As per Intent Market Research, the RFID Tags Market was valued at USD 15.5 billion in 2024-e and will surpass USD 32.8 billion by 2030; growing at a CAGR of 11.3% during 2025 - 2030.

The RFID tags market has witnessed rapid expansion as industries increasingly adopt this technology to enhance operational efficiency, minimize errors, and improve tracking capabilities. With applications spanning logistics, healthcare, retail, and more, RFID tags have become a cornerstone of modern supply chains and inventory management systems. The market is segmented by type, frequency, application, end-user industry, and region, with each segment showcasing unique growth drivers and opportunities.

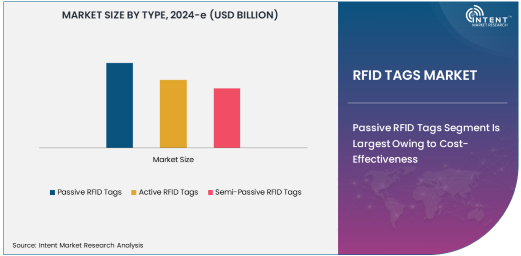

Passive RFID Tags Segment Is Largest Owing to Cost-Effectiveness

Passive RFID tags dominate the market due to their affordability and widespread adoption across various industries. These tags do not require an internal power source, relying instead on energy from RFID readers, making them highly cost-efficient for large-scale deployments.

The retail sector extensively employs passive RFID tags for inventory management, allowing real-time updates and minimizing stock discrepancies. Additionally, their low production cost and durability make them a preferred choice for tracking assets in logistics and supply chains. As industries continue to seek scalable solutions for tracking and data management, passive RFID tags are expected to maintain their market leadership.

Ultra-High Frequency Segment Is Fastest Growing Owing to Advanced Features

The ultra-high frequency (UHF) segment is experiencing the fastest growth due to its superior read range and data transfer speeds. UHF RFID tags are ideal for applications requiring rapid identification of multiple items, such as large-scale warehousing and automated toll collection systems.

Technological advancements have further enhanced the efficiency of UHF RFID tags, enabling better performance even in challenging environments. For instance, in logistics and transportation, UHF tags facilitate seamless tracking of shipments across borders, ensuring transparency and reducing operational delays. Their versatility and growing adoption in various industries position the UHF segment as a critical growth driver.

Inventory Management Segment Is Largest Owing to Operational Efficiency

Inventory management represents the largest application segment, driven by the need for real-time visibility and accuracy in stock levels. RFID tags streamline inventory processes by automating tracking, reducing manual errors, and improving replenishment strategies.

Retail and e-commerce giants have heavily invested in RFID technology to enhance their omnichannel strategies, ensuring that inventory data is synchronized across physical and online stores. This application has also gained traction in the healthcare industry, where RFID-enabled inventory systems ensure the availability of critical medical supplies and prevent stockouts, further boosting the segment's growth.

Healthcare End-User Industry Is Fastest Growing Owing to Patient Safety

The healthcare segment is witnessing rapid growth due to increasing demand for efficient tracking of medical equipment, pharmaceuticals, and patient records. RFID tags enable hospitals and clinics to ensure compliance with stringent regulatory requirements while improving patient safety and operational efficiency.

For example, RFID technology is being used to monitor the storage conditions of temperature-sensitive vaccines and drugs, ensuring they remain effective. Additionally, RFID-enabled wristbands improve patient identification, reducing the risk of medical errors. This growing adoption across healthcare facilities globally underscores the potential of RFID technology in transforming healthcare delivery.

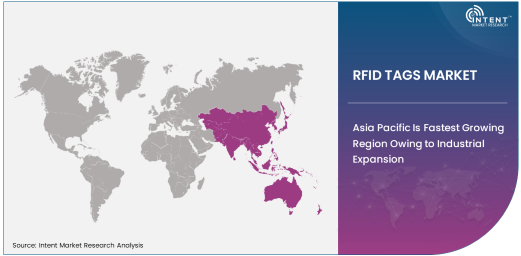

Asia Pacific Is Fastest Growing Region Owing to Industrial Expansion

Asia Pacific is the fastest-growing region in the RFID tags market, fueled by rapid industrialization, growing e-commerce penetration, and advancements in manufacturing technologies. Countries like China, Japan, and India are at the forefront of adopting RFID solutions across retail, logistics, and healthcare sectors.

The region's thriving e-commerce landscape has driven demand for RFID technology to optimize supply chain operations and ensure seamless inventory management. Additionally, government initiatives promoting the adoption of advanced technologies in manufacturing and logistics are further accelerating the market's growth in Asia Pacific.

