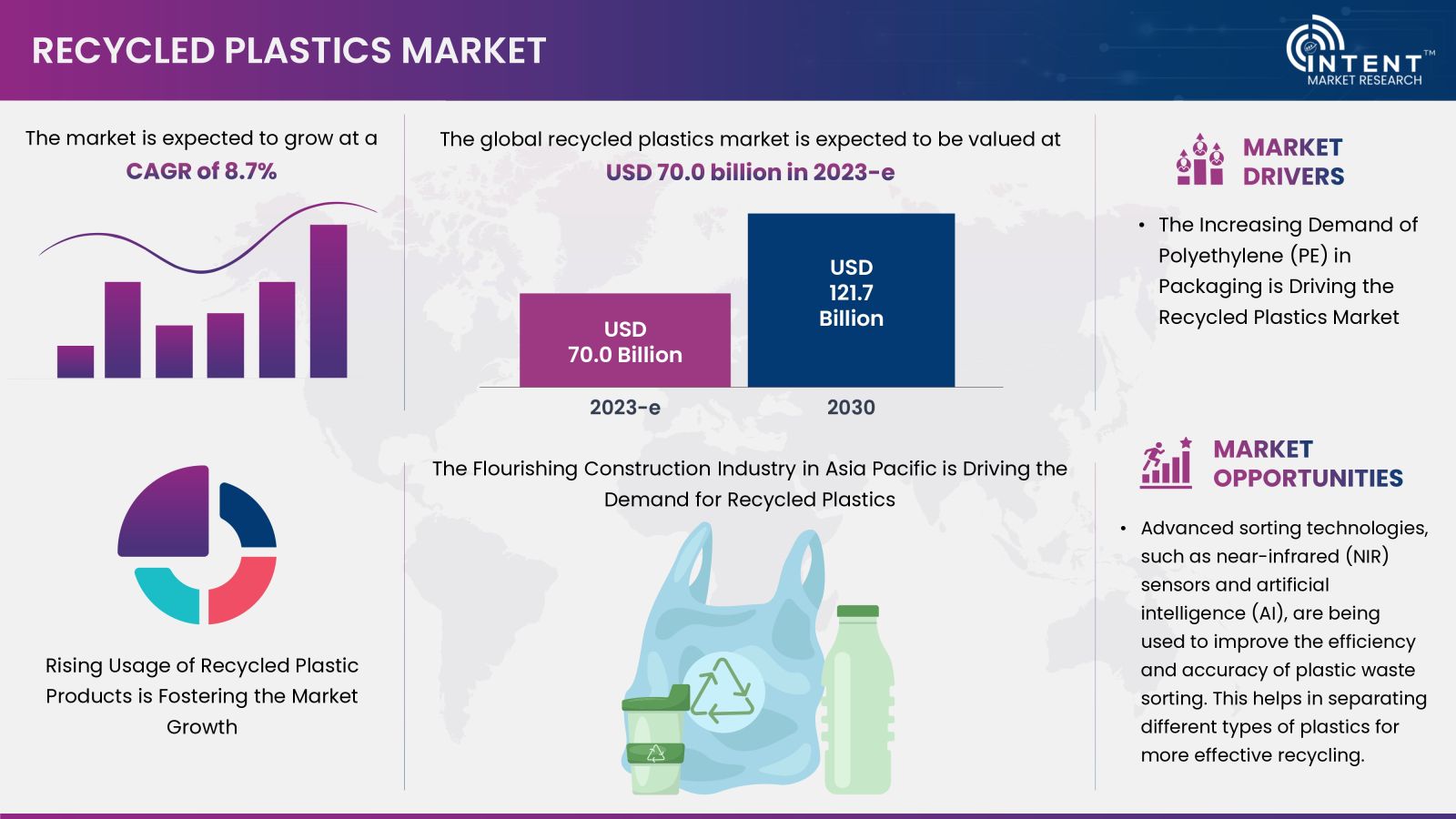

According to Intent Market Research, the Recycled Plastics Market is expected to grow from USD 70.0 billion in 2023-e at a CAGR of 8.7% to touch USD 121.7 billion by 2030. Some of the companies operating in this market include Alpek, Biffa, Cabka, Clean Harbours, Covetsro, Far Eastern New Century, Indorama Ventures Jayplas, Loop Industries, MBA Polymers, Plastipak, Republic Services, Shell, Stericycle, Veolia. Rising plastic consumption in the production of lightweight components that are used in various verticals is driving the growth of the recycled plastic market.

Click here to: Get FREE Sample Pages of this Report

Recycled plastics refer to plastic materials that have undergone a process of collection, sorting, cleaning, and reprocessing to be used again in the production of new plastic products. This helps divert plastic waste from landfills and reduces the demand for new virgin plastic production. The recycling process typically involves melting and reforming the plastic into pellets, which can then be used as raw material for manufacturing various goods.

Recycled Plastics Market Dynamics

Rising Usage of Recycled Plastic Products is Fostering the Market Growth

Growing concerns about plastic pollution, hazardous emissions from petrochemical usage, and depleting crude oil sources have led to an increase in demand for recycled plastics. The majority of recycled plastic materials are produced in Asia-Pacific, North America, and Europe. Recycled plastics are increasingly being used in various industries such as automotive, packaging, electronics & electrical, and building & construction, which is expected to boost the global market for recycled plastics.

There has been a surge in demand for alternatives to traditional plastics due to the increasing concerns about plastic usage. Manufacturers in the market are shifting their focus towards using recycled plastics to reduce the ecological footprint associated with the production process. The rapid pace of invention and new technology development has enabled the use of recycled plastics in many different product lines. To counter the harmful effects of plastic waste, companies are constantly developing product lines that use recycled materials.

