According to Intent Market Research, the Risk-Based Inspection Market is expected to grow at a CAGR of 3.8% during 2024 – 2030. The risk-based inspection market is competitive, the prominent players in the global market include ABS Group, AsInt, Bureau Veritas, General Electric, Intertek, Metegrity, Resco, SAP, SGS, TÜV SÜD, TWI, Wipro, among others. The growth of this market is attributed to factors such as the high cost of equipment failure, stringent government policies for worker safety, and increasing automation.

.jpg)

Click here to: Get FREE Sample Pages of this Report

The integration of advanced technologies such as artificial Intelligence (AI), machine learning (ML), and artificial neuron networks (ANN) offers growth opportunities to the stakeholders of the risk-based inspection market. Strenuous software implementation and integration methods, coupled with a lack of management commitment for regular RBI and poorly defined RBI processes, pose significant challenges for enterprises during the forecast period.

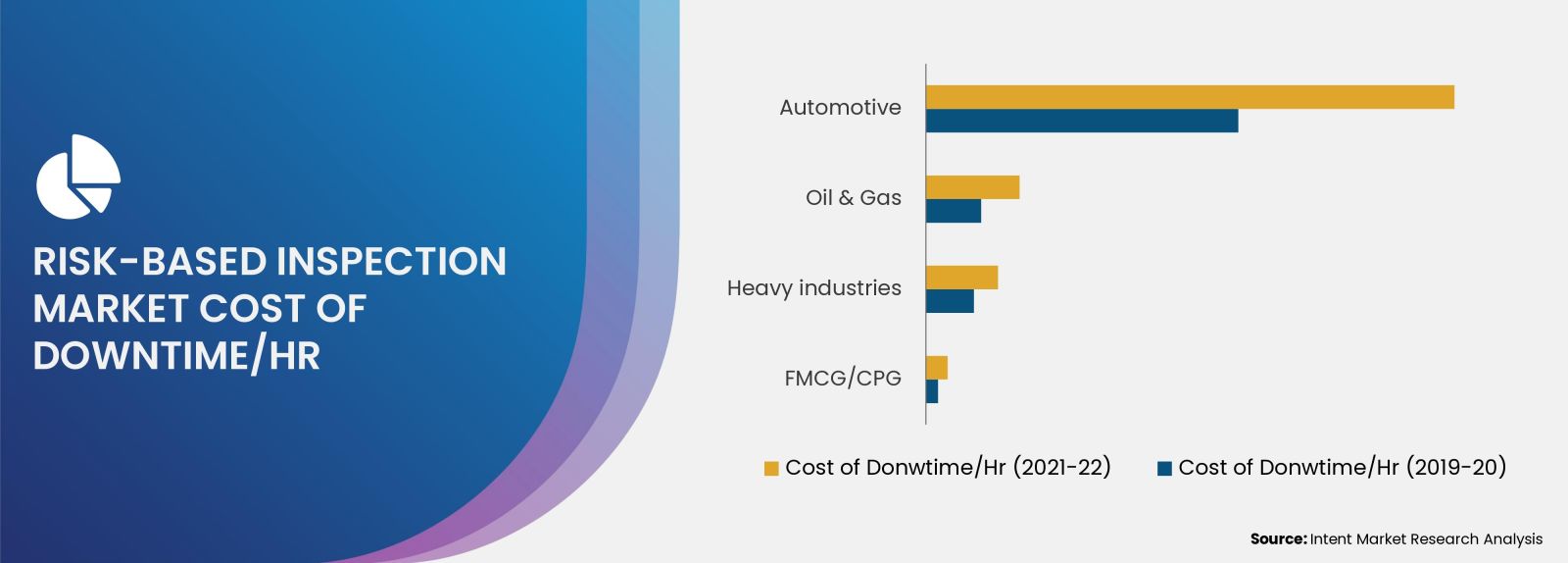

High Cost of Equipment Failure is Driving the Adoption of Risk-Based Inspection Market

Equipment or machine failure is one of the major contributors to the operational costs of the major industries. Siemens reported that for the Fortune Global 500 companies unplanned downtime costs about 11% of their yearly turnover, which is almost USD 1.5 trillion. In addition, among Fortune 500 companies, the annual cost of downtime is USD 129 million per facility, up 65% from 2019-20. In the oil and gas industry, the cost of unplanned plant downtime is USD 500,000, for a machine downtime of 1 hour. Such high cost of downtime incurred by the industries is prompting industry players to invest in the risk-based inspection of their plants. This, in turn, is driving the demand for risk-based inspection across the various industries.

The Solution Segment is Expected to Grow with a Significant CAGR During the Forecast Period

The solution segment is anticipated to experience substantial growth with a significant CAGR during the forecast period, driven by the increasing availability of RBI software adopting a low-pricing model. RBI software provides semi-quantitative and quantitative RBI methods and helps decision-making on methods and frequency of storage tank inspections and repairs, particularly for oil & gas industry. It includes consequence of failure, probability of failure, financial risk, and inspection optimization with quantitative modules.

Growing Adoption of RBI Among SMES is Fueling the Market Growth

The risk-based inspection market is segmented into large enterprises and small and medium enterprises (SMEs). In 2023, the large enterprises segment accounted for a significant market share of the global risk-based inspection market. The high cost of failure compared to SMEs and strict government policies for workers' safety will boost the adoption of RBI in this segment.

The SME segment is anticipated to witness significant growth during the forecast period. The segment is poised for expansion due to the easy availability of RBI software with lower pricing and increasing awareness about the benefits of risk-based inspections among SMEs.

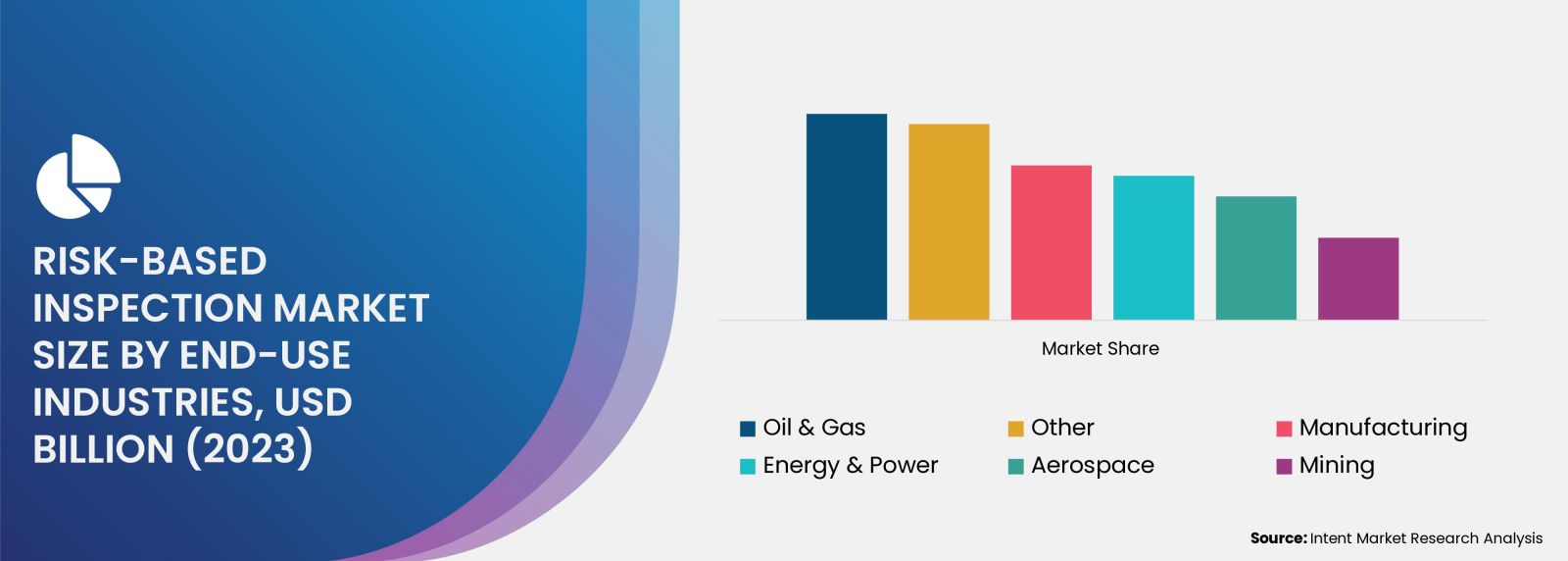

Oil and Gas Captures the Significant Share of the Market

The oil and gas industry will capture a significant share of the market due to the high-risk factor associated with the plant operations. In oil and gas, RBI is critical for safety, efficiency, and mitigating costly insurance claims. It prevents equipment from unexpected degradation, thereby avoids unplanned shutdowns and eradicates risks of environmental hazards. With the RBI, oil & gas industry benefits with longer availability of equipment, lower non-productive time, and reduction in maintenance cost.

