismic Testing Market Outlook |

|

7.6.2. Saudi Arabia |

|

7.6.3. UAE |

|

8.Competitive Landscape |

|

8.1. Market Share Analysis |

|

8.2. Company Strategy Analysis |

|

8.3. Competitive Matrix |

|

9.Company Profiles |

|

9.1. Seismic Testing Companies (Supply-Side) |

|

9.1.1. BGP Inc. |

|

9.1.1.1. Company Synopsis |

|

9.1.1.2. Company Financials |

|

9.1.1.3. Product/Service Portfolio |

|

9.1.1.4. Recent Developments |

|

*Note: All the companies in the section 9.1 will cover same sub-chapters as above. |

|

9.1.2. CGG SA |

|

9.1.3. Emerson |

|

9.1.4. Fugro |

|

9.1.5. Geospace Technologies Corporation |

|

9.1.6. Halliburton |

|

9.1.7. INOVA Geophysical |

|

9.1.8. ION Geophysical Corporation |

|

9.1.9. PGS |

|

9.1.10.SAExploration Holdings |

|

9.1.11.Schlumberger |

|

9.1.12.Shearwater GeoServices |

|

9.1.13.Teledyne |

|

9.1.14.Terraseis |

|

9.1.15.TGS |

|

9.2. Key Insurance Providers (Demand-Side) |

|

9.2.1. BP |

|

9.2.1.1. Company Synopsis |

|

9.2.1.2. Company Financials |

|

9.2.1.3. Demand Analysis |

|

9.2.1.4. Recent Developments |

|

*Note: All the companies in the section 9.2 will cover same sub-chapters as above. |