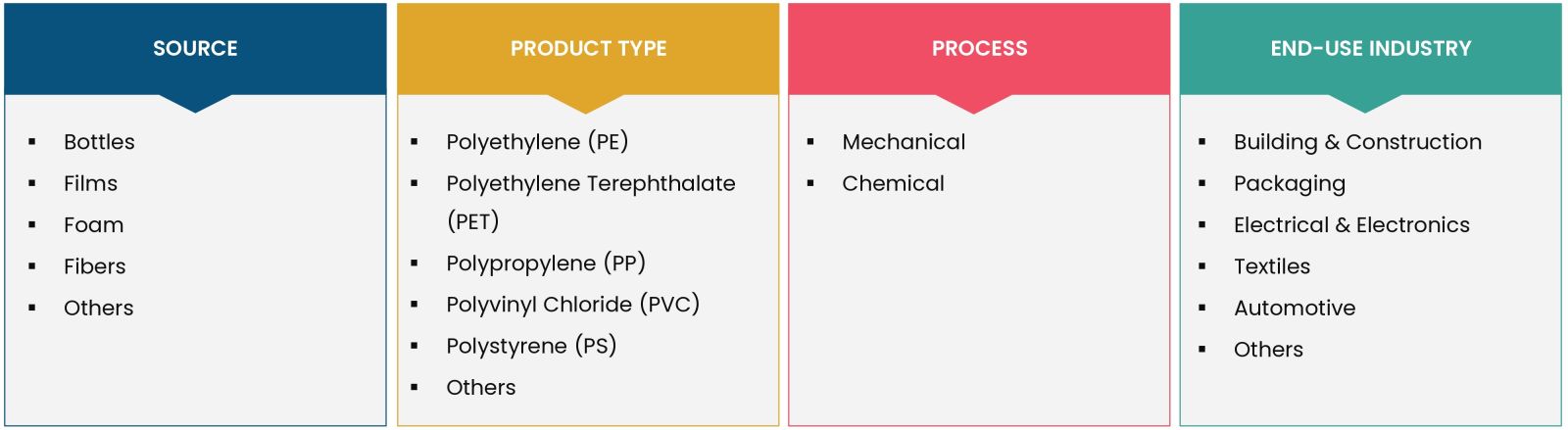

Recycled Plastics Market Segment Insights

Plastic Bottle is the Major Source Utilized in the Production of Recycled Plastics

The market for recycled products continues to grow, with the plastic bottle segment leading the way. Plastic bottles are the primary source of recycled goods, and their usage is widespread across various industries such as packaging water, oils, pharmaceuticals, and carbonated beverages. The recycling of plastic bottles has gained importance in recent years due to environmental concerns and the need to reduce waste. Key players in the production of recycled plastic bottles include SKS Bottle & Packaging, CABKA, Biffa, and Alpek. These manufacturers are committed to producing high-quality, eco-friendly products that meet the demands of today's environmentally-conscious consumers.

The Increasing Demand of Polyethylene (PE) in Packaging Application is Driving the Recycled Plastics Market

Polyethylene (PE) is the most favored material in the packaging industry, due to its flexibility, durability, and resistance to moisture and chemicals. It is extensively used in various sectors such as consumer goods, food and beverage, and industrial sectors for packaging purposes. Additionally, PE is also used in non-packaging applications such as cutting boards, garbage bins, and other household items because of its lightweight, sturdy, and long-lasting nature.

.jpg)

Demand for Chemical Recycling is Rising as it can Handle a Broader Range of Plastics

Chemical recycling is an effective process for recycling plastics that cannot be easily recycled through mechanical methods. These may include mixed plastics or plastics with complex structures, such as multilayered or composite materials. Chemical recycling involves breaking down plastic waste into its basic chemical components, which can then be purified and reconstituted into new products. This process can handle a wider range of plastics, including those with additives, colors, or contaminants, that may be difficult to recycle through traditional methods. By recovering a wider variety of plastics that would otherwise be challenging to recycle mechanically, chemical recycling has the potential to play a significant role in reducing plastic waste and promoting a more circular economy.

Increasing Adoption of Recycled Plastics in Packaging is Bolstering the Market Growth

The market for recycled plastics is currently being led by the packaging application segment. This can be attributed to the growing demand for packed food & beverages, electrical & electronic goods, and textiles. The use of recycled plastics has become increasingly popular in the production of personal hygiene products, such as electronic trimmers and shavers, as well as automotive components. These products not only fulfill their intended purposes but also contribute to the sustainable use of resources. The demand for recycled plastics is expected to continue to rise as more consumers become aware of the benefits of using recycled materials.

Regional Insights

The Flourishing Construction Industry in Asia-Pacific is Driving the Demand for Recycled Plastics

Construction industry in the Asia-Pacific is expected to witness significant growth in the coming years due to the growing demand for non-residential construction projects such as hospitals, schools, and colleges. Recycled plastic can be utilized in several building parts including flooring, roof covering, formwork, landscaping, water, waste management, etc. These materials when used in construction offers several advantages such as sustainability, lightness, durability, pliability, versatility among several others.

As a result, there will be an increasing demand for various construction materials such as roofing tiles, insulation, fences, floor tiles, carpets, and many more, which will propel the overall market growth. This exponential growth is a result of the region's focus on building world-class infrastructure and the rise in investment in the construction industry.

Competitive Landscape

Novel Product Launches are the Major Strategy Adopted by the Key Players for Recycled Plastics Market Growth

Companies in the market are competing based on the technology used for recycling plastic waste. The major players are expanding their plastic recycling facilities, investing in infrastructural development, research & development facilities, and seeking opportunities to vertically integrate across the value chain. These initiatives help them cater to the increasing demand for recycled plastics globally, ensure competitive effectiveness, enhance their operations planning, develop innovative products & technologies, bring down their recycling costs, and expand their customer base. Some of the companies operating in this market include Alpek, Biffa, Cabka, Clean Harbours, Covetsro, Far Eastern New Century, Indorama Ventures Jayplas, Loop Industries, MBA Polymers, Plastipak, Republic Services, Shell, Stericycle, and Veolia.