North America is Leading the Global Market

North America risk-based inspection market has recorded a significant share of the market in 2023. The presence of well-established end-use industries in the U.S. and Canada, principally oil and gas, and stringent policies for workers’ safety have increased the adoption of risk-based inspection in the region.

The presence of a large number of companies in the region and stringent policies for workers’ safety have influenced the adoption of RBI from well-established industries of the region. This has helped North America to account for a significant share of the global market.

Key players operating in the global risk-based inspection market are SAP, TÜV SÜD, Intertek, SGS, Bureau Veritas, Metegrity, TWI, General Electric, Resco, ABS Group, AsInt. and Wipro, among others. Risk-based inspection market is fragmented in nature. The market players are adopting strategies such as partnership and collaboration to improve their market share.

In December 2022, Antea, a global company specializing in risk-based asset integrity software solutions with Digital Twin and headquartered in Italy, and Cetim-Matcor, a Singapore-based leading company in the fields of failure analysis, forensic engineering, materials & corrosion and asset integrity management has entered into a strategic partnership to provide risk based inspection (RBI) solution to operators in the Asia-Pacific region.

Click here to: Get your custom research report today

Risk-based Inspection Market: Market Coverage

The report provides key insights into the risk-based inspection market, and it focuses on market developments, trends, and initiatives taken by the government and private players. It delves into market drivers, restraints, opportunities, and challenges that are impacting market growth. It analyses key players as well as the competitive landscape within the global market.

Risk-based Inspection Market by Type (Solutions, Services), by Enterprise Size (SMEs and Large Enterprises), by End-use Industry (Oil and Gas, Energy and Power, Manufacturing, Mining, Aerospace); and by Region – Growth Trends and Forecasts (2024 - 2030). The report offers the market size and forecasts for the Risk-based Inspection Market in value (USD billion) for all the above segments.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD XX Billion |

|

Forecast Revenue (2030) |

USD XX Billion |

|

CAGR (2024-2030) |

3.8% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Risk-based Inspection Market by Type (Solutions, Services), by Enterprise Size (SMEs and Large Enterprises), by End-use Industry (Oil and Gas, Energy and Power, Manufacturing, Mining, Aerospace); and by Region |

|

Regional Analysis |

North America (U.S., Canada), Europe (Germany, France, U.K., Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America and Middle East & Africa |

|

Competitive Landscape |

SAP, TÜV SÜD, Intertek, SGS, Bureau Veritas, Metegrity, TWI, General Electric, Resco, ABS Group, AsInt, and Wipro |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Key Stakeholders of the Market |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.2.Data Collection |

|

2.3.Market Assessment |

|

2.4.Assumptions and Limitations for the Study |

|

3.Executive Summary |

|

4.Market Dynamics |

|

4.1.Drivers |

|

4.1.1.High Cost of Equipment Failure |

|

4.1.2.Stringent Government Policies about Workers’ Safety |

|

4.1.3.Increasing Automation |

|

4.2.Restraints |

|

4.2.1.Lack of Availability of Quality Data |

|

4.3.Opportunities |

|

4.3.1.Integration of New Technologies (AI, ML, and ANN) |

|

4.4.Threats or Challenges |

|

4.4.1.Strenuous Software Implementation and Integration |

|

4.4.2.Lack of Management Commitment for regular RBI and Lack of well-defined RBI Processes |

|

5.Market Outlook |

|

5.1.Risk-based Inspection Insights |

|

5.1.1.Onshore, Offshore, Qualitative, Semi-Quantitative and Fully Quantitative Methods |

|

5.1.2.Risk Assessment Standards |

|

5.2.Case Studies |

|

5.2.1.Case Study - I |

|

5.2.2.Case Study - II |

|

5.3.Case Study - III |

|

6.Market Segment by Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Solution |

|

6.2.Services |

|

7.Market Segment by Enterprise Size (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Large Enterprises |

|

7.2.SMEs |

|

8.Market Size by End-use Industry (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Oil & Gas |

|

8.2.Energy & Power |

|

8.3.Manufacturing |

|

8.4.Mining |

|

8.5.Aerospace |

|

8.6.Others |

|

9.Regional Outlook (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.1.North America |

|

9.1.1.U.S. |

|

9.1.1.1.U.S. Market Outlook by Type |

|

9.1.1.2.U.S. Market Outlook by Enterprise Size |

|

9.1.1.3.U.S. Market Outlook by End-use Industries |

|

Note: Similar Cross-segmentation by segments for each country will be covered as shown above |

|

9.1.2.Canada |

|

9.2.Asia-Pacific |

|

9.2.1.China |

|

9.2.2.Japan |

|

9.2.3.South Korea |

|

9.2.4.India |

|

9.2.5.Rest of APAC |

|

9.3.Europe |

|

9.3.1.U.K. |

|

9.3.2.Germany |

|

9.3.3.France |

|

9.3.4.Italy |

|

9.3.5.Rest of Europe |

|

9.4.Latin America |

|

9.5.Middle East and Africa |

|

10.Competitive Landscape |

|

10.1.Market Share Analysis |

|

10.2.Company Strategy Analysis |

|

10.3.Competitive Benchmarking |

|

11.Company Profile |

|

11.1.SAP |

|

11.2.TÜV SÜD |

|

11.3.Intertek Group |

|

11.4.SGS |

|

11.5.Bureau Veritas |

|

11.6.Metegrity |

|

11.7.TWI |

|

11.8.General Electric |

|

11.9.Resco |

|

11.10.ABS Group |

|

11.11.AsInt, Inc. |

|

11.12.Wipro |

|

12.Appendix |

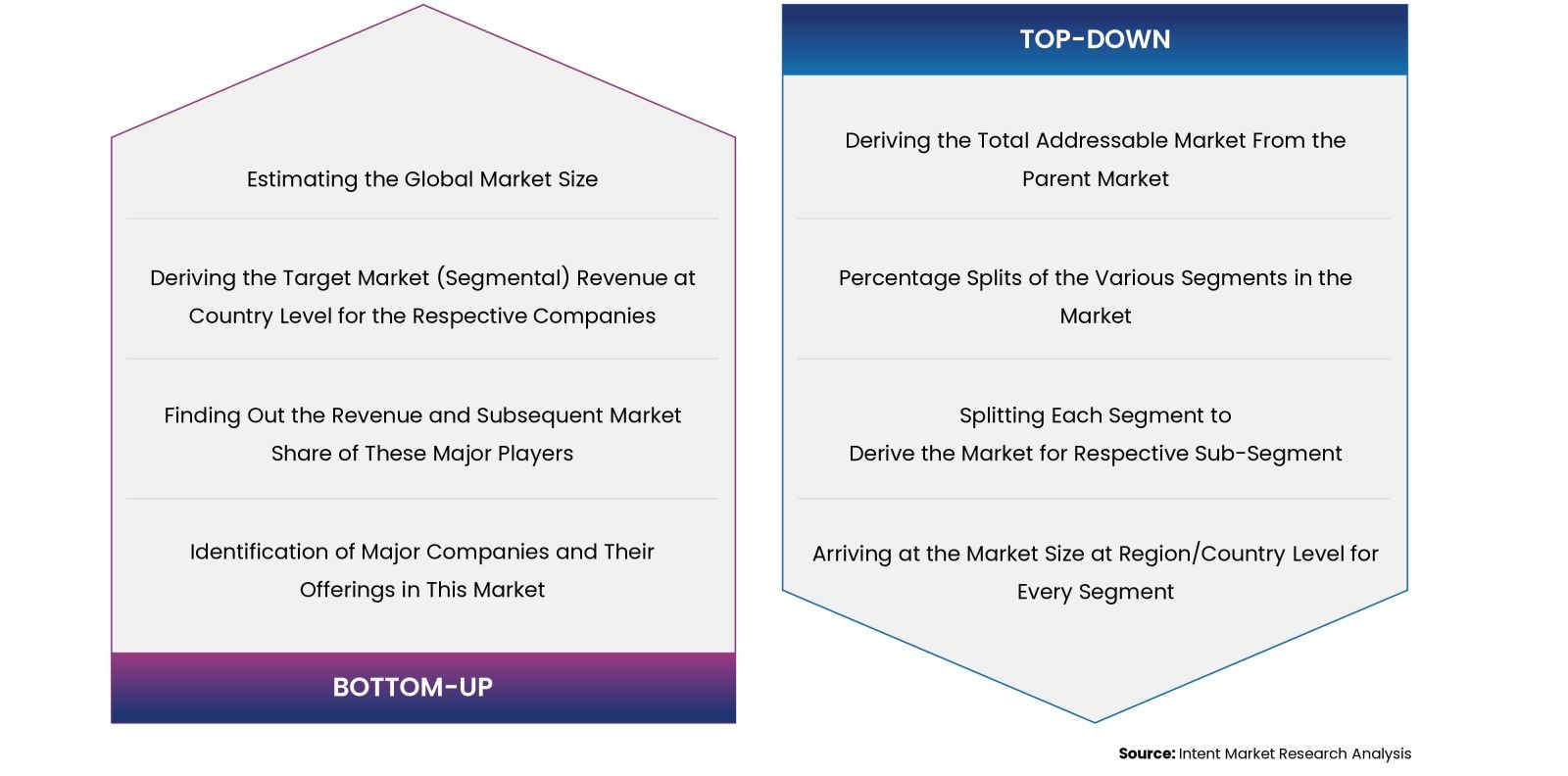

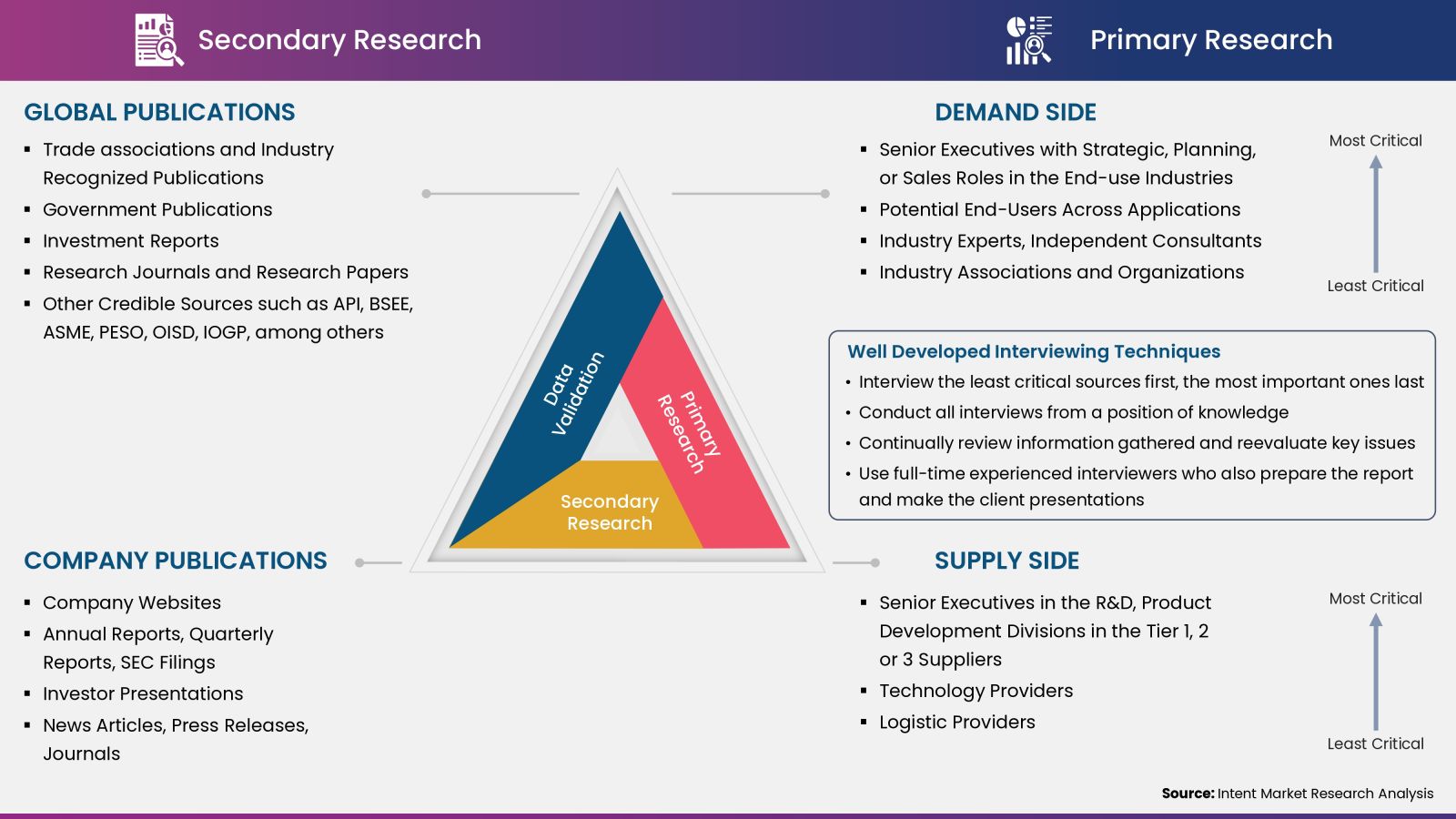

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.