|

9.2.2. Equinor |

|

9.2.3. ExxonMobil |

|

9.2.4. Petrobras |

|

9.2.5. Shell |

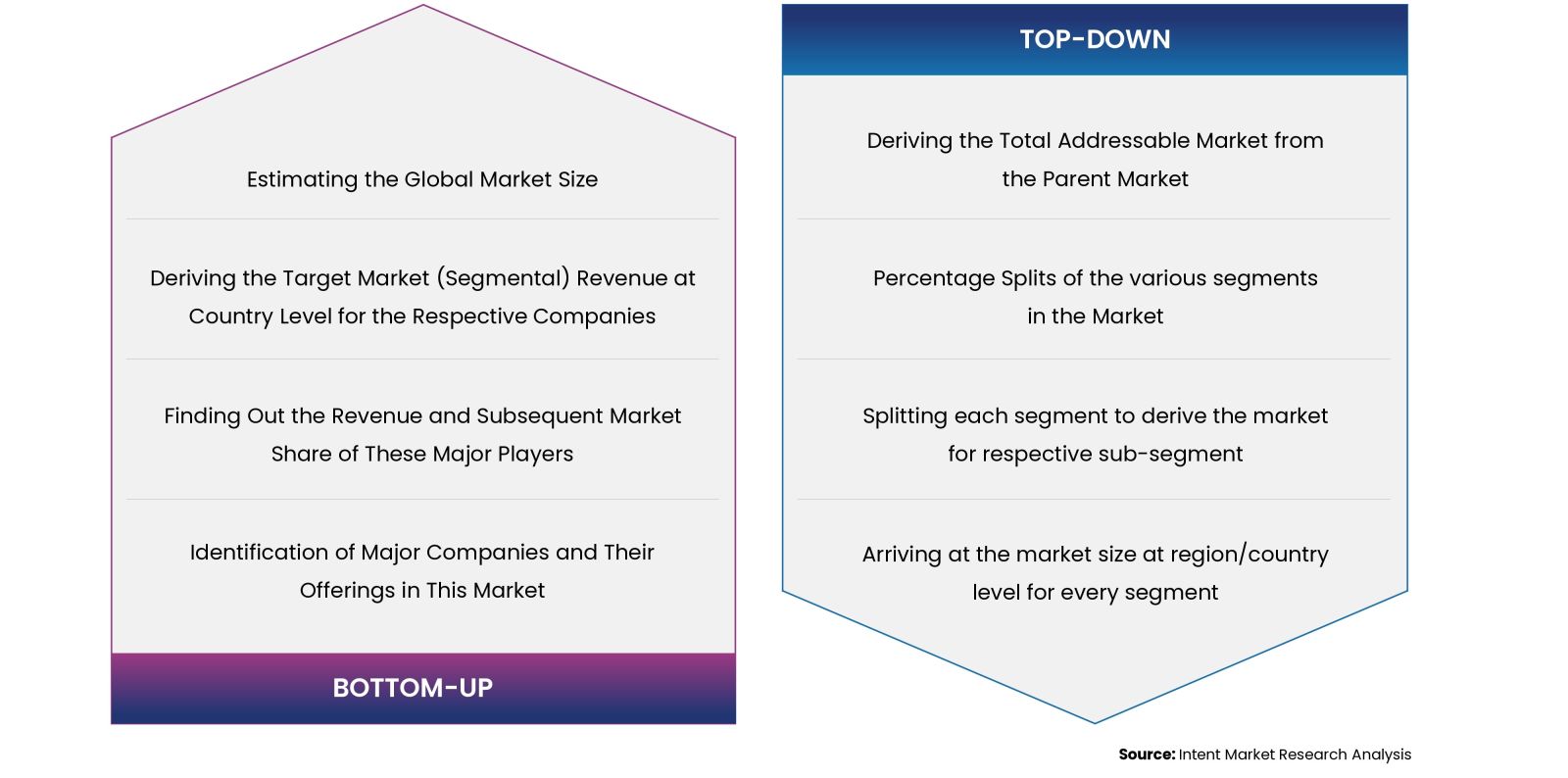

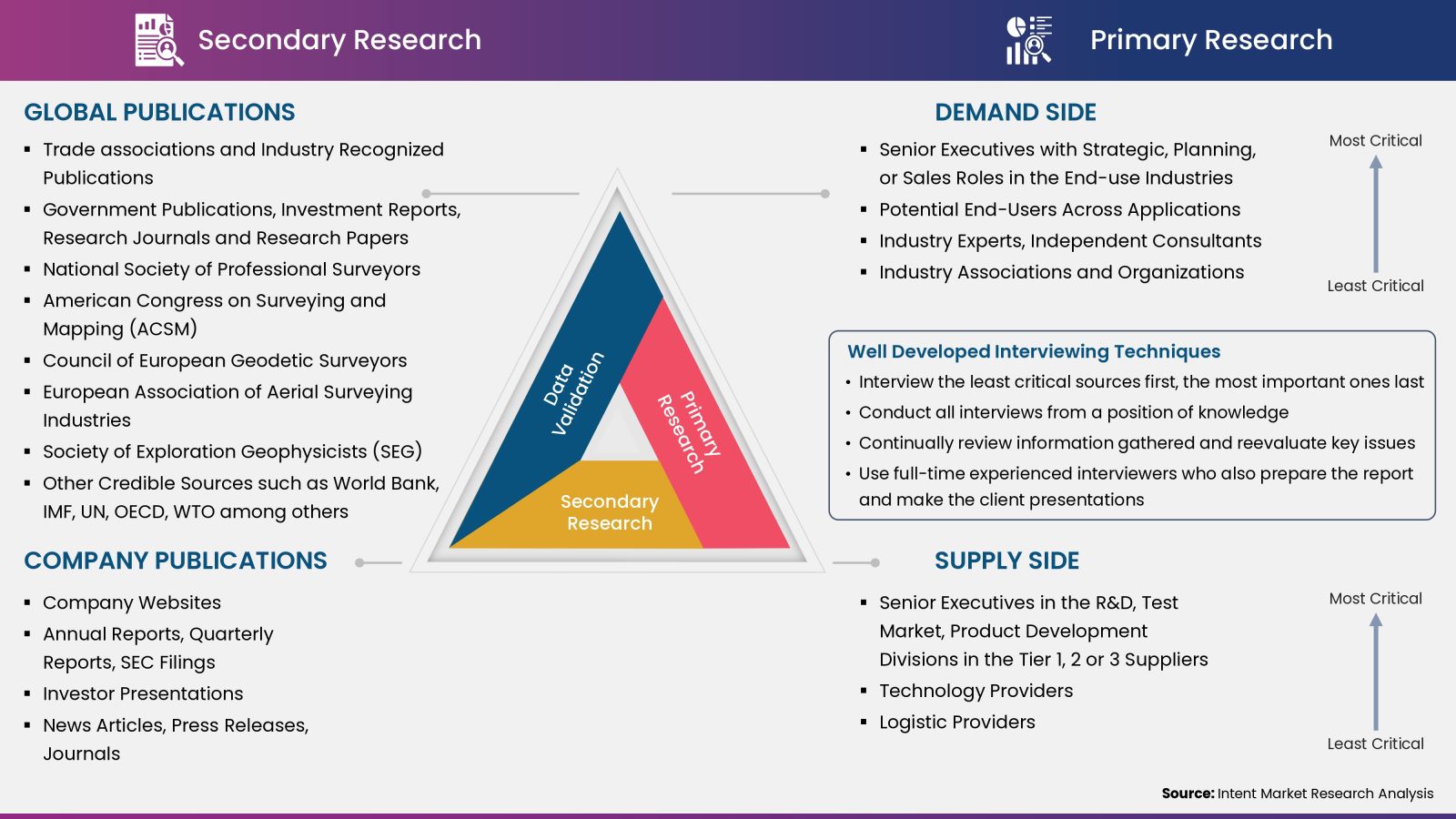

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation and verification process to verify all the market numbers and assumptions by engaging with the subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.