Recycled Plastics Market Coverage

The report provides key insights into the recycled plastics market, and it focuses on technological developments, trends, and initiatives taken by the government. In this sector, the analysis delves into market drivers, restraints, opportunities, and other pertinent factors. The report also scrutinizes key players and the competitive landscape in the recycled plastics market.

Report Scope

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 70.0 billion |

|

Forecast Revenue (2030) |

USD 121.7 billion |

|

CAGR (2024-2030) |

8.7% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

By Source (Bottles, Films, Foam, Fibers, Others), By Product Type (Polyethylene (PE), Polyethylene Terephthalate (PET), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Others), By Process (Mechanical and Chemical), By End-use Industry (Building & Construction, Packaging, Electrical & Electronics, Textiles, Automotive, Others) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy), Asia-Pacific (China, Japan, South Korea, India), Latin America (Brazil, Mexico, Argentina), Middle East and Africa (Saudi Arabia, South Africa, United Arab Emirates) |

|

Competitive Landscape |

Alpek, Biffa, Cabka, Clean Harbors, Covetsro, Far Eastern New Century, Indorama Ventures Jayplas, Loop Industries, MBA Polymers, Plastipak, Republic Services, Shell, Stericycle and Veolia |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1. Introduction |

|

1. 1. Study Assumptions and Recycled Plastics Market Definition |

|

1.2. Scope of the Study |

|

2. Research Methodology |

|

3. Executive Summary |

|

4. Recycled Plastics Market Dynamics |

|

4.1. Market Growth Drivers |

|

4.2 Market Growth Challenges |

|

5. Recycled Plastics Market Outlook |

|

5.1. Industry Value Chain Analysis |

|

5.2.Technological Developments |

|

5.3.Case Study |

|

5.4.Regulatory Framework |

|

5.5. PESTEL Analysis |

|

5.6.Porter's Five Forces analysis |

|

5.7.Consumer Behavior Analysis |

|

5.8.Corporate Social Responsibility (CSR) & Sustainability |

|

6. Global Recycled Plastics Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

6.1 Source |

|

6.1.1 Bottles |

|

6.1.2 Films |

|

6.1.3 Foam |

|

6.1.4 Fibers |

|

6.1.5 Others |

|

6.2 Product Type |

|

6.2.1 Polyethylene (PE) |

|

6.2.2 Polyethylene Terephthalate (PET) |

|

6.2.3 Polypropylene (PP) |

|

6.2.4 Polyvinyl Chloride (PVC) |

|

6.2.5 Polystyrene (PS) |

|

6.2.6 Others |

|

6.3 Process |

|

6.3.1 Mechanical |

|

6.3.2 Chemical |

|

6.4 End-Use Industry |

|

6.4.1 Building & Construction |

|

6.4.2 Packaging |

|

6.4.3 Electrical & Electronics |

|

6.4.4 Textiles |

|

6.4.5 Automotive |

|

6.4.6 Others |

|

6.5 Geography |

|

6.5.1 North America |

|

6.5.2 Europe |

|

6.5.3 Asia-Pacific |

|

6.5.4 Latin America |

|

6.5.5 Middle East and Africa |

|

7. North America Recycled Plastics Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

7.1 Source |

|

7.1.1 Bottles |

|

7.1.2 Films |

|

7.1.3 Foam |

|

7.1.4 Fibers |

|

7.1.5 Others |

|

7.2 Product Type |

|

7.2.1 Polyethylene (PE) |

|

7.2.2 Polyethylene Terephthalate (PET) |

|

7.2.3 Polypropylene (PP) |

|

7.2.4 Polyvinyl Chloride (PVC) |

|

7.2.5 Polystyrene (PS) |

|

7.2.7 Others |

|

7.3 Process |

|

7.3.1 Mechanical |

|

7.3.2 Chemical |

|

7.4 End-Use Industry |

|

7.4.1 Building & Construction |

|

7.4.2 Packaging |

|

7.4.3 Electrical & Electronics |

|

7.4.4 Textiles |

|

7.4.5 Automotive |

|

7.4.7 Others |

|

7.5 Country |

|

7.5.1 United States |

|

7.5.1.1 Source |

|

7.5.1.1.1 Bottles |

|

7.5.1.1.2 Films |

|

7.5.1.1.3 Foam |

|

7.5.1.1.4 Fibers |

|

7.5.1.1.5 Others |

|

7.5.1.2 Product Type |

|

7.5.1.2.1 Polyethylene (PE) |

|

7.5.1.2.2 Polyethylene Terephthalate (PET) |

|

7.5.1.2.3 Polypropylene (PP) |

|

7.5.1.2.4 Polyvinyl Chloride (PVC) |

|

7.5.1.2.5 Polystyrene (PS) |

|

7.5.1.2.6 Others |

|

7.5.1.3 Process |

|

7.5.1.3.1 Mechanical |

|

7.5.1.3.2 Chemical |

|

7.5.1.4 End-Use Industry |

|

7.5.1.4.1 Building & Construction |

|

7.5.1.4.2 Packaging |

|

7.5.1.4.3 Electrical & Electronics |

|

7.5.1.4.4 Textiles |

|

7.5.1.4.5 Automotive |

|

7.5.1.4.5 Others |

|

7.5.2 Canada |

|

7.5.2.1 Source |

|

7.5.2.1.1 Bottles |

|

7.5.2.1.2 Films |

|

7.5.2.1.3 Foam |

|

7.5.2.1.4 Fibers |

|

7.5.2.1.5 Others |

|

7.5.2.2 Product Type |

|

7.5.2.2.1 Polyethylene (PE) |

|

7.5.2.2.2 Polyethylene Terephthalate (PET) |

|

7.5.2.2.3 Polypropylene (PP) |

|

7.5.2.2.4 Polyvinyl Chloride (PVC) |

|

7.5.2.2.5 Polystyrene (PS) |

|

7.5.2.2.6 Others |

|

7.5.2.3 Process |

|

7.5.2.3.1 Mechanical |

|

7.5.2.3.2 Chemical |

|

7.5.2.4 End-Use Industry |

|

7.5.2.4.1 Building & Construction |

|

7.5.2.4.2 Packaging |

|

7.5.2.4.3 Electrical & Electronics |

|

7.5.2.4.4 Textiles |

|

7.5.2.4.5 Automotive |

|

7.5.2.4.5 Others |

|

8. Europe Market Recycled Plastics Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

8.1 Source |

|

8.1.1 Bottles |

|

8.1.2 Films |

|

8.1.3 Foam |

|

8.1.4 Fibers |

|

8.1.5 Others |

|

8.2 Product Type |

|

8.2.1 Polyethylene (PE) |

|

8.2.2 Polyethylene Terephthalate (PET) |

|

8.2.3 Polypropylene (PP) |

|

8.2.4 Polyvinyl Chloride (PVC) |

|

8.2.5 Polystyrene (PS) |

|

8.2.8 Others |

|

8.3 Process |

|

8.3.1 Mechanical |

|

8.3.2 Chemical |

|

8.4 End-Use Industry |

|

8.4.1 Building & Construction |

|

8.4.2 Packaging |

|

8.4.3 Electrical & Electronics |

|

8.4.4 Textiles |

|

8.4.5 Automotive |

|

8.4.8 Others |

|

8.5 Country |

|

8.5.1 United Kingdom |

|

8.5.1.1 Source |

|

8.5.1.1.1 Bottles |

|

8.5.1.1.2 Films |

|

8.5.1.1.3 Foam |

|

8.5.1.1.4 Fibers |

|

8.5.1.1.5 Others |

|

8.5.1.2 Product Type |

|

8.5.1.2.1 Polyethylene (PE) |

|

8.5.1.2.2 Polyethylene Terephthalate (PET) |

|

8.5.1.2.3 Polypropylene (PP) |

|

8.5.1.2.4 Polyvinyl Chloride (PVC) |

|

8.5.1.2.5 Polystyrene (PS) |

|

8.5.1.2.6 Others |

|

8.5.1.3 Process |

|

8.5.1.3.1 Mechanical |

|

8.5.1.3.2 Chemical |

|

8.5.1.4 End-Use Industry |

|

8.5.1.4.1 Building & Construction |

|

8.5.1.4.2 Packaging |

|

8.5.1.4.3 Electrical & Electronics |

|

8.5.1.4.4 Textiles |

|

8.5.1.4.5 Automotive |

|

8.5.1.4.5 Others |

|

8.5.2 Germany |

|

8.5.2.1 Source |

|

8.5.2.1.1 Bottles |

|

8.5.2.1.2 Films |

|

8.5.2.1.3 Foam |

|

8.5.2.1.4 Fibers |

|

8.5.2.1.5 Others |

|

8.5.2.2 Product Type |

|

8.5.2.2.1 Polyethylene (PE) |

|

8.5.2.2.2 Polyethylene Terephthalate (PET) |

|

8.5.2.2.3 Polypropylene (PP) |

|

8.5.2.2.4 Polyvinyl Chloride (PVC) |

|

8.5.2.2.5 Polystyrene (PS) |

|

8.5.2.2.6 Others |

|

8.5.2.3 Process |

|

8.5.2.3.1 Mechanical |

|

8.5.2.3.2 Chemical |

|

8.5.2.4 End-Use Industry |

|

8.5.2.4.1 Building & Construction |

|

8.5.2.4.2 Packaging |

|

8.5.2.4.3 Electrical & Electronics |

|

8.5.2.4.4 Textiles |

|

8.5.2.4.5 Automotive |

|

8.5.2.4.5 Others |

|

8.5.3 France |

|

8.5.3.1 Source |

|

8.5.3.1.1 Bottles |

|

8.5.3.1.2 Films |

|

8.5.3.1.3 Foam |

|

8.5.3.1.4 Fibers |

|

8.5.3.1.5 Others |

|

8.5.3.2 Product Type |

|

8.5.3.2.1 Polyethylene (PE) |

|

8.5.3.2.2 Polyethylene Terephthalate (PET) |

|

8.5.3.2.3 Polypropylene (PP) |

|

8.5.3.2.4 Polyvinyl Chloride (PVC) |

|

8.5.3.2.5 Polystyrene (PS) |

|

8.5.3.2.6 Others |

|

8.5.3.3 Process |

|

8.5.3.3.1 Mechanical |

|

8.5.3.3.2 Chemical |

|

8.5.3.4 End-Use Industry |

|

8.5.3.4.1 Building & Construction |

|

8.5.3.4.2 Packaging |

|

8.5.3.4.3 Electrical & Electronics |

|

8.5.3.4.4 Textiles |

|

8.5.3.4.5 Automotive |

|

8.5.3.4.5 Others |

|

8.5.4 Italy |

|

8.5.4.1 Source |

|

8.5.4.1.1 Bottles |

|

8.5.4.1.2 Films |

|

8.5.4.1.3 Foam |

|

8.5.4.1.4 Fibers |

|

8.5.4.1.5 Others |

|

8.5.4.2 Product Type |

|

8.5.4.2.1 Polyethylene (PE) |

|

8.5.4.2.2 Polyethylene Terephthalate (PET) |

|

8.5.4.2.3 Polypropylene (PP) |

|

8.5.4.2.4 Polyvinyl Chloride (PVC) |

|

8.5.4.2.5 Polystyrene (PS) |

|

8.5.4.2.6 Others |

|

8.5.4.3 Process |

|

8.5.4.3.1 Mechanical |

|

8.5.4.3.2 Chemical |

|

8.5.4.4 End-Use Industry |

|

8.5.4.4.1 Building & Construction |

|

8.5.4.4.2 Packaging |

|

8.5.4.4.3 Electrical & Electronics |

|

8.5.4.4.4 Textiles |

|

8.5.4.4.5 Automotive |

|

8.5.4.4.5 Others |

|

9. Asia-Pacific Recycled Plastics Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

9.1 Source |

|

9.1.1 Bottles |

|

9.1.2 Films |

|

9.1.3 Foam |

|

9.1.4 Fibers |

|

9.1.5 Others |

|

9.2 Product Type |

|

9.2.1 Polyethylene (PE) |

|

9.2.2 Polyethylene Terephthalate (PET) |

|

9.2.3 Polypropylene (PP) |

|

9.2.4 Polyvinyl Chloride (PVC) |

|

9.2.5 Polystyrene (PS) |

|

9.2.9 Others |

|

9.3 Process |

|

9.3.1 Mechanical |

|

9.3.2 Chemical |

|

9.4 End-Use Industry |

|

9.4.1 Building & Construction |

|

9.4.2 Packaging |

|

9.4.3 Electrical & Electronics |

|

9.4.4 Textiles |

|

9.4.5 Automotive |

|

9.4.9 Others |

|

9.5 Country |

|

9.5.1 China |

|

9.5.1.1 Source |

|

9.5.1.1.1 Bottles |

|

9.5.1.1.2 Films |

|

9.5.1.1.3 Foam |

|

9.5.1.1.4 Fibers |

|

9.5.1.1.5 Others |

|

9.5.1.2 Product Type |

|

9.5.1.2.1 Polyethylene (PE) |

|

9.5.1.2.2 Polyethylene Terephthalate (PET) |

|

9.5.1.2.3 Polypropylene (PP) |

|

9.5.1.2.4 Polyvinyl Chloride (PVC) |

|

9.5.1.2.5 Polystyrene (PS) |

|

9.5.1.2.6 Others |

|

9.5.1.3 Process |

|

9.5.1.3.1 Mechanical |

|

9.5.1.3.2 Chemical |

|

9.5.1.4 End-Use Industry |

|

9.5.1.4.1 Building & Construction |

|

9.5.1.4.2 Packaging |

|

9.5.1.4.3 Electrical & Electronics |

|

9.5.1.4.4 Textiles |

|

9.5.1.4.5 Automotive |

|

9.5.1.4.5 Others |

|

9.5.2 Japan |

|

9.5.2.1 Source |

|

9.5.2.1.1 Bottles |

|

9.5.2.1.2 Films |

|

9.5.2.1.3 Foam |

|

9.5.2.1.4 Fibers |

|

9.5.2.1.5 Others |

|

9.5.2.2 Product Type |

|

9.5.2.2.1 Polyethylene (PE) |

|

9.5.2.2.2 Polyethylene Terephthalate (PET) |

|

9.5.2.2.3 Polypropylene (PP) |

|

9.5.2.2.4 Polyvinyl Chloride (PVC) |

|

9.5.2.2.5 Polystyrene (PS) |

|

9.5.2.2.6 Others |

|

9.5.2.3 Process |

|

9.5.2.3.1 Mechanical |

|

9.5.2.3.2 Chemical |

|

9.5.2.4 End-Use Industry |

|

9.5.2.4.1 Building & Construction |

|

9.5.2.4.2 Packaging |

|

9.5.2.4.3 Electrical & Electronics |

|

9.5.2.4.4 Textiles |

|

9.5.2.4.5 Automotive |

|

9.5.2.4.5 Others |

|

9.5.3 India |

|

9.5.3.1 Source |

|

9.5.3.1.1 Bottles |

|

9.5.3.1.2 Films |

|

9.5.3.1.3 Foam |

|

9.5.3.1.4 Fibers |

|

9.5.3.1.5 Others |

|

9.5.3.2 Product Type |

|

9.5.3.2.1 Polyethylene (PE) |

|

9.5.3.2.2 Polyethylene Terephthalate (PET) |

|

9.5.3.2.3 Polypropylene (PP) |

|

9.5.3.2.4 Polyvinyl Chloride (PVC) |

|

9.5.3.2.5 Polystyrene (PS) |

|

9.5.3.2.6 Others |

|

9.5.3.3 Process |

|

9.5.3.3.1 Mechanical |

|

9.5.3.3.2 Chemical |

|

9.5.3.4 End-Use Industry |

|

9.5.3.4.1 Building & Construction |

|

9.5.3.4.2 Packaging |

|

9.5.3.4.3 Electrical & Electronics |

|

9.5.3.4.4 Textiles |

|

9.5.3.4.5 Automotive |

|

9.5.3.4.5 Others |

|

9.5.4 South Korea |

|

9.5.4.1 Source |

|

9.5.4.1.1 Bottles |

|

9.5.4.1.2 Films |

|

9.5.4.1.3 Foam |

|

9.5.4.1.4 Fibers |

|

9.5.4.1.5 Others |

|

9.5.4.2 Product Type |

|

9.5.4.2.1 Polyethylene (PE) |

|

9.5.4.2.2 Polyethylene Terephthalate (PET) |

|

9.5.4.2.3 Polypropylene (PP) |

|

9.5.4.2.4 Polyvinyl Chloride (PVC) |

|

9.5.4.2.5 Polystyrene (PS) |

|

9.5.4.2.6 Others |

|

9.5.4.3 Process |

|

9.5.4.3.1 Mechanical |

|

9.5.4.3.2 Chemical |

|

9.5.4.4 End-Use Industry |

|

9.5.4.4.1 Building & Construction |

|

9.5.4.4.2 Packaging |

|

9.5.4.4.3 Electrical & Electronics |

|

9.5.4.4.4 Textiles |

|

9.5.4.4.5 Automotive |

|

9.5.4.4.5 Others |

|

10. Latin America Recycled Plastics Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

10.1 Source |

|

10.1.1 Bottles |

|

10.1.2 Films |

|

10.1.3 Foam |

|

10.1.4 Fibers |

|

10.1.5 Others |

|

10.2 Product Type |

|

10.2.1 Polyethylene (PE) |

|

10.2.2 Polyethylene Terephthalate (PET) |

|

10.2.3 Polypropylene (PP) |

|

10.2.4 Polyvinyl Chloride (PVC) |

|

10.2.5 Polystyrene (PS) |

|

10.2.10 Others |

|

10.3 Process |

|

10.3.1 Mechanical |

|

10.3.2 Chemical |

|

10.4 End-Use Industry |

|

10.4.1 Building & Construction |

|

10.4.2 Packaging |

|

10.4.3 Electrical & Electronics |

|

10.4.4 Textiles |

|

10.4.5 Automotive |

|

10.4.10 Others |

|

10.5 Country |

|

10.5.1 Brazil |

|

10.5.1.1 Source |

|

10.5.1.1.1 Bottles |

|

10.5.1.1.2 Films |

|

10.5.1.1.3 Foam |

|

10.5.1.1.4 Fibers |

|

10.5.1.1.5 Others |

|

10.5.1.2 Product Type |

|

10.5.1.2.1 Polyethylene (PE) |

|

10.5.1.2.2 Polyethylene Terephthalate (PET) |

|

10.5.1.2.3 Polypropylene (PP) |

|

10.5.1.2.4 Polyvinyl Chloride (PVC) |

|

10.5.1.2.5 Polystyrene (PS) |

|

10.5.1.2.6 Others |

|

10.5.1.3 Process |

|

10.5.1.3.1 Mechanical |

|

10.5.1.3.2 Chemical |

|

10.5.1.4 End-Use Industry |

|

10.5.1.4.1 Building & Construction |

|

10.5.1.4.2 Packaging |

|

10.5.1.4.3 Electrical & Electronics |

|

10.5.1.4.4 Textiles |

|

10.5.1.4.5 Automotive |

|

10.5.1.4.5 Others |

|

10.5.2 Mexico |

|

10.5.2.1 Source |

|

10.5.2.1.1 Bottles |

|

10.5.2.1.2 Films |

|

10.5.2.1.3 Foam |

|

10.5.2.1.4 Fibers |

|

10.5.2.1.5 Others |

|

10.5.2.2 Product Type |

|

10.5.2.2.1 Polyethylene (PE) |

|

10.5.2.2.2 Polyethylene Terephthalate (PET) |

|

10.5.2.2.3 Polypropylene (PP) |

|

10.5.2.2.4 Polyvinyl Chloride (PVC) |

|

10.5.2.2.5 Polystyrene (PS) |

|

10.5.2.2.6 Others |

|

10.5.2.3 Process |

|

10.5.2.3.1 Mechanical |

|

10.5.2.3.2 Chemical |

|

10.5.2.4 End-Use Industry |

|

10.5.2.4.1 Building & Construction |

|

10.5.2.4.2 Packaging |

|

10.5.2.4.3 Electrical & Electronics |

|

10.5.2.4.4 Textiles |

|

10.5.2.4.5 Automotive |

|

10.5.2.4.5 Others |

|

10.5.3 Argentina |

|

10.5.3.1 Source |

|

10.5.3.1.1 Bottles |

|

10.5.3.1.2 Films |

|

10.5.3.1.3 Foam |

|

10.5.3.1.4 Fibers |

|

10.5.3.1.5 Others |

|

10.5.3.2 Product Type |

|

10.5.3.2.1 Polyethylene (PE) |

|

10.5.3.2.2 Polyethylene Terephthalate (PET) |

|

10.5.3.2.3 Polypropylene (PP) |

|

10.5.3.2.4 Polyvinyl Chloride (PVC) |

|

10.5.3.2.5 Polystyrene (PS) |

|

10.5.3.2.6 Others |

|

10.5.3.3 Process |

|

10.5.3.3.1 Mechanical |

|

10.5.3.3.2 Chemical |

|

10.5.3.4 End-Use Industry |

|

10.5.3.4.1 Building & Construction |

|

10.5.3.4.2 Packaging |

|

10.5.3.4.3 Electrical & Electronics |

|

10.5.3.4.4 Textiles |

|

10.5.3.4.5 Automotive |

|

10.5.3.4.5 Others |

|

11. Middle East & Africa Recycled Plastics Market Segmentation (Market Size & Forecast: USD billion, 2024 – 2030) |

|

11.1 Source |

|

11.1.1 Bottles |

|

11.1.2 Films |

|

11.1.3 Foam |

|

11.1.4 Fibers |

|

11.1.5 Others |

|

11.2 Product Type |

|

11.2.1 Polyethylene (PE) |

|

11.2.2 Polyethylene Terephthalate (PET) |

|

11.2.3 Polypropylene (PP) |

|

11.2.4 Polyvinyl Chloride (PVC) |

|

11.2.5 Polystyrene (PS) |

|

11.2.11 Others |

|

11.3 Process |

|

11.3.1 Mechanical |

|

11.3.2 Chemical |

|

11.4 End-Use Industry |

|

11.4.1 Building & Construction |

|

11.4.2 Packaging |

|

11.4.3 Electrical & Electronics |

|

11.4.4 Textiles |

|

11.4.5 Automotive |

|

11.4.11 Others |

|

11.5 United Arab Emirates |

|

11.5.1 Brazil |

|

11.5.1.1 Source |

|

11.5.1.1.1 Bottles |

|

11.5.1.1.2 Films |

|

11.5.1.1.3 Foam |

|

11.5.1.1.4 Fibers |

|

11.5.1.1.5 Others |

|

11.5.1.2 Product Type |

|

11.5.1.2.1 Polyethylene (PE) |

|

11.5.1.2.2 Polyethylene Terephthalate (PET) |

|

11.5.1.2.3 Polypropylene (PP) |

|

11.5.1.2.4 Polyvinyl Chloride (PVC) |

|

11.5.1.2.5 Polystyrene (PS) |

|

11.5.1.2.6 Others |

|

11.5.1.3 Process |

|

11.5.1.3.1 Mechanical |

|

11.5.1.3.2 Chemical |

|

11.5.1.4 End-Use Industry |

|

11.5.1.4.1 Building & Construction |

|

11.5.1.4.2 Packaging |

|

11.5.1.4.3 Electrical & Electronics |

|

11.5.1.4.4 Textiles |

|

11.5.1.4.5 Automotive |

|

11.5.1.4.5 Others |

|

11.5.2 Saudi Arabia |

|

11.5.2.1 Source |

|

11.5.2.1.1 Bottles |

|

11.5.2.1.2 Films |

|

11.5.2.1.3 Foam |

|

11.5.2.1.4 Fibers |

|

11.5.2.1.5 Others |

|

11.5.2.2 Product Type |

|

11.5.2.2.1 Polyethylene (PE) |

|

11.5.2.2.2 Polyethylene Terephthalate (PET) |

|

11.5.2.2.3 Polypropylene (PP) |

|

11.5.2.2.4 Polyvinyl Chloride (PVC) |

|

11.5.2.2.5 Polystyrene (PS) |

|

11.5.2.2.6 Others |

|

11.5.2.3 Process |

|

11.5.2.3.1 Mechanical |

|

11.5.2.3.2 Chemical |

|

11.5.2.4 End-Use Industry |

|

11.5.2.4.1 Building & Construction |

|

11.5.2.4.2 Packaging |

|

11.5.2.4.3 Electrical & Electronics |

|

11.5.2.4.4 Textiles |

|

11.5.2.4.5 Automotive |

|

11.5.2.4.5 Others |

|

11.5.3 South Africa |

|

11.5.3.1 Source |

|

11.5.3.1.1 Bottles |

|

11.5.3.1.2 Films |

|

11.5.3.1.3 Foam |

|

11.5.3.1.4 Fibers |

|

11.5.3.1.5 Others |

|

11.5.3.2 Product Type |

|

11.5.3.2.1 Polyethylene (PE) |

|

11.5.3.2.2 Polyethylene Terephthalate (PET) |

|

11.5.3.2.3 Polypropylene (PP) |

|

11.5.3.2.4 Polyvinyl Chloride (PVC) |

|

11.5.3.2.5 Polystyrene (PS) |

|

11.5.3.2.6 Others |

|

11.5.3.3 Process |

|

11.5.3.3.1 Mechanical |

|

11.5.3.3.2 Chemical |

|

11.5.3.4 End-Use Industry |

|

11.5.3.4.1 Building & Construction |

|

11.5.3.4.2 Packaging |

|

11.5.3.4.3 Electrical & Electronics |

|

11.5.3.4.4 Textiles |

|

11.5.3.4.5 Automotive |

|

11.5.3.4.5 Others |

|

12. Competitive Landscape |

|

12.1 Company Market Share Analysis |

|

12.2 Competitive Matrix |

|

12.3 Product Benchmarking |

|

12.4 Emerging Players operating in the Market |

|

12.5 Company Profiles |

|

12.5.1 Alpek |

|

12.5.1.1 Company Synopsis |

|

12.5.1.2 Company Financials |

|

12.5.1.3 Product/ Service Portfolio |

|

12.5.1.4 Recent Developments |

|

12.5.2 Biffa |

|

12.5.3 Cabka |

|

12.5.4 Clean Harbors |

|

12.5.5 Covetsro |

|

12.5.6 Far Eastern New Century |

|

12.5.7 Indorama Ventures |

|

12.5.8 Jayplas |

|

12.5.9 Loop Industries |

|

12.5.10 MBA Polymers |

|

12.5.11 Plastipak |

|

12.5.12 Republic Services |

|

12.5.13 Shell |

|

12.5.14 Stericycle |

|

12.5.15 Veolia |

|

12.6 Company Profiles (Demand Side) |

|

12.6.1Adidas |

|

12.6.1.1 Company Synopsis |

|

12.6.1.2 Company Financials |

|

12.6.1.3 Product/ Service Portfolio |

|

12.6.1.4 Recent Developments |

|

12.6.2 Coca-Cola |

|

12.6.3 Nestlé |

|

12.6.4 P&G |

|

12.6.5 Unilever |

|

13. Analyst Recommendations |

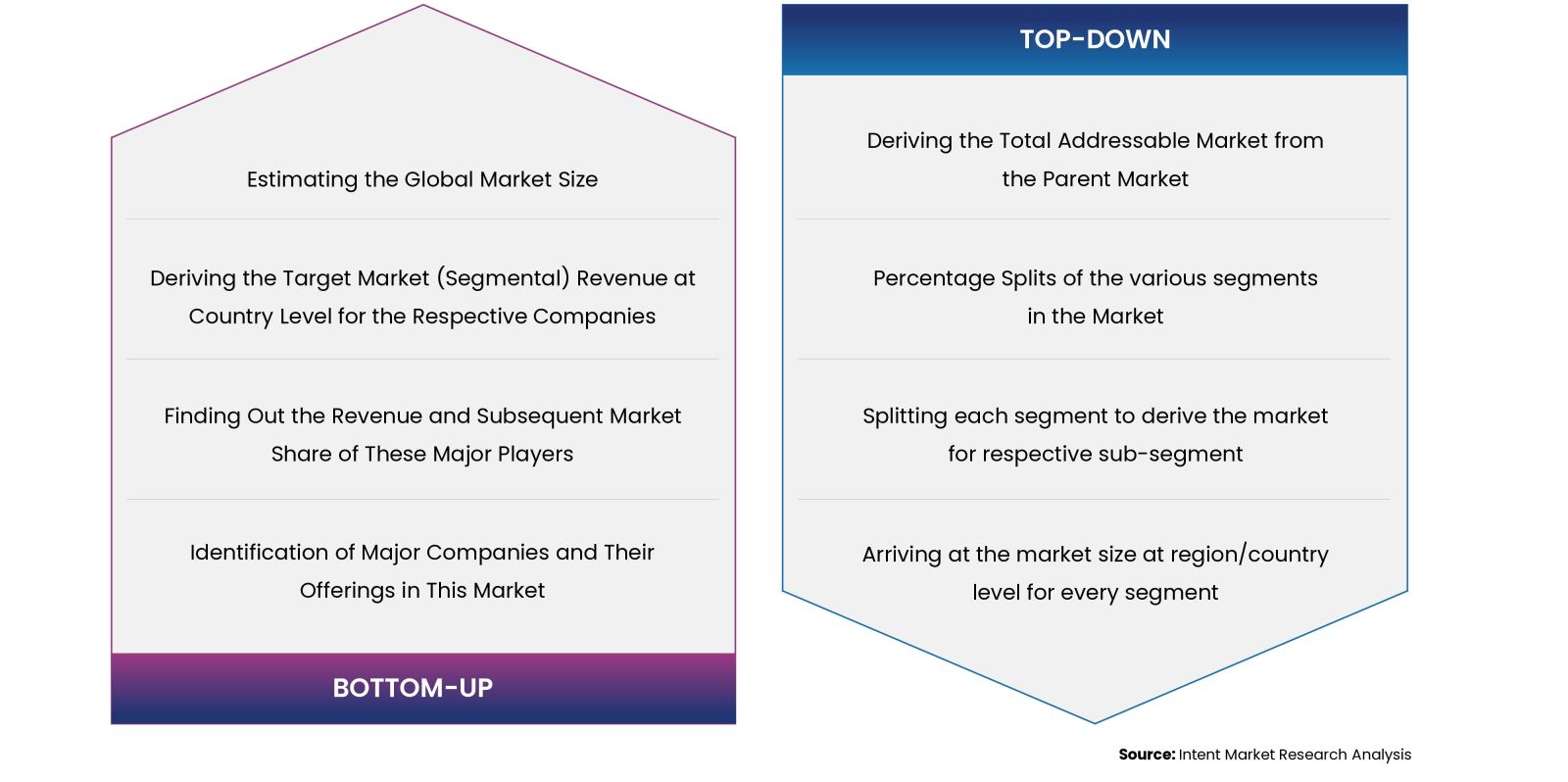

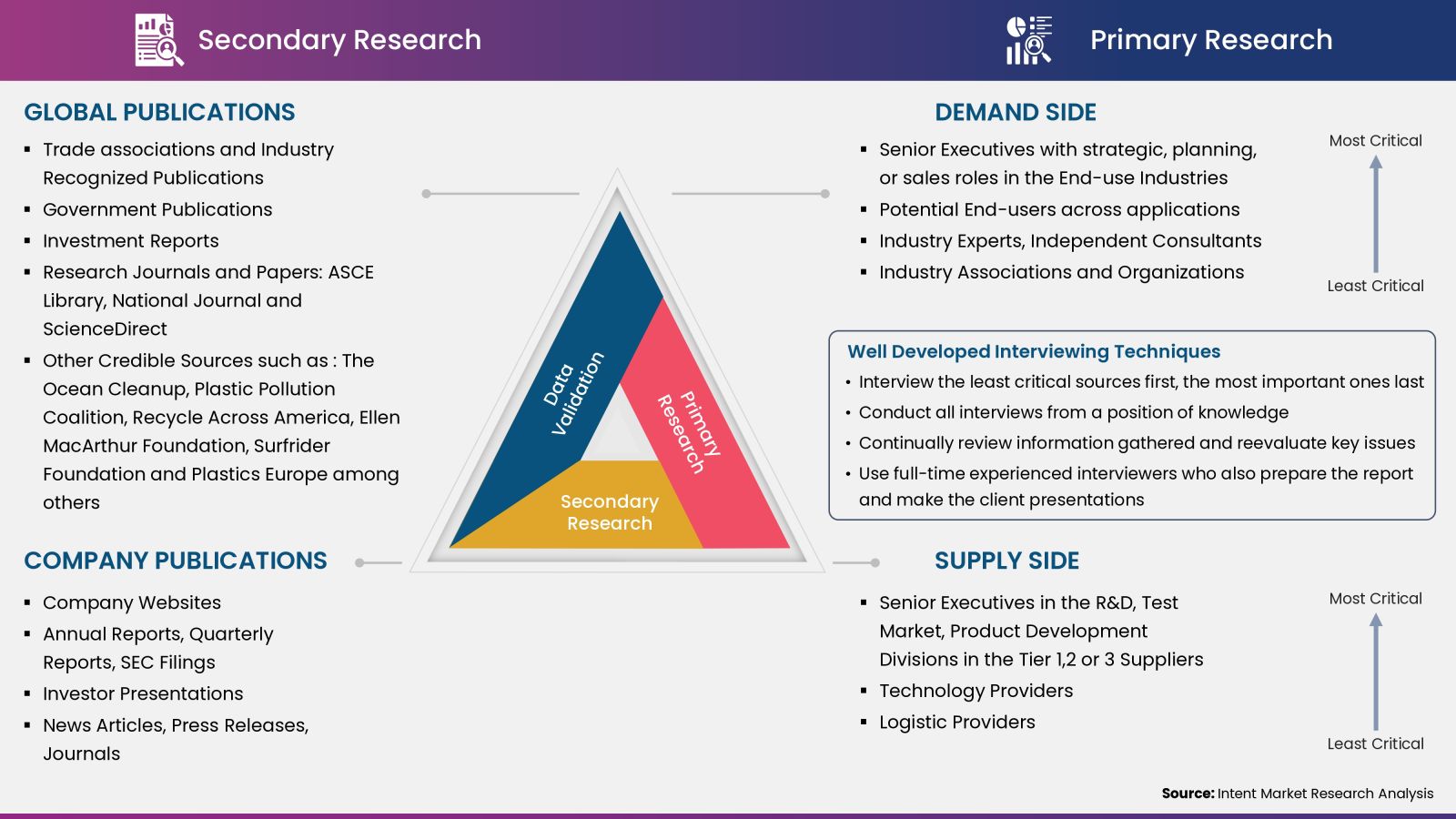

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.