Competitive Landscape: Dominance of Key Players

The RFID tags market is marked by intense competition, with leading players focusing on innovation and strategic partnerships to gain a competitive edge. Companies like Zebra Technologies, Avery Dennison, and Impinj, Inc. dominate the market with their extensive portfolios and strong global presence.

Collaborations between RFID providers and end-user industries have resulted in customized solutions catering to specific needs, such as RFID-enabled smart shelves in retail and patient tracking systems in healthcare. The competitive landscape is further enriched by startups introducing niche solutions, ensuring a dynamic and evolving market.

Recent Developments:

- Zebra Technologies recently launched a new series of passive RFID tags optimized for healthcare and industrial applications.

- Impinj acquired a small RFID solutions company to strengthen its IoT and connected device capabilities.

- Avery Dennison announced a partnership with a leading retail chain to deploy its intelligent RFID solutions for inventory management.

- Checkpoint Systems launched a new line of biodegradable RFID tags as part of its sustainability initiatives.

- Honeywell expanded its RFID offerings in Europe, focusing on automotive and logistics applications.

List of Leading Companies:

- Zebra Technologies Corporation

- Avery Dennison Corporation

- Impinj, Inc.

- Honeywell International Inc.

- Alien Technology Corporation

- NXP Semiconductors N.V.

- HID Global Corporation

- Smartrac N.V.

- GAO RFID Inc.

- Invengo Technology Pte. Ltd.

- Confidex Ltd.

- Omni-ID Ltd.

- Murata Manufacturing Co., Ltd.

- RF Code, Inc.

- Checkpoint Systems, Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 15.5 Billion |

|

Forecasted Value (2030) |

USD 32.8 Billion |

|

CAGR (2025 – 2030) |

11.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

RFID Tags Market By Type (Passive RFID Tags, Active RFID Tags, Semi-Passive RFID Tags), By Frequency (Low Frequency (LF), High Frequency (HF), Ultra-High Frequency (UHF)), By Application (Asset Tracking, Inventory Management, Logistics and Supply Chain, Healthcare and Pharmaceuticals, Retail, Agriculture), By End-User Industry (Retail and E-commerce, Automotive, Healthcare, Transportation and Logistics, Manufacturing, Agriculture, Defense and Aerospace) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Zebra Technologies Corporation, Avery Dennison Corporation, Impinj, Inc., Honeywell International Inc., Alien Technology Corporation, NXP Semiconductors N.V., HID Global Corporation, Smartrac N.V., GAO RFID Inc., Invengo Technology Pte. Ltd., Confidex Ltd., Omni-ID Ltd., Murata Manufacturing Co., Ltd., RF Code, Inc., Checkpoint Systems, Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. RFID Tags Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Passive RFID Tags |

|

4.2. Active RFID Tags |

|

4.3. Semi-Passive RFID Tags |

|

5. RFID Tags Market, by Frequency (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Low Frequency (LF) |

|

5.2. High Frequency (HF) |

|

5.3. Ultra-High Frequency (UHF) |

|

6. RFID Tags Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Asset Tracking |

|

6.2. Inventory Management |

|

6.3. Logistics and Supply Chain |

|

6.4. Healthcare and Pharmaceuticals |

|

6.5. Retail |

|

6.6. Agriculture |

|

6.7. Others |

|

7. RFID Tags Market, by End-User Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Retail and E-commerce |

|

7.2. Automotive |

|

7.3. Healthcare |

|

7.4. Transportation and Logistics |

|

7.5. Manufacturing |

|

7.6. Agriculture |

|

7.7. Defense and Aerospace |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America RFID Tags Market, by Type |

|

8.2.7. North America RFID Tags Market, by Frequency |

|

8.2.8. North America RFID Tags Market, by Application |

|

8.2.9. North America RFID Tags Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US RFID Tags Market, by Type |

|

8.2.10.1.2. US RFID Tags Market, by Frequency |

|

8.2.10.1.3. US RFID Tags Market, by Application |

|

8.2.10.1.4. US RFID Tags Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Zebra Technologies Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Avery Dennison Corporation |

|

10.3. Impinj, Inc. |

|

10.4. Honeywell International Inc. |

|

10.5. Alien Technology Corporation |

|

10.6. NXP Semiconductors N.V. |

|

10.7. HID Global Corporation |

|

10.8. Smartrac N.V. |

|

10.9. GAO RFID Inc. |

|

10.10. Invengo Technology Pte. Ltd. |

|

10.11. Confidex Ltd. |

|

10.12. Omni-ID Ltd. |

|

10.13. Murata Manufacturing Co., Ltd. |

|

10.14. RF Code, Inc. |

|

10.15. Checkpoint Systems, Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the RFID Tags Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the RFID Tags Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the RFID Tags Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA