As per Intent Market Research, the Retractable Needle Safety Syringes Market was valued at USD 5.6 billion in 2024-e and will surpass USD 7.5 billion by 2030; growing at a CAGR of 4.1% during 2025 - 2030.

The retractable needle safety syringes market is gaining momentum globally due to increasing concerns about needle-stick injuries and the need for enhanced healthcare safety practices. These syringes are designed to prevent accidental injuries and reduce the risk of bloodborne infections, driving their adoption across various healthcare settings. Technological advancements, regulatory mandates, and rising awareness have created substantial growth opportunities in the market.

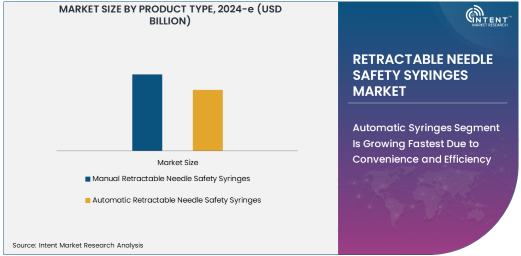

Automatic Syringes Segment Is Growing Fastest Due to Convenience and Efficiency

Among the product types, automatic retractable needle safety syringes are experiencing the fastest growth. Their ability to retract needles automatically post-injection with minimal user intervention enhances safety and convenience for healthcare professionals. These syringes are widely used in high-volume vaccination drives and emergency scenarios where speed and safety are critical.

The increased adoption of automatic syringes is driven by their advanced technology, which reduces the risk of human error. Furthermore, government vaccination campaigns and large-scale immunization programs in emerging economies have bolstered the demand for these syringes, making them a key driver in the market.

Hospitals Segment Is Largest Owing to High Usage in Critical Care Settings

The hospitals segment is the largest end-user of retractable needle safety syringes. Hospitals handle a high volume of patients daily and require a steady supply of syringes for vaccinations, diagnostics, and therapeutic injections. The stringent safety protocols in hospitals further necessitate the use of safety syringes to protect healthcare workers.

In addition, hospitals are early adopters of advanced medical technologies, including retractable needle syringes. The growing emphasis on reducing needle-stick injuries, combined with an increase in surgical procedures and vaccinations administered in hospital settings, reinforces this segment's leading position.

Online Pharmacies Segment Is Fastest Growing Due to Rising Digital Adoption

In the distribution channel category, online pharmacies are the fastest-growing segment. With the proliferation of e-commerce platforms and increasing consumer preference for online purchases, online pharmacies have become a convenient channel for procuring medical supplies, including safety syringes.

This growth is attributed to the ease of access, competitive pricing, and availability of a wide range of products on online platforms. Additionally, healthcare providers and individuals are increasingly opting for online procurement due to time savings and the ability to compare products more efficiently.

Asia Pacific Is Fastest Growing Region Owing to Expanding Healthcare Infrastructure

The Asia Pacific region is the fastest-growing market for retractable needle safety syringes. Countries like China, India, and Japan are witnessing rapid advancements in healthcare infrastructure, coupled with increased government spending on public health initiatives. The growing population and rising prevalence of infectious diseases further contribute to the demand for safety syringes in this region.

The adoption of advanced medical devices in Asia Pacific is supported by favorable government policies and increasing awareness about healthcare safety. Large-scale vaccination campaigns, particularly in response to pandemics, have significantly boosted the market in this region, making it a focal point for future growth.

Competitive Landscape and Leading Companies

The retractable needle safety syringes market is highly competitive, with key players focusing on innovation, partnerships, and regional expansion to gain an edge. Leading companies include Becton, Dickinson and Company (BD), Terumo Corporation, Retractable Technologies, Inc., and Smiths Medical. These firms invest heavily in R&D to develop cost-effective and advanced safety syringes.

The competitive landscape is shaped by strategic mergers and acquisitions, product launches, and collaborations aimed at enhancing market presence. Increasing regulatory scrutiny and compliance requirements also drive companies to innovate and deliver superior-quality products. This competitive dynamic ensures continuous evolution and growth in the market.

Recent Developments:

- Becton, Dickinson and Company (BD) launched a new line of automatic retractable syringes tailored for mass vaccination campaigns in 2024.

- Retractable Technologies, Inc. announced a strategic partnership with a European distributor to expand its market presence in 2023.

- Terumo Corporation received FDA clearance for its next-generation retractable needle safety syringe in 2024.

- Smiths Medical was acquired by ICU Medical in 2023, enhancing its portfolio of needle safety products.

- Nipro Corporation unveiled a sustainability-driven retractable syringe made from eco-friendly materials in late 2023.

List of Leading Companies:

- Becton, Dickinson and Company (BD)

- Retractable Technologies, Inc.

- Smiths Medical

- Terumo Corporation

- Nipro Corporation

- Cardinal Health, Inc.

- Braun Melsungen AG

- Medtronic PLC

- Hindustan Syringes & Medical Devices Ltd. (HMD)

- Gerresheimer AG

- SCHOTT AG

- Baxter International Inc.

- Weigao Group Co., Ltd.

- Ompi (A Stevanato Group Brand)

- Ypsomed Holding AG

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 5.6 Billion |

|

Forecasted Value (2030) |

USD 7.5 Billion |

|

CAGR (2025 – 2030) |

4.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Retractable Needle Safety Syringes Market By Product Type (Manual Retractable Needle Safety Syringes, Automatic Retractable Needle Safety Syringes), By End-User (Hospitals, Clinics, Ambulatory Surgical Centers, Home Care Settings), By Distribution Channel (Online Pharmacies, Retail Pharmacies, Hospital Pharmacies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Becton, Dickinson and Company (BD), Retractable Technologies, Inc., Smiths Medical, Terumo Corporation, Nipro Corporation, Cardinal Health, Inc., Braun Melsungen AG, Medtronic PLC, Hindustan Syringes & Medical Devices Ltd. (HMD), Gerresheimer AG, SCHOTT AG, Baxter International Inc., Weigao Group Co., Ltd., Ompi (A Stevanato Group Brand), Ypsomed Holding AG |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Retractable Needle Safety Syringes Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Manual Retractable Needle Safety Syringes |

|

4.2. Automatic Retractable Needle Safety Syringes |

|

5. Retractable Needle Safety Syringes Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Hospitals |

|

5.2. Clinics |

|

5.3. Ambulatory Surgical Centers (ASCs) |

|

5.4. Home Care Settings |

|

6. Retractable Needle Safety Syringes Market, by Distribution Channel (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Online Pharmacies |

|

6.2. Retail Pharmacies |

|

6.3. Hospital Pharmacies |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Retractable Needle Safety Syringes Market, by Product Type |

|

7.2.7. North America Retractable Needle Safety Syringes Market, by End-User |

|

7.2.8. North America Retractable Needle Safety Syringes Market, by Distribution Channel |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Retractable Needle Safety Syringes Market, by Product Type |

|

7.2.9.1.2. US Retractable Needle Safety Syringes Market, by End-User |

|

7.2.9.1.3. US Retractable Needle Safety Syringes Market, by Distribution Channel |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Becton, Dickinson and Company (BD) |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Retractable Technologies, Inc. |

|

9.3. Smiths Medical |

|

9.4. Terumo Corporation |

|

9.5. Nipro Corporation |

|

9.6. Cardinal Health, Inc. |

|

9.7. Braun Melsungen AG |

|

9.8. Medtronic PLC |

|

9.9. Hindustan Syringes & Medical Devices Ltd. (HMD) |

|

9.10. Gerresheimer AG |

|

9.11. SCHOTT AG |

|

9.12. Baxter International Inc. |

|

9.13. Weigao Group Co., Ltd. |

|

9.14. Ompi (A Stevanato Group Brand) |

|

9.15. Ypsomed Holding AG |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Retractable Needle Safety Syringes Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Retractable Needle Safety Syringes Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Retractable Needle Safety Syringes Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA